Making Tax Digital for VAT (MTD for VAT) is HMRC’s mandatory system for keeping VAT records digitally and submitting VAT returns through approved software.

Since April 2019, most VAT-registered businesses with a taxable turnover above £90,000 must comply. From April 2022, MTD for VAT became compulsory for all VAT-registered businesses, regardless of turnover.

This guide walks you through who must comply, how to register, how to choose VAT software, and how to submit VAT returns correctly. Whether you are managing your own records or advising clients, these steps will help you stay compliant without last-minute errors.

Keep reading or jump to the section you are looking for:

Who Must Follow Making Tax Digital for VAT?

Making Tax Digital for VAT applies to all VAT-registered businesses in the UK, whether trading above or below the VAT threshold.

Voluntary VAT registration

Businesses that registered for VAT voluntarily must still comply with making tax digital VAT rules. Signing up late or continuing to use manual submissions could result in penalties.

| Group | MTD for VAT status |

|---|---|

| VAT-registered businesses with taxable turnover above £90,000 | Must follow MTD rules and file returns using compatible software. |

| VAT-registered businesses with turnover below £90,000 | Must also comply with MTD for VAT since April 2022, unless exempt. |

| Newly VAT-registered businesses | Must sign up for MTD for VAT once VAT registration is complete. |

Exemptions

A business may be exempt from MTD for VAT if it can demonstrate that:

- It is not reasonably practicable to use digital tools due to age, disability, or location.

- It is a member of a religious society whose beliefs prevent the use of technology.

Applications for exemption must be made directly to HMRC. Until confirmed, businesses are expected to continue complying.

Key Dates for MTD VAT Compliance

If you are registered for VAT in the UK, your business must comply with Making Tax Digital for VAT deadlines based on your VAT return periods.

Here are the important dates you need to know:

| Date | What Changed |

|---|---|

| April 2019 | MTD for VAT became mandatory for VAT-registered businesses with taxable turnover above £90,000. |

| April 2022 | MTD for VAT extended to all VAT-registered businesses, regardless of turnover. |

| Ongoing | All VAT returns must be filed through MTD-compatible software unless an exemption is granted. |

Filing deadlines

Businesses must continue to submit VAT returns every quarter based on their usual VAT periods. However, under HMRC making tax digital VAT rules:

- The returns must be filed digitally through approved VAT software.

- Manual entry into HMRC’s old VAT portal (the “Government Gateway”) is no longer allowed for MTD customers.

- Deadlines for payment remain the same — usually one month and seven days after the end of the VAT period.

Example:

If your VAT period ends 31 March, your MTD VAT return must be submitted by 7 May.

Missing deadlines could result in points-based penalties under HMRC’s late submission rules.

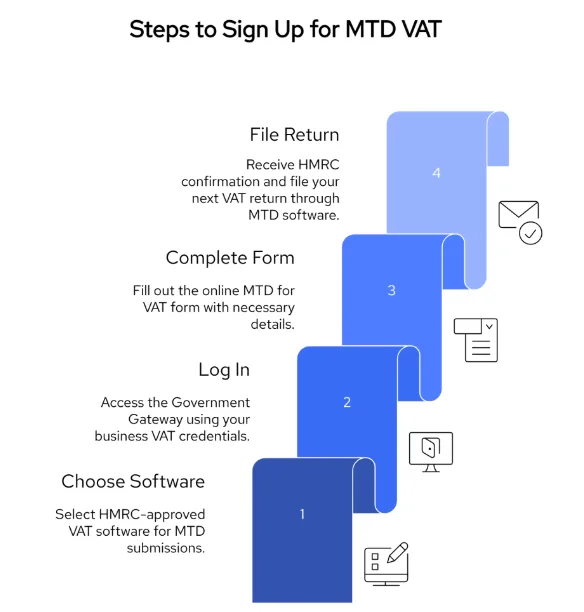

Step-by-Step: How to Sign Up for MTD for VAT

Whether you’re a business owner or an agent acting on behalf of a client, you must register for Making Tax Digital VAT before filing through compatible software. Here’s how:

✅ For Businesses

Step 1: Get MTD-compatible VAT software

Before signing up, choose VAT software that supports MTD submissions. You’ll need this to send your returns to HMRC.

Step 2: Sign in to your Government Gateway account

Use the business’s VAT credentials to access the MTD sign-up page.

Step 3: Register for MTD for VAT on GOV.UK

Go to: Sign up for MTD for VAT – GOV.UK

Fill in your VAT number, business type, and contact details.

Step 4: Wait for confirmation from HMRC

You’ll get a confirmation email within 72 hours. Once confirmed, you must file your next return using MTD software.

✅ For Agents

Step 1: Create an Agent Services Account (if not already done)

This is separate from your regular HMRC agent account. Register here: Create an agent services account – GOV.UK

Step 2: Link clients to your Agent Services Account

Use your client’s VAT number and authorisation code to link them under MTD.

Step 3: Sign up each client for MTD for VAT

You must complete the sign-up form for each business. Do not submit VAT returns under MTD until you’ve received confirmation.

Things to keep in mind

- You must sign up at least 5 working days before your VAT return is due.

- Don’t try to file through old methods after signing up. The old system will reject the return.

- Check that your software supports MTD VAT returns and is properly connected to HMRC’s system.

Choosing the Right VAT Software

Choosing the right VAT software is essential for smooth compliance with Making Tax Digital VAT rules. HMRC does not provide its own software, so businesses must use commercial solutions that meet MTD technical standards.

Here’s what you need to look for:

| Feature | Why it matters |

|---|---|

| HMRC-recognised | Software must appear on HMRC’s list of approved MTD VAT providers. |

| Direct submission to HMRC | It should connect to HMRC’s system without needing manual re-entry. |

| Digital record keeping | The software should store sales and purchase records digitally. |

| Bridging tool compatibility (for spreadsheets) | If clients use spreadsheets, ensure the tool can link spreadsheet totals without breaking digital records. |

| Multi-client support (for agents) | If you file for multiple clients, choose a system that handles agent services and bulk submissions. |

| Bank feed integration | Live bank feeds can reduce manual transaction matching and improve record accuracy. |

How Finexer Helps with Making Tax Digital VAT

While MTD for VAT requires approved VAT software for submissions, the quality of the data that feeds into those returns matters just as much. That’s where Finexer comes in.

Finexer supports VAT-registered businesses and accounting firms by providing secure, real-time bank transaction data using Open Banking — simplifying record keeping and reducing errors before returns are filed.

Why Finexer is useful for MTD VAT

| Benefit | What it means for your VAT workflow |

|---|---|

| 99% UK bank coverage | Instantly pull in transactions from nearly every UK bank account — no need to wait for manual CSVs or PDFs. |

| Real-time feeds | Transactions sync daily, so your books are always up to date before VAT deadlines. |

| No monthly minimums | Pay only when you use it. Ideal for seasonal businesses or firms scaling slowly. |

| FCA-authorised infrastructure | Finexer is regulated, secure, and trusted for financial data delivery. |

| White-label dashboard | Give clients access to the same live bank data you use, under your own brand. |

| Quick onboarding | Connect bank feeds in days, not months — no complex dev work required. |

Finexer in your MTD software stack

Finexer doesn’t replace your VAT submission software — it enhances it. By feeding clean, categorised, real-time transaction data into your MTD software (Xero, QuickBooks, etc.), you reduce manual entry and improve the accuracy of each VAT return.

The result: Fewer errors, faster reviews, and more time to focus on client advisory.

What is Making Tax Digital for VAT?

Making Tax Digital for VAT is a UK government requirement for VAT-registered businesses to keep digital records and submit VAT returns using compatible accounting software.

Who needs to follow Making Tax Digital VAT rules?

All VAT-registered businesses must comply, regardless of turnover. This includes businesses that registered voluntarily. Only those with approved exemptions are excluded from MTD VAT.

How do I sign up for MTD for VAT?

Visit GOV.UK and complete the online sign-up form using your VAT number and business details. You must also use compatible VAT software to submit returns.

How does Finexer help with MTD VAT compliance?

Finexer connects 99% of UK bank accounts to your VAT software, pulling real-time data into your digital records. This reduces errors and speeds up VAT return prep.

Ease your VAT Filing with Accurate Bank Data,Try Finexer! Schedule your free demo and get a 14-day Trial by Finexer 🙂