Finexer Open Banking Blogs

Most popular banking API examples

Explore the most popular banking APIs in 2025 — Plaid,…

Top Scalable Banking Data Aggregation Solutions for UK Businesses in 2026

Find the top scalable banking data aggregation platforms in the…

Open Banking in Practice: Real-World Examples Transforming Accounting Workflows

Learn how accountants use open banking in practice for faster…

6 Bank Feed Software Every Accountant Should Know in 2025

Find the best bank feed software for UK accountants and…

Guide to Scalable Customer Retention with Open Banking UK

Discover how open banking boosts customer retention, guide to building…

White-Label Payment API: A Buyer’s Guide for PSPs

Choosing a white-label payment API? This buyer’s guide helps PSPs…

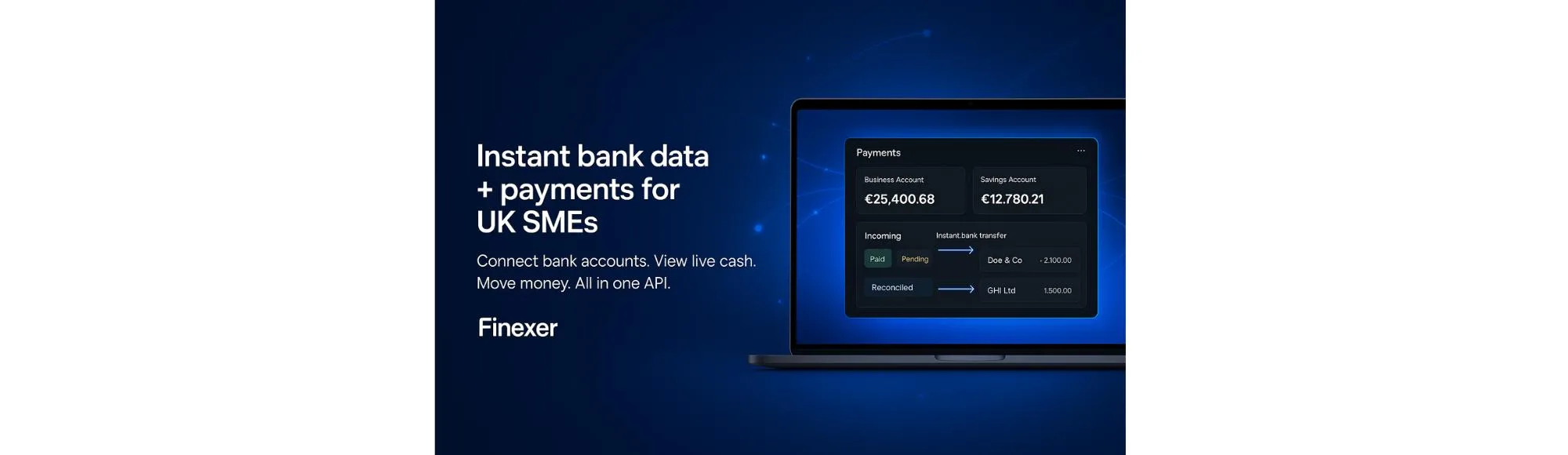

Integrated Digital Banking for UK SME’s

Learn how integrated digital banking helps UK SMEs manage payments,…

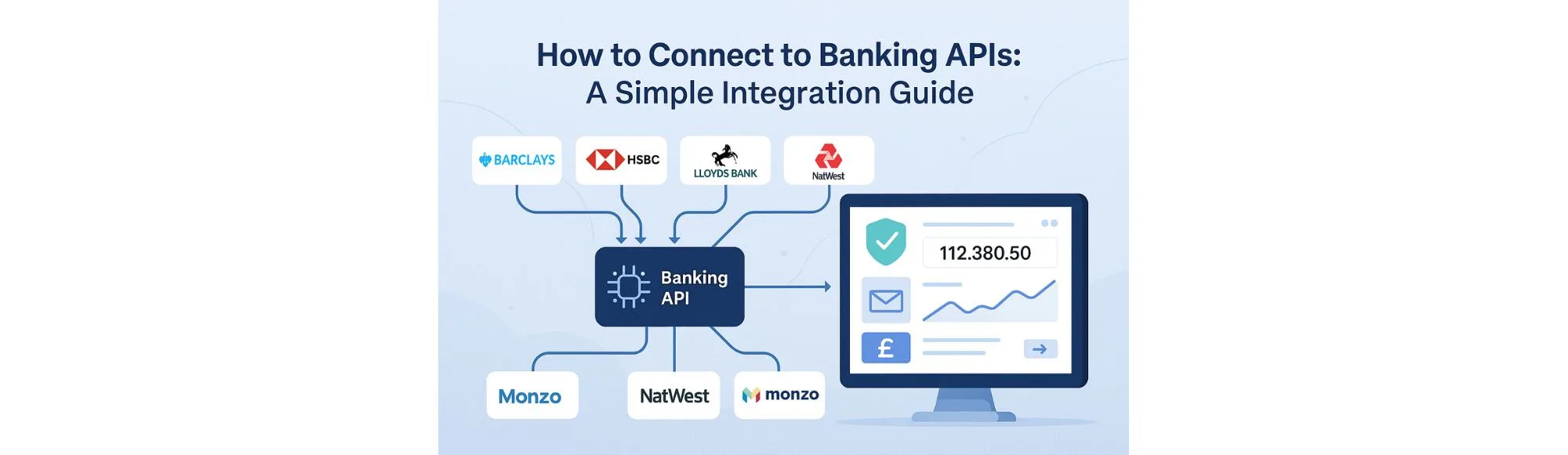

How to Connect to Banking APIs: Open Banking Integration Guide

Learn how to connect to a banking API using secure…

7 Best Banking API Providers in the UK (2026 Guide)

Find the top UK banking API providers. See how Finexer,…

Planky Review for Data Aggregation and Alternatives in the UK (2025 Guide)

Find the best UK alternatives to Planky for Open Banking…

NorthRow Review: Pricing & Competitors for KYB/KYC in the UK

NorthRow review 2025: features, pricing model, strengths, and KYB/KYC competitors…

Ecospend Review: Features, Pros & Cons, and the Best Alternative for UK Businesses

Read our Ecospend review and find out why Finexer is…

Open Banking Security: 5 Myths Every UK Business Owner Still Believes

Discover the truth about open banking security in the UK.…

10 Hidden Bank Charges You Can Eliminate with Open Banking

Explore 10 common bank charges your business can cut instantly…

Open Banking for SMEs: Why UK Small Businesses Should Adopt It in 2025

Explore how open banking for SMEs helps UK businesses cut…

The Most Cost-Effective Open Banking API for UK Businesses

Compare the most cost-effective Open Banking APIs for UK firms.…

5 Real-World Examples of Successful TPPs in Open Banking

Discover how leading TPPs are transforming UK Open Banking. Learn…

In-House vs Outsourced Open Banking Integration: Costs, Security, and Speed

Learn how to plan open banking integration in the UK.…

7 Questions to Ask Before Choosing a Bank Data API

Setup Bank Data API Instantly with Finexer Connect with 99%…

![Top 7 Source of Wealth APIs in the UK [Comparison Guide] 20 Top 7 Source of Wealth APIs in the UK [Comparison Guide]](/wp-content/uploads/2025/10/Source-of-wealth-APIs-in-the-UK-jpg.webp)

Top 7 Source of Wealth APIs in the UK [Comparison Guide]

Try Finexer for Instant Source of wealth Checks Connect with…

Source of Wealth API: Complete Guide for UK Firms

Learn how Source of Wealth APIs help UK firms verify…

Historical Financial Data Aggregation: How It Works and Key Insights

Learn how historical financial data aggregation helps UK businesses access…

20 Open Banking Examples: Real Use Cases Transforming UK Finance

Explore 20 real open banking examples in the UK. Learn…

Transfer Funds Instantly: Fast, Secure Money Transfers in the UK

Learn how to transfer funds instantly in the UK with…

Securing the Open Banking Ecosystem: Technical Implementation Guide

Setup Open banking infrastructure 2-3x faster with finexer Connect with…

Best Bank Data Aggregation Tools for 2025 to Streamline Your Workflow

The information in this comparison table was sourced from publicly…

![5 Best Bank Transaction APIs in the UK [2025 Guide] 27 5 Best Bank Transaction APIs in the UK [2025 Guide]](/wp-content/uploads/2025/10/bank-transaction-api-in-the-UK-jpg.webp)

5 Best Bank Transaction APIs in the UK [2025 Guide]

Compare the best Bank Transaction API providers in the UK.…

Guide to Data Privacy in Account Data Aggregation

Learn how to implement data privacy keeping client data private…

7 Best Financial Data Aggregators in the UK (2026 Guide)

Explore the 7 best financial data aggregator platforms in the…

![Yodlee Aggregator: How It Works & Best UK Alternative [2025] 30 Yodlee Aggregator: How It Works & Best UK Alternative [2025]](/wp-content/uploads/2025/10/Yodlee-aggregator-api-jpg.webp)

Yodlee Aggregator: How It Works & Best UK Alternative [2025]

Learn how the Yodlee Aggregator works, its UK limitations, and…