Why UK Accountants Need More Than Bank Feeds

If you run a mid-sized or growing accounting firm in the UK, you’ve probably noticed how tedious it is to chase clients for bank statements, wait for CSV exports, and reconcile transactions manually. These tasks do more than just slow down workflows; they eat into billable hours, delay reporting, and risk client satisfaction.

A recent report reveals that nearly one in five UK consumers and small businesses (around 20%) are now actively using Open Banking, a jump from just 6% in March 2021, signalling swift adoption of connected banking tools.

By integrating Open Banking APIs into your workflows, you can turn this momentum into a real operational advantage: secure, real-time banking data and payment capabilities, all directly embedded in your accounting tools, and without manual back-and-forth.

Finexer is purpose-built for UK accounting firms. Fully FCA-authorised and offering 99% UK bank coverage, it combines Account Information Services (AIS) and Payment Initiation Services (PIS) in a single, developer-friendly API. That means pulling live transaction data, triggering payroll and supplier payments, and streamlining reconciliations, all without leaving your firm’s systems or juggling multiple logins.

What Is Finexer’s Open Banking API?

Finexer’s Open Banking API is a UK-focused platform designed to give accountants real-time bank data access and secure payment capabilities in a single integration. Unlike global providers that split resources across multiple regions, Finexer is built entirely around UK compliance, banking infrastructure, and accounting workflows.

Key Points at a Glance

- FCA Authorised – Fully regulated for both Account Information Services (AIS) and Payment Initiation Services (PIS) under PSD2.

- 99% UK Bank Coverage – From high street names like Barclays, Lloyds, and HSBC to digital-first challengers such as Starling and Monzo.

- Real-Time Data Refresh – Pull transaction and balance updates instantly without waiting for overnight batches.

- Secure by Default – AES-256 encryption, TLS 1.2, and Strong Customer Authentication (SCA) ensure every data exchange meets strict security standards.

- Flexible Pricing – Usage-based billing with no setup fees, so you can scale without committing to fixed costs.

With a single API, UK accounting firms can:

- Fetch up-to-the-minute bank transactions into accounting software like Xero, QuickBooks, and Sage.

- Initiate payroll, supplier, and contractor payments via Faster Payments.

- Offer white-labelled client portals for consent, verification, and reporting.

In short, Finexer is not just a bank feed, it’s an operational backbone for accountants who want accuracy, compliance, and speed in one place.

Real-World Accounting Workflows Finexer Improves

Finexer isn’t just an API, it’s a toolkit that fits directly into the way UK accountants work. By combining real-time financial data access with secure payment initiation, it streamlines multiple workflows that would otherwise require separate systems and manual intervention.

Multi-Client Reconciliation

- Instantly pull transactions from 99% of UK banks into any accounting platform like Xero, QuickBooks, or Sage.

- Reconcile daily or multiple times a day, without waiting for month-end statements or manual CSV uploads.

Payroll Runs

- Pay employees instantly via Faster Payments, right from your accounting environment.

- Eliminate manual bank uploads and reduce the risk of payment errors or missed deadlines.

Supplier & Contractor Payments

- Initiate bulk payments in one go, keeping suppliers and contractors paid on time.

- Reduce late payment penalties and strengthen vendor relationships.

Client Onboarding & Verification

- Use Account Information Services (AIS) to verify account ownership, income patterns, and source of funds without requesting physical documents.

- Speed up onboarding for new clients and meet compliance requirements without extra paperwork.

Each of these workflows becomes faster, cleaner, and more accurate with Finexer in place, meaning fewer bottlenecks for your team and a better experience for your clients.

Can I use Finexer for both data collection and payments?

Yes. Finexer provides both AIS (real-time bank data access) and PIS (payment initiation) in one integration. You can collect live account data, reconcile it, and make instant payroll or supplier payments without switching between systems.

How quickly can my firm go live with Finexer?

Most accounting firms go live 2–3x faster than with other providers, thanks to Finexer’s sandbox environment, developer-friendly documentation, and 3–5 weeks of hands-on onboarding support.

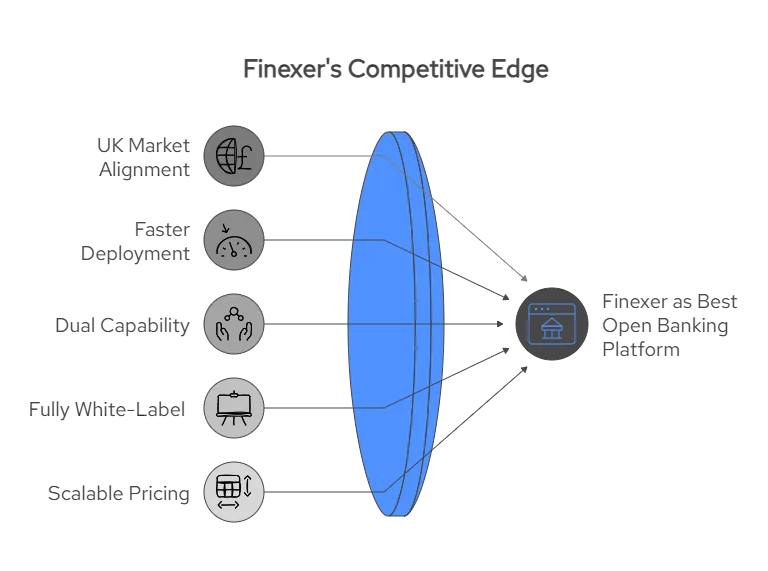

5 Reasons why Mid-Size and Scaling Accounting Firms Choose Finexer

If your accounting firm is at the stage where you’re managing dozens or even hundreds of client accounts every month, you already know the pressure. More clients mean more transactions, more reconciliations, more payroll runs, and if your tools can’t keep up, you end up adding more admin hours instead of freeing them.

This is exactly where Finexer stands out. It’s not a generic Open Banking tool that accountants have to “make work”; it’s a platform built from the ground up for UK accounting workflows. Every feature, every integration, every compliance step has been designed with your reality in mind.

1. UK-First by Design

Unlike providers that spread resources across multiple countries, Finexer focuses entirely on the UK market. That means:

- 99% coverage of UK banks, from Barclays and HSBC to Starling and Monzo.

- Native Faster Payments support for payroll and supplier payouts.

- Every process aligned with FCA and PSD2 regulations so you stay compliant without extra legal overhead.

2. Deployment That’s 2–3x Faster Than the Market

Waiting months for a provider to integrate is a cost most growing firms can’t afford. Finexer’s onboarding is streamlined:

- Developer-friendly API with clear, accountant-specific use cases.

- Sandbox environment so you can test live workflows before going public.

- Dedicated onboarding specialists who guide you from sign-up to first transaction.

3. Hands-On Support That Doesn’t Disappear After Sign-Up

Many providers give you a login and leave you to figure it out. Finexer takes the opposite approach:

- 3–5 weeks of direct, hands-on assistance during your onboarding phase.

- Technical, compliance, and operational guidance from people who understand UK accounting.

- Ongoing support for API updates, new features, and workflow optimisation.

4. Built to Scale With Your Firm

Whether you’re onboarding your 50th client or your 500th, Finexer’s infrastructure is designed to handle high transaction volumes without slowing down. That means:

- Real-time data refreshes without delays or missing transactions.

- Bulk payment processing that doesn’t choke under load.

- White-label client portals that keep your brand front and centre as you grow.

5. Pricing That Works for Growth

With usage-based pricing, you don’t get locked into expensive fixed fees. You pay only for the volume you process, which means:

- Lower costs when you’re building your client base.

- Predictable spend as your volumes increase.

- No surprise setup charges or hidden fees.

Get Started

Connect today and see why businesses trust Finexer for secure, compliant, and tailored open banking solutions.

Try NowHow to Get Started with Finexer

Switching to a new Open Banking API can feel like a big leap, but with Finexer, the process is designed to be clear, guided, and quick. Whether you’re a partner at a mid-size accounting firm or leading the tech stack for a scaling practice, you can go from first call to live transactions in weeks, not months.

Step 1: Book Your Intro Call

It starts with a quick conversation. You’ll speak to someone who understands accounting workflows, not a generic sales rep reading from a script. This is where we:

- Learn about your current data and payment processes.

- Identify the bottlenecks slowing your client work.

- Map how Finexer’s API can integrate into your existing systems.

Step 2: Get Your Sandbox Access

Once you’re set, we’ll give you access to our sandbox environment. Here’s where you can:

- Test AIS (Account Information Services) by pulling sample bank transactions.

- Try PIS (Payment Initiation Services) for payroll or supplier payments.

- Experiment with white-label consent flows for clients.

No risk, no live banking data, just a safe space to see how Finexer fits.

Step 3: Integrate With Your Tools

Finexer is developer-friendly, meaning integration can happen fast:

- Use our API documentation to connect with Xero, QuickBooks, Sage, or your own in-house tools.

- Map custom data points for specific reconciliation or reporting needs.

- Automate payment flows to cut down manual work.

If you don’t have in-house developers, our onboarding team will work with your tech provider to get it done.

Step 4: Go Live

When you’re confident, everything is set up:

- Switch from sandbox to live mode.

- Start pulling real-time bank data directly from 99% of UK banks.

- Initiate instant payments for payroll, suppliers, and contractors without logging into separate banking portals.

Step 5: Ongoing Support & Optimisation

Your support doesn’t stop at launch. With 3–5 weeks of hands-on onboarding assistance, plus continued access to our technical and compliance experts, you can:

- Add new workflows as your firm grows.

- Keep up to date with API improvements.

- Get guidance on scaling client onboarding without increasing admin.

How secure is client banking data when using Finexer?

Finexer uses AES-256 encryption, TLS 1.2, and Strong Customer Authentication (SCA) to protect all transactions and data transfers. As an FCA-authorised provider, every process follows UK regulatory standards for Account Information Services (AIS) and Payment Initiation Services (PIS).

Does Finexer work with my existing accounting software?

Yes. Finexer’s Open Banking API integrates with any UK accounting platforms such as Xero, QuickBooks, and Sage, as well as custom in-house tools. This means you can automate bank data feeds, reconciliations, and payments without changing your core accounting system.

Start your Finexer journey today — request a live demo or sandbox access and future-proof your firm’s accounting operations