Expense claims are one of the most common back-office frustrations. Between chasing receipts, entering amounts manually, and tracking down approvals, UK accounting teams often spend more time managing expenses than reviewing them.

The process is slow, repetitive, and leaves room for error, especially when spreadsheets and disconnected systems are involved.

That’s why more firms are turning to expense automation powered by real-time bank data. By connecting directly to employee accounts (with consent) using Open Banking, finance teams can eliminate the bottlenecks and improve both accuracy and turnaround time.

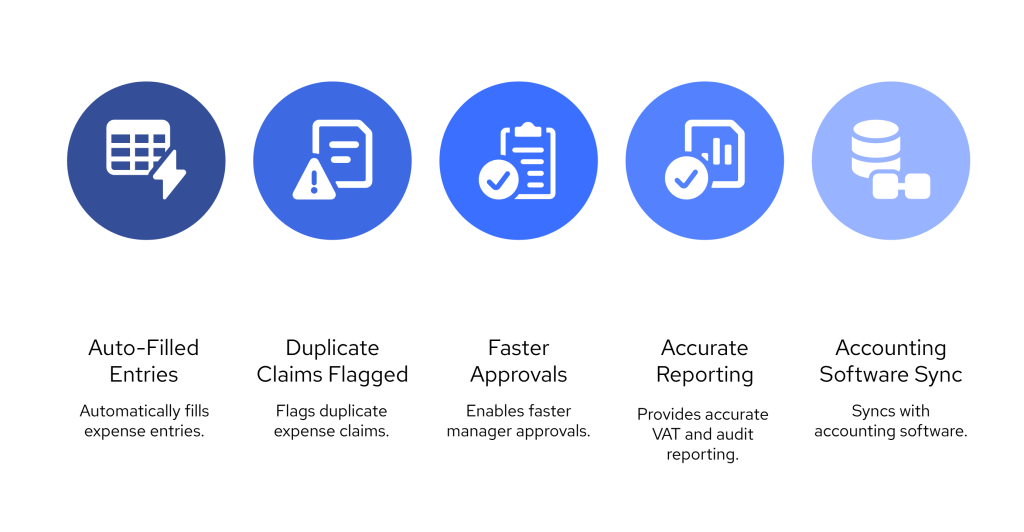

Below are five specific ways that automated expense workflows are transforming claims across UK accounting teams.

1. No More Manual Entry: Bank Feeds Pre-Fill Expense Data

Manually entering expense data is time-consuming and easy to get wrong. Whether it’s transposing numbers, selecting the wrong category, or copying from a photo of a receipt, these small mistakes add up.

With real-time bank data, expense tools can pull in verified transaction details directly from employee accounts. That includes:

- Merchant name

- Amount

- Date

- Transaction type (credit/debit)

- Categorisation (e.g., travel, meals, fuel)

Instead of asking employees to type in every line item, expense automation tools now offer pre-filled entries that only need a quick review and confirmation.

2. Duplicate Claims Get Flagged Instantly

Duplicate claims are one of the most overlooked issues in manual expense processes. A train ticket paid for by card and later submitted again via a scanned receipt. A meal shared between two employees, both of whom claim it. Or a recurring subscription mistakenly reimbursed twice.

These overlaps are easy to miss and hard to catch without checking line by line.

Real-time bank data makes this much easier. When your expense platform is connected to a live feed of employee transactions, it can automatically compare incoming claims to previous entries. If the same amount, merchant, and timestamp already exist in the system, the claim is flagged instantly.

Finance teams no longer need to manually search for duplicates. Instead, the system spots them and prompts the employee or manager to review.

This not only prevents overpayments but also supports stronger internal controls, especially in firms managing high volumes of expense claims.

3. Faster Manager Approvals with Live Data Visibility

One of the biggest delays in expense processing happens after a claim is submitted. Managers often need to cross-check entries, ask for missing receipts, or clarify vague descriptions before signing off.

With real-time bank data, much of this back-and-forth is eliminated.

Because the transaction information is pulled directly from the employee’s bank account, every claim comes with verified details. Managers can instantly see the date, merchant, and exact amount spent, which helps speed up approval decisions.

Some expense automation platforms also allow managers to approve or reject claims in bulk based on this pre-verified data. This shortens turnaround time from days to just a few hours, without compromising accuracy.

Faster approvals mean happier employees and less admin stress for the finance team.

4. More Accurate VAT Reclaims and Reporting

VAT errors often happen when expense claims rely on incomplete or unclear information. Missing receipts, incorrect tax categorisation, or estimates instead of actual values can all reduce the accuracy of VAT records.

By using real-time bank data through Open Banking connections, finance teams get access to structured, timestamped transactions directly from employee accounts. This provides clear audit trails and improves the accuracy of VAT claims.

With clean data and categorisation, it’s easier to match eligible expenses to the correct VAT codes. Many expense automation tools now use this data to auto-assign tax categories and generate reports that are HMRC-ready.

This doesn’t just support compliance. It also means less time spent chasing documents or correcting ledger entries during your next tax return.

5. Seamless Integration with Accounting Software

When expense claims live in one system and accounting records live in another, mistakes are inevitable. Manual exports, CSV uploads, and copy-paste workarounds often break the link between the original transaction and how it’s recorded.

Expense automation tools that use real-time bank data solve this by integrating directly with cloud accounting platforms like Xero, QuickBooks, or Sage.

Each approved claim is mapped to the correct chart of accounts entry, matched with a verified transaction, and sent to your ledger in real time. No exporting or syncing delays.

This ensures:

- Audit-ready documentation

- Faster month-end close

- Clean, accurate records across systems

With Finexer’s API infrastructure, developers can connect expense workflows directly to 99 percent of UK bank accounts and route data into the software their teams already use.

How Finexer Helps with Expense Automation

Finexer provides the infrastructure that powers them.

For accounting teams, finance software providers, or internal tool builders, the real challenge with expense claims lies in data: getting clean, real-time, categorised transaction data from employee accounts into your system without delays or errors.

That’s exactly what Finexer enables.

Using secure, FCA-regulated Open Banking APIs, Finexer gives you real-time access to verified bank transactions from 99% of UK banks. This means you can:

✅ Auto-Fill Claims with Verified Data

Instead of relying on employees to upload receipts or enter expenses manually, you can pre-fill claims with actual transaction data pulled directly from the source. Each entry includes the amount, merchant, date, and transaction type, ready to match against company policies or accounting categories.

✅ Flag Duplicate Claims Automatically

By matching real-time transaction feeds with previously submitted claims, your system can detect duplicates before they’re approved or paid. Finexer provides structured data with clear identifiers, making these checks fast and reliable.

✅ Route Clean Data into Your Accounting Platform

Finexer’s APIs are designed for integration. You can push categorised expense data straight into tools like Xero or QuickBooks or route it into a custom chart of accounts for internal systems. This removes the need for messy CSV uploads or reconciliation later.

✅ Reduce Admin and Improve Compliance

Each data point from Finexer comes with time, merchant, and category context, which simplifies VAT categorisation and audit readiness. Whether you’re managing compliance for HMRC or building an internal audit trail, Finexer helps keep your records clean and standardised.

✅ Flexible, Developer-First Setup

You don’t need to rebuild your system. Finexer provides developer-friendly documentation, white-labelled consent flows, and webhook-based updates that make it easy to drop real-time expense data into your existing workflow, without long implementation cycles or licensing hurdles.

Finexer is already used by platforms automating reconciliation, cash flow, onboarding, and tax workflows. Now, expense automation is one more process that helps streamline, clean and affordably.

Get Started

Connect today and see why businesses trust Finexer for secure, compliant, and tailored open banking solutions.

How does real-time bank data improve expense automation?

Real-time bank data feeds automatically fill in transaction details such as amount, merchant, and date. This removes manual entry, reduces errors, and speeds up the claim review process.

Can Open Banking be used for employee expense claims?

Yes. With employee consent, Open Banking APIs can pull in transaction data directly from bank accounts. This data helps automate expense claims, detect duplicates, and improve approval accuracy.

What tools support bank-connected expense automation in the UK?

UK tools like Dext, Pleo, and Soldo support expense automation using bank feeds. For custom workflows, Finexer provides real-time access to UK bank data through developer-friendly APIs.

Start automating your expense claims the right way with Finexer powering the data layer with Open Banking.