Open banking data is usually used as a synonym for the general term “open banking”. This practice allows third-party providers of financial services to access consumer account data and other relevant financial information with their express permission.

Overview

Open Banking Data by Finexer revolutionises the way businesses access and utilise real-time bank transaction data. Leveraging the latest advancements in AIS (Account Information Services) 2.0, Finexer provides a seamless and secure integration with multiple banks, enabling businesses to offer tailored advice, promotions, and enhanced user experiences based on accurate financial data.

Key Features

Real-time Bank Transaction Data

Instant Access: Obtain immediate updates on customer transactions as they occur. Enable real-time decision-making with the most current financial data.

Comprehensive History: Access a detailed history of all transactions, providing a complete financial overview.Facilitate long-term financial analysis and trend identification

Accurate Categorisation: Automatically categorise transactions into predefined categories for easy analysis.Improve financial reporting and data organisation with precise categorisation.

Balance Check

Current Balance: Retrieve up-to-date balances for all linked accounts, ensuring accurate financial tracking.Display real-time balance information to customers, enhancing transparency.

Spending Insights:Analyse income and expenditure patterns to identify spending habits and trends.Provide customers with detailed insights into their financial behaviour.

Financial Health Monitoring:Continuously monitor overall financial health and cash flow to detect potential issues.Offer proactive advice to customers based on their financial status.

Authentication

Account Verification: Confirm the ownership and details of accounts to ensure data accuracy.

Secure Access: Utilise robust security protocols to protect sensitive financial data.Ensure secure data transmission between systems and prevent unauthorized access.

Multi-factor Authentication: Enhance security with additional authentication steps, such as OTPs or biometrics.Reduce the risk of data breaches and enhance customer confidence.

Customisable API Integration

Developer Support:Access comprehensive developer documentation and support resources.Resolve technical issues quickly with dedicated developer assistance.

API Integration: Integrate with various systems using a highly adaptable API.Simplify the integration process with clear documentation and examples.

Scalable Solutions: Scale the integration to match business growth and evolving needs.Support a growing number of users and transactions without compromising performance.

Data Enrichment

Enhanced Data:Enrich transaction data with additional details such as merchant names and locations.Improve the quality and usefulness of financial data with enriched information.

Contextual Information: Add context to transactions, making it easier to understand spending patterns.Help customers identify and manage their expenditures more effectively.

User-friendly Reporting: Generate easy-to-read reports that include enriched and contextualised data.Provide actionable insights through detailed and comprehensive financial reports.

Security and Compliance

Data Protection:Ensure data protection with industry-standard encryption and secure protocols.Safeguard customer data from unauthorized access and cyber threats.

Regulatory Compliance: Adhere to industry standards and regulations, such as GDPR and PSD2.Maintain compliance with evolving regulatory requirements to avoid penalties.

Audit Trails: Maintain detailed logs of all transactions and data access activities.Support compliance and auditing processes with comprehensive audit trails.

Benefits

Enhanced Customer Insights 🗹

Personalised Services: Gain a deeper understanding of customers’ financial behaviours, enabling the provision of tailored and relevant services.

Targeted Marketing: Utilise accurate financial data to create targeted marketing campaigns, improving customer engagement and conversion rates.

Behaviour Analysis: Analyse spending and saving patterns to offer customised financial advice and products that meet individual customer needs.

Improved Accuracy 🗹

Data Precision: With AIS 2.0: SMART DATA, businesses can ensure higher data accuracy, reducing errors in financial data handling.

Enriched Transaction Details: Access enriched transaction details, such as merchant names and locations, for better financial analysis and reporting.

Minimised Errors: Reduce manual entry errors and discrepancies in financial records, leading to more reliable data for decision-making.

Cost Efficiency 🗹

Reduced Operational Costs: Automate financial data collection and processing, leading to lower operational costs and reduced need for manual intervention.

Savings on Compliance: Ensure compliance with regulatory requirements automatically, reducing the costs associated with manual compliance checks and audits.

Scalable Solutions: Scale the solution as your business grows without incurring significant additional costs, ensuring long-term cost efficiency.

Regulatory Compliance 🗹

Adherence to Standards: Comply with industry standards and regulations, reducing the risk of legal issues and fines.

Up-to-date Practices: Stay updated with evolving regulatory requirements, ensuring that your business remains compliant at all times

Audit Readiness: Maintain detailed records and audit trails, simplifying the process of regulatory audits and reviews.

Customer Satisfaction 🗹

Improved Transparency: Provide customers with real-time access to their financial data, enhancing transparency and trust.

Better Financial Management: Help customers manage their finances more effectively with accurate and timely data.

Enhanced User Experience: Offer a seamless and intuitive user experience, increasing customer satisfaction and loyalty.

Use Cases

Lending

Creditworthiness Assessment: Use accurate financial data to assess the creditworthiness of loan applicants.

Loan Eligibility: Quickly determine eligibility for various loan products based on real-time financial information.

Risk Management: Minimise lending risks by accessing comprehensive financial histories and current account balances.

KYC/AML

Identity Verification: Verify customer identities with accurate and up-to-date account information.

Transaction Monitoring: Monitor transactions for suspicious activities to comply with Anti-Money Laundering (AML) regulations.

Regulatory Compliance: Ensure compliance with Know Your Customer (KYC) and AML regulations through continuous financial data monitoring.

Insurance Pricing

Risk Assessment: Use financial data to assess the risk profile of customers and set appropriate insurance premiums.

Claims Verification: Verify claims with real-time financial data to detect potential fraud.

Policy Customisation: Offer customised insurance policies based on individual financial behaviours and needs.

Rental

Tenant Verification: Verify tenant financial stability by accessing real-time bank transaction data.

Rent Payments: Facilitate timely rent payments directly from tenant bank accounts to landlords.

Lease Management: Monitor and manage lease agreements with accurate financial data for both tenants and property managers.

Expense Tracking

Real-time Monitoring: Track and categorise expenses as they occur, providing up-to-date financial insights.

Budget Management: Help users set and manage budgets by analysing their spending patterns.

Financial Planning: Assist in long-term financial planning by identifying areas for potential savings and investment.

Payroll & Invoicing

Salary Verification: Verify employee salaries and payment histories to ensure accurate payroll processing.

Compliance Management: Ensure compliance with employment regulations by monitoring payroll transactions and tax payments.

Employee Onboarding: Simplify the onboarding process with seamless financial data integration, verifying bank details and salary disbursements.

Accounting & ERP

Automated Data Entry: Integrate real-time transaction data into accounting systems, reducing manual data entry errors.

Financial Reporting: Enhance financial reporting accuracy and detail with enriched transaction data.

Reconciliation: Streamline the reconciliation process by matching transactions with accounting records in real-time.

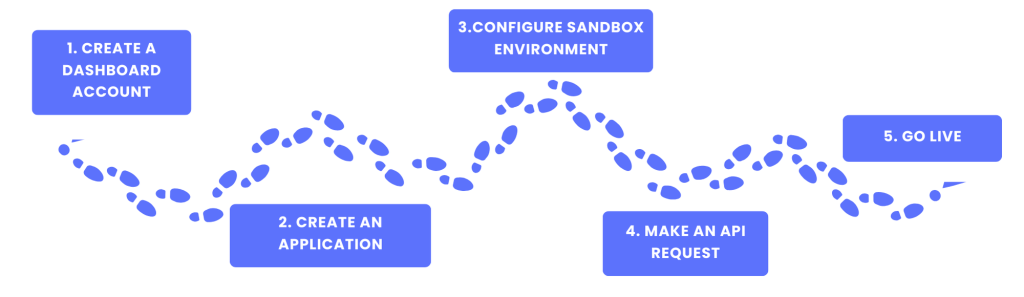

Getting Started

1.Create a Dashboard Account: Set up an account on the Finexer dashboard to manage and monitor payments.

2.Create an Application

3.Configure Sandbox Environment: Test integrations in a separate sandbox environment without affecting live data.

4.API Integration: Utilise Finexer’s APIs for seamless integration into existing systems.

5.Go Live: Launch the instant payment solution and start benefiting from real-time, secure transactions.

GET IN TOUCH

Unlock Financial Innovation with Finexer’s Open Banking Data Start Now!—read on to learn more!