Category: Open Banking

Open Banking AIS: How to Access Financial Data Reliably

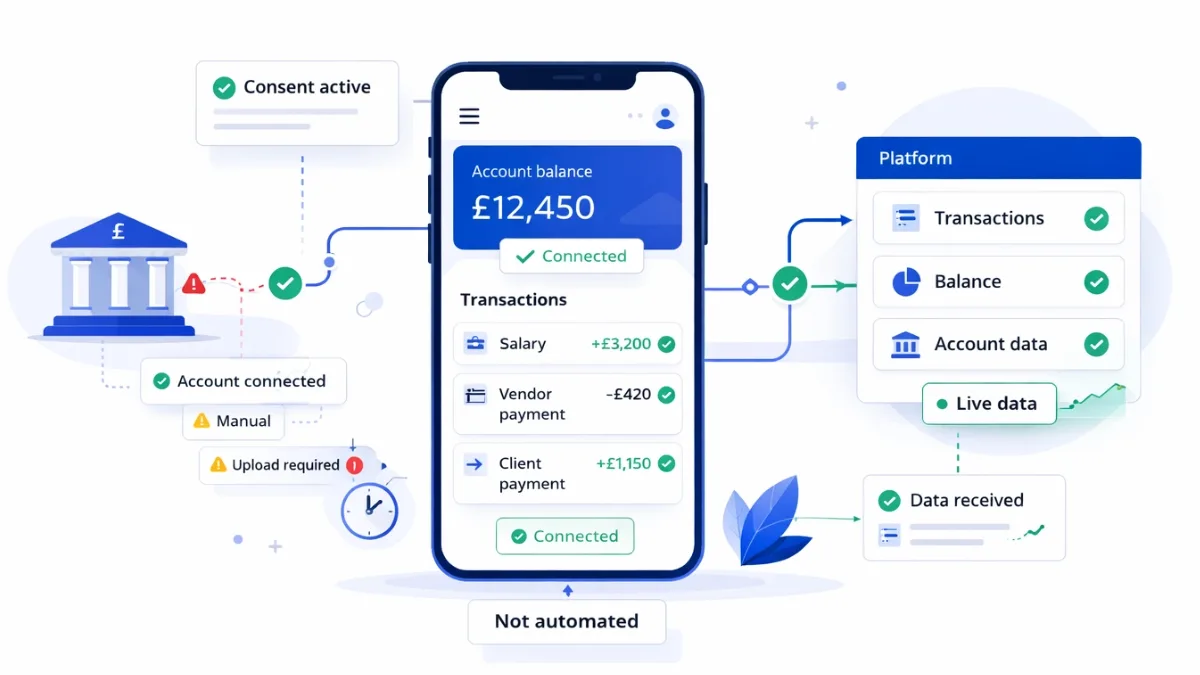

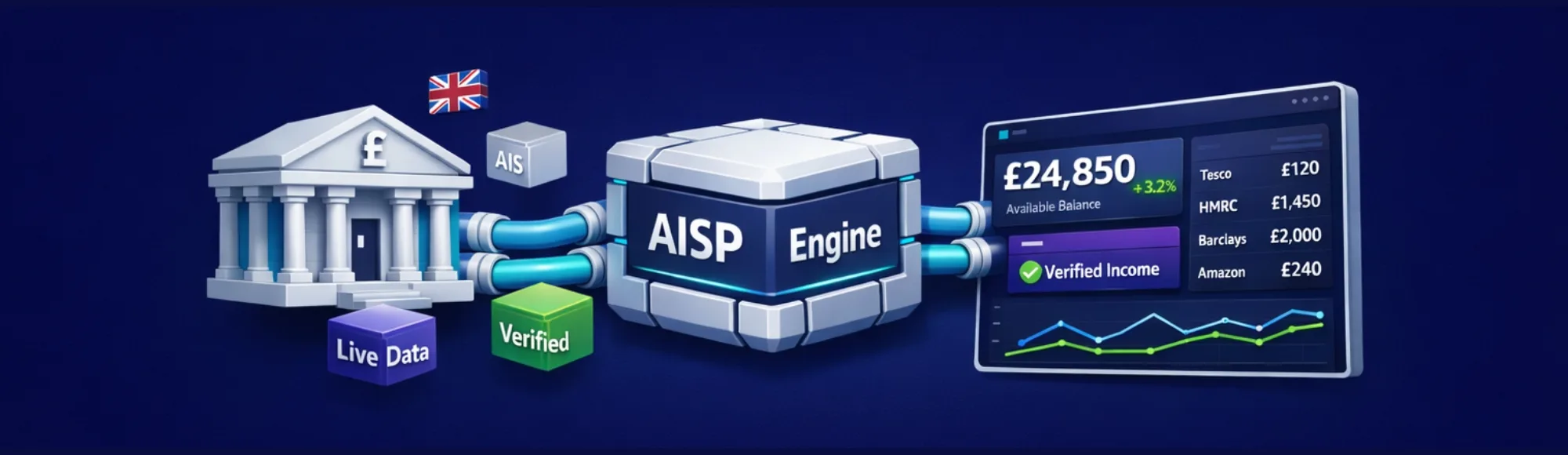

Open banking AIS infrastructure enables UK platforms to access bank account data reliably. Platforms evaluate FCA authorisation, bank coverage, connection reliability, and consent management when choosing AIS banking providers.

Data Enrichment API for UK Financial Platforms

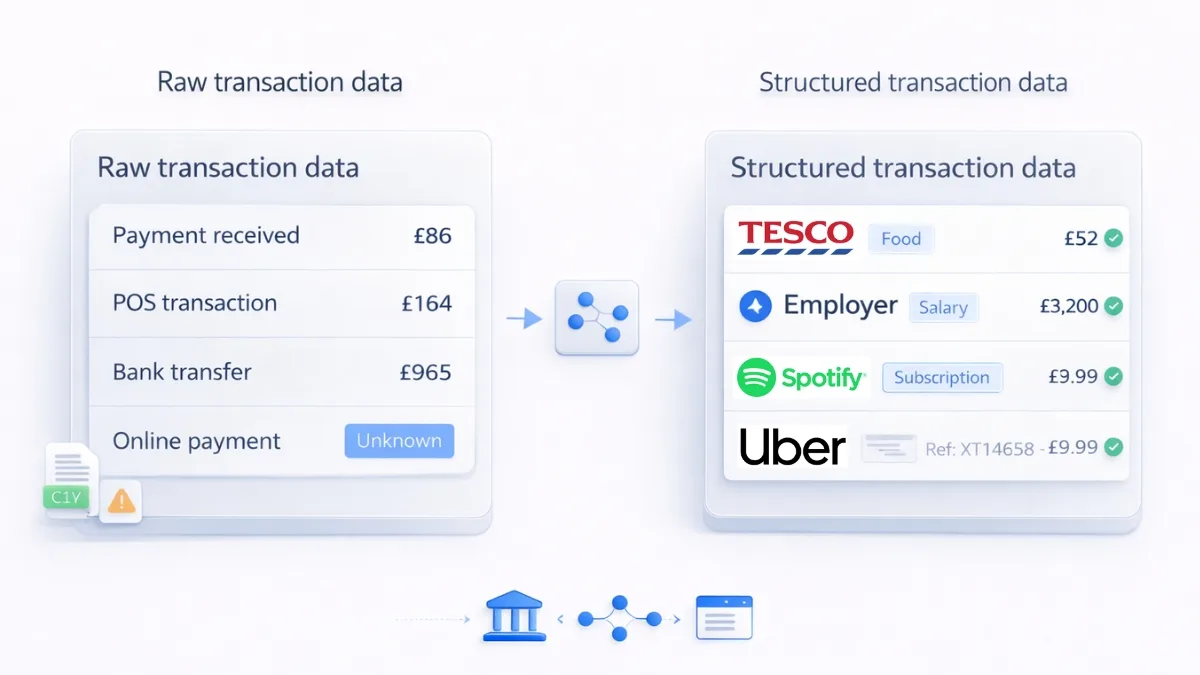

Need structured transaction data for your platform? Access enriched bank transaction data via open banking APIs Contact Now UK platforms building financial features cannot automate workflows when transaction data arrives unclear and unstructured. Accounting software, lending platforms, and fintech products need data enrichment API access providing merchant details, transaction categories, and structured information without manual…

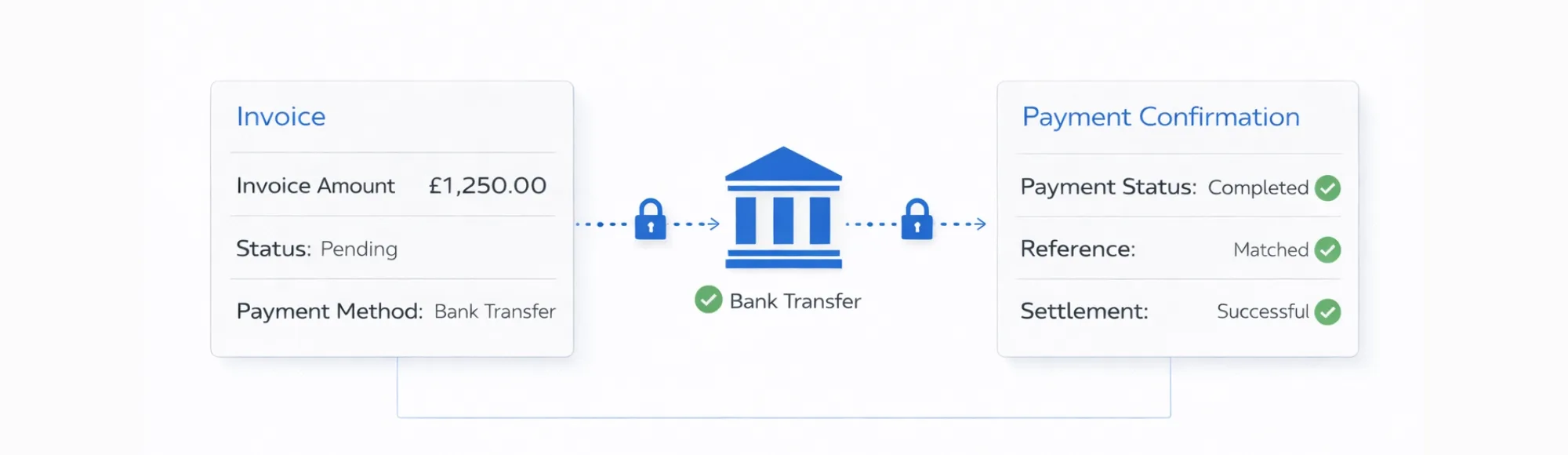

B2B Payment Automation: How UK Platforms Replace Manual Bank Transfers

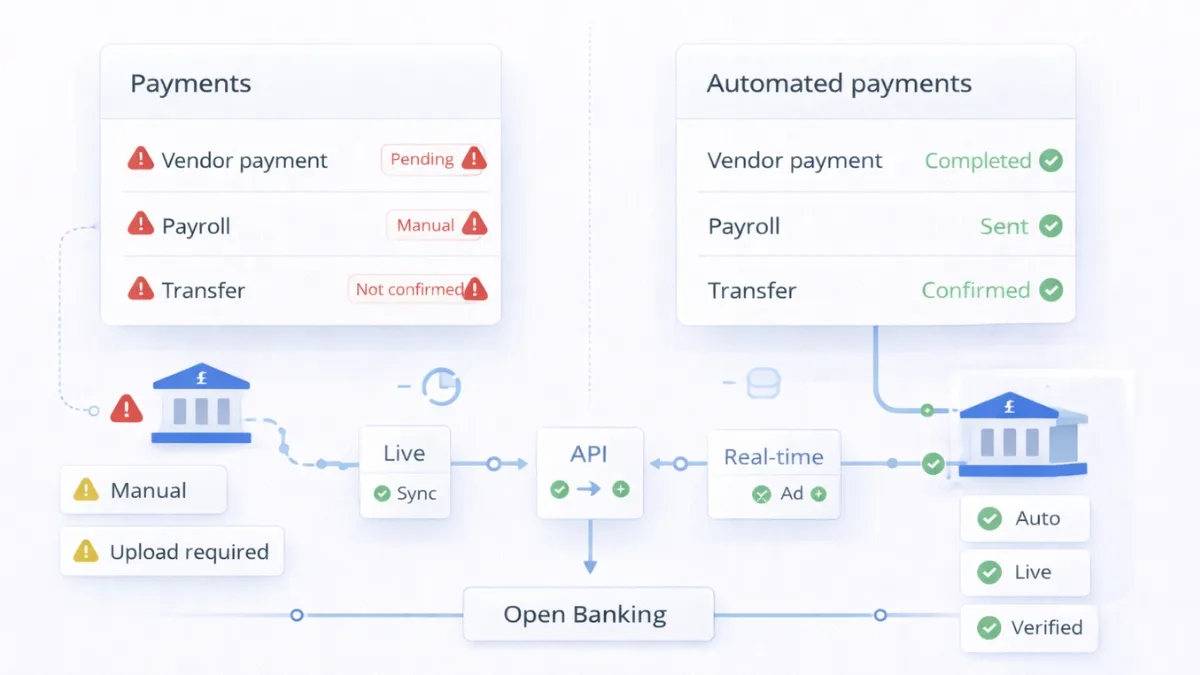

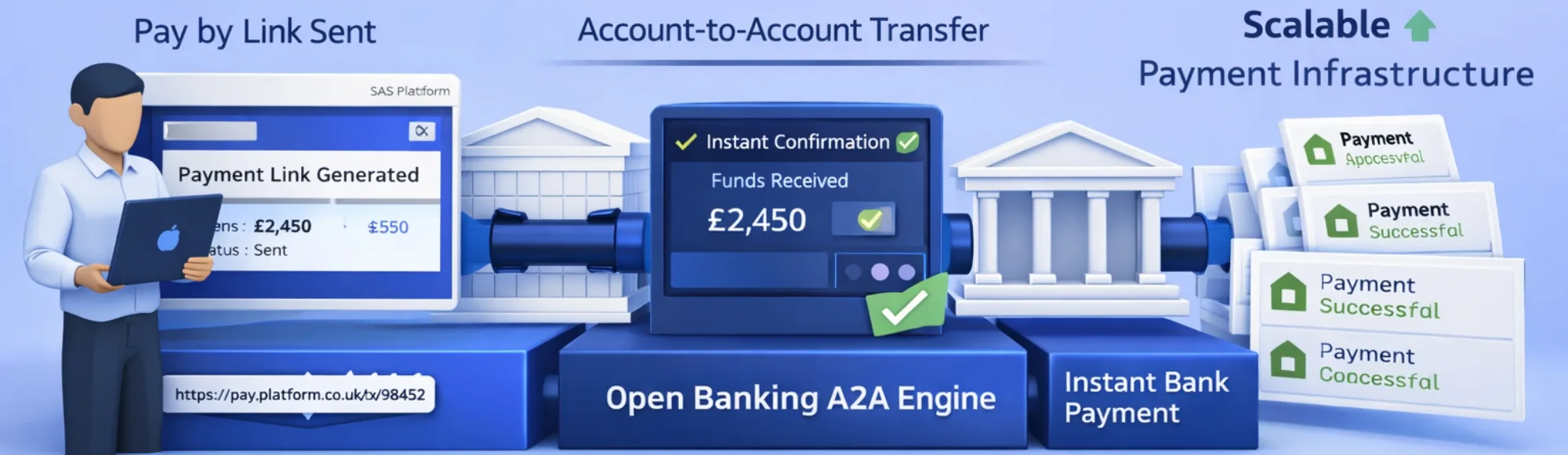

B2B payment automation enables UK platforms to replace manual bank transfers with programmatic payment initiation. Platforms integrate open banking infrastructure for automated execution, real-time confirmations, and streamlined reconciliation.

Open Banking Financial Data: UK Platform Integration Checklist

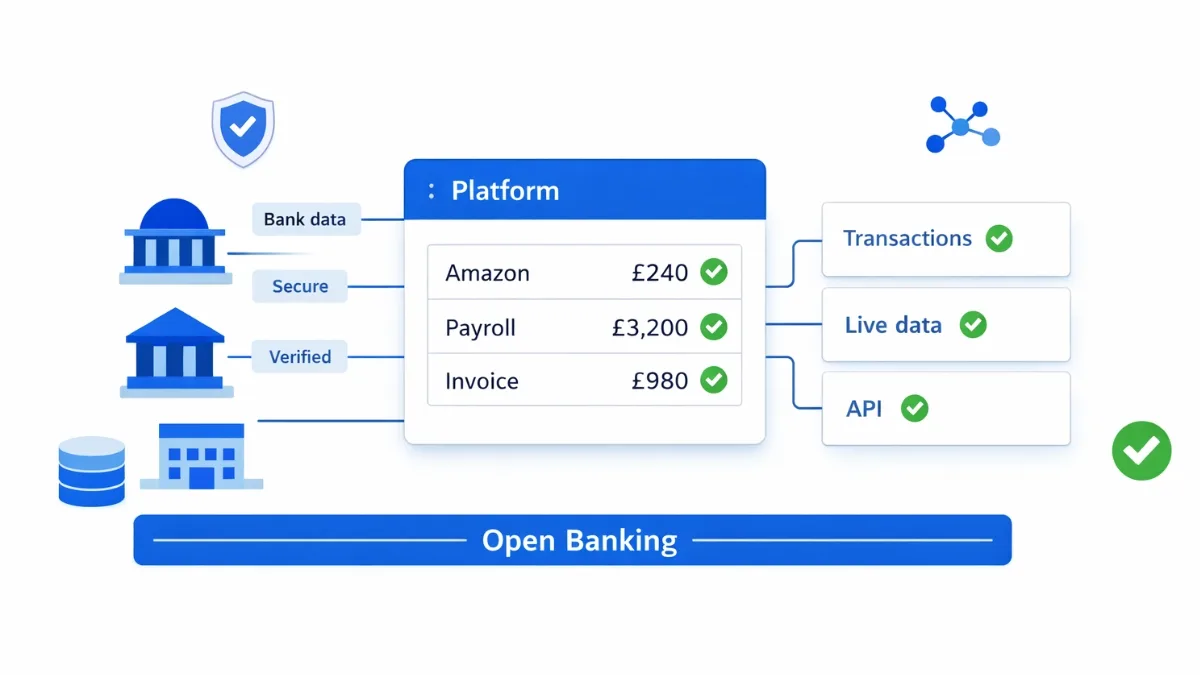

Open banking financial data integration requires reliable infrastructure. UK platforms evaluate bank coverage, feed reliability, and consent management when choosing providers. Finexer provides FCA-authorised connectivity with structured transaction feeds.

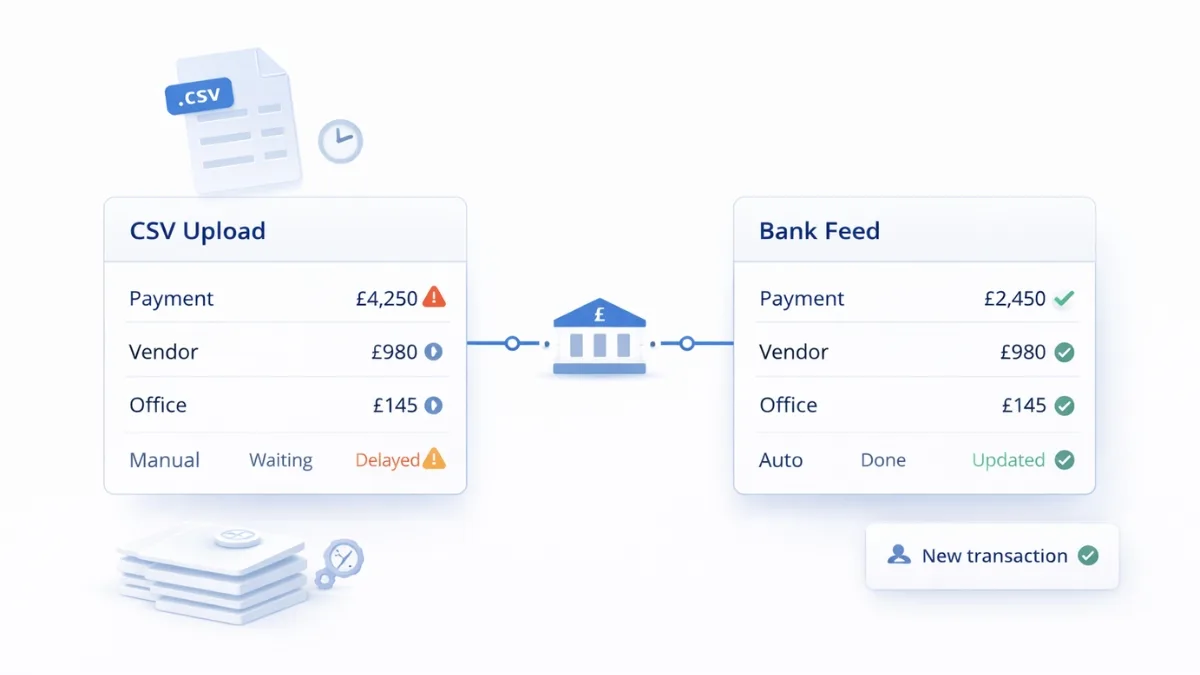

Automation of Accounting Process Using Bank-Verified Data

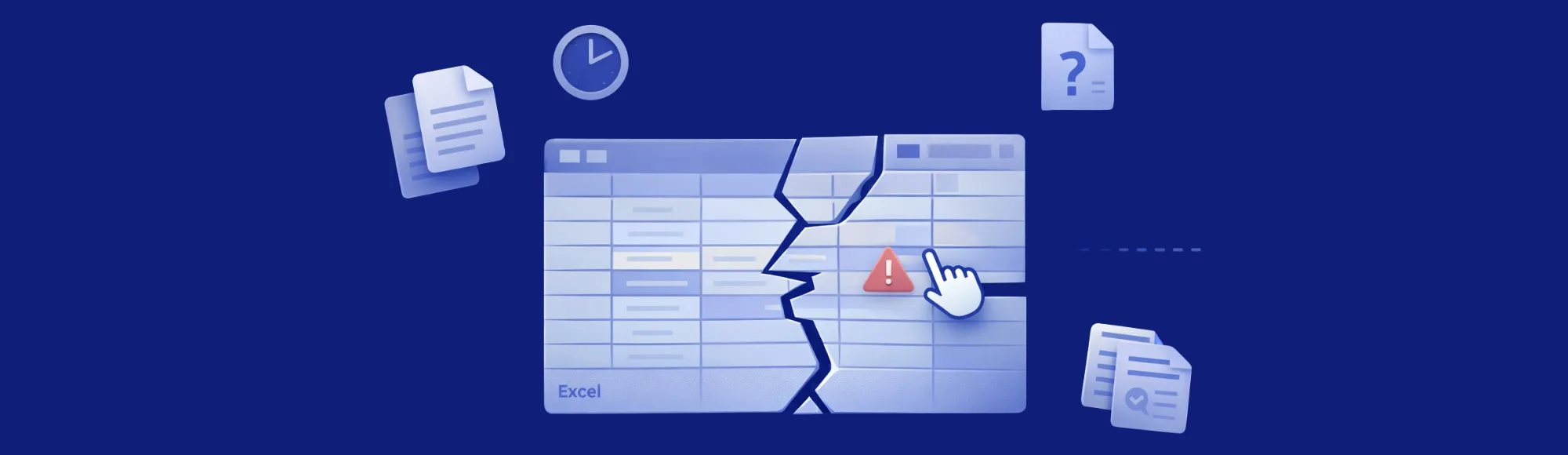

Automation of accounting process requires reliable bank transaction data. UK platforms use Finexer’s FCA-authorised Open Banking infrastructure to access verified feeds that enable automated reconciliation and reporting without manual uploads.

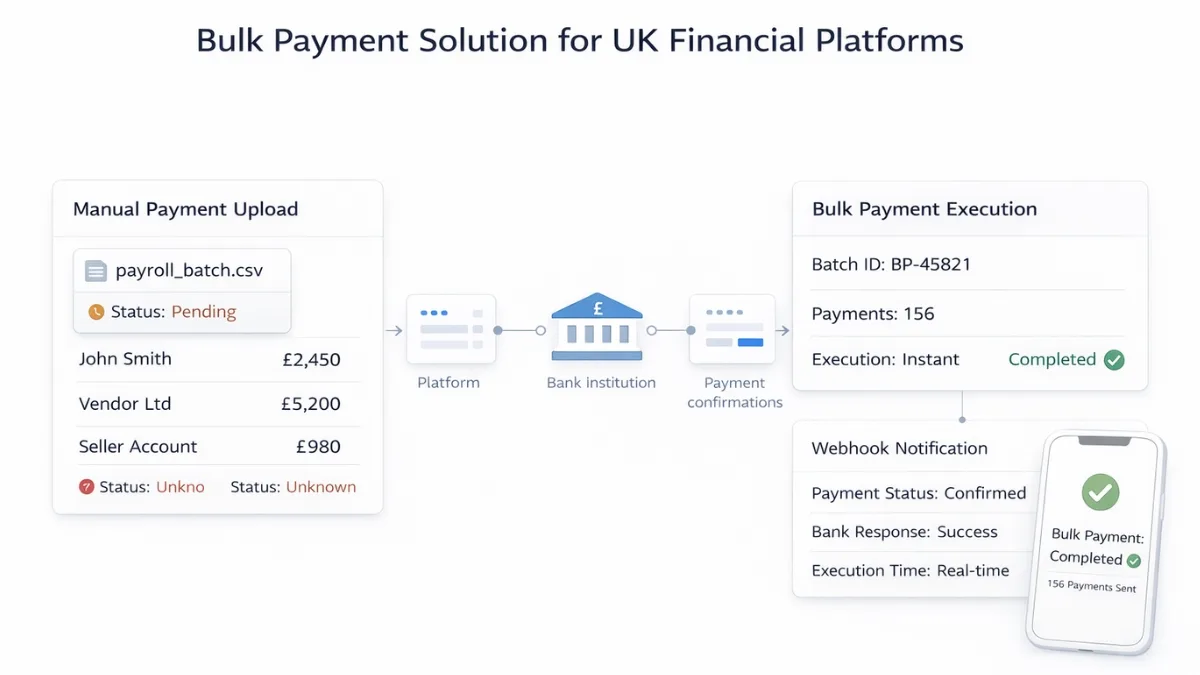

Bulk Payment Solution for UK Financial Platforms

UK platforms need reliable bulk payment solution infrastructure for payroll, vendor payouts, and settlements. Finexer provides FCA-authorised Open Banking connectivity that enables automated payment initiation without manual CSV uploads.

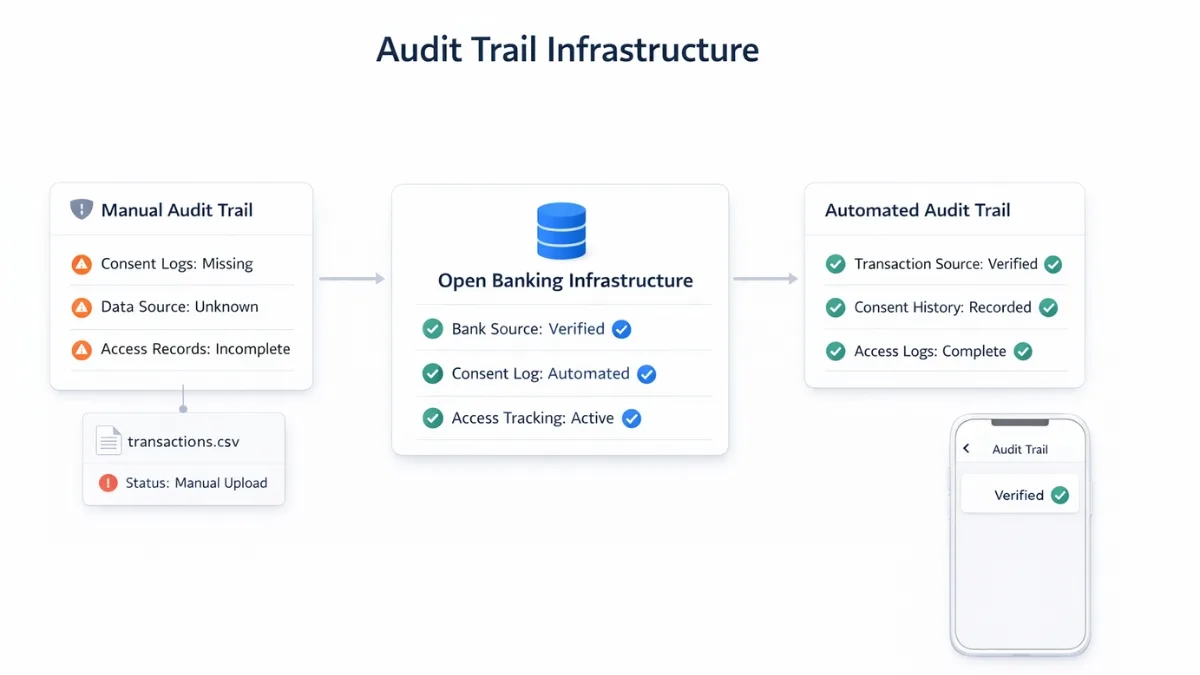

Audit Trail Infrastructure for UK Fintech Platforms

Audit trail in financial platforms tracks data origin and consent. UK platforms use Open Banking infrastructure to automate verified transaction records.

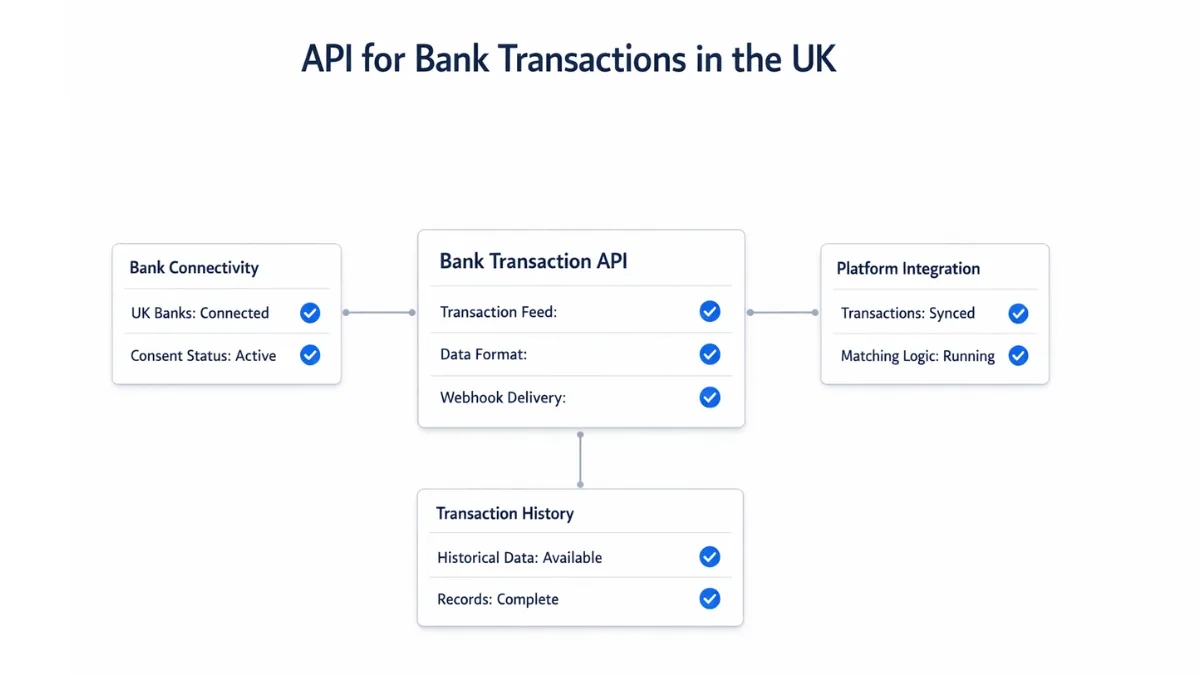

API for Bank Transactions in the UK: What Product Teams Should Check

API for bank transactions evaluation guide for UK product teams. Check coverage, data structure, webhooks before choosing Open Banking infrastructure.

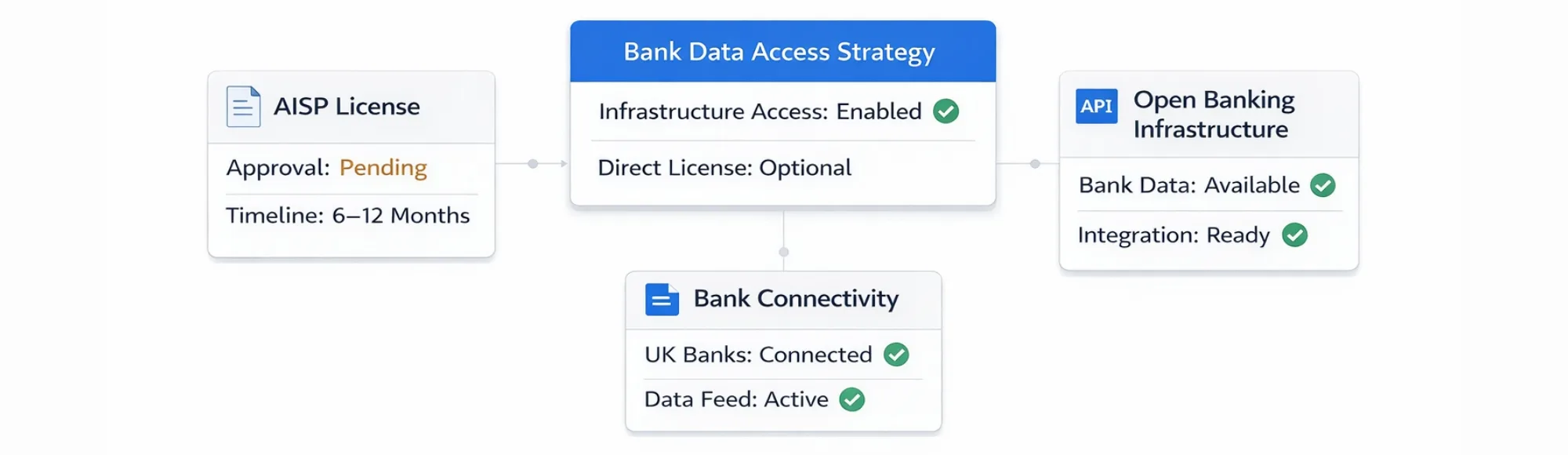

AISP License in the UK: What Founders Actually Need to Know

AISP license evaluation guide for UK fintech founders. Understand direct FCA authorisation vs infrastructure model for bank data access. Make informed regulatory decisions.

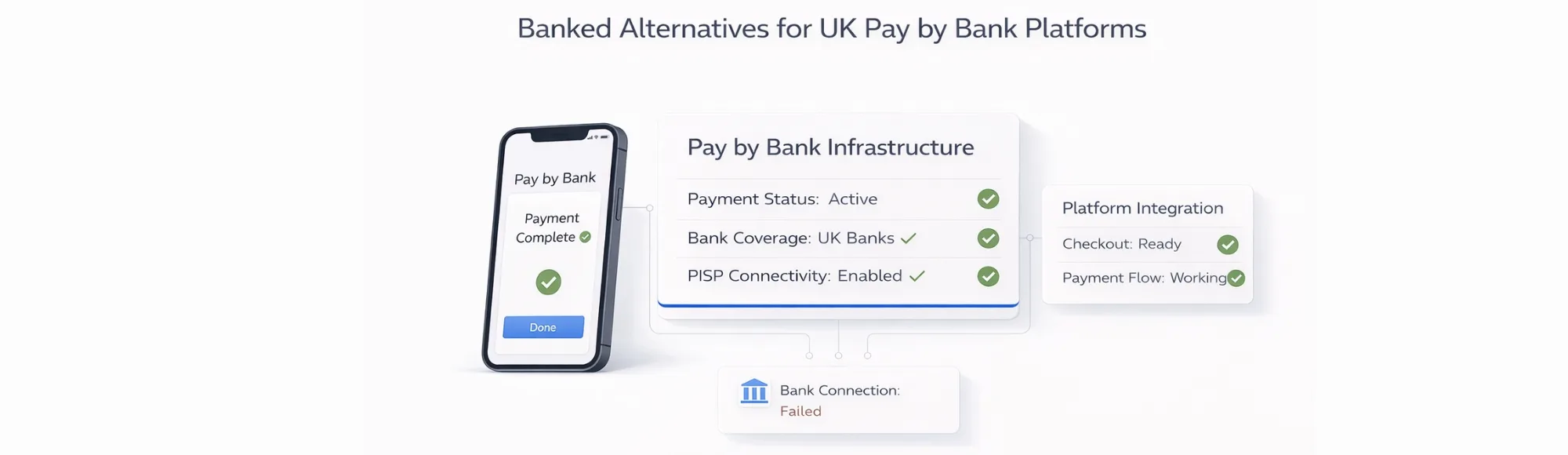

Top 6 Banked Alternatives for UK Pay by Bank Platforms

Compare 6 Banked alternatives for UK Pay by Bank platforms. Evaluate FCA-authorised PISP infrastructure options with stable connectivity and transparent pricing.

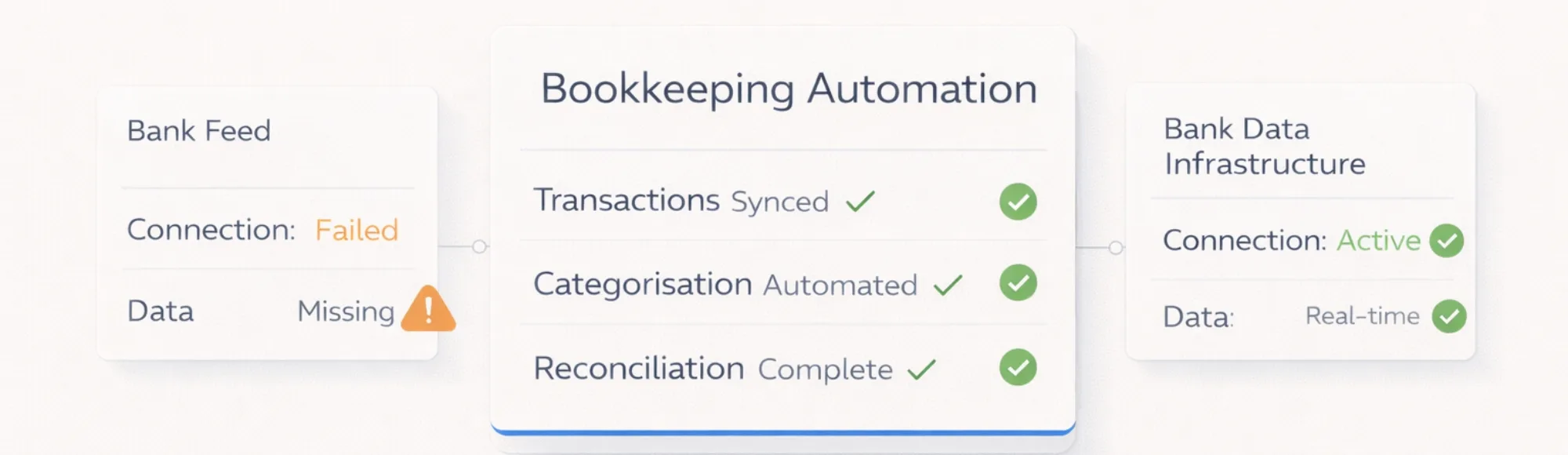

Bookkeeping Automation Software in the UK: What Actually Powers It

Bookkeeping automation software needs reliable bank data infrastructure. See how Open Banking powers automation features for UK accounting platforms.

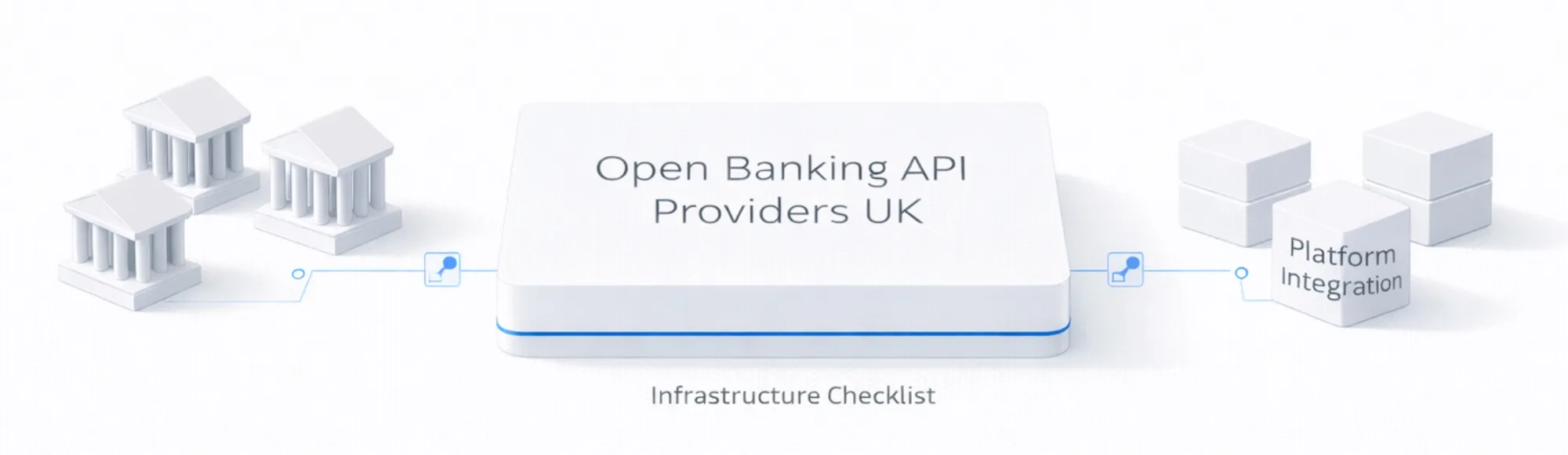

Best Open Banking API Providers UK (2026 Buyer Checklist)

Compare open banking API providers UK with infrastructure-focused checklist. Evaluate coverage, pricing, deployment beyond feature lists. FCA-authorised connectivity for platforms.

Pay by Invoice in the UK: A Smarter Way to Collect Payments

PISP payment infrastructure checklist for UK platforms. Evaluate providers with 99% bank coverage, consent handling, and webhook delivery. FCA-authorised Open Banking.

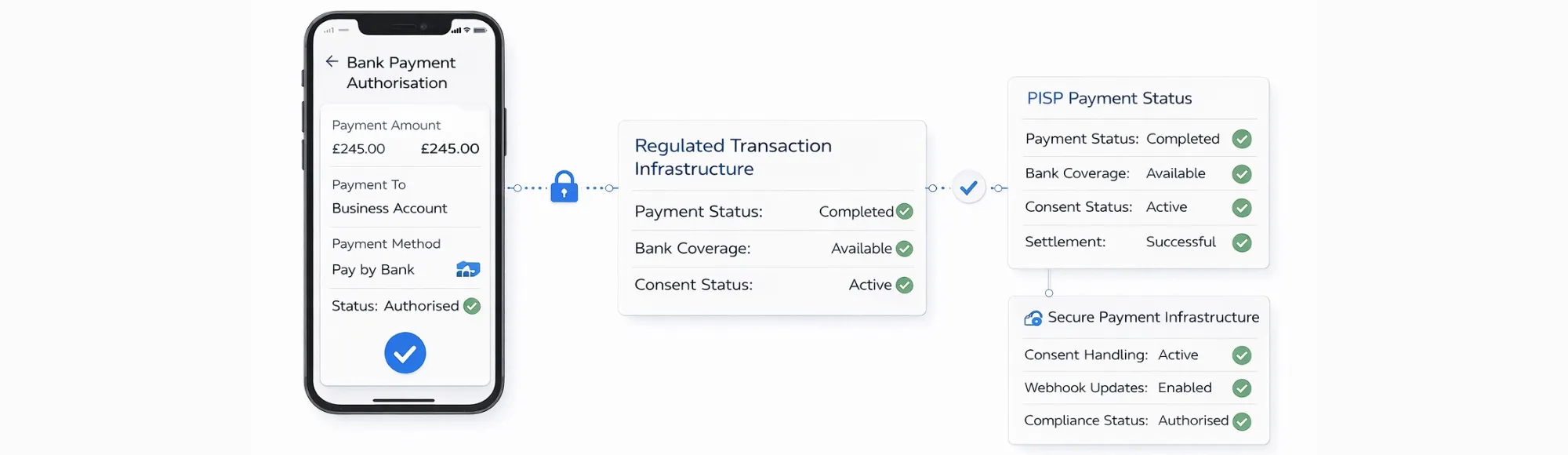

PISP Payment in the UK: Infrastructure Checklist for Platforms

PISP payment infrastructure for UK platforms. Evaluate providers with 99% bank coverage and consent handling. Compare Open Banking payment initiation now

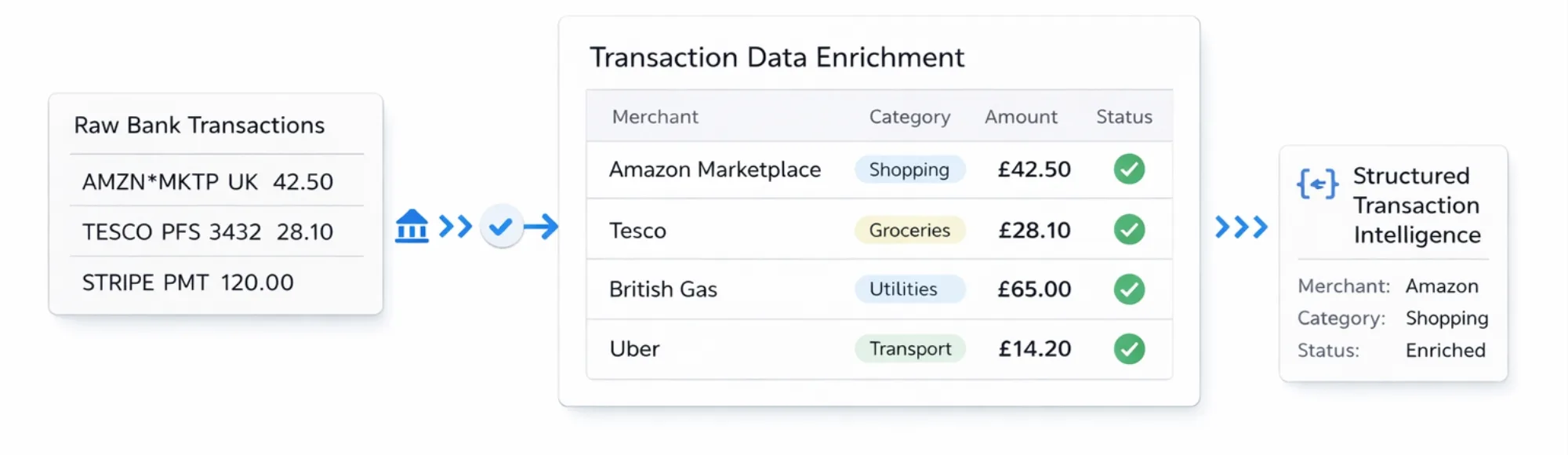

Transaction Data Enrichment for Platforms: Turn Raw Bank Transactions into Usable Intelligence

FCA-authorised APIs for UK platforms. Evaluate enrichment infrastructure now

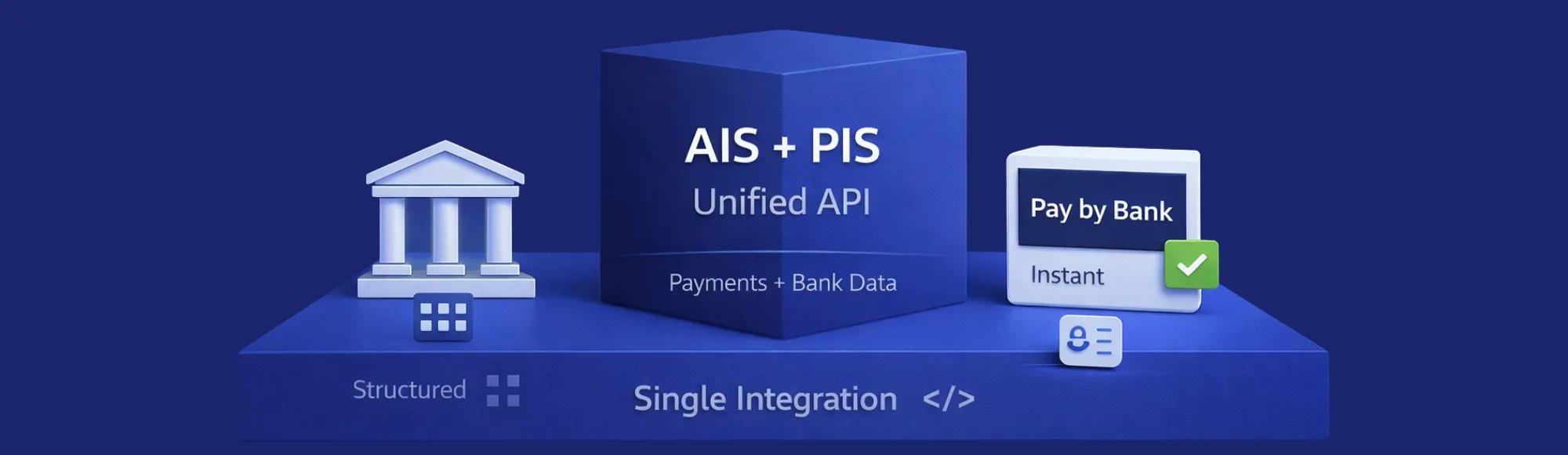

API Financial Services for Platforms Building Payments & Open Banking

API financial services with AIS+PIS in one integration. Compare Open Banking providers for UK platforms. Evaluate payments and bank data infrastructure now.

Pay by Link Service: Instant Bank Payments for UK Platforms

Pay by link service with instant bank transfers. Skip card fees and chargebacks. Finexer’s Open Banking enables A2A payments for UK SaaS platforms in 3-5 weeks. Character Count: 160 characters

AISP Open Banking: Build Faster AIS Banking Access for Your Platform

aunch faster with AISP Open Banking in the UK. Access verified AIS banking data from 99% of banks. Build verification & aggregation. Book a demo.

Bank Account Aggregation API for SaaS & Fintech Platforms

Aggregate bank accounts via Open Banking APIs. Access enriched, consent-based transaction data across 99% of UK banks. Book a demo with Finexer.

Account Information Service (AIS): How Platforms Access Bank Data via Open Banking

Access verified UK bank data with Finexer’s account information service. Connect to 99% of banks via Open Banking APIs. Book a demo today.

Making Tax Digital for ITSA: How to Prepare for HMRC’s 2026 Mandate

Making Tax Digital for ITSA: How to Prepare for HMRC’s 2026 Mandate Heading: Prepare for MTD ITSA Before April 2026 Sub-heading: Access bank-verified transaction data for quarterly HMRC reporting through FCA-authorised infrastructure Button Text: Book Demo (Use this button link: https://finexer.com/contact) HMRC is rolling out Making Tax Digital for ITSA from April 2026. Manual spreadsheets,…

Excel MTD Bridging Software: Automate MTD Reporting Using Open Banking APIs

Replace Excel-based MTD workflows with automated bank feeds. Use excel mtd bridging software powered by Open Banking APIs – scale MTD reporting with Finexer. Book a demo.

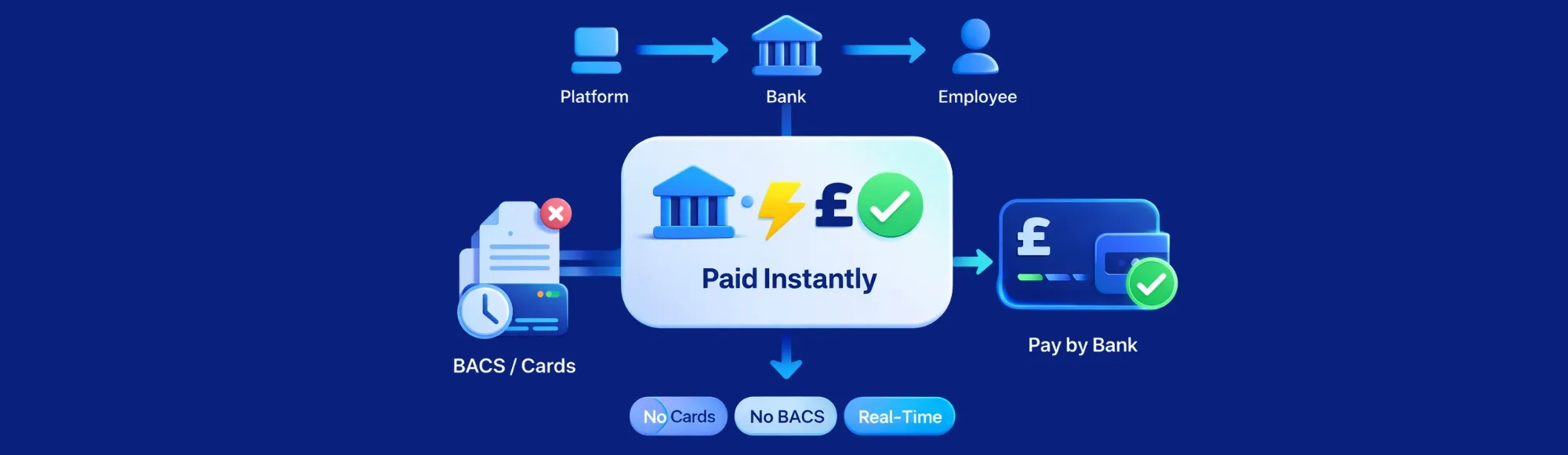

Smart Payroll Processing Payments: Automate Salary Payouts via Bank APIs

Modern payroll processing payments using bank APIs. Replace manual BACS files with real-time salary payouts, instant confirmation, and reconciliation – powered by Finexer.

Payroll Reconciliation Automation Using Real-Time Bank Data

Payroll reconciliation software for finance teams. Automate payroll payments reconciliation with real-time bank data-eliminate manual matching & Excel errors.

Open Banking Payroll Disbursement APIs: How Fintechs & Payroll Platforms Enable Real-Time Salary Payouts Without Cards or BACS

Open banking payroll disbursement API for fintechs & payroll platforms. Enable real-time salary payouts without cards or BACS-99% UK coverage, instant settlement.

AML Checks for Estate Agents Using Open Banking Data

AML checks for estate agents using open banking data. Verify bank accounts, funds & financial history in minutes. Reduce manual onboarding and fraud.

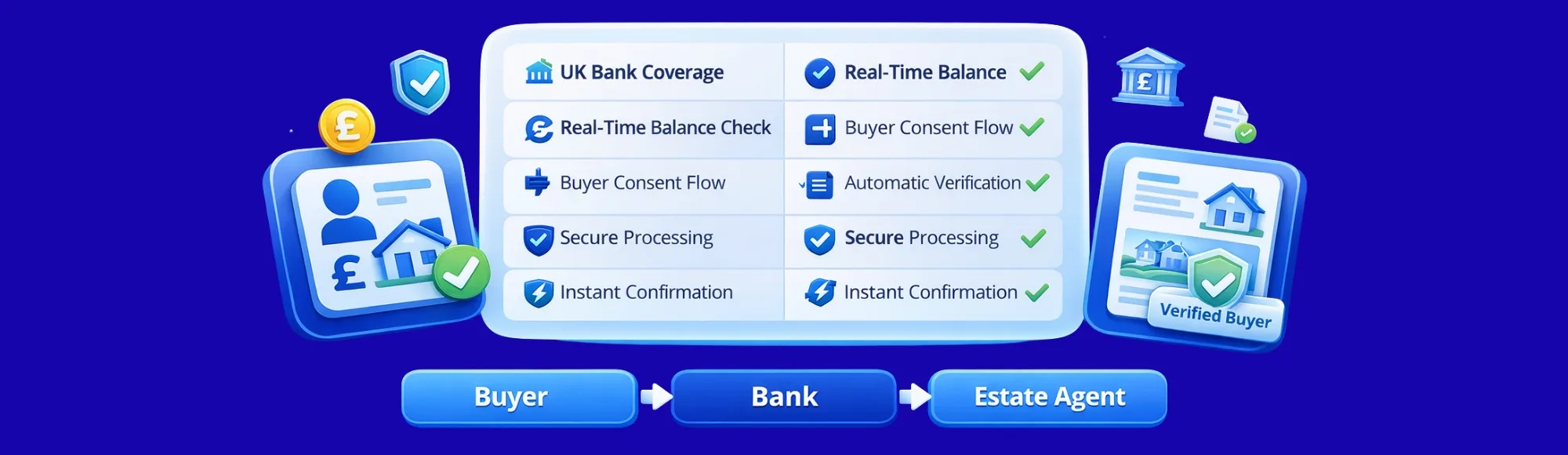

Real Estate Bank Verification: How Estate Agents Instantly Verify Proof of Funds & Bank Accounts Using Open Banking

Real estate bank verification for UK estate agents. Verify buyer funds instantly, eliminate statement delays & close deals faster with open banking technology.

Instant Payroll Payment Software: How Businesses Can Pay Employees in Real Time Without Bank Delay

Instant payroll payment software for UK businesses. Pay employees in real time, eliminate 3-day bank delays & improve retention with 99% UK bank coverage.

Law Firm Payment Automation for UK Firms: Automating Client Payments End-to-End

Law firm payment automation for UK firms. Automate client payments end-to-end, reduce admin by 90% & eliminate delays with 99% UK bank coverage from Finexer.

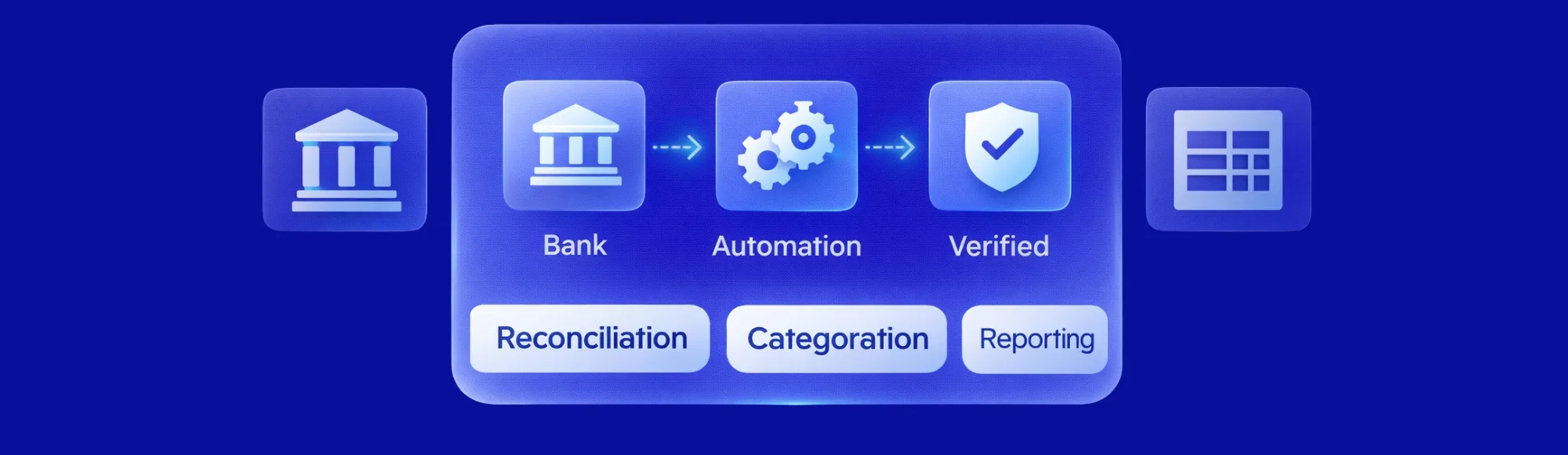

Accounting Workflow Automation: How Modern Finance Teams Automate Reconciliation, Categorisation, and Reporting

Get Accounting Workflow Automation with Finexer Cut manual processing time, improve accuracy & automate reconciliation with real-time bank connectivity Contact Now You’ve probably been there: it’s month-end, your finance team is buried in spreadsheets, manually matching hundreds of transactions. Someone’s chasing down a missing payment reference whilst another team member is three hours into reconciling…