Your fintech or payroll platform processes 5,000 salary payments monthly. Right now, you’re either submitting BACS files three days before payday or managing prepaid card programmes with onboarding friction and monthly fees. Meanwhile, employees wait days for clearing or struggle with card activation issues.

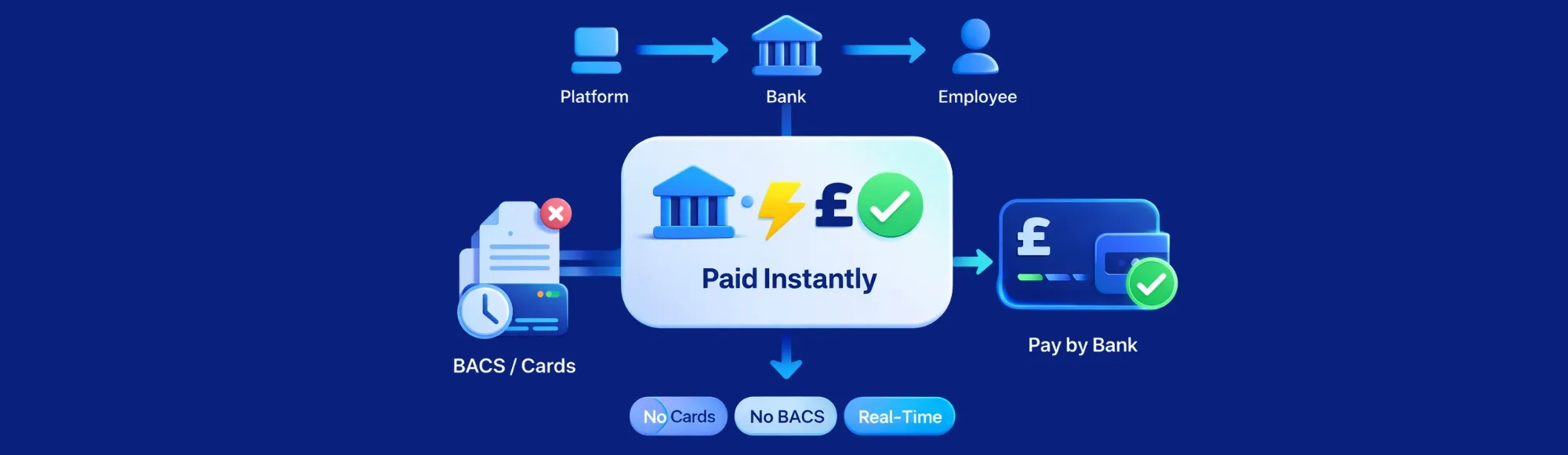

An open banking payroll disbursement API changes this by connecting your platform directly to employee bank accounts through regulated payment initiation. Approve payroll, the real time payroll payout API initiates transfers instantly, employees receive funds within minutes. No BACS clearing delays. No card programme costs. No employee onboarding barriers.

This architectural shift matters because instant settlement transforms from premium feature to competitive necessity for platforms competing on employee experience.

Why Traditional Payroll Disbursement Methods Create Operational Friction

Most fintechs and payroll platforms still rely on either BACS batch processing or prepaid card programmes. BACS requires three-day clearing cycles and manual file submissions. Card programmes involve employee onboarding, monthly fees per card, and reconciliation complexity.

What these create operationally:

- BACS payouts require initiating payments 3 working days before desired settlement

- Bank holidays extend delays further, creating employee cash flow stress

- Card programmes charge per-card monthly fees regardless of usage patterns

- Employee onboarding for cards involves KYC, card activation, and PIN setup friction

- Reconciliation requires matching payments across multiple systems and card networks

- Scaling either method increases operational costs proportionally rather than through efficiency

The fundamental issue isn’t payment reliability-it’s that both methods introduce delays, costs, or friction that open banking payroll disbursement APIs eliminate through direct bank-to-bank settlement infrastructure.

What Open Banking Payroll Disbursement API Actually Enables

Traditional disbursement treats employee payment as either batch file submission or card network transaction. Pay by bank payroll API treats disbursement as direct payment initiation from your platform to employee bank accounts through FCA-regulated open banking infrastructure.

When your platform approves payroll, the API initiates individual payments through payment initiation services. Each transaction authenticates through your platform’s open banking authorisation, settles directly with the employee’s bank, and confirms completion back to your system. Your platform orchestrates real-time settlement without intermediary clearing systems or card networks.

From Our Experience: What Changes When Fintechs Adopt Disbursement APIs

We’ve observed fintech and payroll platforms transitioning from BACS or cards to open banking disbursement. The operational differences become apparent across multiple dimensions:

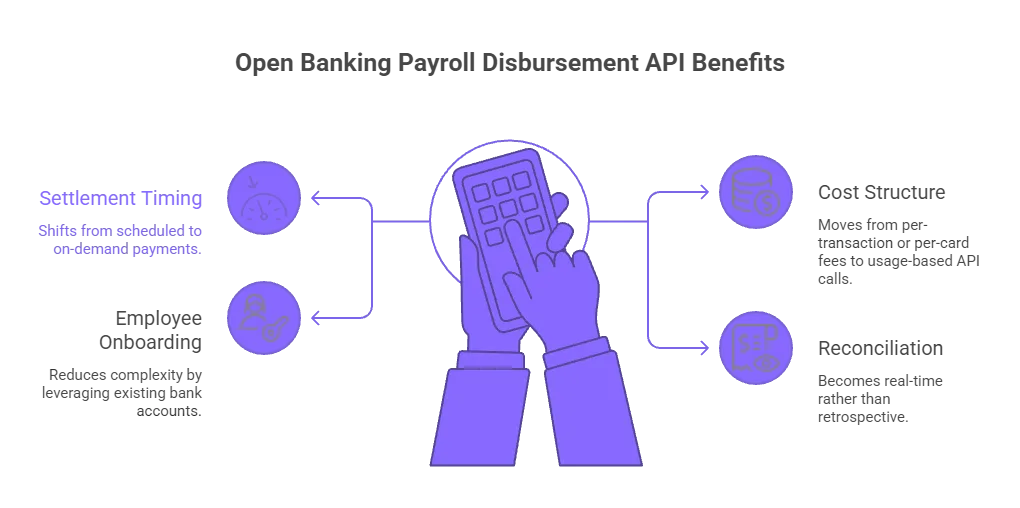

Settlement timing shifts from scheduled to on-demand. BACS-dependent platforms think in terms of payment cycles tied to clearing schedules. Instant salary payments API architecture enables payments triggered by any event-employee requests, project completions, tip distributions, emergency advances. The payment model changes from scheduled batches to event-driven settlement.

Cost structure moves from per-transaction or per-card fees to usage-based API calls. Card programmes charge monthly fees per active card plus transaction fees. BACS involves per-payment processing charges. Real time payroll payout API pricing typically follows transaction-based models without per-employee fixed costs. For platforms with variable payout volumes, this aligns costs with actual usage.

Employee onboarding complexity reduces dramatically. Card programmes require separate KYC, card ordering, delivery, activation, and PIN setup. Open banking payroll disbursement API leverages employees’ existing bank accounts. Onboarding involves providing bank details already used for other purposes-no new accounts, no cards, no activation friction.

Explore open banking payroll implementation

Reconciliation becomes real-time rather than retrospective. Traditional methods require matching payment files or card transactions against bank statements after settlement completes. Pay by bank payroll API returns immediate settlement confirmation per transaction. Your platform maintains current payment status continuously instead of reconciling periodically.

How Does Open Banking Disbursement Compare to BACS and Cards?

Your current disbursement probably uses BACS for bulk salary runs or card programmes for flexible payout timing. BACS offers reliability but lacks speed. Cards offer instant access but involve onboarding friction and ongoing costs.

BACS vs Cards vs Open Banking Payroll Disbursement

| Disbursement Aspect | BACS Batch Processing | Prepaid Card Programmes | Open Banking Payroll Disbursement API |

|---|---|---|---|

| Settlement Speed | 3 working days minimum | Instant to card (if activated) | Minutes to bank account |

| Employee Onboarding | Provide bank details | KYC, card order, activation, PIN | Provide bank details |

| Ongoing Costs | Per-payment processing fees | Monthly per-card + transaction fees | Transaction-based API calls only |

| Bank Holiday Impact | Extends clearing delays | No impact if card active | No impact |

| Reconciliation | Post-settlement file matching | Card + bank reconciliation | Real-time confirmation |

| Scaling Economics | Linear cost increase | Per-employee monthly fees | Infrastructure scales |

Learn about open banking for payroll platforms

The architectural difference matters most for platforms experiencing rapid growth or variable payout patterns. BACS costs and card fees scale linearly with employee count. Instant salary payments API infrastructure scales with transaction volume but avoids per-employee fixed costs.

What Should Fintechs and Payroll Platforms Evaluate in Disbursement APIs?

UK bank coverage determines whether your API handles all employee payouts or requires fallback methods. Partial coverage means maintaining multiple disbursement codepaths-open banking for supported banks, BACS or cards for others. Real time payroll payout API needs connectivity to banks your employees actually use.

Technical integration requirements that matter for disbursement:

- Payment initiation endpoints supporting bulk payout batches efficiently

- Webhook infrastructure for asynchronous settlement notifications

- Idempotency controls preventing duplicate payments during network retries

- Comprehensive error taxonomy distinguishing retryable from permanent failures

- Rate limiting designed for burst payout volumes (payday processing)

- Detailed transaction status tracking throughout settlement lifecycle

- Sandbox environment matching production behaviour for integration testing

See payroll and invoicing use cases

Compliance with UK payment regulations isn’t optional. The open banking payroll disbursement API must operate under FCA authorisation with proper payment initiation permissions. For platforms handling employee funds, regulatory compliance determines infrastructure viability and reduces operational risk.

Pricing models reveal whether providers understand fintech economics. Fixed monthly fees assume consistent payout volumes. But fintech platforms experience growth phases, seasonal variations, and usage spikes. Usage-based pricing that scales with actual payment volume aligns costs with your platform’s transaction patterns without capacity forecasting.

Common Issues Platforms Face When Moving to Open Banking Disbursement

From working with fintechs implementing disbursement APIs, several integration challenges consistently emerge:

Bulk payout fan-out requires different logic than single transactions. Paying 5,000 employees simultaneously through API calls requires implementing queuing, rate limiting respect, and failure handling at scale. Platforms succeeding with bulk disbursement design fan-out logic from the start rather than treating mass payouts as individual transactions multiplied.

Status tracking complexity increases with real-time settlement. BACS batch files have simple states: submitted, processing, settled. Individual API transactions have granular states: initiated, authorised, settling, settled, failed. Effective platforms build comprehensive state machines tracking each payment’s lifecycle rather than binary success/failure tracking.

Employee bank account validation prevents failed payments. Unlike cards where the card number guarantees validity, bank account details can be mistyped or outdated. Pay by bank payroll API often includes account validation endpoints. Platforms using validation before payment initiation reduce failed payout rates significantly compared to validating only at payment time.

Who Should Use Open Banking Payroll Disbursement APIs?

This infrastructure suits specific platform types and use cases:

Fintech platforms offering flexible payouts: Earned wage access, gig economy payments, tip distribution, or on-demand contractor payments benefit from real-time settlement without card programme overhead.

Payroll platforms prioritising employee experience: When instant access to earned wages differentiates your platform, open banking disbursement eliminates the BACS delay competitive disadvantage.

Platforms with variable payout volumes: If your payment volumes fluctuate seasonally or with growth, usage-based API pricing avoids the per-employee fixed costs that card programmes impose.

Platforms targeting UK employees with existing bank accounts: When your workforce already has UK bank accounts, leveraging existing banking relationships avoids card onboarding friction entirely.

When to Choose an Open Banking Payroll Disbursement API

The decision point typically involves evaluating current disbursement costs against API economics and employee experience requirements:

Choose open banking disbursement when: Your BACS delays create employee satisfaction issues, card programme fees exceed transaction-based API costs, or you’re launching new flexible payout features requiring instant settlement.

Maintain traditional methods when: Your established BACS arrangements work reliably for your use case, employees prefer card programmes for specific reasons, or your platform operates internationally beyond UK open banking coverage.

Consider hybrid approaches: Different employee segments have different needs-some require instant access (open banking), others prioritise simplicity (BACS), creating value in supporting multiple disbursement methods.

How Finexer Enables Real-Time Payroll Disbursement

Finexer connects to 99% of UK banks through regulated open banking infrastructure. This coverage means virtually all your employees receive payments through their existing bank accounts without platform-imposed banking requirements.

The platform provides 3-5 weeks of dedicated onboarding support. This ensures open banking payroll disbursement API integration aligns with your specific platform architecture, bulk payout patterns, and reconciliation requirements rather than forcing generic implementation approaches.

Fintechs and payroll platforms using real time payroll payout API report significant operational improvements. BACS submission windows disappear. Card programme fees are eliminated for employees using bank accounts. Instant settlement becomes a platform capability rather than a premium feature. Employee complaints about payment timing reduce as settlement becomes predictable.

Pricing works on actual payment volume rather than fixed monthly fees or per-employee charges. This aligns costs with your platform’s transaction patterns-whether consistent monthly payrolls or variable on-demand payouts-without requiring capacity forecasting.

The API integrates through standard REST endpoints with comprehensive webhook support for settlement notifications. Your engineering team gets sandbox access matching production behaviour for thorough testing before live payroll deployment. Documentation covers authentication, bulk payment initiation, webhook handling, error scenarios, and reconciliation patterns.

What is an open banking payroll disbursement API?

Infrastructure connecting fintech and payroll platforms to employee bank accounts through FCA-regulated payment initiation services, enabling direct bank-to-bank salary payments without BACS clearing or card networks.

How does real time payroll payout API differ from BACS processing?

Individual payment initiation through API calls settling within minutes versus batch file submission with 3-day clearing, providing immediate settlement confirmation rather than post-processing reports.

Why use pay by bank payroll API instead of prepaid card programmes?

Eliminates per-card monthly fees and employee onboarding friction by leveraging existing bank accounts, reducing costs whilst improving employee experience through familiar banking relationships.

Can instant salary payments API handle bulk payouts at scale?

Yes-designed for platforms processing thousands of simultaneous payments through queuing, rate limiting management, and parallel processing whilst maintaining per-transaction status tracking.

What compliance requirements apply to open banking payroll disbursement API?

FCA authorisation for payment initiation services, adherence to open banking standards, and proper handling of payment data under UK financial regulations and data protection requirements.

Ready to Enable Real-Time Salary Disbursement?

See how Finexer’s open banking payroll disbursement API reduces settlement time by 95% whilst cutting costs up to 90%

Book Demo Now