Open banking providers are third-party companies that enable the secure sharing of financial data between banks and authorised service providers through APIs. This allows consumers and businesses to access a wider range of financial services, enhancing control and improving financial experiences.

We will guide you through:

Purpose of the Guide:

- Compare features, services, and overall value of top open banking providers.

- Provides comprehensive understanding of what each open banking platform offers.

- Enable businesses to select the best open banking provider based on detailed, up-to-date comparisons.

Open Finance Expansion

By 2025, nearly 70% of financial institutions are expected to offer or partner with open banking providers for broader open finance solutions, including insurance, pensions, and investment services.

1. TrueLayer

Founded: 2016

Headquarters: London, UK

Location:Primarily operates in the UK and Europe, with plans for global expansion

Overview

TrueLayer is one of the leading open banking providers that offers robust API solutions for businesses. TrueLayer’s platform enables secure access to financial data and payment initiation, making it a powerful tool for fintech companies and developers.

Key Features:

✓ Data Connectivity: Seamlessly connect to a wide range of banks and financial institutions.

✓ Payment Initiation: Facilitate secure and efficient payments directly from bank accounts.

✓ Advanced Security: Utilise top-tier security protocols to protect user data.

Benefits for Businesses and Consumers

Benefits for Businesses and Consumers

For Businesses: TrueLayer’s API solutions help businesses integrate open banking functionalities into their services, enhancing customer experiences and operational efficiency.

For Consumers: Consumers benefit from streamlined financial services and secure, efficient payment processes provided by open banking providers like TrueLayer.

📚 Best Alternative to Truelayer

2.Finexer

Founded: 2018

Headquarters: London, UK

Location: Primarily operates within the UK.

Overview

Finexer is emerging as a leading innovator in open banking, One of the fastest growing Open Banking Platform delivering cutting-edge solutions that simplify payment processes and enhance financial transparency for both businesses and consumers.

Key Features:

✓ Innovative A2A Payment Solutions: Provides secure and instant account-to-account payments.

✓ Robust Security Infrastructure: Utilises advanced security measures, including AES-256 encryption, TLS 1.2, SHA-1 HMAC, and full compliance with PSD2 regulations

✓ User-Friendly Platform: Known for its easy integration and user-friendly dashboard.Finexer makes it easy for businesses to adopt open banking functionalities.

Benefits for Businesses and Consumers

For Businesses: Finexer’s payment integration and real-time data capabilities help businesses streamline operations and improve cash flow management.

For Consumers: Users benefit from transparent and efficient payment processes, alongside comprehensive financial overviews provided by open banking providers like Finexer.

| Service | Category | Description |

|---|---|---|

| Instant Payment | PIS (Payments) | Request to Pay-By-Bank for instant transactions. |

| Payout | PIS (Payments) | Instant refunds and withdrawals. |

| Bulk Payout | PIS (Payments) | Multiple payments in a single click. |

| Recurring Payment | PIS (Payments) | VRP (Variable Recurring Payments) and Sweeping. |

| Transactions Data | AIS (Data) | Real-time bank transaction data retrieval. |

| Balance Check | AIS (Data) | Access income, expenses, and balance information. |

| Authenticate | AIS (Data) | Retrieve account details, sort code, IBAN, and BIC. |

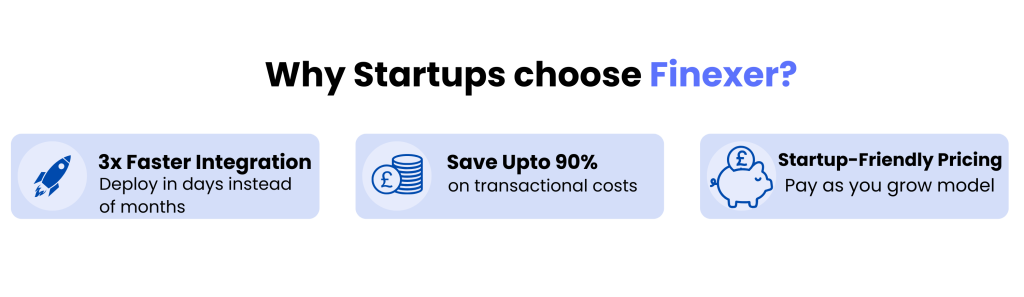

Why Businesses Choose Finexer

✅ No Setup Fees – Get started without upfront costs.

✅ No Cancellation Charges – Stop anytime without penalties.

✅ Usage-Based Pricing – Only pay for what you use, ideal for startups and scaling firms.

✅ Fastest UK Deployment – Go live in days, not months.

✅ Developer-Friendly APIs – Easy to integrate into any B2B or financial workflow.

“We were looking for a partner that could not only meet our current needs but also anticipate and support our growth. Finexer delivered exactly what we needed, from compliance-ready software to seamless integration with our existing systems.”

— David, CEO, VirtualSignature-ID

Get Started

Start your 14-day free trial today and see why businesses trust Finexer for secure, compliant, and tailored open banking solutions.

📚 Yapily vs Truelayer vs Finexer

3. Plaid

Founded: 2013

Headquarters: San Francisco, USA

Location:Operates in the UK, US, and Europe

Overview

Plaid has become a cornerstone for many of the world’s leading fintech companies, with up to 80% of top fintechs relying on its API infrastructure. In the UK, Plaid operates as one of the top open banking providers, allowing users to execute real-time payments seamlessly within apps, enhancing the user experience and streamlining financial transactions.

Key Features

✓ Broad Bank Connectivity: Connect to a vast network of banks and financial institutions.

✓ Easy Integration: Developer-friendly tools and comprehensive documentation for smooth integration.

✓ Transaction Data: Access detailed transaction data to power financial applications.

Benefits for Businesses and Consumers

For Businesses: Plaid’s reliable infrastructure allows businesses to build robust financial applications with ease.

For Consumers: Enhanced financial app experiences through seamless connectivity and accurate data retrieval from open banking providers like Plaid.

📚Detailed guide to Top 3 Plaid alternatives

4. Yapily

Founded: 2017

Headquarters: London, UK

Location:Operates in the UK and Europe.

Overview

Yapily stands out among open banking providers with its robust focus on the social impact of open banking. Serving notable clients like Intuit QuickBooks, Yapily emphasises creating solutions that not only enhance financial services but also contribute positively to society.

Key Features

✓ Social Impact: Focus on creating positive societal impacts through financial solutions.

✓ Client Partnerships: Collaboration with major fintech players to deliver enhanced services.

✓ Innovative Solutions: Development of solutions that drive transformation in financial services.

Benefits for Businesses and Consumers

- For Businesses: Yapily’s solutions help businesses improve financial service delivery while contributing to societal benefits.

- For Consumers: Enhanced financial services that are designed with a focus on positive social impact, thanks to open banking providers like Yapily.

5. Tink

Founded: 2012

Headquarters: Stockholm, Sweden

Location: Operates in Europe and Latin America.

Overview

Originating in Sweden and now operating across Europe and Latin America, Tink has significantly expanded its influence with strategic investment from PayPal. Tink’s platform offers a wide range of services, making it one of the most comprehensive open banking providers.

Key Features

✓ Payment Initiation: Enable secure and efficient payments directly from bank accounts.

✓ Data Aggregation: Provide a consolidated view of financial data from multiple sources.

✓ Strategic Partnerships: Collaboration with PayPal and other significant players to enhance service offerings.

Benefits for Businesses and Consumers

- For Businesses: Tink’s comprehensive platform supports a wide range of financial services, promoting transparency and innovation among open banking providers.

- For Consumers: Users benefit from a streamlined financial experience with access to consolidated data and efficient payment solutions provided by open banking providers like Tink.

📚 Top 5 Tink alternatives in UK

Conclusion

Selecting the right open banking provider is crucial for businesses looking to enhance financial efficiency and customer experiences. Providers like Finexer, Truelayer, Yapily, Plaid and Tink offer unique features and robust security, enabling secure and seamless financial transactions. Businesses can make informed decisions to leverage open banking technology by comparing their services.

What new open banking regulations are expected in 2025?

Look out for PSD3 updates and expanded open finance rules mandating stricter data-sharing consent and enhanced security measures across the UK and EU.

Why is selecting the right open banking provider crucial?

The right provider ensures secure integrations, cost-effective payment solutions, and a smoother user experience that boosts customer satisfaction and business growth

Which providers dominate the 2025 open banking landscape?

Top contenders include Finexer, TrueLayer, Plaid, Yapily, and Tink, each offering robust APIs, strong security protocols, and innovative payment features.

Is open banking safe for UK businesses and consumers?

Yes. Reputable providers comply with FCA regulations, use high-level encryption, and adopt multi-factor authentication to safeguard financial data.

How does open banking benefit small businesses in 2025?

It streamlines payments, automates accounting tasks, and offers real-time cash flow insights—reducing admin overhead and improving financial transparency.

What’s the difference between open banking and open finance?

Open banking focuses on bank account data; open finance expands to include insurance, pensions, and investments for a more comprehensive financial view.

Ease Banking process with Finexer in 2025 ! Schedule your free demo and get a 14 days Trial by Finexer 🙂