Financial reporting is one of those things that’s easy to push to the side—until you actually need it. Whether it’s month-end reports, cash flow forecasts, or board packs, many UK businesses still rely on time-consuming spreadsheets or outdated software that doesn’t show the full picture.

If your reporting process feels manual, messy, or disconnected from your actual data, you’re not alone. Common issues include:

- Reports that don’t match your accounting data

- No visibility into current cash flow

- Struggles with multi-entity or department reporting

- Limited ability to share reports with the right people

That’s why more businesses are turning to dedicated financial reporting tools. These platforms help you build accurate, up-to-date reports without hours of copy-pasting, and they often include templates, dashboards, and features that keep you on top of tax deadlines, budget targets, and performance metrics.

Keep reading, or jump to the section you’re looking for:

What to Look for in a Financial Reporting Tool

With so many financial reporting tools available in 2025, the real challenge isn’t finding one—it’s finding the right fit for your business. Whether you’re running monthly management reports or preparing for HMRC submissions, the best financial reporting software should give you clarity, control, and confidence in your numbers.

Here are six essential features to consider when comparing financial reporting systems, especially for UK-based businesses:

1. Custom Reporting Features That Reflect Your Business

Not all reporting tools offer the same flexibility. The best financial reporting software goes beyond generic templates and allows you to build custom reports around the way your business actually operates.

Look for platforms that let you:

- Filter reports by department, business unit, or project

- Create your own financial metrics (e.g. revenue per head, gross margin by product)

- Adjust layouts to suit board packs, internal reviews, or client summaries

If you’re presenting to stakeholders or managing multiple revenue streams, these capabilities are critical.

2. Reliable Data Sync with Your Accounting Software

Accurate reporting depends on up-to-date data. A strong financial reporting tool should integrate with your existing accounting platform—whether that’s Xero, QuickBooks, Sage, or FreeAgent—and update automatically.

Key features to look for:

- Real-time or scheduled data syncing

- Easy handling of historical records for trend analysis

- Warnings or alerts for any failed data imports

Manual CSV uploads create more work and increase the risk of errors. For most UK businesses, native integration is a must.

3. UK Compliance and Reporting Standards

When choosing financial reporting software in the UK, don’t overlook compliance. Your tool should help you stay aligned with:

- Making Tax Digital (MTD) requirements

- VAT reporting formats

- HMRC-compatible export files (P&L, balance sheets, audit logs)

Some systems also support UK-specific features like Construction Industry Scheme (CIS) or payroll cost allocation, which can save hours when preparing year-end packs.

4. Built-In Forecasting and Scenario Planning

The best financial reporting tools offer more than historical data—they help you look ahead. If you’re budgeting, planning for headcount changes, or managing cash flow across multiple locations, you’ll want built-in forecasting tools.

Consider:

- Whether you can run multiple “what-if” scenarios (e.g. revenue drop, new hires)

- The ability to adjust assumptions like payment terms, supplier costs, or tax rates

- Forecasts that update automatically as actuals are added

This makes it easier to respond to change—not just record it.

5. Clear Access Controls and Sharing Options

If you’re part of a finance team or working with external accountants, you’ll likely need to share your reports. Look for tools with built-in user roles and access controls.

Helpful options include:

- View-only access for leadership

- Editable reports for finance teams

- Sharable links, password protection, and PDF/Excel export

Good financial reporting software should support collaboration—without compromising on privacy.

6. Integration with Broader Business Tools

Beyond your accounting platform, the best reporting software for finance teams connects with:

- Payroll systems (for accurate staff costs)

- CRMs (to track revenue or pipeline metrics)

- Google Sheets or Excel (for offline planning or audits)

- Time-tracking or expense management apps

These integrations reduce duplication, align data sources, and keep reporting accurate across your entire workflow.

📚 Accurate cash flow forecasting with Finexer

1. Fathom

Fathom is a financial reporting tool designed for businesses that want clear, visual reports without having to build everything from scratch. It connects directly with platforms like Xero, QuickBooks, and Excel to help finance teams create performance dashboards, compare multiple business units, and track key metrics over time.

For accountants, CFOs, or multi-entity operators, Fathom’s ability to automate group reporting is a major time-saver.

Best For

- Accountants managing reports across multiple clients

- Multi-entity businesses that need consolidated reporting

- Finance teams presenting to directors or investors

Key Features

- Financial statement analysis with custom ratios and formulas

- Consolidated group reporting for multiple entities

- KPI tracking and visual dashboards

- Cash flow insights and basic scenario modeling

- Presentation-ready reports and templates

- Excel import and export support

Pros

- Visual dashboards are easy to understand and share

- Saves time by automating multi-entity reporting

- Flexible enough for both internal teams and client-facing firms

- Good control over period comparisons and report formats

Cons

- Forecasting and budgeting tools are limited

- Takes time to define and set up custom KPIs

- Some features may require light training for first-time users

Integrations

- Xero

- QuickBooks

- Excel

- MYOB

Pricing

- Starter plan: $48/month for 1 company

- Silver plan: $250/month for up to 10 companies

- Gold plan: $360/month for up to 25 companies

- Platinum plan: $650/month for up to 50 companies

- Additional entities priced separately

Why We Recommend It

Fathom is a strong financial reporting solution for businesses that want more than static spreadsheets. Its focus on visual output, combined with group reporting features, makes it a reliable choice for accountants and CFOs managing multiple companies or departments. If your goal is to clearly present financial performance and compare across business units, Fathom is a tool worth considering.

2. Sage Intacct

Sage Intacct is a powerful financial reporting software built for companies that have outgrown basic accounting tools. It offers multi-dimensional reporting, real-time visibility, and precise control over how financial data is organised and presented. For finance teams managing multiple departments, locations, or projects, it helps create tailored reports that align closely with how the business actually works.

Although it’s part of the broader Sage ecosystem, Sage Intacct focuses specifically on advanced reporting, forecasting, and compliance, making it well-suited for growing UK businesses.

Best For:

- Finance teams at expanding companies

- Multi-location or multi-entity organisations

- CFOs preparing detailed board and investor reports

Key Features:

- Multi-dimensional general ledger (track by department, location, project, etc.)

- Custom and pre-built report templates

- Real-time dashboards for revenue, spend, and performance

- Automated group consolidations

- UK compliance support including VAT and audit trails

- Built-in budgeting and scenario planning tools

Pros:

- Flexible structure that adapts to complex reporting requirements

- Strong support for intercompany reporting and group financials

- Works well for both finance managers and external advisors

- Scales with your business over time

Cons:

- Steeper learning curve compared to small business tools

- Upfront costs can be high for small teams

- Typically requires onboarding through a certified implementation partner

Integrations:

- Sage Payroll

- Salesforce

- Microsoft Power BI

- Many third-party tools via open API

Pricing:

- Custom pricing only

- Entry-level packages start around £5,000 per year

- Cost increases with number of users, modules, and entities

- Sage or its partners will provide quotes based on your setup

Why We Recommend It:

Sage Intacct is a good match for UK companies that want structured, in-depth financial reporting without building everything manually in Excel. Its reporting engine is designed for finance teams that need to track details across multiple parts of the business, while still meeting UK compliance standards.

3. Xero Analytics Plus

Xero Analytics Plus is a financial reporting software add-on designed to bring cash flow visibility and performance insights directly into the Xero accounting dashboard. For small business owners and finance leads who don’t want to jump between systems, it offers a straightforward way to track real-time numbers, plan short-term scenarios, and understand the financial health of the business.

As part of the Xero ecosystem, it’s a good fit for those already using Xero for bookkeeping and want to add lightweight reporting without managing another platform.

Best For

- Small businesses using Xero

- Startups needing built-in reporting without extra software

- Teams looking for cash flow forecasts and business performance snapshots

Key Features

- 30-day and 90-day cash flow forecasting

- Business performance dashboards (revenue, cash, and expenses)

- Scenario planning for changes in income or spending

- Real-time updates from bank feeds and invoicing

- No setup or extra integrations for Xero users

Pros

- Simple and quick to use

- Cost-effective for businesses already on Xero

- Gives visibility into short-term liquidity

- Scenario planning helps with operational decisions

Cons

- Limited to short-term forecasting

- No multi-entity or advanced report building

- Only available as a Xero add-on, not a standalone product

Integrations

- Native to Xero Accounting

- Uses live data from Xero invoicing, expenses, and bank feeds

- No third-party tool integration

Pricing

- Add-on cost: £5/month in addition to a Xero Business plan

- Available to users on Standard or Premium Xero subscriptions

- 30-day free trial available via the Xero dashboard

Why We Recommend It

Xero Analytics Plus is one of the simplest financial reporting tools available for UK businesses already using Xero. While it doesn’t have deep customisation or multi-entity reporting, it covers the basics well, especially cash flow forecasts and easy-to-read performance dashboards. It’s a great entry-level reporting solution for small teams who want better insight without extra complexity.

4. Datarails

Datarails is a financial reporting software designed for finance teams that rely heavily on Excel but require more robust features for planning, analysis, and reporting. It enhances traditional spreadsheets by automating data consolidation, enabling real-time dashboards, and providing AI-driven insights. This makes it a compelling choice for mid-sized businesses aiming to modernise their financial processes without abandoning familiar tools.

Best For

- Finance teams accustomed to Excel workflows

- Organisations needing automated financial reporting and consolidation

- Companies seeking AI-powered insights without overhauling existing systems

Key Features

- Excel Integration: Seamlessly integrates with existing Excel models, preserving familiar workflows

- Automated Data Consolidation: Aggregates data from multiple sources for accurate reporting

- Real-Time Dashboards: Provides up-to-date visualisations for informed decision-making

- AI-Powered Insights: Utilises AI to generate narratives and identify key financial trends

- Scenario Modeling: Allows for the creation of various financial scenarios to assess potential outcomes

- Collaboration Tools: Facilitates teamwork with shared reports and dashboards

Pros

- Enhances existing Excel-based processes without requiring a complete system change

- Automates repetitive tasks, freeing up time for strategic analysis

- Offers real-time data visualisation, improving transparency and decision-making

- Provides AI-driven narratives, simplifying complex data interpretation

Cons

- Higher price point may be a barrier for smaller businesses

- Initial setup and customisation can be time-consuming

- Some users report a learning curve associated with advanced features

Integrations

- Microsoft Excel

- QuickBooks

- NetSuite

- Salesforce

- Google Sheets

- Various ERP and CRM systems via API

Pricing

- Custom Pricing: Tailored based on company size, user count, and required features

- Estimated Range: Annual costs typically start around $24,000 and can exceed $80,000 for larger enterprises

- Implementation Fees: Additional costs may apply for setup and training services

Why We Recommend It

Datarails stands out among financial reporting tools for its ability to enhance existing Excel-based workflows with advanced automation and AI capabilities. It’s particularly well-suited for mid-sized businesses looking to upgrade their financial reporting software without disrupting current processes. By combining the familiarity of Excel with powerful new features, Datarails offers a balanced solution for modern financial management.

5. Joiin

Joiin is a cloud-based financial reporting software designed to simplify the process of consolidating financial data from multiple entities. It integrates seamlessly with popular accounting platforms like Xero, QuickBooks, and Sage, allowing businesses to generate comprehensive reports without manual data manipulation. For finance teams managing multiple subsidiaries or departments, Joiin offers a streamlined solution to produce accurate and timely consolidated reports.

Best For

- Businesses operating multiple entities or subsidiaries

- Finance teams seeking automated consolidation of financial data

- Organisations using Xero, QuickBooks, or Sage for accounting

Key Features

- Automated Consolidation: Combines financial data from various entities into unified reports

- Customisable Reporting: Offers templates and customisation options for income statements, balance sheets, and cash flow reports

- Multi-Currency Support: Handles currency conversions for international operations

- KPI Tracking: Monitors key performance indicators across different entities

- Collaboration Tools: Enables sharing of reports with stakeholders through secure links

Pros

- Eliminates manual data consolidation, saving time and reducing errors

- User-friendly interface with intuitive navigation

- Real-time data synchronisation with connected accounting platforms

- Scalable solution suitable for growing businesses

Cons

- Limited advanced analytics compared to some comprehensive financial reporting tools

- Customisation options may not meet all complex reporting requirements

- Dependent on the quality and consistency of data from integrated accounting systems

Integrations

- Xero

- QuickBooks

- Sage

- Excel (for importing additional data)

Pricing

- Starter Plan: £10/month for up to 3 entities

- Pro Plan: £30/month for up to 10 entities

- Premium Plan: £50/month for up to 20 entities

- Enterprise Plan: Custom pricing for more than 20 entities

- 14-day free trial available

Why We Recommend It

Joiin stands out among financial reporting tools for its focus on simplifying multi-entity financial consolidation. Its seamless integration with leading accounting software and user-friendly design make it an excellent choice for businesses looking to streamline their reporting processes. By automating the consolidation of financial data, Joiin enables finance teams to focus on analysis and strategic decision-making.

6. Workiva

Workiva is a cloud-based financial reporting software designed to streamline complex reporting processes for large organisations. It offers a unified platform that connects data across finance, risk, compliance, and sustainability functions, enabling real-time collaboration and ensuring data integrity. With its robust features, Workiva is particularly suited for enterprises that need to manage intricate reporting requirements and maintain compliance with various regulatory standards.

Best For

- Enterprises with complex financial reporting needs

- Organisations requiring integrated compliance and audit management

- Companies aiming for real-time collaboration across departments

Key Features

- Connected Reporting: Links data across reports, presentations, and spreadsheets to ensure consistency

- Real-Time Collaboration: Allows multiple users to work simultaneously with full audit trails

- Automated Workflows: Streamlines processes for financial close, compliance, and reporting

- Data Integration: Connects with various ERP, CRM, and other systems for seamless data flow

- Compliance Management: Supports adherence to regulations like SOX, SEC, and ESG reporting standards

- Audit Management: Provides tools for internal audit planning, execution, and documentation

Pros

- Enhances accuracy by reducing manual data entry and errors

- Facilitates collaboration across teams and departments

- Offers comprehensive compliance and audit management features

- Scalable to accommodate growing organisational needs

Cons

- Higher cost may be prohibitive for smaller businesses

- Implementation and training can be time-consuming

- May offer more features than necessary for organisations with simpler reporting requirements

Integrations

- NetSuite

- Workday

- Salesforce

- Microsoft Excel

- Google Drive

- Dropbox

- Various ERP and CRM systems via API

Pricing

- Custom Pricing: Based on company size, user count, and required features

- Estimated Range: Annual costs typically start around $31,815 and can exceed $152,003 for larger enterprises

- Median Buyer Pays: Approximately $55,271 per year

- Implementation Fees: Additional costs may apply for setup and training services

Why We Recommend It

Workiva stands out among financial reporting tools for its ability to handle complex reporting and compliance needs within a single platform. Its robust features and integrations make it an ideal choice for large enterprises seeking to enhance accuracy, collaboration, and regulatory adherence in their financial reporting processes.

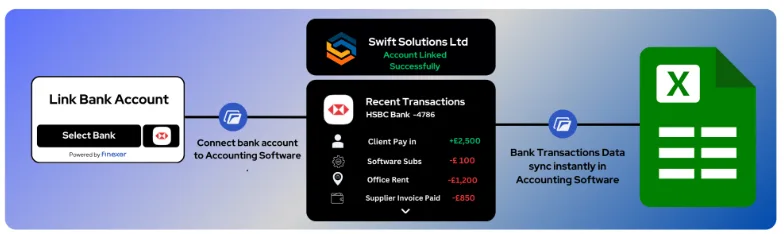

How Finexer Supports Financial Reporting with Bank Data Integration

While financial reporting tools help you build the reports, they still rely on accurate and timely data to deliver value. That’s where Finexer comes in.

Finexer makes it easier for finance teams to keep their reporting tools up to date by feeding real-time bank data directly into the platforms they already use. This reduces manual uploads, improves reconciliation, and gives your team confidence that what they’re reporting matches what’s actually in the bank.

- Live Bank Feeds: Automatically pull transaction data from 99% of UK banks and match it to your chart of accounts or categories used in Xero, QuickBooks, or other systems.

- Bulk Payment Metadata: Every payroll or supplier payment processed through Finexer includes structured metadata—like employee names, payment references, and timestamps—that make reconciliation easier when running month-end reports.

- API Integrations: Finexer can connect directly to your financial reporting software or your accounting platform. This ensures your reports reflect the latest cash movements without extra steps.

- Developer Sandbox: For companies building custom reporting tools or internal dashboards, Finexer offers a test environment where your developers can simulate pay runs, reconciliations, or payment delays.

- White-Labeled for Platforms: If you’re a software provider offering reporting tools or accounting services, Finexer can integrate directly into your platform under your brand, keeping your clients in one unified workflow.

Get Started

Start your 14-day free trial today and see why businesses trust Finexer for secure, compliant, and tailored open banking solutions.

Why Finance Teams Choose Finexer:

- Real-time access to 99% of UK bank data

- Bulk payment initiation for salaries, suppliers, and reimbursements

- Secure APIs built for integration with accounting and reporting tools

- Developer sandbox for testing before going live

- Fully compliant with UK Open Banking regulations

What is the best financial reporting software for small UK businesses?

For small businesses already using Xero, Xero Analytics Plus is a cost-effective option that adds forecasting and performance dashboards directly into your accounting workflow. If you’re looking for more advanced visuals and multi-entity support, Fathom is another great fit.

What software helps with consolidated financial reporting across multiple entities?

Fathom and Joiin both specialise in group reporting. They allow you to consolidate financial data from different companies or departments, handle currency conversion, and produce consistent reports without the usual manual effort.

What’s the difference between financial reporting tools and accounting software?

Accounting software (like Xero or QuickBooks) handles day-to-day transactions and bookkeeping. Financial reporting tools, on the other hand, are built to organise, analyse, and present that data in reports, forecasts, and dashboards for decision-making or stakeholder communication.

How does Finexer improve financial reporting workflows?

Finexer helps by feeding real-time bank data into your accounting or reporting system, automating payment metadata, and simplifying reconciliation. This ensures that the data your reports rely on is always current and accurate—especially helpful during payroll runs and month-end closes.

What is the most cost-effective financial reporting tool for startups in the UK?

If you’re running a startup and want affordable financial reporting software, Xero Analytics Plus is one of the most budget-friendly options, starting at just £5/month. It offers short-term cash flow forecasting and business dashboards. For early-stage teams managing multiple entities, Joiin also provides excellent value with pricing starting at £10/month.

Get Instant Bank Data with Finexer in 2025 ! Schedule your free demo and get 14 days free Trial by Finexer 🙂