An instant payment enables businesses to transfer money quickly – usually between five and 30 seconds – although it can sometimes take a few minutes depending on system availability and the type of bank being used. Regular online bank transfers usually take at least one working day for the money to reach the recipient’s bank account.

Overview

Finexer’s Instant Payment solution revolutionises financial transactions by leveraging Open Banking technology to offer secure, cost-effective, and instantaneous bank-to-bank payments. This innovative platform provides businesses and consumers with an efficient alternative to traditional payment methods, enhancing operational efficiency and customer satisfaction.

Key Features

Cost Reduction

Fixed-Fee Structure: Finexer’s Instant Payment drastically reduces transaction costs by eliminating the need for card and acquirer fees, offering up to 90% savings compared to conventional payment methods.

Transparent Pricing: Businesses benefit from predictable and transparent pricing, making financial planning and budgeting more straightforward.

Instant Settlement

Faster Payments Network: Utilising the Faster Payments rails, Finexer ensures that funds are settled in the recipient’s account within seconds, improving cash flow and operational efficiency.

Real-Time Transactions: Both businesses and customers can enjoy the convenience of real-time transaction confirmations, reducing waiting times and enhancing the payment experience.

Enhanced Security

Secure Authentication: Users authenticate directly with their banks through secure Open Banking APIs, minimising the risk of fraud and chargebacks associated with card payments.

Fraud Prevention: Advanced security protocols, including AES-256 data encryption and TLS 1.2, ensure the highest level of transaction security.

Seamless Integration

White Label Solutions: Finexer offers customisable white-label interfaces that integrate seamlessly into existing platforms, providing a consistent brand experience.

API Integration: Businesses can integrate Finexer’s APIs into their systems effortlessly, enabling instant payments with minimal technical overhead.

Versatile Payment Options

Multiple Channels: Finexer supports various payment channels, including in-app payments, online payments, payment links, and QR codes, catering to diverse business needs.

User-Friendly Experience: The intuitive design ensures a smooth user experience, encouraging higher adoption rates among customers.

Benefits

Operational Efficiency 🗹

Quick Setup: Businesses can quickly integrate Finexer’s Instant Payment solution, thanks to the streamlined API and comprehensive developer support.

Reduced Manual Errors: Automated processes reduce the likelihood of manual errors, ensuring accuracy and reliability in financial operations.

Customer Satisfaction 🗹

Instant Access to Funds: Customers and service providers can access their funds immediately, eliminating the frustration of waiting periods.

Improved Experience: The seamless payment process enhances the overall customer experience, leading to higher satisfaction and loyalty.

Regulatory Compliance 🗹

PSD2 Compliance: Finexer handles compliance with PSD2 regulations, saving businesses time and resources while ensuring adherence to industry standards.

Fraud Detection: Real-time fraud detection mechanisms protect both businesses and customers, providing peace of mind.

Use Cases

PropTech/Real Estate

Rent Payments: Facilitate instant rent payments from tenants to property managers or landlords.

Property Transactions: Enable immediate transfer of funds during property sales, reducing delays in closing deals.

EPOS (Electronic Point of Sale)

Retail Transactions: Allow retailers to accept instant payments, enhancing customer checkout experiences.

In-store Purchases: Integrate with EPOS systems to provide quick and secure payments for in-store purchases.

Credit and Lending

Loan Disbursements: Disburse loans instantly to borrowers’ bank accounts.

Instant Loan Repayments: Allow borrowers to make quick repayments, improving loan recovery rates.

Payments

Direct Payments: Facilitate instant direct payments between businesses and customers.

Recurring Payments: Enable instant recurring payments for subscriptions and services.

Personal & Business Finance

Expense Management: Allow individuals and businesses to manage expenses with instant payment capabilities.

Instant Transfers: Provide instant money transfers between personal or business accounts.

iGaming

Deposit Funds: Allow players to deposit funds instantly for immediate gaming.

In-game Purchases: Facilitate quick in-game purchases for a seamless gaming experience.

Kiosk & Vending Machines

Quick Transactions: Enable instant payments for purchases from kiosks and vending machines.

Cashless Payments: Provide cashless payment options for users.

LawTech

Client Payments: Facilitate immediate payments from clients for legal services.

Case-Related Expenses: Allow law firms to instantly pay for case-related expenses.

Utility Bills

Bill Payments: Enable customers to make instant utility bill payments.

Payment Reminders: Send reminders for instant payments to avoid late fees.

Payroll & Invoicing

Employee Payments: Ensure employees receive their salaries instantly.

Invoice Payments: Allow clients to pay invoices immediately upon receipt.

Accounting & ERP

Expense Reconciliation: Provide instant payment options to streamline expense reconciliation processes.

Vendor Payments: Enable instant payments to vendors, ensuring timely supply chain operations.

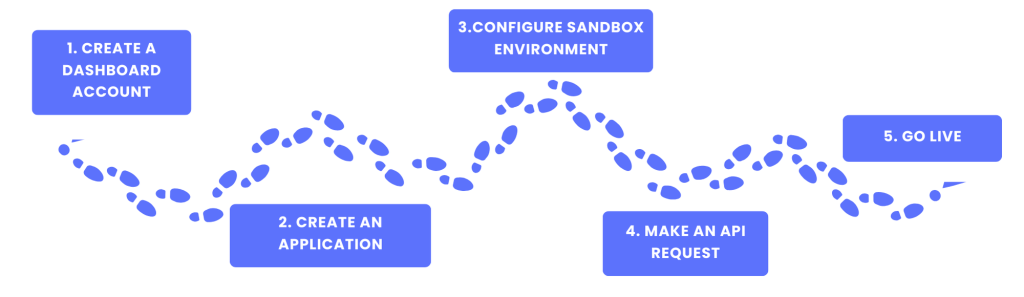

Getting Started

1.Create a Dashboard Account: Set up an account on the Finexer dashboard to manage and monitor payments.

2.Create an Application

3.Configure Sandbox Environment: Test integrations in a separate sandbox environment without affecting live data.

4.API Integration: Utilise Finexer’s APIs for seamless integration into existing systems.

5.Go Live: Launch the instant payment solution and start benefiting from real-time, secure transactions.

GET IN TOUCH

Experience seamless transactions with Finexer’s instant payment solution—read on to learn more!