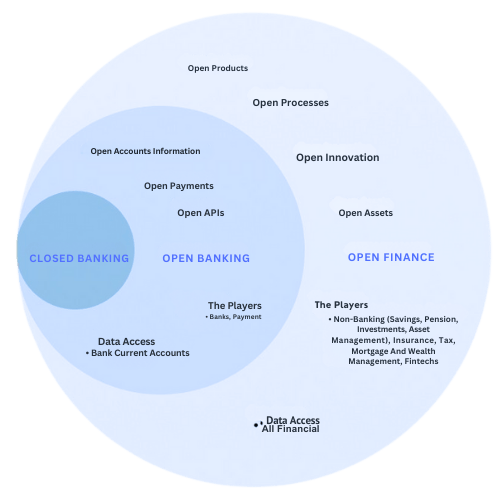

Open Finance is an extension of Open Banking that allows businesses and consumers to access and share not just banking data but a broader range of financial information, such as investments, pensions, mortgages, and insurance.

What you will Discover:

Introduction

Struggling with slow and complicated financial processes? Imagine a solution that not only makes everything faster but changes the way you manage money in your company. The financial world is changing quickly, and old payment systems are failing. Manual work, slow procurement processes, and late payments are common issues. This is where Open Finance comes in – a new way of handling money that makes everything more automated, connected, and efficient.

How Financial Operations Have Changed for Businesses

Financial needs in business-to-business (B2B) environments have greatly changed, especially with digital technology transforming industries. Old payment methods and separate data systems cannot keep up with how fast businesses need to work today. Open Finance goes beyond Open Banking by giving access to more than just bank accounts. It includes a complete picture of a company’s financial information – like investments, insurance, mortgages, and wealth management. This complete access allows for real-time data connections, better use of information, and automation of manual tasks, making businesses more efficient.

📚 Faster B2B Payments with Finexer

What’s the Difference?

| Aspect | Open Banking | Open Finance |

|---|---|---|

| Scope of Data | Shares banking-specific data, such as transaction information and account details, through secure connections between banks, fintechs, and third-party providers. | Expands beyond banking data to include financial information such as mortgages, investments, pensions, and insurance, offering a holistic view of consumer finances. |

| Services Offered | Supports payment initiation and account aggregation, making banking more convenient for consumers. | Extends to other financial products like wealth management, insurance, and pensions, enabling businesses to offer comprehensive financial solutions. |

| Customer Benefits | Improves banking-related services by providing consumers with a single dashboard for all bank accounts. | Empowers consumers to manage their entire financial ecosystem from one platform, covering savings, investments, insurance, and more. |

| Opportunities for Businesses | Allows innovation in banking services by leveraging banking-specific data. | Broadens opportunities by using a wider dataset, enabling industries like healthcare and insurance to offer more tailored, value-driven services. |

Simply put, Open Banking is the foundation, focusing mainly on bank data and payments. At the same time, Open Finance builds on it by integrating additional financial information, offering a complete picture of a consumer’s financial life.

📚 Learn more about open banking vs traditional payments

Key Use Cases

- Cash Flow Management for SMEs

Small and medium enterprises (SMEs) often struggle to maintain a steady cash flow. An Open Finance application can automatically gather and analyse financial data from multiple bank accounts, invoices, and expenses in real-time. By integrating with Open Banking APIs, the application can predict cash shortages, suggest optimal payment times, and provide actionable insights to help business owners manage their finances more effectively. - Employee Expense Automation

Managing employee expenses manually is both time-consuming and prone to errors. An Open Finance application can automate this process by allowing employees to link their bank accounts, upload receipts, and categorise expenses. The application can then use Open Banking APIs to validate transactions in real-time and automate reimbursements. This reduces paperwork, eliminates manual reconciliation, and speeds up reimbursement times, making it highly efficient for employees and finance teams. - Wealth and Investment Management for Individuals

Many individuals struggle to manage their wealth across different accounts, investments, and insurance policies. An Open Finance application can provide a unified platform that aggregates data from all these sources, offering users a complete overview of their financial health. By leveraging Open Banking and investment APIs, users can track their spending, monitor their investment performance, and even receive personalised suggestions for growing their wealth—all in one place.

How Open Finance Can Solve Business Problems

There are endless possibilities for making financial applications using Finexer’s API. Here’s a summary of the problems Open Finance can solve for businesses and how Finexer’s API can help build it:

| Problem | Leveraging Finexer’s API |

|---|---|

| Manual cash flow management | Automate cashflow management using Finexer’s Open banking data API |

| Delayed supplier payments | Early payment programs using Finexer’s Request to Pay feature |

| Lack of unified financial insights | Integrated financial data with Finexer’s Data aggregation API, providing a complete view. |

| Lengthy credit assessments | Faster and more accurate risk evaluations with Finexer’s verification and data API. |

| Complex wealth and insurance management | Build a Unified view and management service using Finexer’s Data aggregation API |

What is Finexer?

Finexer is an Open Banking platform that helps businesses with powerful APIs for payments, data access, and verification services. Our platform allows companies to automate complicated financial processes, like managing cash flow, paying suppliers, and handling employee expenses. Imagine having all your financial data connected in real time, giving you insights that help you make better decisions. Finexer makes this possible, allowing businesses to create Open Finance applications that solve key issues and save valuable time and resources.

Winding Up

Open Finance is changing how financial operations work by providing solutions that go beyond traditional payments. Whether it’s improving cash flow management, making risk assessments easier, or integrating wealth and insurance management, It offers huge benefits. By using Finexer’s API, you can access these benefits to automate payments, streamline data management, and simplify verification processes.

Build your Open Finance application with Finexer’s API. Schedule your demo now! We’re just a click away 🙂