Despite the rise of modern digital finance tools, legacy payments are still deeply embedded in how many UK SMEs operate. Cheques, BACS transfers, manual bank reconciliation, and even faxed invoices continue to be used every day, not because they’re efficient, but because they’re familiar.

For many small and medium-sized businesses, switching away from these outdated processes can feel risky or unnecessary. After all, if the payments still go through, why change what “works”?

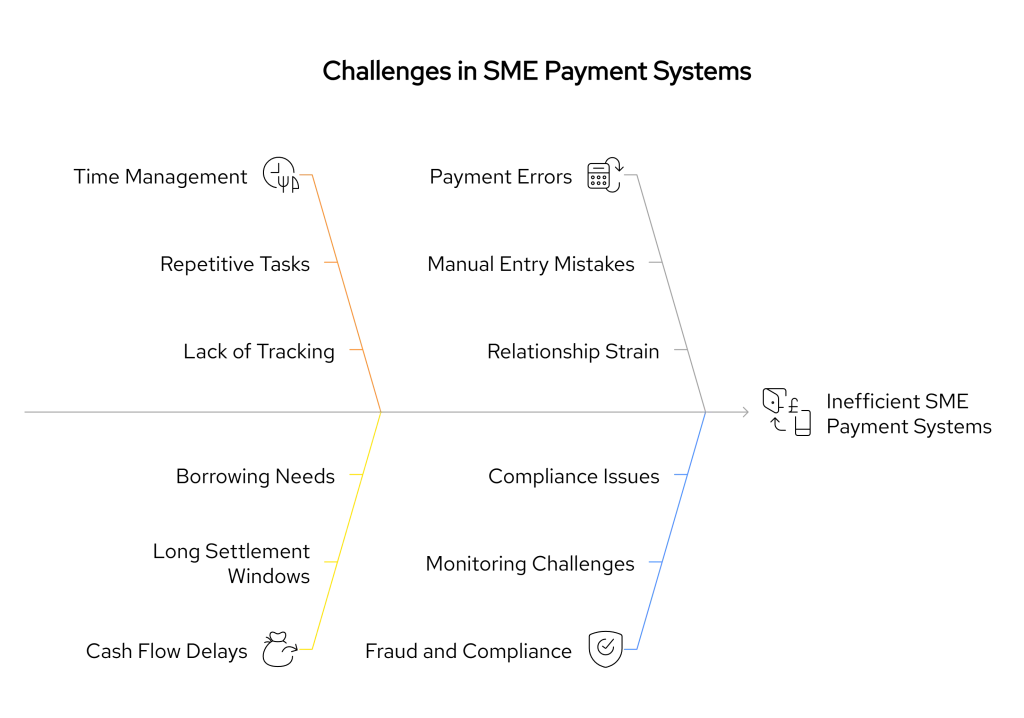

But what often goes unnoticed is the hidden cost of legacy payment methods: slower cash flow, excessive admin time, increased fraud exposure, and a general lack of visibility over incoming and outgoing funds.

In a competitive environment where every margin matters, sticking with legacy systems is no longer a neutral decision; it’s a liability.

📚 Pay by bank vs Card Payments

The Real Cost of Legacy Payment Methods in the UK

At first glance, legacy payment systems can seem low-cost or even free. But for UK SMEs, these outdated methods quietly drain resources in ways that aren’t always visible on a bank statement. From staff hours to delayed income, the cost of legacy payment systems adds up fast, and often goes unaccounted for.

1. Time = Money

Processing cheques, keying in bank details, manually reconciling transactions, these repetitive tasks create unnecessary admin overhead. Most SMEs don’t track the time spent managing payments, but every hour lost to manual effort is time not spent on growth or client work.

2. Cash Flow Delays

Legacy payment methods like BACS or cheques come with long settlement windows. A standard BACS payment takes up to 3 working days to clear. That means slower access to cash, more borrowing to fill short-term gaps, and limited agility when responding to financial needs.

3. Payment Errors and Rework

Manual entry mistakes lead to failed transactions, payment reversals, and strained client or supplier relationships. Each correction wastes time, and in some cases, costs real money, such as late fees, missed early payment discounts, or double-payments that go unnoticed.

4. Hidden Bank and Processing Fees

Some banks still charge per-transaction fees for legacy rails. Others apply monthly charges for manual payment handling or cheque deposits. SMEs often overlook these because they’re small per item, but across dozens or hundreds of payments, they cut into profit.

5. Increased Fraud and Compliance Risk

Paper-based and manual payment systems are harder to monitor and secure. Fraud losses, data breaches, or compliance issues can result in penalties or forced process overhauls, all of which carry real cost beyond the incident itself.

Legacy Payment System Cost Breakdown for UK SMEs

| Cost Category | Typical Impact When Using Legacy Payments |

|---|---|

| Admin Hours per 100 Payments | 6 – 10 hours spent on data entry, approvals, chasing remittances, and manual reconciliation. |

| Settlement Delay | 2 – 5 working days before funds clear (e.g., BACS, cheques), slowing cash-flow and tying up working capital. |

| Transaction & Bank Fees | Card interchange (1.4% – 2.9% + £0.20 per txn), cheque processing (~£1 each), BACS submission fees (£0.23 – £0.50 per file). |

| Error-Correction Cost | Manual rework for failed or duplicate payments; 10–30 minutes per incident plus potential late-payment penalties. |

| Fraud & Security Risk | Higher exposure to cheque alteration, spoofed emails, and payment-redirection scams; losses or chargebacks can exceed transaction value. |

| Cash-Flow Opportunity Cost | Revenue locked in transit forces SMEs to use overdrafts or credit lines, adding interest expense and limiting reinvestment. |

| Staff Morale & Productivity | Repetitive data entry and chasing overdue funds reduce employee satisfaction and divert focus from revenue-generating tasks. |

Why Legacy Payment Systems Still Dominate SME Finance

Despite the growing number of modern payment alternatives, many UK SMEs continue to rely on legacy payments. This isn’t just about convenience, it’s often about perception, inertia, and gaps in awareness.

Here’s why outdated systems remain so common in SME workflows:

1. Familiarity Beats Efficiency

Legacy processes like BACS, cheques, and paper-based invoicing are embedded into how many SMEs operate. Staff know how to use them, and decision-makers often feel they’re “good enough.” But outdated SME payment systems rarely hold up when you factor in cash-flow delays and admin costs.

2. Misunderstood Switching Costs

One of the biggest myths in SME finance is that switching from legacy systems to modern payment alternatives is costly and disruptive. In reality, many Open Banking-enabled tools offer plug-and-play integrations with minimal training and zero operational downtime.

3. Lack of Awareness About Open Banking for UK SMEs

Even though Open Banking is regulated and widely available, many small businesses still associate it with fintech startups or complex builds. In truth, Open Banking for UK SMEs can be implemented in days and offers direct cost and speed advantages over legacy rails.

4. Stakeholder Dependency

Some SMEs keep using legacy methods because their clients or suppliers do. A long-standing supplier might still send cheques, or a customer might request paper invoices. But businesses that adopt modern tools often discover that others follow their lead, especially when faster payments and cleaner workflows benefit everyone.

Open Banking: An Affordable Upgrade for UK SMEs

For UK businesses looking to cut costs without compromising on control, Open Banking offers a smarter way to move money. It removes the manual effort and slow settlement times that define legacy payment systems, while keeping fees low and workflows efficient.

1. Instant, Direct Bank Transfers

Open Banking enables account-to-account payments that settle in seconds, without relying on card networks or BACS. That means faster access to cash, fewer late payments, and tighter financial control.

2. Lower Fees and No Interchange Charges

There are no card processing fees or cheque handling charges. Most Open Banking providers charge a flat, usage-based fee, which is far more affordable for SMEs handling large or frequent transactions.

3. Automated Reconciliation Built In

Payments can be automatically matched to invoices and accounting entries using live bank data. This eliminates hours of admin and drastically reduces the chance of human error.

4. Secure by Design

Unlike legacy systems, which rely on email or paper trails, Open Banking uses bank-level authentication and secure APIs. This lowers fraud risk and improves regulatory compliance.

5. Built for Modern SME Workflows

From payroll to rent collection to supplier payments, Open Banking fits directly into your existing software stack, often with same-day onboarding and minimal setup.

Legacy Payments vs Open Banking

| Feature | Legacy Payment Systems | Open Banking for UK SMEs |

|---|---|---|

| Settlement Speed | 2–5 working days (BACS, cheques) | Instant or same-day |

| Transaction Fees | Card fees, cheque handling, bank charges | Low flat fee per payment |

| Admin Time per 100 Transactions | 6–10 hours (manual data entry, chasing) | <1 hour (automated matching) |

| Error & Rework Risk | High (manual inputs, mismatches) | Very low (API-verified data) |

| Fraud Risk | High (phishing, cheque fraud, spoofing) | Bank-level authentication via secure APIs |

| Cash-Flow Impact | Funds held in transit, delayed reinvestment | Immediate access to capital |

| Integration with Tools | Often manual (CSV uploads, double entry) | Syncs with modern accounting & finance apps |

| Scalability | Limited — breaks at volume | Scalable for growing teams and transaction loads |

Meet Finexer: The Open Banking Solution Built for SMEs

Finexer helps UK businesses move on from legacy payment systems without the usual friction or cost. Whether you’re handling client invoices, supplier payments, or internal transfers, Finexer’s Open Banking platform gives you the tools to pay and get paid in real time, all while reducing admin and avoiding card fees.

Why SMEs Choose Finexer:

- Instant account-to-account payments with no card networks involved

- Automated reconciliation using live bank data

- Low, usage-based pricing that scales with your transaction volume

- No lengthy setup — Finexer deploys in days, not months

- Developer-friendly APIs that integrate with your existing finance stack

- 3-5 weeks of hands-on assistance during onboarding

Finexer is already helping accounting firms, payroll providers, and professional services teams across the UK eliminate the hidden costs of outdated payment systems.

“We were looking for a partner that could not only meet our current needs but also anticipate and support our growth. Finexer delivered exactly what we needed, from compliance-ready software to seamless integration with our existing systems.” – David Kern, CEO of VirtualSignature-ID

Get Started

Connect today and see why businesses trust Finexer for secure, compliant, and tailored open banking solutions.

Try NowWhat are legacy payment systems?

Legacy payment systems include cheques, BACS, and manual bank transfers. They’re still used by UK SMEs despite being slow and admin-heavy.

How much do legacy payments cost UK SMEs?

Legacy systems cost SMEs through delays, admin time, errors, and fees. These hidden costs often exceed thousands per year.

What are the risks of outdated SME payment systems?

Manual entry, fraud exposure, and payment errors are common. Outdated systems increase both financial and operational risks.

Can SMEs easily switch from legacy to Open Banking?

Yes. Tools like Finexer deploy in days, work with existing systems, and offer a cost-effective move away from legacy payment systems.

Legacy payments are slowing you down. See how Open Banking can help your business move faster, cheaper, and smarter 🙂