Imagine onboarding a new customer in just 90 seconds with KYC verification that’s not only faster but also more accurate. In a world where fraud is on the rise, traditional KYC processes often fall short—slowing down onboarding, increasing costs, and exposing businesses to higher risks.

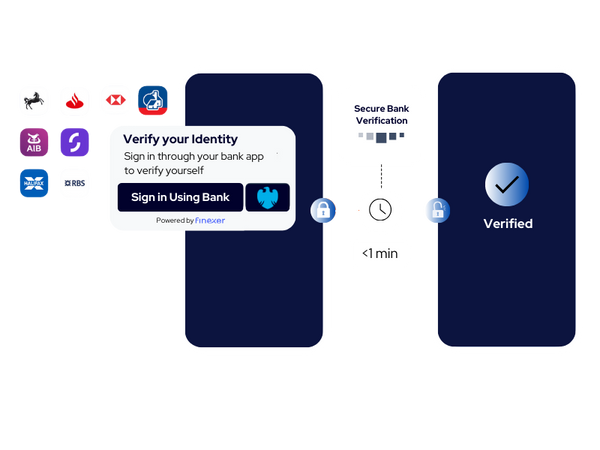

But what if you could verify a customer’s identity using real-time data from their bank? This is where Open Banking transforms KYC verification, offering a seamless, more secure way to confirm identities and reduce fraud.

We will guide you through:

Why Traditional KYC Needs an Upgrade

Traditional KYC verification involves manual document review, which can take days to complete. It requires businesses to validate multiple pieces of customer information, including identity documents and financial history, through disconnected processes.

Key challenges include:

- Lengthy Onboarding Times: Delayed verification can lead to customer drop-offs.

- Fraud Vulnerabilities: Documents can be easily forged or tampered with, increasing fraud risk.

- High Compliance Burden: Keeping up with evolving KYC and AML compliance requirements can be costly.

- Inconsistent Accuracy: Manual checks are prone to human error, leading to verification failures.

How Open Banking Transforms KYC Verification

Open Banking is reshaping how businesses approach KYC verification. By providing real-time access to verified bank data, Open Banking eliminates the need for manual document checks and significantly reduces onboarding time.

Here’s how Open Banking enhances the KYC process:

- Instant Identity Verification: Match a customer’s name and account information with bank records in seconds.

- Fraud Prevention: Real-time data access reduces the risk of identity theft and document fraud.

- Streamlined Compliance: Ensures businesses meet regulatory requirements by accessing accurate, up-to-date information.

- Faster Onboarding: Verification that once took hours can now be completed in 90 seconds, improving customer experience and reducing drop-offs.

Key Verification Methods in the KYC Process

Modern KYC verification relies on multiple layers of identity checks to ensure accuracy and reduce fraud risks. While traditional KYC methods often focus solely on document checks, combining several verification techniques provides a more secure and comprehensive process.

Here are the four key verification methods used in Open Banking-powered KYC and how they work:

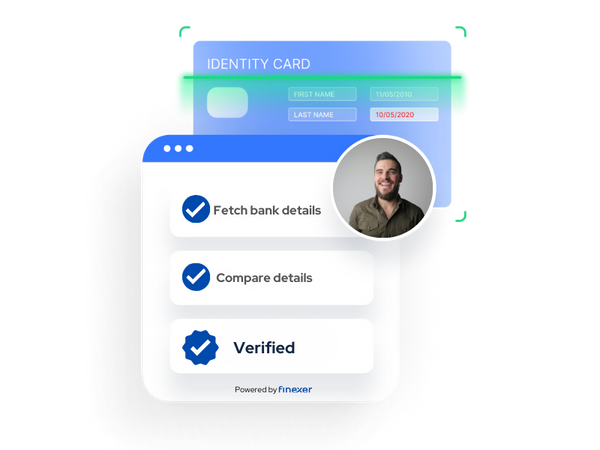

1. Biometric Verification

User Flow:

- Selfie Capture: The user takes a live selfie during the onboarding process.

- Facial Matching: The system compares the selfie with the photo on the uploaded ID.

- Similarity Score Calculation: A similarity score is generated to determine how closely the two images match.

- Real-Time Feedback: The result is provided instantly, confirming the user’s identity.

Why It Matters:

- Prevents identity theft by ensuring the person submitting the document is physically present.

- Adds an extra layer of security to the verification process.

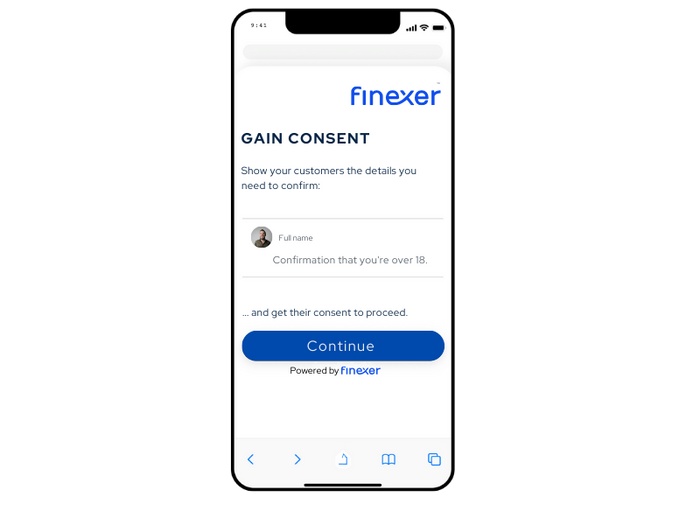

2. Age Verification

User Flow:

- Data Retrieval: The user’s date of birth is extracted from the submitted document and cross-checked with bank records.

- Compliance Check: The system verifies whether the user meets the required age criteria for the service (e.g., 18+ for financial products).

- Approval or Rejection: Based on the verification result, the system either approves or flags the user for further review.

Why It Matters:

- Ensures compliance with age-restricted services.

- Reduces the risk of underage users accessing restricted products.

3. Identity Verification

User Flow:

- Data Submission: The user provides their full name and bank account details.

- Bank Data Cross-Check: Finexer’s system verifies the name against bank records to ensure accuracy.

- Real-Time Confirmation: The system confirms identity in seconds, generating a verification report.

Why It Matters:

- Ensures 100% accurate identity verification.

- Eliminates the need for additional documentation or manual checks.

Get Started

Start your 14-day free trial today and see why businesses trust Finexer for secure, compliant, and tailored open banking solutions.

How Finexer Supported KYC Verification

VirtualSignature-ID (VSID), a UK Government-accredited eSignature and digital identity provider, partnered with Finexer to improve its KYC verification process. Before this collaboration, VSID faced challenges integrating compliant Open Banking solutions into their existing services. Finexer’s FCA-compliant Open Banking API provided the perfect solution, enabling seamless identity verification and helping VSID enhance compliance and customer experience.

With Finexer’s technology, VSID streamlined its workflows, reduced operational costs, and ensured faster client onboarding for the legal and accountancy sectors. The collaboration improved security, speed, and efficiency, allowing VSID to meet its clients’ high expectations for digital verification services.

“Finexer is a trusted partner who helped us meet our KYC needs while improving efficiency and security,” said David Kern, CEO of VirtualSignature-ID.

Key Takeaways

- Challenge: Need for a compliant, cost-effective Open Banking solution for KYC.

- Solution: Finexer’s Open Banking API enabled real-time KYC verification.

- Results: Faster onboarding, reduced costs, and improved compliance.

Why Businesses Choose Finexer for Verification

Here’s how Finexer makes KYC verification faster and more reliable:

1. Real-Time Bank Data Access for Instant Verification

Unlike traditional KYC providers that rely solely on static documents, Finexer connects to 99% of UK banks to verify a user’s identity in real time. This bank data ensures that key information—such as name, account ownership, and transaction history—matches the user’s submitted details.

- Why It Matters: Real-time verification reduces fraud risks and provides instant confirmation, eliminating the need for lengthy manual checks.

2. Multi-Layered Fraud Prevention

By combining document verification, biometric matching, and bank data validation, Finexer offers a comprehensive defense against identity fraud.

- Document Check: Confirms the authenticity of passports, driving licenses, and other IDs.

- Biometric Verification: Ensures the individual submitting the ID is physically present.

- Bank Data Matching: Cross-verifies the user’s name and account details with official bank records.

Each layer adds an extra level of security, making it nearly impossible for fraudsters to bypass the system.

3. 90-Second Onboarding Process

Finexer’s KYC verification takes 90 seconds or less, offering one of the fastest onboarding experiences in the market. Businesses no longer have to worry about customers dropping out due to long wait times.

- Example: A fintech lending platform can verify a new borrower’s identity and financial data in under two minutes, allowing for immediate loan approval.

4. Transparent, Affordable Pricing

Finexer’s pricing model is built with small to medium businesses (SMBs) and fintech startups in mind.

- No Hidden Fees: Finexer provides clear, tiered pricing based on verification volume and service usage.

- Flexible Plans: Businesses can scale their KYC processes without being locked into expensive contracts.

5. Easy Integration and Developer-Friendly API

Finexer’s API is designed for easy integration, even for businesses with limited technical resources. Whether you’re running a fintech app or a lending platform, you can quickly embed Finexer’s KYC solution into your existing workflow.

- Developer Support: Comprehensive documentation and technical assistance ensure a smooth integration process.

- Customisable Workflows: Tailor the KYC process to meet your business’s unique needs.

The Finexer Advantage

Finexer brings together the best of Open Banking and advanced verification techniques to create a solution that’s accurate, fast, and scalable. Whether you’re a growing startup or an established financial institution, Finexer helps you stay compliant while providing a seamless user experience.

What makes Open Banking-based KYC different from traditional methods?

Traditional KYC often relies on manual document checks that can be time-consuming and prone to human error. Open Banking-based KYC, on the other hand, taps directly into real-time bank data to verify a customer’s identity. This not only speeds up the onboarding process—often to under 90 seconds—but also significantly reduces the risk of fraud by validating critical information (like name, account ownership, and transaction history) against authoritative bank records.

How can Finexer help reduce fraud risks?

Finexer employs a multi-layered verification approach, combining document checks, biometric matching, and real-time bank data validation. Each layer adds an extra level of security, making it very difficult for fraudsters to slip through. With Finexer, businesses can detect inconsistencies faster and prevent fraudulent onboarding attempts right at the start.

Why is real-time verification important for customer onboarding?

Real-time verification allows businesses to make immediate decisions about whether to approve or reject an application. This speeds up the onboarding process, reduces drop-off rates, and minimises the need for manual reviews. In a competitive market, offering a near-instant onboarding experience can significantly improve customer satisfaction and conversion rates.

Can Open Banking-powered KYC improve compliance efforts?

Yes. By accessing live bank data, businesses can quickly confirm critical details—such as a customer’s identity and financial history—without depending solely on static documents. This ensures a more thorough compliance process that aligns with evolving KYC and AML (Anti-Money Laundering) regulations. When regulations change, Finexer’s system automatically updates verification checks, keeping your organisation compliant with minimal effort.

Is a 90-second onboarding process really possible?

Absolutely. By automating identity checks and leveraging real-time bank data, Finexer cuts out the need for manual document processing. The streamlined workflow can verify essential information—like identity, age, and account ownership—almost instantly, bringing the total onboarding time down to 90 seconds or less.

Can Finexer integrate with my existing platform or CRM system?

Yes. Finexer offers developer-friendly APIs and documentation that make integration straightforward. Whether you’re using a specialised CRM, a fintech platform, or a lending application, you can customise how Finexer’s KYC process fits into your existing workflows.

Why should I choose Finexer over other KYC providers?

Finexer offers a unique combination of real-time bank data access, biometric verification, and easy API integration—all while maintaining transparent, cost-effective pricing. These factors, combined with their commitment to compliance and fraud prevention, make Finexer an ideal partner for businesses seeking a fast, secure, and scalable KYC solution.

Try Onboarding with Finexer in 2025 ! Schedule your free demo and get a 14 days Trial by Finexer 🙂