Financial planning software is no longer just a tool for enterprise finance teams—it’s now essential for businesses of all sizes aiming to stay on top of budgets, forecasts, and real-time performance. Whether you’re an accountant managing client portfolios, a CFO driving strategic planning, or a startup founder preparing investor reports, the right software can help you streamline your financial operations and make smarter decisions.

With budgeting and forecasting software becoming more powerful and accessible, finance teams are moving away from manual spreadsheets and turning to platforms that offer automation, collaboration, and integration with tools like QuickBooks, Xero, and Excel.

In this guide, we’ve shortlisted 7 top-rated financial planning software solutions for 2025. Each tool has been selected for its ability to handle forecasting, financial reporting, scenario modeling, and planning workflows with ease.

We will guide you through:

What to Look for in Financial Planning Software

In 2025, financial planning software is more than just a budgeting tool — it’s the foundation for making better, faster, and more confident decisions across your business. But with so many options available, the challenge isn’t just choosing software — it’s choosing one that actually aligns with your planning workflows, business model, and growth goals.

Whether you’re managing financial strategy in-house or delivering client-facing forecasts as a finance partner, the right financial planning solution should help you turn data into decisions, not more admin work.

Here are seven key features to look for when comparing today’s top-rated financial planning software tools:

1. Flexible Budgeting and Forecasting That Adapts to Your Needs

Every business plans differently. Your software should reflect that, not force you into a rigid template. Top financial planning software allows you to build rolling forecasts, annual budgets, and dynamic models tailored to your business structure.

Look for tools that let you:

- Build forecasts from historical actuals or custom assumptions

- Adjust plans on a monthly, quarterly, or project basis

- Set flexible time horizons (e.g. 12 months, 3 years, etc.)

- Link multiple departments or business units together in one model

If you’re supporting a growing or multi-entity company, this flexibility is non-negotiable.

📚 Best Cloud Accounting Software in 2025

2. Real-Time Data Sync for Ongoing Accuracy

Manual data entry and static spreadsheets introduce delays and errors. Leading financial planning platforms pull live data from your accounting, banking, or ERP system, keeping forecasts current without added admin.

Features to prioritise include:

- Live syncing with accounting tools like Xero, QuickBooks, or Sage

- Real-time visibility into cash flow, expenses, and revenue

- Automatic reconciliation with actuals to update forecasts regularly

- Alerts when discrepancies or data sync issues occur

This ensures your financial model reflects what’s actually happening, not what happened last month.

3. Scenario Planning and “What-If” Modelling

Good planning goes beyond a single forecast. It explores outcomes.

Advanced financial planning software should let you build multiple “what-if” scenarios — from best-case growth to worst-case slowdowns — and quickly see how changes in assumptions impact your future cash position, profitability, or funding needs.

Key use cases include:

- Hiring plans vs budget availability

- Supply chain delays or price changes

- Delayed receivables or rising interest rates

- New product launches or geographic expansion

The more robust the scenario planner, the more confident your team will be in choosing a path forward.

4. Visual Dashboards and Reporting for Stakeholders

Numbers only matter if people understand them. The best financial planning tools offer visual dashboards, charts, and custom reports that translate financial models into clear summaries, perfect for board presentations, client updates, or investor decks.

Look for:

- Drag-and-drop dashboards to track KPIs and variances

- Customised reporting layouts (monthly packs, quarterly reviews, etc.)

- PDF, Excel, and online sharing capabilities

- Commentary and annotation options for context

If you’re working in client advisory or cross-functional teams, these features can streamline communication and speed up decision-making.

5. Collaboration and User Roles for Team Access

Most planning isn’t done in isolation. Whether you’re part of a finance team or leading planning across departments, your software should allow safe, structured collaboration.

Helpful features include:

- User roles (view-only, edit, admin)

- Audit logs and version control

- Team-based permissions by entity, department, or location

- Cloud-based access with activity tracking

This ensures everyone stays aligned — without sacrificing data integrity or privacy.

6. Integration with Your Financial and Operational Stack

Planning doesn’t happen in a vacuum. The best financial planning software integrates with the rest of your ecosystem to reduce manual work and maintain consistency across systems.

Prioritise tools that connect with:

- Accounting software (e.g. Xero, QuickBooks, NetSuite)

- Payroll platforms (for salary forecasts and headcount planning)

- Google Sheets or Excel (for flexibility and audit trails)

- CRM and billing systems (for revenue pipeline planning)

Strong integration means faster setup, fewer manual uploads, and better-quality forecasts.

7. Scalability and Support as Your Needs Grow

As your business evolves, so should your planning software. What works for a 5-person startup might not work for a multi-entity company with multiple departments.

Look for:

- Tiered pricing and flexible licensing

- Support for consolidated planning across entities or geographies

- Dedicated customer support or onboarding guidance

- Community resources or finance knowledge hubs

Whether you’re an early-stage company or scaling fast, your software should grow with you, not slow you down.

1. Abacum

Abacum is a modern financial planning software designed for fast-scaling startups and mid-sized companies. Built with collaboration and real-time insights in mind, it empowers finance teams to move beyond spreadsheets and build dynamic forecasts, budgets, and models that adapt as the business evolves.

It’s especially well-suited for teams that want to reduce the time spent collecting data and increase the time spent analysing and planning.

Best For

- Mid-sized businesses and SaaS startups

- FP&A teams looking to automate manual processes

- Finance leaders who want to align budgets with strategic goals

Key Features

- Real-time collaboration across finance and non-finance teams

- Automated data consolidation from multiple sources

- Scenario planning and multi-version forecasting

- Departmental budgeting with access controls

- Integration with tools like NetSuite, Xero, QuickBooks, and Google Sheets

Pros

- Clean interface tailored for finance workflows

- Designed for speed — monthly close and forecast updates are faster

- Encourages transparency between finance and department heads

- Great support and onboarding for new teams

Cons

- Best suited for mid-market — may be too advanced for very early-stage startups

- No native payroll integration yet for UK-based teams

Pricing

- Custom pricing based on team size and integrations

- Tailored onboarding included for new customers

- Free demo available on request

Best Use Case for This Tool

Abacum stands out for its real-time collaboration and user-first design. Unlike traditional financial planning tools built solely for analysts, it gives department heads a voice in the budgeting process—without risking model integrity. It’s a strong fit for finance teams looking to build agile, collaborative financial planning systems.

2. Workday Adaptive Planning

Workday Adaptive Planning is a leading enterprise-grade financial planning software trusted by large organisations across sectors. It enables finance teams to manage complex budgets, forecasts, and workforce plans across departments, business units, and geographies — all in one integrated environment.

Designed with scalability in mind, it’s a powerful choice for companies that have outgrown spreadsheets and need a robust, cloud-based FP&A platform that can handle multi-scenario modelling at scale.

Best For

- Mid-sized to large enterprises with multi-departmental needs

- Finance leaders who manage headcount, revenue, and operational forecasts

- Teams transitioning from Excel-based planning to enterprise-grade workflows

Key Features

- Driver-based planning and multi-scenario modelling

- Real-time dashboards and variance reporting

- Role-based access for collaborative planning

- Workforce, sales, and operational planning modules

- Seamless integration with ERP and HCM systems (like NetSuite and Workday)

Pros

- Enterprise-level capability with broad feature depth

- Handles multi-entity planning with ease

- Great for aligning financial and operational planning

- Highly configurable to suit unique workflows

Cons

- May be complex for smaller businesses or lean finance teams

- Requires onboarding time and training for full adoption

Pricing

- Custom pricing based on organisation size and module needs

- Tiered packages available (financial, workforce, sales planning, etc.)

- Onboarding and support available via partners and Workday directly

Best Use Case for This Tool

Workday Adaptive Planning excels at connecting strategic goals to operational performance. Its real-time planning engine and deep analytics make it one of the most trusted tools for CFOs managing multi-dimensional forecasts across fast-moving environments. If your business is scaling rapidly or managing complex structures, it delivers the depth and flexibility required for enterprise-grade financial planning.

3. Datarails

Datarails is a financial planning software designed specifically for small to mid-sized finance teams that still rely heavily on Excel. Instead of replacing spreadsheets entirely, it enhances them—offering automation, real-time consolidation, and advanced reporting without forcing teams to abandon their existing workflows.

It’s a popular choice for CFOs and finance managers who want the flexibility of spreadsheets but the power of a dedicated FP&A platform.

Best For

- Finance teams that rely on Excel but want automation

- SMBs seeking visibility without large enterprise software

- Controllers and CFOs managing multi-departmental budgets

Key Features

- Excel-native financial planning and reporting

- Automated consolidation of multiple spreadsheets

- Scenario modelling and variance tracking

- Built-in dashboards and KPI monitoring

- Integration with accounting systems like NetSuite, QuickBooks, and Xero

Pros

- Quick implementation with minimal change management

- Retains Excel formulas and structure — great for spreadsheet users

- Provides strong control over version history and audit trails

- Short learning curve for finance professionals

Cons

- Not ideal for companies moving fully away from Excel

- Limited collaboration tools for non-finance teams

Pricing

- Custom pricing based on company size and use case

- Free demo and tailored onboarding support available

Best Use Case for This Tool

Datarails is ideal for finance teams that want to modernise their budgeting and forecasting processes without leaving Excel behind. It bridges the gap between manual spreadsheets and enterprise FP&A platforms—making it a practical upgrade for SMBs seeking more structure without sacrificing flexibility.

4. RightCapital

RightCapital is a purpose-built financial planning software for advisors who work with individuals, families, and small business owners. It simplifies complex planning tasks—like retirement, tax, and estate modelling—into visual, client-friendly dashboards and workflows.

Unlike corporate-focused tools, RightCapital is designed with financial advisors in mind, offering strong client engagement features and white-labeled planning outputs.

Best For

- Independent financial advisors and wealth managers

- Firms offering goal-based financial planning to individuals

- Advisors needing visual, easy-to-explain financial models

Key Features

- Retirement planning with Social Security and tax optimisation

- Insurance, debt, and estate planning modules

- Interactive client portals with live goal tracking

- Cash flow, Monte Carlo, and Roth conversion analysis

- White-label reports and branded dashboards

Pros

- Advisor-friendly interface with guided workflows

- Strong client engagement features

- Great for firms offering holistic personal finance planning

- Custom reports tailored to individual client needs

Cons

- Focused on personal financial planning — not business FP&A

- Limited integrations with corporate accounting systems

Pricing

- Starts at $124/month per advisor (Essentials plan)

- Premier and Platinum plans available with more features

- Free trial available on request

Best Use Case for This Tool

RightCapital is a top choice for financial advisors who want to deliver detailed, client-friendly planning experiences without overwhelming users with spreadsheets. It’s especially useful for firms focused on retirement, insurance, and tax strategy—where education and clarity matter as much as accuracy.

5. Prophix

Prophix is a powerful financial planning software platform designed to automate and unify core FP&A functions across budgeting, forecasting, reporting, and financial consolidation. Built for mid-sized and large organisations, it replaces manual spreadsheets with structured workflows that reduce errors and improve visibility.

With a strong focus on automation and scenario modelling, Prophix is ideal for finance teams managing complex planning cycles across multiple departments or business units.

Best For

- Mid-market and enterprise finance teams

- Companies transitioning away from spreadsheet-heavy workflows

- CFOs looking to centralise forecasting, reporting, and budgeting

Key Features

- Driver-based forecasting and budget automation

- Built-in workflow approvals and audit tracking

- Visual dashboards with drill-down reporting

- Scenario planning and rolling forecasts

- Integration with ERPs, CRMs, and accounting platforms

Pros

- Automates recurring tasks like budget approvals and consolidations

- Supports multi-currency, multi-entity reporting

- Flexible enough for both finance and operational planning

- Strong governance controls and audit compliance

Cons

- May require initial setup and training for full adoption

- Not ideal for small businesses with simpler planning needs

Pricing

- Custom pricing depending on team size and modules required

- Tiered licensing for FP&A, workforce planning, and advanced reporting

- Free demo and solution consultation available

Best Use Case for This Tool

Prophix is best suited for mid-sized to large organisations that need to scale their financial planning tools without relying on complex spreadsheets. It delivers automation, control, and visibility across all stages of budgeting and forecasting—making it a go-to platform for finance teams managing detailed, recurring planning cycles.

6. Vena Solutions

Vena Solutions blends the familiarity of Excel with the structure of modern financial planning software. It’s designed for finance teams that want to keep the flexibility of spreadsheets while gaining access to features like automated data consolidation, version control, and real-time dashboards.

Built with Microsoft 365 at its core, Vena enables collaborative budgeting, forecasting, and financial reporting without forcing teams to abandon the spreadsheet interface they’re used to.

Best For

- Finance teams that want Excel-style workflows with modern controls

- SMBs and enterprises needing cross-departmental collaboration

- Organisations transitioning from manual spreadsheets to FP&A platforms

Key Features

- Excel-native budgeting and forecasting

- Workflow automation with approvals and audit trails

- Real-time reporting with embedded Power BI dashboards

- Role-based access controls for department-level planning

- Integration with accounting systems, CRMs, and ERPs

Pros

- Fast adoption due to familiar interface

- Reduces manual errors while maintaining Excel flexibility

- Highly customisable for different industries and departments

- Strong training and support ecosystem

Cons

- Heavily tied to the Microsoft 365 ecosystem

- May not suit teams looking for a spreadsheet-free environment

Pricing

- Custom pricing based on modules, integrations, and company size

- Tiered licensing with planning, reporting, and analytics bundles

- Free demo and tailored onboarding support available

Best Use Case for This Tool

Vena Solutions is ideal for finance teams that want the power of enterprise-level FP&A tools without losing the usability of Excel. It provides a structured, audit-ready approach to budgeting and forecasting while keeping the familiarity and speed of spreadsheet workflows.

7. Anaplan

Anaplan is a high-performance financial planning platform designed for large organisations that need real-time visibility, scenario planning, and cross-functional collaboration. Unlike traditional tools focused only on finance, Anaplan helps connect financial planning with sales, operations, HR, and supply chain teams — all within one unified platform.

It’s built for scale and speed, making it a popular choice for enterprises with complex planning needs and frequent strategic shifts.

Best For

- Large enterprises with multi-departmental planning needs

- CFOs and strategy teams requiring real-time modelling

- Companies managing interconnected forecasts across finance, sales, and operations

Key Features

- Cloud-native modelling engine for fast scenario testing

- Real-time data collaboration across business units

- Centralised driver-based forecasting

- End-to-end planning from strategic to operational level

- Integration with ERPs, CRMs, and data warehouses

Pros

- Built for highly complex planning environments

- Strong scenario modelling and workflow management

- Excellent for aligning planning across departments

- Trusted by global finance and strategy teams

Cons

- Requires a steeper learning curve and setup time

- More suited to enterprise than small or mid-sized teams

Pricing

- Enterprise pricing model (custom quotes based on users and use cases)

- Tailored implementation and onboarding support available

Best Use Case for This Tool

Anaplan is ideal for enterprise finance teams that want to align strategic goals with day-to-day execution. Its real-time planning capabilities and connected models help decision-makers see the impact of changes across every part of the business from budget allocations to hiring plans to supply chain shifts.

How to Choose the Right Financial Planning Software

With so many financial planning tools available, choosing the right one depends on more than just price or popularity. The right solution should align with your business size, reporting complexity, and how your finance team works day to day. Whether you’re building long-term budgets, running monthly forecasts, or delivering reports to stakeholders, here’s how to narrow your options.

1. Identify Your Core Planning Needs

Start by defining what you actually need the software to do. Are you managing basic budgets and forecasts, or do you need advanced financial modelling across multiple departments? Tools like Abacum and Datarails are built for mid-market teams with flexible needs, while platforms like Workday Adaptive Planning and Prophix are better suited to enterprise-level forecasting and reporting.

2. Consider Your Team’s Workflow

If your team is comfortable in Excel, spreadsheet-friendly solutions like Vena or Datarails offer a smoother transition. But if you’re looking to move away from spreadsheets entirely, a cloud-based planning environment like Prophix or Abacum may be a better fit.

3. Evaluate Integration Capabilities

Make sure your financial planning software can connect to your accounting systems (like Xero, QuickBooks, or NetSuite) and other operational tools (payroll, CRMs, spreadsheets). Real-time data sync reduces manual work and ensures your forecasts reflect the latest financial activity.

4. Match the Tool to Your Business Size

Some software is designed for advisors or startups, while others are built for large, multi-entity organisations. For example, RightCapital works well for individual client planning, whereas Adaptive Planning and Vena cater to businesses managing cross-functional planning and consolidation.

5. Test Before You Commit

Most platforms offer free trials or demos. Use this time to test reporting workflows, collaboration tools, and dashboard features with your real data. Involve multiple team members during the trial to see how well it fits across roles.

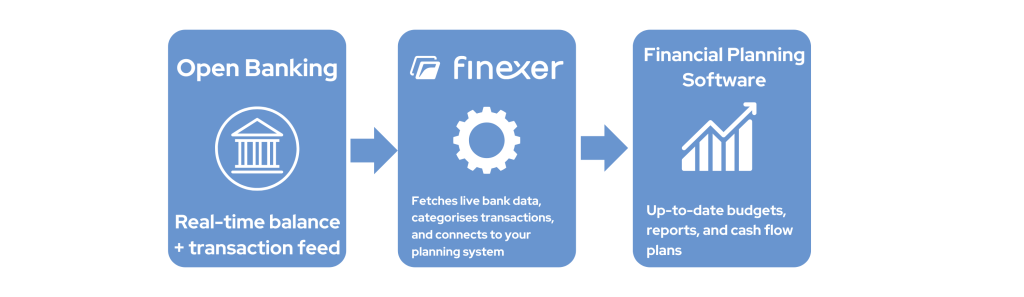

How Finexer Can Help

Most financial planning software is only as good as the data you feed into it. That’s where Finexer comes in.

Finexer provides real-time access to a business’s bank account data using AIS (Account Information Services), a core part of Open Banking. Instead of downloading statements manually or relying on outdated figures, Finexer connects directly to 99% of UK banks and pulls in up-to-date balances and transaction history securely and instantly.

✅ Your forecasts reflect real, live numbers — no more waiting for CSV exports or end-of-month statements.

✅ Budgets and cash flow models stay accurate because Finexer keeps them synced with actual bank activity.

✅ Finance teams save hours by removing the need to manually import, clean, or reconcile data from different accounts.

Finexer also supports multi-account and multi-entity setups, making it easier for planning software to consolidate financial data across departments or businesses.

Whether you’re syncing data into Google Sheets, building forecasts in Excel-based platforms like Vena, or working with more advanced FP&A tools such as Workday Adaptive Planning, Finexer ensures your financial planning software is always powered by the most current bank data—reliably and without the manual work.

What is financial planning software?

Financial planning software helps businesses and finance teams manage budgets, forecasts, and reporting using real-time financial data.

Who should use financial planning software?

CFOs, finance managers, advisors, and growing businesses use it to improve forecasting, scenario planning, and data-driven decision-making.

Can financial planning tools integrate with my accounting system?

Yes, most platforms integrate with tools like Xero, QuickBooks, or NetSuite for real-time syncing of actuals and reporting data.

What’s the difference between financial planning and budgeting software?

Budgeting software focuses on setting limits, while financial planning software supports forecasts, modelling, reporting, and long-term strategy.

Which financial planning software is best for small businesses?

Tools like Datarails and Vena are ideal for SMBs, offering flexibility, Excel compatibility, and easier setup compared to enterprise platforms.

Ease Financial Planning with Accurate Bank data in 2025! Schedule your free demo and get 14-day Free Trial by Finexer 🙂