KYC verification doesn’t always fail because of bad data. Sometimes it fails because nothing happens at all.

Your applicant clicks “verify,” consents to share their details, and then… silence. No confirmation. No next step. Just a stalled request sitting somewhere in your system. This is the part that most compliance teams overlook. KYC processing delays aren’t just about slow systems. They’re about lack of visibility and missing ownership.

The Real Risk of KYC Stalling

When identity checks stay unresolved, two things happen:

- Your team doesn’t know it’s stuck

Manual review queues build up. There’s no timer, no alert, and no escalation process. Operations teams assume it’s still moving through the pipeline when it’s actually on hold indefinitely. - Your applicant drops off

Customers expect to be verified within minutes. If their KYC status remains unclear or unresolved, most won’t follow up. They’ll abandon the process, and your onboarding metrics will take the hit.

According to NorthRow, 20% of KYC checks take more than 24 hours to complete. Another study showed that the average KYC review in the UK now takes 95 days. These KYC processing delays are not just technical issues. They are operational gaps that damage customer trust, create compliance risk, and stall revenue.

What Really Causes KYC Processing Delays (And Why They Go Unnoticed)

It’s easy to assume that KYC delays are caused by slow users or failed verifications, but more often than not, the real problem is internal.

Here’s what typically causes KYC processing delays behind the scenes:

1. No SLA Monitoring in Place

Once a user clicks the “verify identity” button, there’s often no system tracking how long their session stays unresolved. If their session times out, stalls, or the consent link is ignored, no one knows, and the case just sits there.

2. Lack of Ownership for Stalled Requests

Without clear escalation paths, stalled verifications don’t get flagged or reassigned. Operations teams believe compliance is handling it. Compliance assumes the user abandoned it. In reality, no one owns the next step.

3. Manual Review Bottlenecks

Even with automated systems in place, some users get routed to manual review. If those queues aren’t prioritised or monitored against response times, cases can remain untouched for hours.

4. No Visibility Into Verification Status

In many KYC systems, once a user enters a third-party verification flow, the internal team can’t see whether the session is pending, failed, or expired. This “black box” approach to verification makes it impossible to intervene when something goes wrong.

Use SLA Timers and Escalation Paths to Eliminate KYC Stalling

To fix KYC processing delays, you don’t need more staff or faster users. You need structure.

That’s where SLA-based KYC workflows come in.

An SLA, or Service Level Agreement, sets a clear time limit for each stage of the KYC process. For example:

- The consent link must be completed within 15 minutes

- Verification must return results within 10 minutes

- Manual review must be resolved within 60 minutes

These time windows aren’t just benchmarks, they’re triggers. When a session exceeds its SLA, the system should:

- Alert the appropriate team

- Escalate the case to a reviewer

- Notify the user with a reminder or fallback option

- Log the delay for audit reporting

By embedding SLAs directly into your KYC flow, you shift from passive monitoring to proactive resolution. You don’t wait for something to go wrong; you respond in real time when progress stalls.

With tools like Finexer, this is fully achievable. Consent sessions are time-stamped, data is returned via secure webhooks, and each verification can be tracked against your internal thresholds, giving your compliance and operations teams the insight they need to act before delays stack up.

What Escalation Paths Should Look Like in Practice

SLA timers mean little without a structured escalation path. When a verification request goes unresolved, your system needs a clear process to reassign responsibility and move the case forward.

Here’s what a practical KYC escalation path looks like:

15 minutes: Reminder Trigger

If the user hasn’t completed the consent flow within 15 minutes, an automated reminder should be sent via email or SMS. This prompt often re-engages the user and prevents unnecessary drop-offs.

30 minutes: Internal Alert

If there’s still no progress, the case should be flagged on your compliance dashboard. Assigned team members are alerted and can assess whether the session needs escalation or fallback options.

60 minutes: Manual Review Escalation

At the one-hour mark, the request should be routed to a senior reviewer or moved into a manual verification queue. This is the point where alternative verification methods, such as video KYC or document upload, can be offered if needed.

Having a predefined escalation path like this gives your team control over KYC processing delays. Instead of cases sitting idle, every delay is met with a timed response, helping reduce overall turnaround times and improving accountability across teams.

Power Your SLA-Based KYC Workflow with Verified Data from Finexer

Designing a strong SLA strategy only works if your system has access to reliable, real-time identity data. That’s where Finexer fits in.

Finexer provides the Open Banking KYC infrastructure you need to trigger SLA timers, respond to delays, and verify customers without waiting on documents or manual checks.

Here’s how Finexer helps your internal KYC workflow run faster and more efficiently:

1. Verified Identity in Real Time — Without Documents

With a user’s consent, Finexer connects to their UK bank and returns verified identity data, including full name, account ownership, and address. This eliminates delays caused by document uploads or manual entry, and gives your system the information it needs to begin verification the moment a session starts.

This is especially useful when applying SLA logic. Since every verification response is returned via API, your system can timestamp the request, measure turnaround time, and escalate any session that exceeds the set threshold.

2. Add Biometric and Document Matching, When You Need It

If your SLA policy includes multi-factor identity checks, Finexer supports that too. You can build flows that include:

- Document extraction from passports or driver’s licenses

- Live selfie capture for biometric matching

- Instant similarity scoring to confirm that the person matches the ID

Each of these steps returns structured data that can be tracked and logged, so your team knows when a verification has stalled and why.

3 . Layer in Financial Checks for Added Assurance

In cases where your SLA thresholds depend on transaction-level due diligence, Finexer enables secure access to a customer’s financial data. With user consent, you can:

- Pull the balance and transaction history

- Generate cash flow summaries

- Use financial insights to support risk-based reviews

This helps your compliance team meet SLA targets while improving the quality of onboarding and fraud prevention decisions.

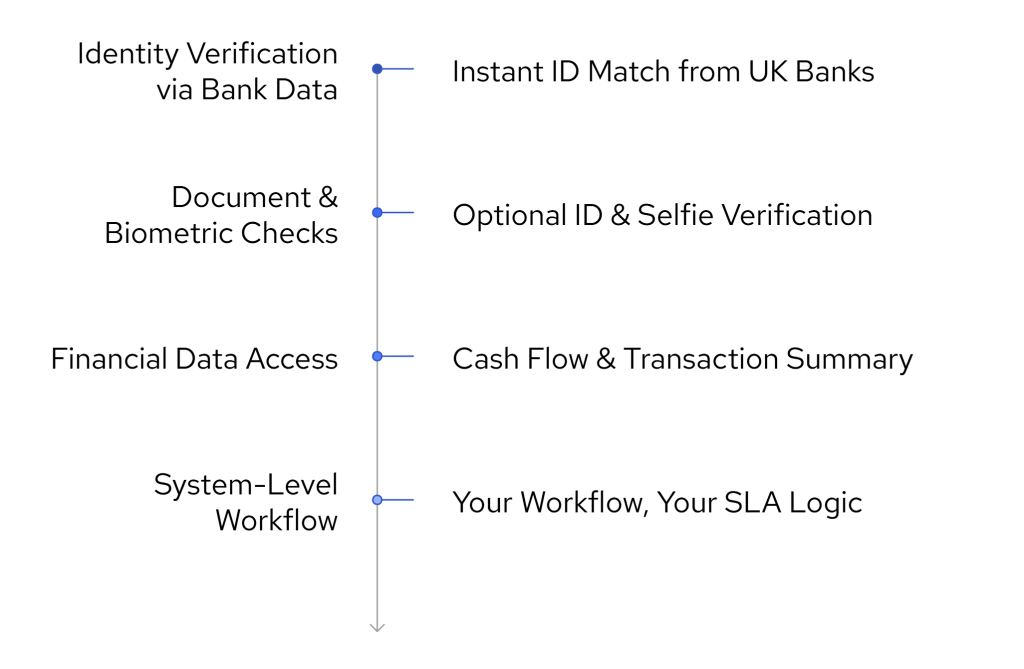

4. One API, Flexible Workflows

Whether you’re building a simple identity check or a more advanced multi-step flow, Finexer lets you do it all from one integration:

- Identity verification via bank data

- Document and biometric matching

- Financial analysis for onboarding and credit decisions

You stay in control of the workflow. Finexer delivers the real-time data your SLA system needs to keep moving.

What causes KYC processing delays?

Delays happen when verification sessions are stalled with no tracking or escalation, often due to expired links, manual reviews, or a lack of workflow control.

How do SLAs help reduce KYC delays?

SLAs set time limits for each verification step. If a step exceeds the limit, your system can trigger alerts or escalate the case automatically.

Does Finexer handle workflow automation?

No. Finexer provides real-time identity and financial data via API. You manage the workflow logic and escalations on your end.

What KYC checks does Finexer support?

Finexer supports bank-based identity checks, document extraction, biometric matching, and similarity scoring — all via API.

Can I integrate Finexer with my platform?

Yes. Finexer offers an easy-to-integrate API that works with your onboarding, compliance, or CRM systems.

Build faster, more accountable KYC workflows using Finexer’s KYC and Open banking data API!