Still waiting for a cheque to clear? You’re not alone.

Many UK businesses continue to experience bank payment delays, even in 2025. A supplier sends an invoice, the finance team processes it, and then… a paper cheque gets mailed. From there, it’s a waiting game: waiting for the post, waiting for the cheque to be deposited, and then waiting again for the bank to process it.

What was once standard is now a significant slowdown.

Despite the decline in cheque usage, they remain in circulation. In 2023, approximately 110 million cheques were used for payments in the UK, marking a 15% decrease from the previous year. This number is projected to fall further to 56 million by 2033. However, for businesses still relying on cheques, the delays are tangible.

Even with digital accounting systems, if your payments are still paper-based, the bottleneck persists.

This blog covers:

Why Are Cheques Still So Slow in 2025?

Despite the rise of digital banking, traditional bank bill-pay systems still rely heavily on paper cheques. Here’s why that creates friction:

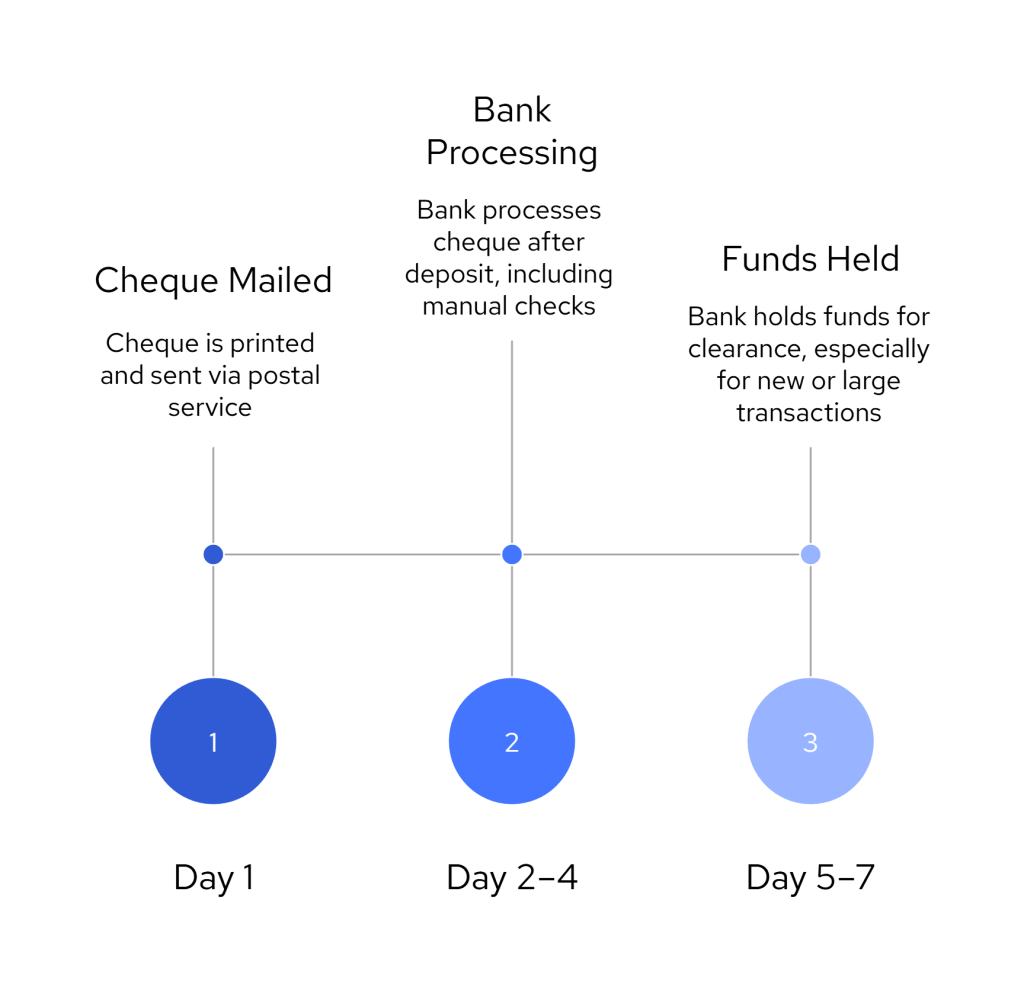

1. Mail-Based Delivery

Most bank-issued cheques are printed and sent via post, which means you’re relying on physical logistics. Delays due to weekends, public holidays, or postal service backlogs are common, especially for B2B payments where timing matters most.

2. Cheque Processing Time at the Receiving Bank

Even after the cheque arrives, your bank may take an additional 1–3 working days to clear the funds. The cheque processing time depends on the bank’s batch processing systems and manual verification workflows.

3. Built-In Hold Periods

Some banks automatically apply a holding period after a deposit, especially for first-time transactions or higher-value payments. This can stretch your payment timeline even further, leading to missed early-payment discounts or strained supplier trust.

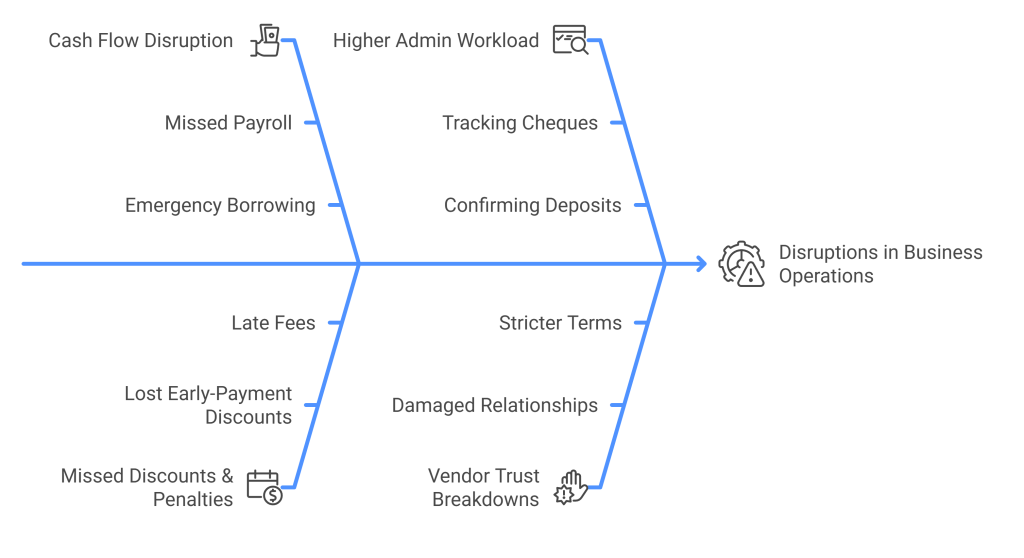

How Bank Payment Delays Hurt Cash Flow and Vendor Trust

The longer it takes for a payment to land, the more disruption it causes. Bank payment delays don’t just slow down transactions; they ripple into multiple areas of business operations, particularly for contractors and finance teams managing supplier relationships.

Here’s where the real impact shows up:

1. Cash Flow Disruption for Contractors

Many small businesses and independent contractors rely on timely payments to cover their own operating costs. When a cheque arrives late, it puts their cash position at risk. According to recent UK Finance data, 52% of SMEs have experienced cash flow issues due to late or slow payments.

Inconsistent income means delayed purchases, missed payroll deadlines, and in some cases, needing to borrow just to stay afloat.

2. Missed Early-Payment Discounts and Added Penalties

Vendors often offer discounts for early payment, but a cheque in the post rarely arrives in time to take advantage. At the same time, some contracts include penalties for late payment, especially in construction or B2B services.

With cheque processing time being unpredictable, many businesses end up losing out on both sides: no discount and a penalty fee.

3. Higher Admin Workload

Your finance team may spend hours each week tracking sent cheques, confirming deposits, and chasing payment confirmations. If a cheque gets lost, they’ll have to void it and reissue a new one, restarting the entire delay cycle.

With electronic payment options, this work is almost entirely eliminated.

4. Vendor Frustration and Reduced Trust

When suppliers receive late payments, even for reasons outside your control, it affects how they view your business. Over time, vendors may tighten payment terms, limit credit, or deprioritise your orders in favour of faster-paying clients.

Switching to faster, traceable payment methods helps preserve vendor relationships and keeps your business in good standing.

📚 Guide to Checkout Process Optimisation

Faster, UK-Ready Alternatives to Cheques

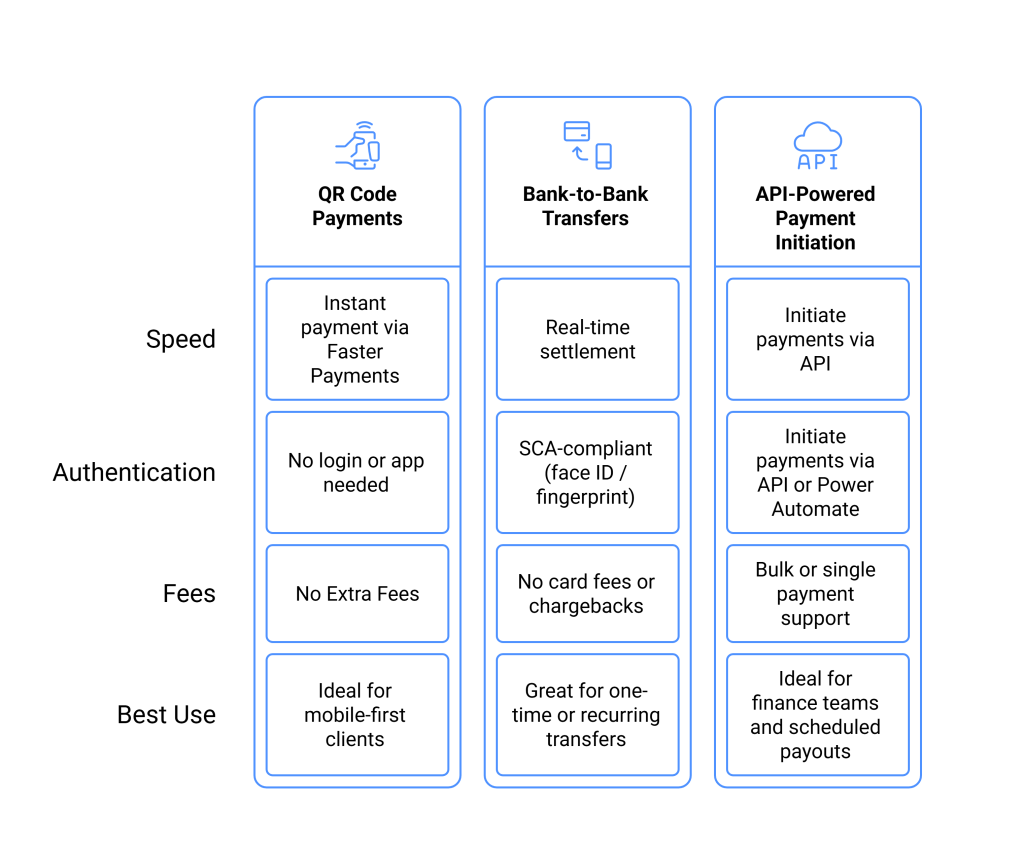

If your business is still using paper cheques, you’re adding unnecessary delays to every transaction. With Finexer’s Open Banking infrastructure, you can switch to faster, trackable payment flows built for modern finance teams. Here are three ways you can use Open Banking to remove friction from payments:

1. QR Code Payments

Finexer enables QR-powered checkout experiences backed by Open Banking. You generate a QR code on an invoice or payment screen. The client scans it with their phone, confirms the payment through their own banking app, and the funds settle almost instantly.

- Payments processed via Faster Payments

- No login, no card, no app download needed

- Compatible with 99% of UK bank apps

- Perfect for mobile-first users and fast-turnaround payments

This is one of the most user-friendly ways to eliminate cheque-based workflows.

2. Bank-to-Bank Transfer

This is the core of Open Banking. With Finexer, you can request a direct bank-to-bank payment using a secure, embedded link or button. The client logs in through their bank, approves the payment, and funds are transferred directly no intermediaries, no delays.

- Real-time settlement via Faster Payments

- SCA-compliant (face/fingerprint/2FA)

- Zero card fees, no chargebacks

- Used for one-time or recurring collections and disbursements

This completely replaces the need for cheques or manual bank transfers, with better speed, security, and transparency.

3. API-Powered Payment Initiation for Finance Teams

For businesses with higher volumes or recurring payouts, Finexer offers direct API access and support for tools like Power Automate. You can initiate and manage payments without leaving your accounting software.

- Trigger bulk or single payments programmatically

- Works for payroll, supplier payments, and invoice runs

- Built-in reconciliation and automated receipts

- Eliminates manual entry and reduces the chance of duplicate payments

Whether you’re disbursing hundreds of invoices or managing scheduled payouts, this gives you complete control from within your own system.

Get Started

Connect today and see why businesses trust Finexer for secure, compliant, and tailored open banking solutions.

How VSID Replaced Manual Payments with Finexer’s Open Banking Solution

While many businesses are still navigating bank payment delays, others have already moved on, and they’re seeing results.

VirtualSignature-ID (VSID), a UK-accredited digital identity platform, serves high-value clients in the legal and accountancy sectors. Before partnering with Finexer, their team relied on a combination of manual uploads, document checks, and traditional fund transfers. These processes introduced delays at critical points in the transaction lifecycle, especially when handling client payments tied to property deals or legal agreements.

VSID needed a faster, more secure way to handle payments and proof-of-funds validation, without compromising on compliance.

They chose Finexer.

Through Finexer’s payment initiation and account information APIs, VSID embedded Open Banking directly into its platform. Now, their clients can complete identity verification and initiate payments to designated client accounts in one seamless flow.

Here’s what changed:

- Payments that once took days now settle within minutes using Faster Payments

- Every transaction is authenticated through the client’s bank, removing the risk of fraud or chargebacks

- Manual document collection has been replaced with verified bank-sourced data

- The entire user journey is faster, more secure, and fully audit-ready

As a result, VSID improved operational efficiency, reduced friction in high-value transactions, and delivered a better client experience, all while maintaining regulatory compliance.

For businesses still relying on outdated systems like cheques or legacy portals, VSID’s experience shows what’s possible when you replace delays with Open Banking-powered electronic payment options.

Why do bank cheques take so long to clear?

Bank cheques are subject to postal delays, manual processing at the receiving bank, and clearance hold periods. These steps often result in bank payment delays ranging from 3 to 7 working days.

What is the average cheque processing time in the UK?

On average, cheque processing time ranges from 5 to 7 working days in the UK. This includes delivery, deposit, and settlement time, making cheques one of the slowest payment methods still in use.

What are better alternatives to cheque payments for businesses?

Some of the most effective payment method alternatives include:

->QR code payments

->Open Banking-based bank transfers

->Payment initiation APIs

->Payment links with real-time confirmation

Platforms like Finexer support all of these through a single integration.

How does Open Banking help reduce bank payment delays?

Open Banking allows payments to be initiated directly from a client’s bank account, with strong authentication and real-time settlement. Using Faster Payments rails, businesses can avoid manual delays and receive funds within minutes.

Tired of waiting on cheques? Switch to secure, real-time payments with Finexer!