Open banking is a banking practice that provides third-party financial service providers open access to consumer banking, transactions, and other financial data from banks and non-bank financial institutions through application programming interfaces (APIs).

What You Will Discover:

As open banking continues to take hold across the EU and the UK, businesses are starting to ask an important question: how does it compare to the traditional banking methods we’ve relied on for so long? With the rise of open banking, offering greater flexibility, security, and speed, you might wonder if it’s time to move away from familiar methods like card payments and bank transfers.

But what exactly is open banking, and could it be the smarter choice for your business? In this blog, we’ll explore how open banking stands up against traditional banking, helping you understand which option could best support your growth and customer satisfaction

What is Open Banking?

Open banking is a game-changer in the financial world, offering a streamlined and more efficient way to manage payments and financial data. At its core, open banking allows consumers to authorise third-party providers(TPPs) to access their bank data securely, enabling them to make real-time payments directly from their bank accounts to merchants. This means no more waiting for funds to clear and no need for intermediaries like card networks or payment gateways that can slow down the process.

But open banking doesn’t just stop at faster payments. It opens the door to a whole new level of personalisation and control. By sharing financial data with authorised third parties, consumers can receive tailored recommendations, manage their finances more effectively, and even access new services that were previously out of reach. For businesses, this translates to lower transaction costs, reduced fraud risks, and the ability to offer a more seamless customer experience.

Open banking is designed for the digital age, where speed, security, and convenience are paramount. It’s a forward-thinking approach that meets the demands of today’s consumers and anticipates tomorrow’s needs.

Traditional Vs Open Banking

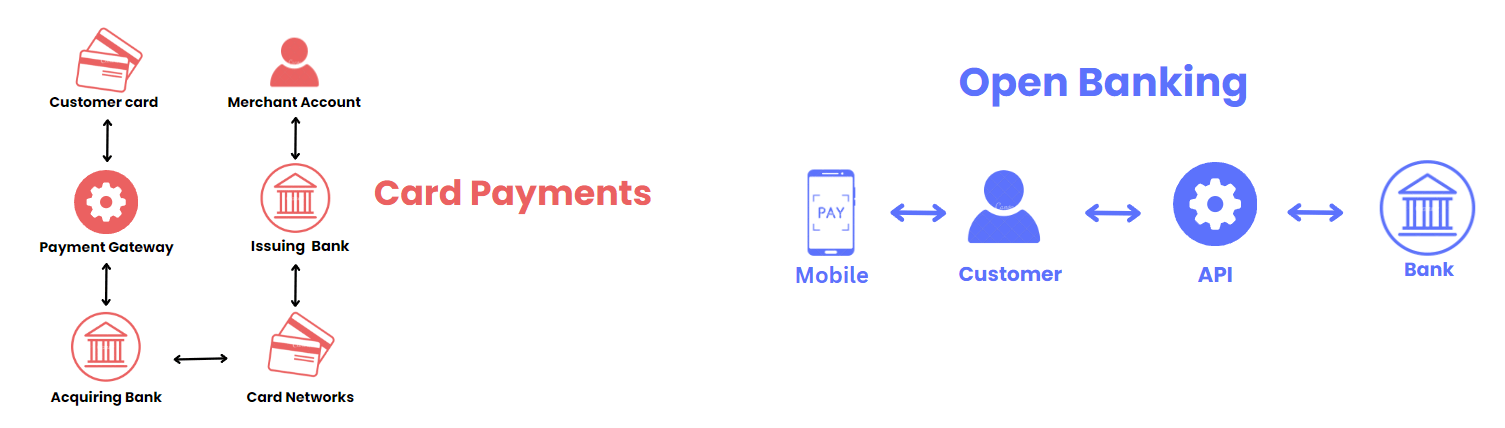

Card Payments Process:

In card payments, the customer initiates a transaction by providing their card details, which are then processed through multiple intermediaries, including a payment gateway, acquiring bank, and card network. These intermediaries communicate with the customer’s issuing bank to verify the transaction and ensure funds are available. Once approved, the funds are transferred through the network of intermediaries, often taking a few days to settle into the merchant’s account. This process involves multiple steps, making it slower and sometimes more costly due to the fees charged by each intermediary.

Open Banking Process:

Simplifies the payment process by allowing customers to make payments directly from their bank account through a secure API without the need for intermediaries like card networks. The customer authorises the payment using their mobile device, and the funds are transferred instantly from their bank to the merchant’s bank. This streamlined process reduces transaction costs and speeds up settlement, providing a more efficient and secure payment experience.

As we examine the comparison, it’s essential to understand how traditional and open banking methods compare, particularly in the areas that matter most to businesses: speed, cost, security, and customer experience.

1. Speed and Efficiency

- Card Payments: Traditional card payments involve several steps, including processing through a third-party payment gateway and a card network. This multi-step process not only adds time but also increases the complexity of each transaction. Settlements can be delayed, especially during weekends or holidays, leading to slower access to funds.

- Open banking, on the other hand, enables real-time payments. Transactions are completed instantly, with funds transferred directly from the customer’s account to the merchant without intermediaries. This speed is a significant advantage, allowing businesses to access their money faster and maintain better control over their cash flow.

2. Cost-Effectiveness

- Traditional payment methods, especially card payments, often have high processing fees. These fees are spread across various intermediaries, such as payment gateways and card networks. For businesses, this means a lower margin on each transaction, particularly when dealing with small, high-volume sales.

- Open Banking: One of the most attractive aspects of open banking is the reduced cost. With fewer intermediaries, the fees associated with transactions are significantly lower. This cost-effectiveness makes open banking appealing for businesses looking to reduce overheads and improve their profit margins.

3. Security and Trust

- Traditional payment methods have been around for decades, earning the trust of consumers and businesses alike. Well-established security measures back card payments, though not immune to fraud. The use of multiple parties in each transaction can introduce vulnerabilities, particularly when payment details are entered manually.

- Open banking takes security to the next level. The customer authorises transactions directly through strong customer authentication (SCA), Which reduces the risk of fraud and enhances overall security. However, as a relatively new technology, open banking is still building its reputation, and some consumers may hesitate to adopt it immediately.

4. Customer Experience and Conversion Rates

- Traditional Banking: While traditional payment methods are familiar and widely accepted, they can sometimes lead to a less seamless experience. The need to enter payment details, navigate through multiple steps, and wait for transaction confirmations can create friction at checkout, potentially leading to abandoned carts and lost sales.

- Open banking offers a smoother, more streamlined experience. The ability to make instant payments without entering card details, combined with secure authentication methods, results in a faster, more user-friendly checkout process. This convenience often translates to higher conversion rates, as customers appreciate the ease and security of the transaction.

| Aspect | Open Banking | Traditional Banking |

|---|---|---|

| Service Delivery Speed | Quicker through API integration | Often slower due to internal procedures |

| Data Sharing | Facilitated via APIs with third-party providers | Data is generally not shared |

| Product Offering | Tailored financial services | Standardised offerings |

| Collaboration | Works closely with fintechs and other entities | Little to no collaboration |

| Innovation | Drives innovation | Can be restricted by internal bureaucracy |

| Competition | Promotes competition | Preserves higher barriers to entry |

| Regulation | Governed by regulations specific to data sharing | Adheres to conventional regulatory standards |

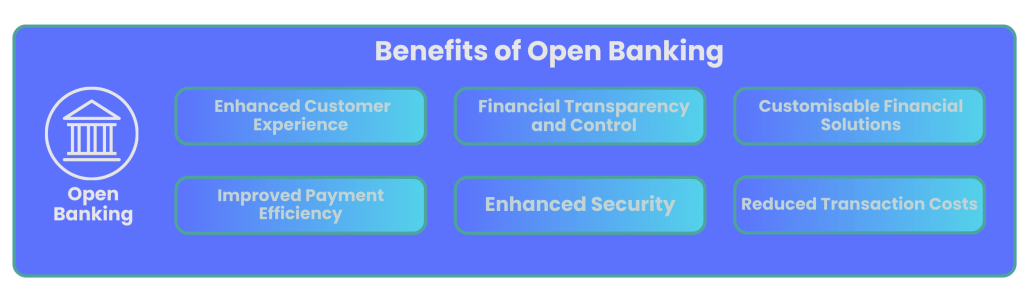

Benefits You’ll Get!

✓ Enhanced Customer Experience: Provides a smoother, more personalised customer experience, making financial transactions easier and more user-friendly.

✓ Financial Transparency and Control: Users gain greater visibility and control over their finances, allowing them to make more informed decisions.

✓ Customisable Financial Solutions: Enables tailored financial services that meet the specific needs of businesses and customers.

✓ Improved Payment Efficiency: Payments are processed faster and more efficiently, reducing delays and improving cash flow.

✓ Enhanced Security: Advanced security measures protect transactions, making them safer than traditional methods.

✓ Reduced Transaction Costs: Cutting out intermediaries lowers the transaction cost, saving both businesses and customers money.

Future-Proofing Your Business with Open Banking

As the financial world rapidly evolves, staying competitive requires more than meeting today’s demands—it means preparing for tomorrow’s challenges. Open Banking offers a future-ready solution that enhances your operations and positions your business to thrive in a dynamic market.

Adapting to Change: Open Banking is built for the digital age. It easily integrates with emerging technologies like AI and blockchain, ensuring your business stays at the cutting edge.

Meeting Consumer Expectations: With Open Banking, you can provide the personalised, real-time services that modern customers expect, helping you attract and retain loyal clients.

Staying Competitive: By lowering barriers to entry and fostering innovation, Open Banking keeps your business agile and ahead of the competition.

Scalability and Security: Offers the flexibility to scale with your business growth while maintaining the highest security and compliance standards.

How Do You Choose the Right Open Banking Provider?

Selecting the best Open Banking provider is crucial for leveraging the full potential of this innovative technology. The right provider can offer tailored solutions, robust security, and scalability, ensuring your business remains competitive and future-proofed.

When evaluating providers, consider their expertise in your industry, the security protocols they employ, and their ability to scale with your business as it grows. Choosing a provider that offers reliable support is essential, guiding you through the complexities of Open Banking with ease.

For a detailed guide on making the right choice, check out our 5-Step Guide to Choosing the Best Open Banking Provider. This resource will help you confidently navigate the decision-making process, ensuring that your business benefits from the best that Open Banking offers.

Want to improve your payment system with Open Banking technology? We are here to help, just a click away 🙂