Imagine pulling every bank transaction, account balance, and financial record you need in seconds without chasing clients for PDFs or juggling multiple logins. That’s what financial data aggregation makes possible.

Across the UK, more than 7 million users now rely on Open Banking data sharing, with over 11 billion API calls made in 2024 (OBIE). Instead of manual uploads or insecure scraping, regulated APIs enable consent-driven, secure access to real-time financial data.

This guide explains what financial data aggregation is, why account aggregator consent and consent manager frameworks matter, and how secure, standardised APIs are reshaping data access for financial institutions and fintechs. If you’re building financial products or handling compliance, this is the right place to start.

Definition and Core Principles

Financial data aggregation refers to securely collecting and structuring financial information from multiple sources through regulated APIs and Open Banking data sharing, instead of manual uploads or scraping. With account aggregator consent, users authorise what data can be accessed, by whom, and for how long, ensuring transparency and control.

Core Principles

- Explicit Consent: Users grant clear, time-bound permission.

- Transparency: Managed through consent manager frameworks where access can be reviewed or revoked.

- Security: Strong financial data aggregation security standards replace insecure credential sharing.

- Standardisation: Data is delivered in consistent formats for easy analysis.

- Regulatory Compliance: Aligned with UK Open Banking and PSD2 rules for consumer protection.

By applying these principles, institutions can replace fragmented, manual workflows with real-time, compliant data flows that improve accuracy, speed, and user trust.

From Manual Methods to Secure Aggregation

| Aspect | Manual / Screen Scraping Methods | Secure Financial Data Aggregation |

|---|---|---|

| Data Collection | Relies on users sharing banking credentials with third parties, followed by scraping from online portals. | Uses regulated APIs and open banking data sharing to access information with account aggregator consent. |

| Security | High risk. Credentials are stored by intermediaries and scraping methods are vulnerable to breaches. | Data moves through encrypted, regulated channels. Managed through consent manager frameworks for full transparency. |

| Speed & Reliability | Slow and error-prone. Changes in bank interfaces often break the connection. | Real-time data transfer with consistent structure, ensuring stability and fewer operational delays. |

| User Control | Users have limited visibility and no easy way to revoke access once credentials are shared. | Users grant clear, time-bound permissions and can revoke access at any time via consent tools. |

| Compliance | Difficult to audit and often falls outside regulatory frameworks. | Fully compliant with FCA and PSD2 standards, with built-in audit trails through regulated financial data aggregation flows. |

How Consent-Driven Financial Data Aggregation Works

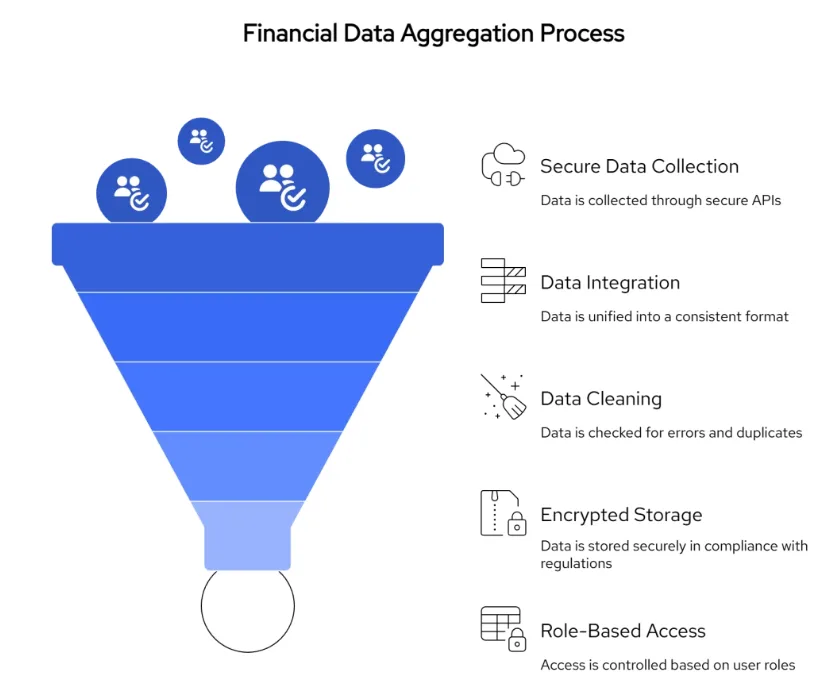

Consent is the foundation of modern financial data aggregation. Instead of sharing credentials or sending documents by email, users approve access through secure, regulated flows. Here’s how it works step by step with Finexer’s infrastructure:

1. User Consent Comes First

Customers start on a secure interface, such as Finexer’s hosted consent page, where they choose which accounts to connect, what data to share, and for what purpose (for example, accounting or lending). Consent is always granular, time-bound, and can be revoked at any time through consent manager tools.

2. Secure Data Collection Through APIs

Once consent is granted, Finexer connects to banks using regulated open banking data sharing APIs. Real-time financial data is pulled directly from accounts — no more manual statement uploads or email attachments.

3. Integration and Standardisation

Data from multiple sources, including bank accounts and credit cards, is automatically unified into a consistent format. This ensures compatibility with accounting platforms, ERP systems, and business tools without additional formatting work.

4. Cleaning, Validation and Categorisation

Finexer checks every data point for errors or duplicates, enriches it with metadata, and tags transactions by category (e.g., rent, salaries, utilities). The result is clean, structured data that’s ready for reporting, analysis, and compliance reviews.

5. Encrypted Storage and Compliance

All information is stored in encrypted environments that meet FCA, PSD2, and GDPR standards. Security and privacy are built in from the start, protecting both businesses and end users.

6. Role-Based Access and Dashboards

Only authorised roles such as accountants, business owners, or end users can view or use the data. Finexer provides clear dashboards and access controls for complete transparency and easy management.

Regulatory Framework

Financial data aggregation is built on strict legal and technical standards that protect consumers and give institutions a clear operating structure.

Open Banking Standards

In the UK, Open Banking data sharing is regulated by the Financial Conduct Authority (FCA). Only authorised Account Information Service Providers (AISPs) can access customer bank data, and every request must be backed by explicit account aggregator consent. APIs follow common technical specifications to ensure security, interoperability, and auditability.

Regional Compliance Requirements

- UK: FCA rules govern AISPs and PISPs, with a focus on strong customer authentication, consent management, and secure data handling.

- EU: PSD2 and the upcoming PSD3 framework mandate regulated API access and clear consent flows across member states.

Consumer Rights Protection

Users retain the right to decide what data is shared, for how long, and with whom. Through consent manager frameworks, they can review and revoke access at any time. These measures ensure transparency, control, and compliance with data protection laws.

Benefits of Financial Data Aggregation for Institutions

| Benefit Area | How Financial Data Aggregation Helps | Impact for Institutions |

|---|---|---|

| Customer Insights | Access verified, real-time transaction data via open banking data sharing rather than PDFs or self-reported info. Analyse spending patterns, income streams, and overall financial health with confidence. | More precise credit scoring, affordability checks, and segmentation strategies. |

| Operational Efficiency | Automate collection, validation, and integration across multiple banks. Remove manual follow-ups and document handling. | Cut onboarding and processing time from days to minutes, reduce admin costs, and improve data accuracy. |

| Risk Management | Use regulated APIs with account aggregator consent for secure, structured, and traceable records that support fraud detection and ongoing monitoring. | Stronger underwriting, lower fraud exposure, and improved decision accuracy. |

| Regulatory Compliance | Log and manage consent through consent manager frameworks with clear audit trails aligned to FCA, PSD2, and GDPR requirements. | Easier audits, reduced manual review, and demonstrable user consent. |

| Revenue Opportunities | Build new services on reliable, structured data, such as real-time lending decisions, personalised wealth dashboards, or embedded finance features. | Faster product launches, increased engagement, and new monetisation streams. |

Aggregate Financial Data with Finexer!

Finexer provides the infrastructure layer for secure, consent-driven financial data aggregation in the UK. Our regulated Open Banking APIs give fintechs, accounting firms, lenders, law firms, and platforms direct access to real-time bank data, without the complexity of managing compliance and bank integrations in-house.

Why Finexer

- 99% UK Bank Coverage

Fetch data from nearly every UK retail and business bank through a single, reliable integration. - Secure, Regulated Infrastructure

Finexer is FCA-authorised and fully aligned with PSD2 and Open Banking standards, so your data flows remain compliant from the start. - Consent-Driven Access

Built-in consent flows and transparent audit trails give end users full control over what data is shared, and for how long. - Faster Deployment

Our developer-first APIs, white-labelled flows, and hands-on onboarding support help teams go live 2–3× faster than the market average. - Flexible Pricing

Usage-based pricing means you only pay for what you use — no setup fees, no minimums.

Use Cases We Power

- Account aggregation for accounting and wealthtech platforms

- Real-time affordability checks for lenders

- Source of funds and income verification for legal and compliance workflows

- Multi-bank reconciliation and data feeds for ERP systems

Finexer simplifies regulated data access, letting teams focus on building products and services, not maintaining bank connections or compliance pipelines.

What is financial data aggregation?

Financial data aggregation means securely collecting information from multiple bank accounts in one place using regulated APIs. It’s powered by open banking data sharing and user consent, so institutions get real-time access while individuals keep control over what’s shared and for how long.

Is financial data aggregation secure?

Yes. It uses encrypted API connections and regulated consent frameworks instead of password sharing. This makes data access more secure and transparent, helping institutions meet regulations while giving users full control over their information.

How does consent work in financial data aggregation?

Before data is shared, users give clear, time-limited permission through consent manager tools. They can see what’s being shared and revoke access anytime, ensuring transparency and control over their financial information.

Access real-time bank data securely with Finexer Open Banking. Schedule your free demo now!