EPOS stands for Electronic Point of Sale, a system used in retail and hospitality to process sales transactions, track inventory, and manage customer data. It typically includes hardware like tills, barcode scanners, and card readers, along with software for sales and inventory management.

Introduction

In an era where technology and finance intersect with unprecedented complexity and potential, the evolution of Electronic Point of Sale (EPOS) systems through Open Banking stands as a particularly transformative development. This convergence promises to revolutionize how businesses of all sizes, including those utilizing square EPOS, restaurant POS systems, and various epos till systems, manage transactions and interact with financial data. By integrating Open Banking, EPOS systems can offer more streamlined, secure, and customer-friendly services, making the epos login process more than just a gateway to traditional sales transactions. This shift not only signifies a move towards more efficient operational models but also underscores the growing significance of innovative financial solutions in the digital age.

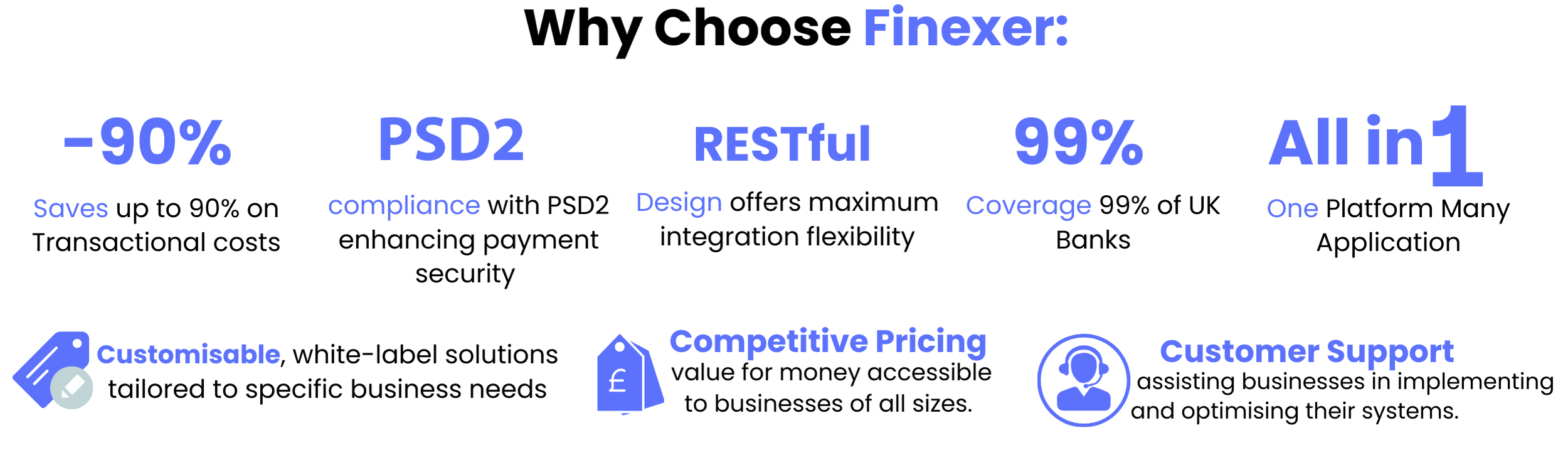

The forthcoming sections will delve into the role of Open Banking in enhancing EPOS systems, spotlighting Finexer as a pivotal solution provider in this landscape. We’ll explore how these advancements augment payment services, bolster security measures, prevent fraud, and ultimately, transform the consumer payment experience. Additionally, we’ll outline the manifold benefits to businesses—from operational efficiency gains to elevated customer satisfaction—and project into the future of Open Banking in payment services. As we navigate through the synergistic relationship between Open Banking and EPOS systems, we aim to provide a comprehensive perspective on how this integration can empower retailers, consumers, and the broader financial ecosystem.

Definition of Open Banking

Open Banking refers to the use of open APIs that enable third-party developers to build applications and services around the financial institution. This technology allows the secure sharing of financial information, under customer consent, to provide enhanced capabilities for banking and financial services.

Understanding Open Banking in EPOS Systems

The integration of Open Banking with Electronic Point of Sale (EPOS) systems presents a mutually beneficial relationship, enhancing both operational efficiency and consumer experience. By streamlining the transaction process through direct bank-to-bank transfers, EPOS systems benefit from reduced processing times and lower transaction costs. This efficiency not only accelerates the checkout process but also minimises the operational burden on businesses, allowing them to allocate resources more effectively.

Benefits to Businesses

✔ Improved Transaction Speeds:Open banking technology, as implemented by Finexer, significantly enhances transaction speeds within EPOS systems. This is achieved by facilitating direct bank-to-bank transfers, which bypass traditional intermediaries that often slow down the payment process. Such improvements are crucial in environments where time is of the essence, ensuring that customer checkouts are swift and efficient.

✔ Cost Reduction and Efficiency : Finexer’s open banking solutions also focus on cost reduction and increasing operational efficiency. By eliminating the need for intermediaries in the payment process, businesses benefit from lower transaction fees and reduced operational costs. Additionally, the ability to handle bulk payouts and manage recurring payments efficiently helps businesses streamline their financial operations, leading to further cost savings and improved overall financial management.

✔ Enhanced customer experience in EPOS systems, facilitated by Finexer’s open banking solutions, significantly streamlines the customer onboarding process and payment transactions. The seamless integration of real-time bank transaction data through Finexer allows businesses to offer faster service, reducing wait times and improving customer satisfaction. This integration not only accelerates the processing of payments but also ensures a smoother, more efficient customer interaction, fostering loyalty and repeat business. Additionally, the use of advanced security measures in the payment process reassures customers, enhancing their trust in the transaction system.

✔ Reduction in Fees and Fraud: Open banking technology, particularly through platforms like Finexer , significantly lowers transaction costs for EPOS systems. By eliminating the need for intermediaries in the payment process, such as card acquirers, businesses can enjoy a direct transfer of funds between bank accounts. This streamlined approach not only reduces fees associated with card processing—which can be as high as 6%—but also minimises the financial burden on retailers, often bringing transaction fees to less than 1%.

✔ Better Financial Insights

In the financial sector, traditional payment systems often involve multiple intermediaries, leading to increased transaction costs and delays in fund transfers. This complexity can hinder the efficiency of financial operations and elevate the risk of inaccuracies in financial insights.

Finexer leverages open banking to offer enhanced financial insights by providing businesses with access to real-time transaction data, balance checks, and comprehensive analytics on income and expenses. Their platform ensures that businesses can monitor their financial health accurately and efficiently, leading to better financial decision-making and strategy formulation.

Key Considerations for Implementation

Technical Integration

Open Banking revolutionises EPOS systems by facilitating direct bank-to-bank transactions, eliminating the need for intermediaries and thus reducing transaction costs and processing times. This integration supports instant payments, bulk payouts, and access to detailed financial data, enabling businesses to make informed decisions swiftly. Additionally, enhanced security features like Secure Customer Authorisation (SCA) and biometric verification protect against fraud, ensuring a secure transaction environment for both businesses and consumers.

Successful implementation of Open Banking in EPOS systems requires meticulous technical integration. Retailers must ensure that their systems can seamlessly connect with banking APIs. This involves setting up secure, stable connections that can handle real-time data transfer efficiently. Additionally, the integration process should include thorough testing phases to address any potential disruptions in the existing workflow and to ensure compliance with financial regulations.

This integration supports a robust framework that not only simplifies the payment process but also fortifies it against potential security threats.

Customer Adoption

For Open Banking to be effective at the point of sale, customer adoption is crucial. Retailers need to focus on educating consumers about the benefits of Open Banking, such as enhanced security and quicker transactions. Encouraging customers to transition from traditional card payments to Open Banking solutions involves clear communication of its advantages and ease of use. Retailers might consider implementing incentive programs that reward customers for using Open Banking methods, thereby accelerating adoption rates.

Future of Open Banking in Payment Services

The trajectory of Open Banking is set to revolutionise the payment services landscape by introducing more streamlined, secure, and user-friendly payment options directly at points of sale. As technology and consumer demand evolve, the adoption of Open Banking for in-store payments is gaining momentum, mirroring the transformative impact once seen with contactless payments on public transport. This shift is largely driven by the significant growth in transaction volumes processed through Open Banking, as evidenced by entities like HMRC, which saw its Open Banking payments surge from £2.5 billion to £10.5 billion in just one year.

Conclusion

Finexer’s open banking solutions offer a transformative approach for EPOS systems, focusing on operational efficiency, enhanced customer experience, and increased security. By facilitating direct bank-to-bank transactions, Finexer reduces the need for intermediaries, which significantly lowers transaction costs and speeds up processing times. This efficiency is crucial in environments where every second counts, leading to quicker checkouts and reduced wait times for customers.

Additionally, Finexer’s robust security measures, including real-time transaction monitoring and AI-driven fraud detection algorithms, safeguard against fraudulent activities, ensuring a secure transaction environment. This not only protects businesses but also boosts consumer confidence, fostering a safer shopping experience.

By integrating these advanced open banking technologies, EPOS systems can leverage real-time data for better decision-making and streamlined operations, ultimately enhancing the overall customer experience and operational agility.

Streamline your business operations with Finexer’s secure, cost-effective open banking solutions for EPOS – the future of financial transactions is here!