Choosing the right payment platform is a critical decision for any business aiming to improve customer experience and reduce transaction friction. While digital wallets like Google Pay, Apple Pay, and PayPal dominate the market, each offers different strengths when it comes to fees, settlement speeds, integration options, and platform compatibility.

In this guide, we break down the key features, supported markets, security protocols, and cost structures of these three popular options. If you’re evaluating what works best for your checkout flow or are looking for a more efficient payment solution, this comparison will help clarify your decision.

Overview

Google Pay, launched as Android Pay in 2015 and rebranded in 2018, is Google’s digital wallet solution built primarily for Android users. It enables seamless peer-to-peer transfers, in-app payments, and contactless tap-to-pay options. Google Pay is tightly integrated with Google’s ecosystem and serves millions of users worldwide.

Apple Pay, introduced in 2014, provides a similar digital wallet experience for iOS users. Available on iPhones, iPads, Apple Watches, and Macs, it supports both online and in-person transactions using biometric security like Face ID or Touch ID. However, it’s only available on Apple devices, which limits its accessibility for Android users.

PayPal, one of the oldest digital payment platforms, offers broad support for online and cross-border payments. It allows users to store cards, link bank accounts, and send or receive money in multiple currencies. Its extensive merchant ecosystem and global reach make it a go-to option for many e-commerce businesses.

While each of these platforms serves a large customer base and has evolved over time, they also rely heavily on traditional card networks and intermediaries.

Supported Markets and Customer Base

Google Pay

Google Pay supports online, in-app, and contactless payments across 189 countries and regions. However, its Google Wallet functionality for in-store NFC-based payments is limited to around 99 countries. The platform supports 78 currencies and 31 languages, allowing businesses to localise payment experiences across a broad range of geographies.

Merchants across retail, travel, entertainment, SaaS, and food services commonly integrate Google Pay to offer quick, mobile-friendly checkouts. In the UK, Google Pay is supported by most major banks, including Barclays, NatWest, HSBC, Lloyds, and Monzo, making it widely accepted among local consumers.

Apple Pay

Apple Pay is available in over 80 countries, including the UK, US, Canada, Australia, and much of Europe. Its strength lies in the iOS user base anyone with an iPhone, Apple Watch, iPad, or Mac can use Apple Pay to make purchases both online and in-store via contactless terminals.

The platform supports numerous currencies and languages, making it a strong option for businesses serving Apple users across retail, finance, education, and lifestyle sectors. In the UK, all major banks support Apple Pay, including Halifax, Nationwide, and Santander, alongside the previously mentioned ones.

PayPal

PayPal boasts the widest reach, operating in over 200 countries and regions and supporting 25+ currencies. It offers a tailored checkout experience based on the user’s location and language, helping businesses cater to a global audience without additional setup.

Its popularity spans across industries, e-commerce, travel, SaaS, marketplaces, and freelancers all leverage PayPal for both domestic and international payments. PayPal’s massive user base and established trust make it a powerful option for merchants seeking global scale.

Supported Payment Methods

When comparing PayPal, Google Pay, and Apple Pay, it’s important to understand the types of payments each platform supports and how they fit into typical checkout flows.

| Payment Method | Google Pay | Apple Pay | PayPal |

|---|---|---|---|

| Credit & Debit Cards | Supports Visa, Mastercard, American Express, Discover, and JCB. In the UK, works with nearly all major banks (e.g., NatWest, HSBC, Barclays, Lloyds). | Supports major cards including Visa, Mastercard, and American Express. UK coverage is broad across all leading banks. | Accepts Visa, Mastercard, American Express, and Discover. UK support is comprehensive across major card issuers. |

| Digital Wallets | Can integrate with PayPal in certain regions like the US and Germany. | Natively built into iOS ecosystem. Can also be used via Safari for online checkouts. | Offers its own digital wallet, and supports wallet-based payments including Apple Pay, Google Pay, and Venmo (US). |

| Regional Payment Systems / Bank Redirects | Supports limited local methods like Google Play Balance and Paysafecard for digital purchases. | Focused on global card network compatibility; limited local payment methods. | Supports local options like BLIK (Poland), EPS (Austria), Multibanco (Portugal), iDEAL (Netherlands), Bancontact (Belgium), and Trustly in the UK and EU. |

Each platform accommodates common payment preferences but differs in how much flexibility it offers with local and alternative payment systems. While Apple Pay and Google Pay are ideal for mobile-first card payments, PayPal gives broader access to regional payment rails, especially in Europe.

Recurring Billing and Subscription Management

For businesses offering memberships, SaaS plans, or ongoing services, the ability to handle recurring billing efficiently is essential. Here’s how Google Pay, Apple Pay, and PayPal compare when it comes to subscription capabilities.

Google Pay

Google Pay supports recurring billing through its online checkout system. Merchants can set up automatic, recurring payments for services like app subscriptions, media content, or digital memberships. The functionality is typically facilitated by the Payment Service Provider (PSP) used by the merchant—Google Pay itself does not manage the billing engine but integrates smoothly into systems that do.

Apple Pay

Apple Pay supports recurring payments via merchant subscription setups, particularly in iOS apps and platforms that rely on Apple’s in-app purchase (IAP) infrastructure. Outside of the Apple ecosystem, however, recurring billing relies on external PSPs or platforms that use Apple Pay only as a payment method, meaning it’s not natively built for complex billing cycles unless the system around it supports it.

PayPal

PayPal offers the most robust recurring billing features of the three. Merchants can create fixed, tiered, or usage-based subscription plans, configure trial periods, and manage upgrades or downgrades from within their dashboard. Customers can also view, manage, or cancel subscriptions directly from their PayPal account, adding an extra layer of transparency and control.

Integration, Dashboard, and Pricing Compared

When choosing a payment platform, it’s not just about what the customer sees, it’s also about what happens in the background: how easy it is to integrate, manage, and what it costs.

Integration

- Google Pay and Apple Pay both require a third-party Payment Service Provider (PSP) like Stripe, Adyen, or Checkout.com. They act as payment facilitators, not processors—meaning your PSP handles the actual transaction, fees, and compliance.

- PayPal, on the other hand, offers direct integration through APIs, SDKs, and ready-made plugins for over 25 platforms. It’s more flexible for developers and easier to plug into broader business workflows, like accounting and CRM tools.

Merchant Dashboard

- Google Pay and Apple Pay provide no standalone dashboards. All transaction data and settings must be accessed through your PSP.

- PayPal includes a comprehensive dashboard with real-time reporting, subscription management, invoicing, and dispute handling—all within one place.

Pricing

- Google Pay and Apple Pay don’t charge merchants directly. But since they use card networks, the fees depend on your PSP—typically around 1.4% to 2.9% + 20–30p per transaction, plus any cross-border or FX charges.

- PayPal’s fees are usually higher: around 2.9% + £0.30 for UK transactions and additional 1.29%–1.99% for international payments, along with a 3% currency conversion fee and £14 chargeback fee.

A Smarter Alternative for UK Businesses

If you’re a business owner frustrated by high transaction fees, delayed payouts, and limited platform control, you’re not alone. While PayPal, Google Pay, and Apple Pay are familiar options, they are all built around card networks and third-party intermediaries. This structure leads to rising costs, slower settlements, chargeback risks, and a lack of flexibility when scaling across payment channels.

Finexer offers a fundamentally different approach. Built for UK-based businesses and fully authorised by the FCA, Finexer enables direct account-to-account payments using Open Banking. That means customers pay straight from their bank account, without cards or wallets involved.

This setup helps you reduce costs, improve cash flow, and offer a more modern checkout experience your customers actually prefer.

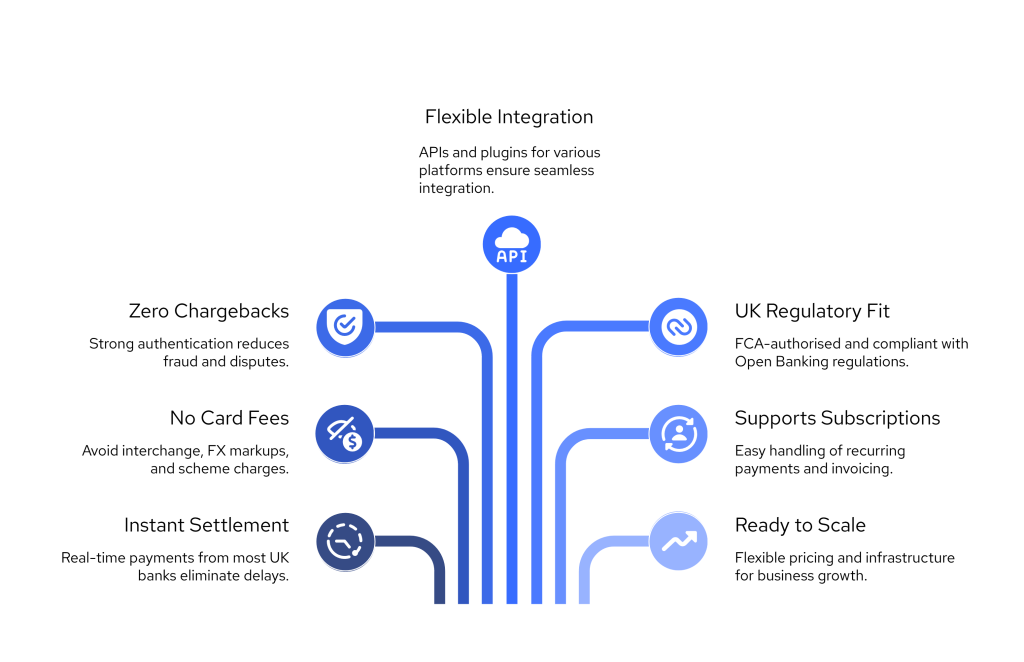

What Makes Finexer Stand Out?

1. Instant Settlement Across UK Banks

Unlike PayPal and card-based methods that take 1 to 3 business days, Finexer enables real-time payments. Funds move directly from the customer’s account to yours, with no middlemen slowing things down.

2. No Interchange, No Card Fees

Since transactions are processed through bank APIs, you avoid card network fees, interchange costs, and hidden FX markups. This is ideal for businesses managing thin margins or high-volume sales.

3. Zero Chargebacks by Design

All payments go through Strong Customer Authentication (SCA), meaning every transaction is verified at the bank level using biometrics or banking app login. This makes fraud far less likely and eliminates chargeback disputes entirely.

4. Full Integration Flexibility

Finexer offers flexible APIs, SDKs, and ready-made plugins for platforms like WooCommerce, Magento, and custom-built stacks. Businesses can go live in days, not months, without heavy development overhead.

5. Built for UK Compliance

As an FCA-authorised provider, Finexer meets all Open Banking regulatory requirements, ensuring both you and your customers stay protected and compliant.

6. Ideal for Subscriptions, Invoicing, and Platform Payments

Whether you’re running a SaaS platform, invoicing clients, or managing marketplace payouts, Finexer supports recurring billing, scheduled settlements, and split payments out of the box.

7. Designed for Scaling, Not Just Starting

Start small and scale smart. Whether you’re a new e-commerce brand or a fast-growing fintech, Finexer’s infrastructure supports your growth with no lock-ins or enterprise-only pricing.

Is It Time to Move Past Wallets and Cards?

Digital wallets and card-based systems have served their purpose. But if you’re looking to improve margins, speed up cash flow, and take full control over your payments, Open Banking is no longer just an alternative; it’s a strategic advantage.

With Finexer, UK businesses can simplify their payment stack, lower costs, and offer a checkout experience that feels native, secure, and fast.

Get Started

Connect today and see why businesses trust Finexer for secure, compliant, and tailored open banking solutions.

Is Google Pay free for merchants to use?

Google Pay itself doesn’t charge merchants, but you’ll still pay standard card processing fees through your Payment Service Provider (PSP), such as Stripe or Adyen. These typically range from 1.4% to 2.9% per transaction.

Can I use Apple Pay and Google Pay without a PSP?

No, both Apple Pay and Google Pay require integration with a PSP to process payments, handle settlements, and manage compliance. They are front-end payment methods, not full processors.

How does Finexer differ from traditional payment platforms?

Finexer uses Open Banking to facilitate direct bank-to-bank payments, eliminating card networks and associated fees. It offers real-time settlements, no chargebacks, and connects with 99% of UK banks, making it ideal for businesses focused on cost efficiency and faster cash flow.

Which is faster for receiving funds: PayPal, Google Pay, or Apple Pay?

PayPal usually settles funds within 48 to 72 hours. Google Pay and Apple Pay settlements depend entirely on your PSP, which may offer next-day or instant payouts depending on your plan.

Tired of high fees and delayed payouts? See how Finexer helps UK businesses accept instant, secure payments without card networks.