Open Banking API Security in the UK has reached a scale where security failures now pose systemic risk, not isolated product issues. Active users grew from 12.1 million (Dec 2024) to 13.3 million (Mar 2025), while Open Banking payments reached 31 million transactions.

As adoption grows, the FCA is increasing scrutiny. Between April 2023 and March 2024, 83 of 188 enforcement actions were linked to financial crime controls, signalling that firms handling bank data and payment initiation are expected to meet stronger security and governance standards.

In 2026, open banking API security checks is no longer optional. It is assessed alongside fraud exposure, consumer protection, and operational resilience.

Fraud and APP Payments Are Driving Security Expectations

Fraud is a key reason regulators are tightening Open Banking security requirements.

Data shows that 74% of Open Banking fraud cases involve Authorised Push Payment (APP) fraud. These payments are real-time and often high value, which increases regulatory expectations around authentication, consent validation, and transaction controls.

This is reflected in the Joint Regulatory Oversight Committee (JROC) priorities, where fraud mitigation is a core focus. Security controls around payment initiation are now a baseline expectation for Open Banking compliance.

Why API-Based Access Is Replacing Screen Scraping

Regulators are clearly favouring API-based access over screen scraping.

- 81% consent completion with Open Banking APIs

- 50% with screen scraping

- Significantly lower failure rates with APIs

Screen scraping introduces weaknesses in consent visibility, access control, and auditability. As consumer trust remains low with only 16% considering Open Banking completely safe, regulators are pushing toward access models that are explicit, bank-authorised, and traceable.

This makes open banking API security the preferred and increasingly expected standard.

How the Finexer’s Open Banking API Supports Secure Access

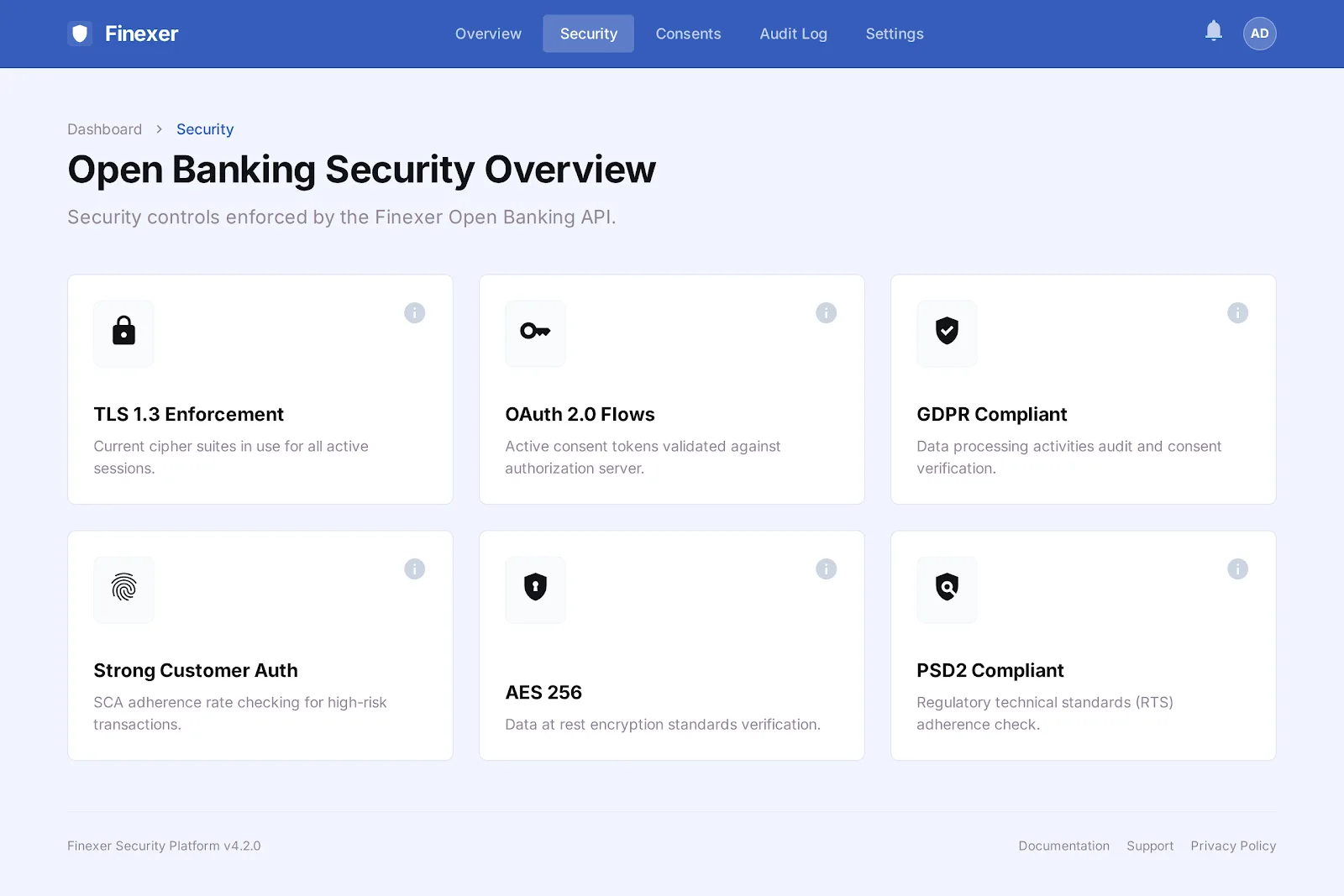

The Finexer Open Banking API implements security controls that align with the UK’s FCA-regulated Open Banking framework. These controls are enforced across data access and payment initiation flows, as reflected in the platform’s security dashboard.

API-Based Access Only

All connectivity is established through regulated Open Banking APIs. The Finexer Open Banking API does not support credential sharing or screen scraping, ensuring access remains permission-based and bank-authorised.

OAuth 2.0 Consent Flows

Consent is managed using OAuth 2.0 authorisation flows, with active consent tokens validated against the authorisation server. This ensures access is granted only within the scope and duration approved by the user.

Bank-Level Strong Customer Authentication (SCA)

Authentication is performed directly at the bank level. Users authenticate with their bank, keeping control of consent and meeting SCA requirements for higher-risk actions.

TLS 1.3 Enforcement

All active sessions use TLS 1.3, ensuring encrypted communication channels between banks, the Finexer platform, and connected applications.

AES-256 Data Encryption

Data at rest is protected using AES-256 encryption, supporting secure storage of sensitive Open Banking data in line with industry standards.

Audit-Ready Access Visibility

Access events and payment initiation actions are logged and traceable, supporting internal monitoring and regulatory review requirements.

GDPR and PSD2 Alignment

The Finexer Open Banking API operates within GDPR data protection principles and PSD2 regulatory technical standards (RTS), supporting consent verification, data minimisation, and secure access controls.

Is Open Banking secure in the UK in 2026?

Yes. Open Banking in the UK operates within an FCA-regulated framework using bank-level authentication, consent-based access, and secure APIs, with increasing oversight as adoption grows.

What does Open Banking API security mean?

It refers to using regulated APIs for bank data and payments, including strong customer authentication, encrypted data transfer, consent controls, and audit-ready access logs.

Why is the FCA focusing more on Open Banking security?

As Open Banking usage scales, security failures can affect consumer protection and payments, leading to stronger regulatory oversight and clearer security expectations.

What should businesses look for in a secure Open Banking provider?

Businesses should look for regulated API access, bank-level authentication, clear consent management, encrypted data handling, and visibility into data and payment access.

For secure, API-based Open Banking access aligned with UK regulation, consider the Finexer Open Banking API !