When One Payment Covers Ten Invoices, Your Team Pays the Price

It sounds simple: your client sends you a lump-sum payment for several outstanding invoices. But when that money hits your account, it’s anyone’s guess which invoices it actually covers.

For accounts receivable teams, payment reconciliation becomes a frustrating detective game. You’re left digging through spreadsheets, chasing down remittance emails, or making awkward follow-up calls to confirm what got paid. And all the while, your open invoice list stays cluttered, your DSO creeps up, and your cash flow reports start to mislead.

This isn’t just inefficient, it’s a risk. Misapplied payments mean:

- Overdue notices for already-paid invoices

- Duplicate entries or missed receivables

- Auditing headaches at month-end

And if you’re handling bulk payment matching manually, you know it doesn’t scale. Even a small delay or mismatch in invoice recognition can hold up approvals, customer relationships, and revenue recognition.

📚 Guide to AR Ageing Automation

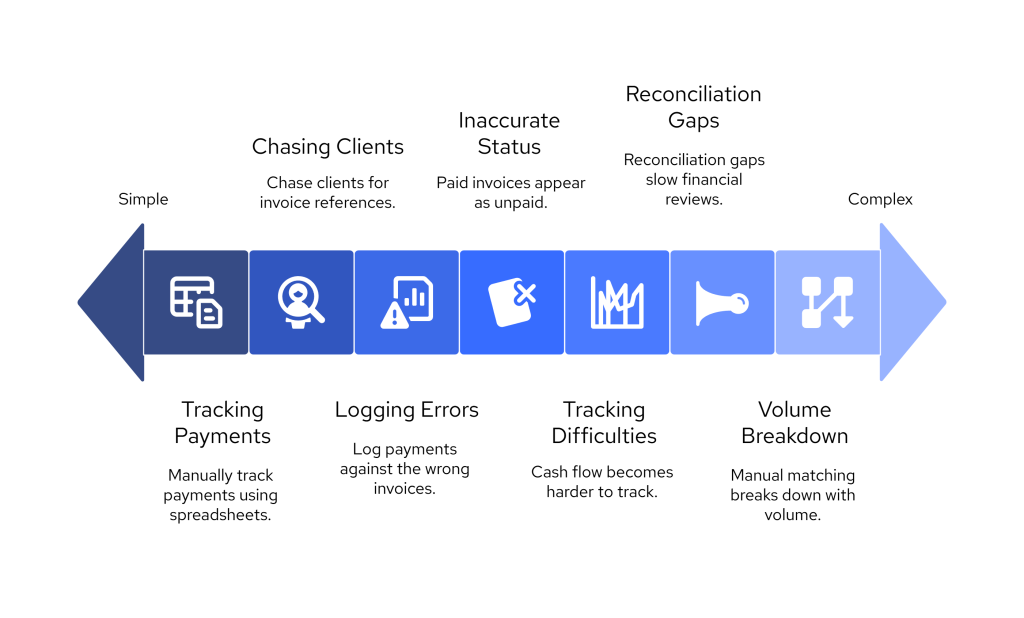

Why Manual Reconciliation Slows Everything Down

It’s not just about the time lost. The real cost of manual payment reconciliation shows up across your entire finance operation.

When one lump-sum payment hits your account without a clear breakdown, your team is forced to:

- Cross-reference remittance emails (if you even get one)

- Manually assign amounts to open invoices

- Reopen past statements to double-check allocations

- Delay the month-end close because customer payments haven’t been matched

If you’re handling dozens or hundreds of transactions like this each week, the process becomes a full-time job.

This is where bulk payment matching becomes a bottleneck. You may have the payment, but your receivables report still shows those invoices as open, leaving you chasing money that’s technically already in the bank.

Even if your accounting system supports invoice matching automation, it often needs:

- Structured references from payers (which you don’t always get)

- Manual approval before closing entries

- Extra audit steps to prove accuracy

You end up with inefficiencies that compound:

- Delayed reporting

- Poor customer experience

- And ultimately, slower cash conversion

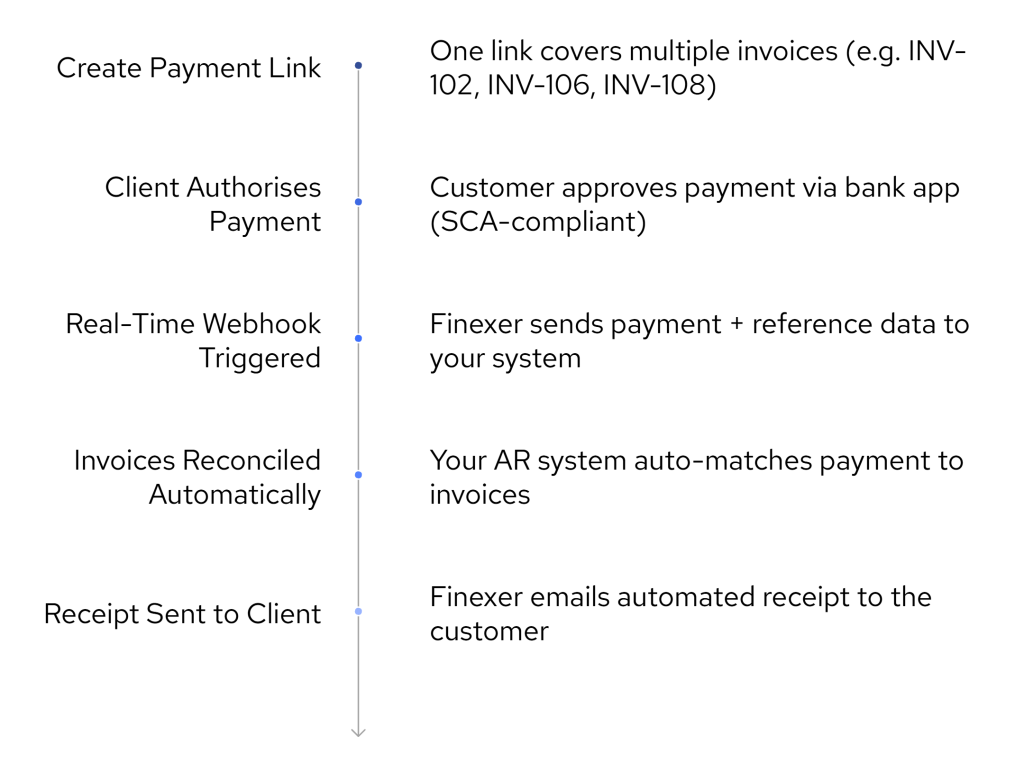

How to Automate Payment Reconciliation with Finexer

Finexer makes it easy to go from “payment received” to “invoices reconciled” without manual matching or spreadsheet juggling.

Here’s how it works:

1. Generate a Single Payment Link Covering Multiple Invoices

Using Finexer’s API or dashboard, create a payment request that references all outstanding invoices. This can be structured inside the description field, metadata payload, or your internal logic (e.g., INV-102, INV-106, INV-108).

This way, your client makes one secure transfer through their bank — and Finexer captures the invoice details at the source.

2. Client Authorises the Payment via Their Bank

The payer approves the payment using Strong Customer Authentication (SCA), verifying their identity through fingerprint, Face ID, or banking app credentials.

The funds are transferred instantly or within minutes via Faster Payments, with no intermediaries or card fees involved.

3. Finexer Triggers a Webhook Upon Payment Completion

Once the payment is processed, Finexer sends a real-time webhook to your system containing:

- Payer name and bank

- Amount received

- Timestamp

- Description/metadata with invoice references

This webhook can be routed directly to your accounting or ERP system.

4. Your System Matches the Payment to Invoices

Using the metadata from Finexer, your AR system can:

- Identify the relevant invoices

- Mark them as paid

- Update internal reports and customer ledgers automatically

This is where invoice matching automation becomes reality: no emails, no CSV imports, and no guesswork.

5. Confirmation and Receipt Handling

Finexer can generate and send an automated receipt to your customer, listing the payment amount and confirmation timestamp, helping close the loop and reduce post-payment inquiries.

| Aspect | Manual Reconciliation | With Finexer |

|---|---|---|

| Payment Identification | Requires manual review of payer references and emails | Invoice references captured automatically in payment metadata |

| Invoice Matching | Spreadsheet-driven, time-consuming | Real-time webhook matches payment to invoices instantly |

| Client Communication | Follow-ups needed to confirm what was paid | Automated receipts sent post-payment |

| Error Risk | High — prone to duplicate entries or missed allocations | Low — structured process ensures accurate reconciliation |

| Impact on DSO | Delays lead to longer Days Sales Outstanding | Faster matching shortens DSO |

| Audit and Reporting | Difficult to trace transactions at month-end | All payments are logged and audit-ready |

| Scalability | Doesn’t scale well with growing volume | Built for high-volume reconciliation workflows |

| System Integration | Often disconnected from accounting tools | Direct integration via webhook into ERP or AR systems |

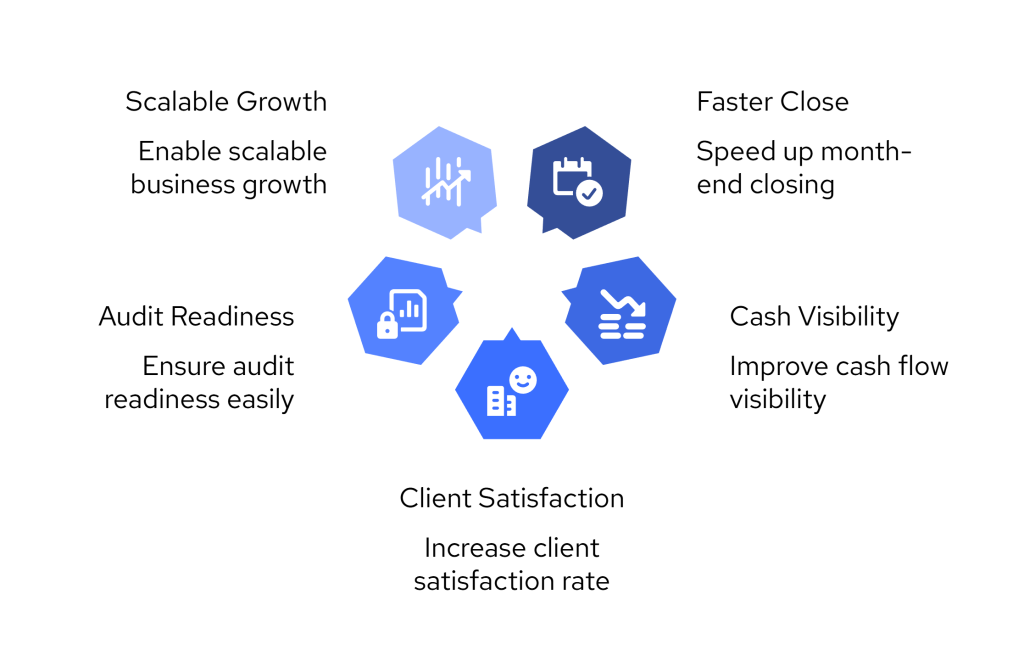

Benefits of Using Finexer for Faster Payment Reconciliation

When you stop spending hours matching lump-sum payments to invoices manually, your entire finance workflow becomes faster, clearer, and far less error-prone.

With Finexer handling the reconciliation through structured payment links and real-time webhooks, you unlock real business outcomes:

✓ Faster Month-End Close

No more chasing down who paid what. Your AR team can reconcile payments the same day they arrive, not days or weeks later.

✓ Lower DSO, Better Cash Visibility

As payments are matched and posted instantly, your Days Sales Outstanding improves, and your cash flow reports become more accurate in real time.

✓ Happier Clients, Fewer Follow-Ups

Clients get one link, one transfer, and an instant receipt. There’s no confusion about which invoices are paid, and no duplicate reminders are sent by mistake.

✓ Audit-Ready Without Extra Work

Every payment is logged, time-stamped, and tied to its invoice references. When it’s time for internal reviews or external audits, you already have everything tracked and in place.

✓ Scalable Process for Growth

Whether you’re reconciling 5 or 500 invoices a week, the process doesn’t change. It’s built to scale without needing more headcount or manual effort.

Get Started

Connect today and see why businesses trust Finexer for secure, compliant, and tailored open banking solutions.

Can one Finexer link cover multiple invoices?

Yes, you can send one payment link that includes all open invoices for a single client.

Does Finexer work with accounting tools?

Yes, Finexer sends real-time webhooks that integrate with most accounting and ERP systems.

Can receipts be automated with Finexer?

Yes, receipts can be emailed to clients automatically after a successful payment.

Is Finexer secure for payment collection?

Yes, Finexer is FCA-authorised and uses SCA, encryption, and tokenisation for full security.

Close your books faster with Finexer’s real-time payment tracking and automated receipts! Book a demo today & get benefits 🙂