In the UK, growing accounting firms are under more pressure than ever to deliver faster client payouts. Whether it’s reimbursing expenses, processing payroll, or making supplier payments, waiting several days for funds to clear can frustrate clients and slow down business operations.

Open banking is changing that. According to Open Banking Limited, more than 13 million UK users now use open banking services, and payment volumes are rising every quarter. For accounting firms in the growth phase, this means the ability to send account-to-account payments in seconds, with full compliance and a built-in audit trail.

In this guide, you’ll see exactly how growing accounting firms are using open banking to speed up payouts, reduce admin workload, and give clients a payment experience that matches their expectations in a real-time economy.

What Is Open Banking and Why Does It Matter for Accountants

Open banking is a secure way for authorised providers to access bank account data and initiate payments with the account holder’s consent through APIs built into the UK’s banking system. Introduced under PSD2 regulations and overseen by the Financial Conduct Authority (FCA), it’s designed to make financial services faster, more transparent, and more competitive.

For growing accounting firms, the real opportunity lies in combining account information services (AIS) with payment initiation services (PIS). Together, these make it possible to:

- See up-to-date account balances and transactions in real time

- Verify client account details before sending money

- Trigger pay by bank instantly, without relying on Bacs or cheques

The open banking benefits for accountants go beyond faster payments. It also cuts down on manual data entry, reduces the risk of errors, and provides a full digital audit trail for every transaction. In an industry where compliance and trust are non-negotiable, this is a technology shift worth paying attention to.

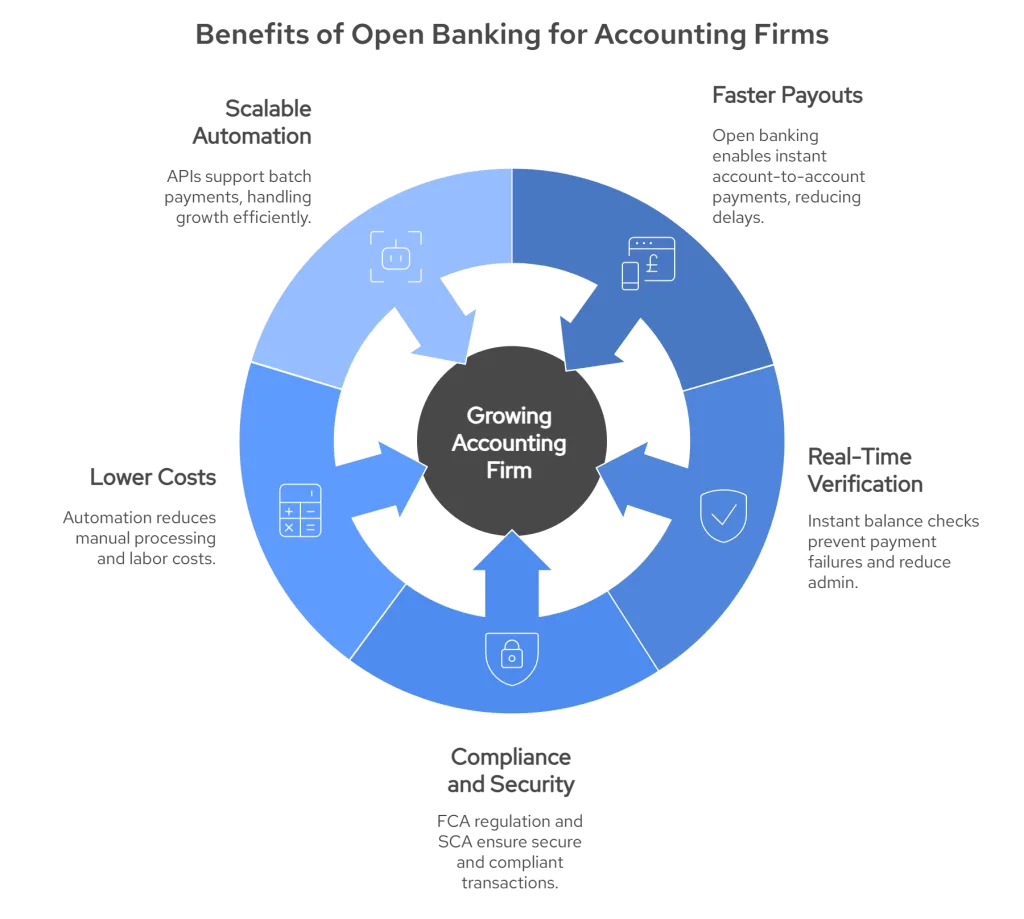

Key Benefits of Open Banking for Growing Accounting Firms

For growing accounting firms, open banking isn’t just about moving money faster, it’s about upgrading the entire payout process to match client expectations in a real-time economy.

1. Faster Client Payouts

Traditional payment methods like Bacs can take up to three working days. With open banking, account-to-account payments clear in seconds. This speed can be a game-changer when you need to reimburse expenses, run payroll, or pay suppliers at short notice.

2. Real-Time Balance Verification

Before sending funds, you can instantly check a client’s account balance. This prevents failed payments, reduces returned transactions, and saves hours of follow-up admin.

3. Built-In Compliance and Security

Open banking payments are regulated by the FCA and require Strong Customer Authentication (SCA). Every transaction has a complete audit trail, making it easier to meet compliance obligations.

4. Lower Operational Costs

By removing manual payment processing and reducing errors, growing accounting firms can cut down on labour costs while improving service delivery.

5. Scalable Payment Automation

As your client base grows, so does the number of payouts you manage. Open banking APIs support batch payment automation for accounting, allowing you to process hundreds of transactions in one go without sacrificing speed or accuracy.

How Open Banking Enables Faster Client Payouts

For growing accounting firms, payment delays usually come from two bottlenecks:

- Reliance on legacy payment rails like Bacs

- Manual approval and processing steps

Open banking removes both.

Direct Account-to-Account Transfers

With payment initiation services (PIS), you can send money directly between bank accounts in seconds. There’s no need for card networks or third-party intermediaries, which is why open banking payments can settle instantly.

Fewer Handoffs, Less Admin

Since the process runs through secure bank APIs, approvals and verifications happen within the same workflow. That means no jumping between systems, fewer email chasers, and less risk of human error.

Built-In Verification Before Sending

Before releasing funds, you can use account information services (AIS) to confirm the correct account details and ensure enough balance is available. This reduces failed payments and the costly reprocessing they cause.

Consistent, Predictable Payouts

Clients value certainty. By switching to open banking for payouts, growing accounting firms can set clear expectations and deliver on them, whether it’s for weekly payroll or one-off supplier payments.

Why Growing Accounting Firms Choose Finexer

For accounting firms, instant payouts are important, but the real foundation is having reliable, MTD-compliant bank transaction data in the UK. Without it, VAT submissions, reconciliations, and compliance workflows can’t run smoothly.

Finexer combines real-time bank data access with instant, compliant payments in a single API, purpose-built for the UK accounting industry.

Key Reasons Firms Switch to Finexer

- MTD-Compliant Bank Feeds – Direct, secure access to bank transaction data that meets HMRC requirements for VAT reporting.

- 99% UK Bank Coverage – From high street to challenger banks, your clients’ accounts can be connected in seconds.

- FCA Authorised for AIS & PIS – Secure, compliant access to both account data and instant payments.

- Batch Payment Capabilities – Payroll, supplier disbursements, and client reimbursements in one run.

- Real-Time Verification – Confirm account details and balances before sending, cutting failed payouts dramatically.

- Deployment 2–3x Faster Than Market – Go live in weeks, not months, with dedicated onboarding support.

- Flexible Pricing – Usage-based billing with no setup fees, so costs scale with your client base.

With Finexer, growing accounting firms get both sides of the open banking equation:

- Accurate, MTD-compliant bank transaction data for tax and reconciliation workflows

- Instant account-to-account payments for faster, smoother client service

Is open banking safe for accountants and their clients?

Yes. In the UK, open banking is regulated by the Financial Conduct Authority (FCA). Only authorised providers can access account data, and all activity is protected with bank-grade encryption and Strong Customer Authentication (SCA).

Why is MTD-compliant bank transaction data important for accounting firms?

MTD-compliant bank feeds ensure that transaction data meets HMRC’s Making Tax Digital requirements. For growing accounting firms, this means VAT submissions and reconciliations can be completed without manual data entry, saving time and reducing errors.

Start your Finexer journey today — request a live demo or sandbox access and future-proof your firm’s accounting operations