Despite major advances in property technology, many platforms still rely on slow, manual finance checks leading to delays, fraud risks, and lost revenue across the rental journey.

UK landlords lose an average of £1,085 for every rental void, with some areas reaching losses over £1,600 per vacancy. These costs are rising year on year.

When platforms ask tenants to upload payslips, scan bank statements, or manually fill in affordability forms, it adds unnecessary steps and slows down everyone involved.

Open banking for Proptech solves this by letting your platform access verified data straight from the tenant’s bank account. With their consent, you can:

- run instant affordability checks based on real-time income

- trigger secure, low-fee Pay by Bank rent payments

- conduct source of funds checks that meet AML requirements

All through a single integration with no need to become a regulated AISP or PISP.

In this guide, you’ll learn how Proptech platforms are using Open Banking across three high-impact areas: tenant affordability, rent collection, and AML compliance. We’ll also show how solutions like Finexer make it possible to deploy these tools in days, not months.

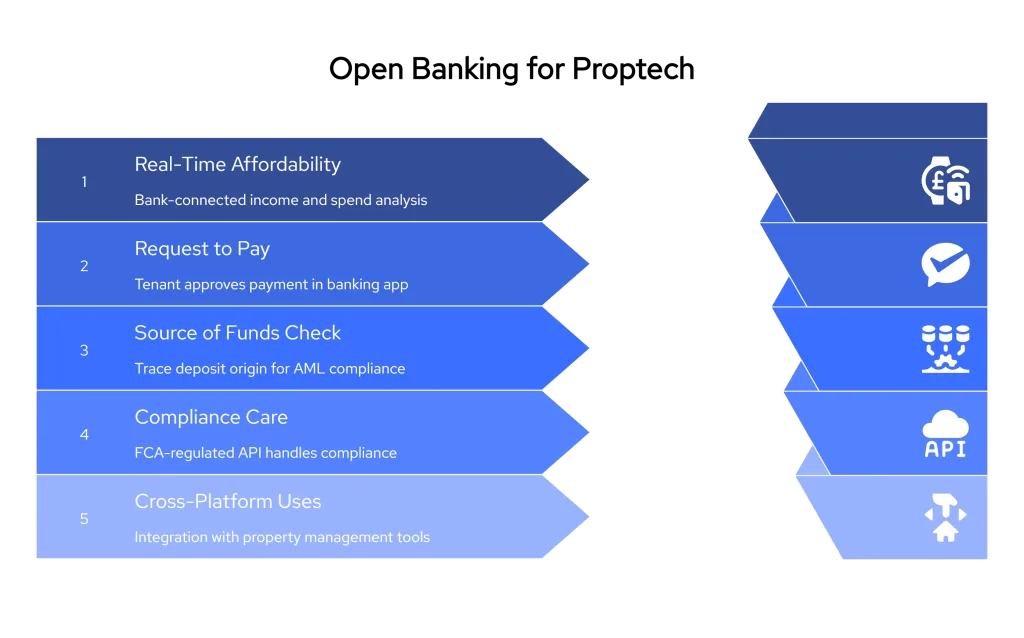

1. Real-Time Affordability Checks Without PDFs or Payslips

Tenant screening still relies on outdated paperwork scanned payslips, downloaded PDFs, or screenshots from banking apps. These documents are slow to collect, easy to edit, and give only a partial view of a tenant’s financial situation.

With open banking for proptech, you can offer tenants a faster, verified process. Through a secure, consent-driven flow, the tenant connects their bank account, and your platform receives:

- net income across one or more accounts

- salary consistency and deposit frequency

- spending patterns that affect affordability, such as loan repayments or subscriptions

This level of insight can’t be faked or photoshopped. And because it’s machine-readable, you can feed it directly into your decision engine enabling instant approvals, faster move-ins, and stronger landlord trust.

Developer Benefit

Open Banking APIs like Finexer’s return a structured JSON summary, including average monthly income, stability score, and account verification. Integration requires no regulatory licence and can be live in days.

📚 Open Banking for Income verification & Affordability

2. Rent Collection That Doesn’t Fail at the Payment Stage

Rent collection is one of the most fragile parts of the tenancy process. Cards expire. Direct Debits fail when there are insufficient funds. Even standing orders can go unpaid if the tenant forgets.

With Open Banking rent collection, you give tenants a simpler, faster, and more secure option, no cards or login credentials required.

The tenant simply clicks a payment link or button. Their banking app opens. They approve the rent amount. The funds move instantly from their account to yours.

Why More Platforms Are Using Pay by Bank for Rent:

- Instant settlement: funds clear in seconds, not days

- Lower costs: no card network or interchange fees

- Better experience: tenants don’t need to enter card details or remember due dates

- Automated reconciliation: each payment is linked to the correct tenant or unit, reducing manual tracking

📚 Guide to tenant referencing for property managers

Recurring Payments Without the Risks of Direct Debit

Unlike Direct Debit, which can bounce or be reversed, Request to Pay for rent enables direct account-to-account payments that settle immediately. You can send a one-time link or enable recurring flows that prompt tenants monthly, no apps to install, no friction.

Finexer enables this flow through a single API, complete with real-time webhooks, branded payment journeys, and built-in fraud protection.

3. Source of Funds Checks That Satisfy AML Without Delays

When tenants transfer large deposits, especially for higher-end rentals or international lets, letting agents must verify where the funds came from. This step is essential for fraud prevention and required under AML for property lettings compliance rules.

But asking tenants to send proof by email leads to delays, missing documents, and inconsistent formats.

A source of funds check powered by Open Banking solves this instantly. With the tenant’s consent, your platform can access:

- the origin of the deposit (salary, savings, loan, or gift)

- the time the funds have been held

- incoming transaction patterns that support affordability

Because this data comes directly from the tenant’s bank account and is categorised automatically it’s both tamper-proof and easy to audit.

Built-In Compliance for Every Check

Platforms like Finexer enable you to run source of funds checks within your onboarding or referencing flow. Each check is logged with timestamped consent, full transaction history, and audit-ready reporting, no PDFs or screenshots needed.

This approach speeds up onboarding while reducing compliance risks, giving property firms a faster, more secure alternative to manual AML reviews.

4. Integrate Open Banking Without Compliance Headaches

For many Proptech teams, the idea of offering Open Banking features sounds risky mainly because of licensing and regulatory concerns. Becoming a registered AISP or PISP with the FCA involves months of compliance work, audits, and ongoing oversight.

The good news is: you don’t need to take that on yourself.

By working with a regulated Open Banking provider, you can plug into an Open Banking API for Proptech that handles the hard parts including:

- end-user consent flows

- secure bank data connections

- token refresh and revocation

- real-time monitoring and data uptime guarantees

What You Get With Finexer

Using a provider like Finexer, Proptech platforms can embed Request to Pay for rent, affordability checks, and source of funds verification in their application without managing any of the underlying compliance.

Here’s what that looks like:

For Developers:

- Fast setup via drop-in widget or full API

- Support for both tenant-facing and back-office flows

- Instant webhooks for payment events and data fetches

- Sandbox access and pre-built consent UIs

For Compliance & Ops Teams:

- Audit logs with every user consent and data call

- Expiry controls to limit how long access lasts

- Built-in reporting for AML tracking and tenant risk reviews

- Optional filtering to limit the scope of data accessed

This approach gives you full control of the user journey, while your provider handles the regulated rails behind the scenes letting you focus on product, not paperwork.

5. Cross-Platform Use Cases Across the Proptech Stack

Open Banking is not limited to one feature or use case. Proptech companies across different segments are using it to solve various operational bottlenecks from rent payment integration to automated AML reviews.

Here are some of the most common adoption points:

| Proptech Segment | Open Banking Feature | What It Solves |

|---|---|---|

| Build-to-Rent Operators | Live income verification + recurring Request to Pay for rent | Faster move-ins and reduced arrears |

| Property Management Platforms | Open Banking rent collection with webhook triggers | Rent is reconciled instantly, no manual matching |

| Tenant Referencing Tools | Real-time affordability insights from connected accounts | No documents required, results in minutes |

| AML & Risk Software | Automated source of funds check + audit log export | Verifies deposits and supports AML for property lettings |

| Onboarding & Legal Flows | Account owner verification + deposit tracking | Ensures tenant funds are real, match ID, and are available before contract signing |

1.Build-to-Rent Platforms

Large-scale rental operators need batch rent collection and real-time affordability checks at volume. With Open Banking:

- tenants can connect their bank to verify income automatically

- rent can be collected using Pay by Bank for rent with no manual steps

- account data can be reused to support renewals and top-up checks

2.Property Management Software

Letting agents using digital tools for rent reminders and statements can benefit from:

- automated Open Banking rent collection

- webhook alerts for successful or failed payments

- faster reconciliation using real-time account data

3.Tenant Screening Tools

Reference platforms can plug in live income data to replace outdated document uploads. The result:

- faster application decisions

- verified income streams

- no risk of edited or outdated payslips

4.AML and Deposit Validation

Firms subject to KYC and AML regulations can build in a source of funds check at the deposit stage. This ensures:

- full transparency around incoming payments

- easier reporting for compliance teams

- no need to chase down secondary documents

5.Legal and Onboarding Flows

Platforms managing tenancy agreements, right-to-rent forms, or contract signing can use Open Banking to:

- verify the account holder’s name and sort code

- confirm payment capacity without separate bank proof

- create an end-to-end onboarding flow without asking for PDF uploads

Open Banking is no longer a niche feature. For Proptech platforms looking to reduce admin, cut fraud risk, and improve tenant experience, it’s becoming the default layer for payments and financial verification.

Finexer for Proptech: What You Get

| What You Need | What Finexer Delivers | Why It Matters |

|---|---|---|

| Fast tenant affordability checks | Real-time income data via Open Banking | No PDFs, decisions in under 2 minutes |

| Fewer late or failed rent payments | Request to Pay for rent with instant bank approval | No card fees, instant settlement, and automatic reconciliation |

| Easy AML compliance on deposits | Source of funds check with full audit trail | Satisfies AML for property lettings without extra documents |

| No regulatory overhead | FCA-regulated API — no AISP or PISP licence needed | Stay compliant without owning the risk |

| Fast, flexible developer integration | API + SDKs, sandbox access, webhook alerts | Go live in days, not months |

| Predictable costs, no long-term lock-in | Usage-based pricing, no setup fees, no cancellation fees | Scale affordably without commitment |

| Seamless tenant experience | White-labelled consent and payment flows | You stay in control of the user journey |

Get Started

Connect today and see why businesses trust Finexer for secure, compliant, and tailored open banking solutions.

Try NowWrapping Up

The rental process shouldn’t be slowed down by missing PDFs, failed rent payments, or unclear deposit sources. Today’s renters expect faster approvals. Landlords expect payment reliability. Compliance teams need clean audit trails.

That’s why more platforms are adopting Open Banking for Proptech to replace manual admin with instant, verified data that works in real time.

With the right partner, you can:

- Assess affordability using verified income directly from tenant accounts

- Automate rent payments using Request to Pay for rent, with no cards or delays

- Run a secure, exportable source of funds check to support AML for property lettings

- Deploy everything via an Open Banking API for Proptech without taking on regulatory risk

What is Open Banking for Proptech?

Open Banking for Proptech uses secure APIs to access tenant bank data (with consent). Platforms can verify income, collect rent, and meet AML rules faster without PDFs or manual checks.

How does Request to Pay for rent work?

Request to Pay for rent sends a payment prompt to the tenant’s banking app. They approve the rent instantly no cards, no delays, no failed payments.

Can I run a source of funds check using Open Banking?

Yes. A source of funds check uses Open Banking to trace where a deposit came from salary, loan, or gift supporting AML checks without asking for documents.

Can Open Banking reduce rent arrears?

Instant payment prompts, real-time failure alerts, and automatic retries let agents act early, lowering arrears by up to 30 % in early adopter trials.

How does Open Banking help with AML for property lettings?

Automated source-of-funds checks create a tamper-proof audit trail that satisfies AML for property lettings rules without asking tenants for extra documents.

One API. Tenant affordability. Rent collection. AML checks!

Start using Open Banking with Finexer 🙂