Even with the best systems in place, payroll doesn’t always run on schedule. A late timesheet approval, a bonus added at the last minute, or a banking holiday can all push your payroll submission dangerously close to the cut-off time. And if that cut-off is missed, your payroll processing timeline gets pushed back, resulting in delayed payments, stressed finance teams, and unhappy employees.

For payroll professionals, the pressure to meet tight deadlines is real. Traditional methods like BACS rely on fixed payment processing windows. However, modern payroll processing with bank APIs is changing how UK businesses handle these tight deadlines.

That’s why finance teams across the UK are now looking beyond legacy systems. With Open Banking-powered real-time payments, you can still meet your payroll deadline, even if your submission is late. This guide breaks down how you can manage a tight payroll processing timeline with more confidence, less stress, and better reliability.

Keep reading or Jump to the section you’re looking for:

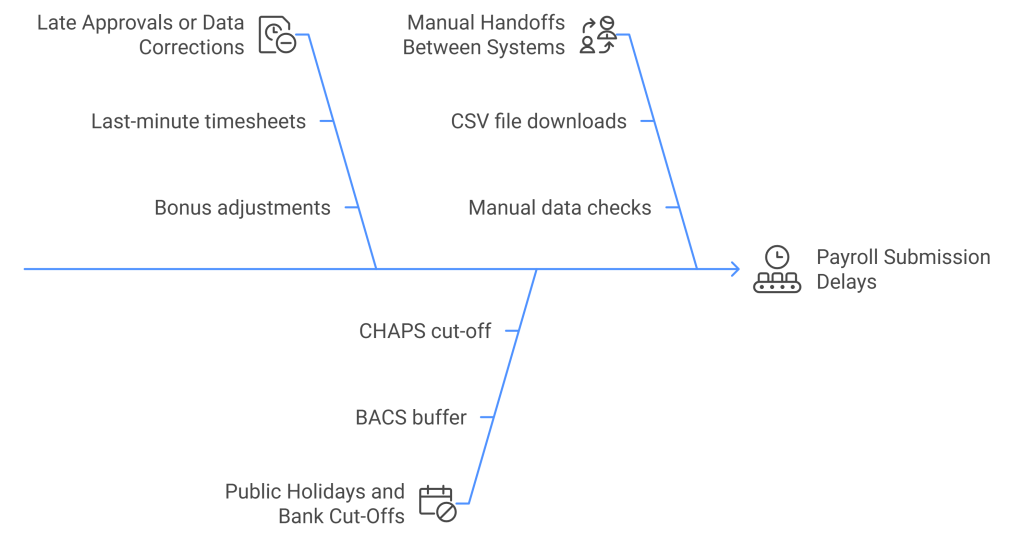

What Causes Payroll Submission Delays?

Despite best intentions, payroll submissions are often delayed, and not always due to poor planning. In reality, many delays come from unavoidable situations that traditional payroll systems are simply not designed to handle.

Late Approvals or Data Corrections

One of the most common issues in the payroll processing timeline is late approvals. Whether it’s a department manager submitting timesheets hours before the deadline or HR making last-minute corrections to employee data, these delays can leave payroll teams rushing to finalise submissions.

- A late bonus inclusion

- An employee bank detail change

- PTO corrections right before payday

These last-minute adjustments can push you past your regular payroll deadline, especially if your system relies on file exports and manual uploads.

Public Holidays and Bank Cut-Offs

Banking schedules don’t always match business needs. If payday falls on a bank holiday or Friday, your effective payroll deadline may be two to three days earlier due to fixed payment processing windows.

- BACS requires submission two working days before settlement

- CHAPS has mid-afternoon cut-off times

- Weekends or holidays mean no processing until the next business day

This creates narrow windows for submission, and any delay means a missed payday.

Manual Handoffs Between Systems

When your payroll, HR, and banking platforms aren’t fully integrated, every step adds friction. Downloading CSV files, manually verifying amounts, logging into bank portals, and waiting for confirmations introduce delay risks.

If even one step breaks down or takes longer than expected, your team is at risk of missing the payroll cut-off and delaying employee payments.

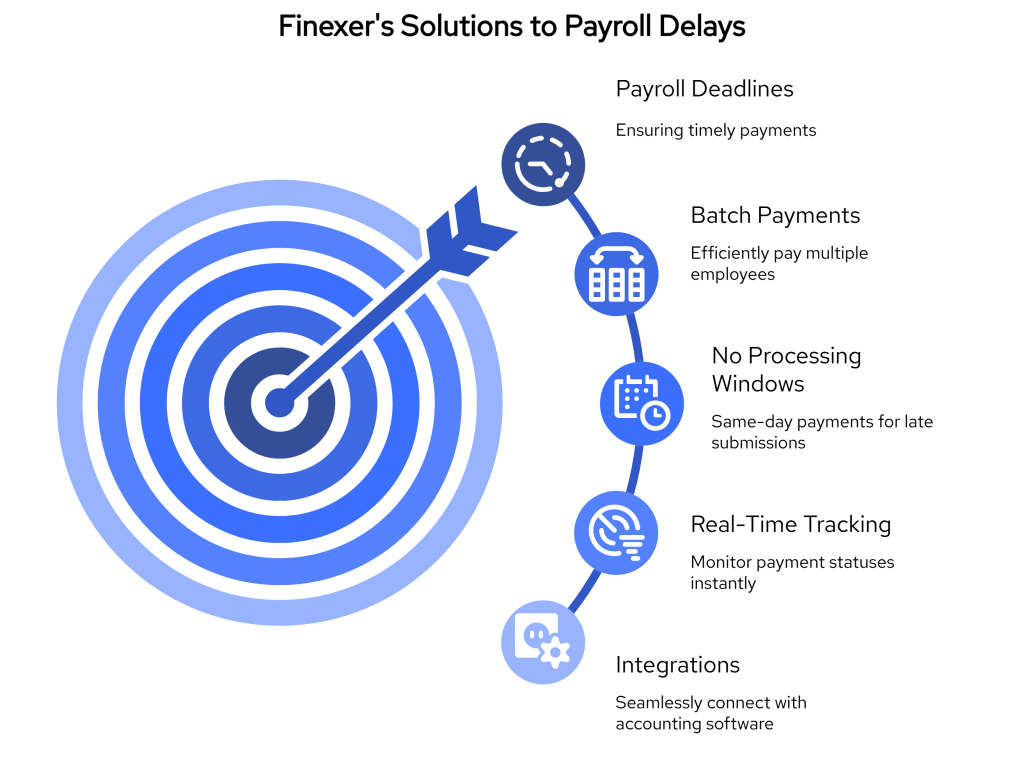

How Finexer Helps You Meet Payroll Deadlines

Missing a payroll submission deadline doesn’t have to mean missing payday. If your team is finalising payroll close to the cut-off or struggling with delays caused by data issues or internal approvals, Finexer helps you recover lost time without sacrificing reliability.

Built on FCA-regulated Open Banking infrastructure, Finexer enables instant salary payouts to multiple employees, even after traditional BACS or CHAPS windows have closed. Instead of having to prepare files days in advance, you can now approve payroll hours before payday and still ensure every payment lands on time.

1. Send One Batch, Pay Everyone Instantly

Whether you’re paying 5 employees or 500, Finexer’s batch payment feature lets you authorise the entire payroll in one go. There’s no need to process payments individually or manage multiple bank transfers.

- Set up a single payment to multiple accounts

- Authorise once, and funds are transferred instantly

- Works even on evenings, weekends, or bank holidays

This is especially helpful when payroll is finalised late in the day, or if your business runs weekly cycles with little room for error.

2. No More Waiting for the Next Processing Window

Traditional payroll systems tie you to specific payment processing windows. If you submit late, payments are delayed, sometimes by days. Finexer bypasses those restrictions entirely by settling payments in real time.

- Finalise payroll at 4:50 PM and still pay by 5:00 PM

- Eliminate delays caused by weekends or bank holidays

- Avoid employee frustration and payment support tickets

This flexibility turns rigid payroll deadlines into manageable workflows.

3. Real-Time Visibility, Fewer Surprises

With Finexer’s real-time payment tracking, you’ll know exactly when funds are sent, received, or flagged without checking separate platforms or waiting overnight for confirmation.

- Instant status updates on each transaction

- See cleared, pending, or failed payments as they happen

- Quickly resolve any payment issues before employees even notice

This level of visibility adds a layer of confidence for payroll teams working under pressure.

4. Prevent Last-Minute Errors Before They Happen

Many missed payroll deadlines are caused by incorrect bank details or outdated salary data. Finexer reduces those risks through:

- Authenticate: Verifies employee bank accounts before payroll

- Income Check: Validates current income to prevent under/overpayment

- Bulk Payout Verification: Ensures all recipient details are accurate in advance

By automating these checks, Finexer ensures your payroll submission is ready to go, without last-minute errors that push you past the deadline.

5. Compatible with the Tools You Already Use

Finexer connects to your existing accounting or payroll platform, whether that’s Xero, Sage, QuickBooks, or any custom solution. There’s no need to switch systems, retrain staff, or create custom integrations.

- Plug-and-play Open Banking API

- Minimal setup time

- Full PSD2 compliance and 99% UK bank coverage

This means your team can start using Finexer for real-time payroll without disrupting your current process.

Get Started

Connect today and see why businesses trust Finexer for secure, compliant, and tailored open banking solutions.

How Open Banking Makes Payroll Flexible

Modern payroll cycles don’t always go as planned. A late bonus, an urgent correction, or a missed approval can throw off even the most carefully scheduled run. That’s where Open Banking steps in, not just as a technical improvement, but as a practical solution to real-world payroll challenges.

With platforms like Finexer, powered by Open Banking APIs, your team gains the freedom to approve and settle payroll closer to payday without risking delays. There’s no need to plan around bank hours or file submission deadlines. Here’s how Open Banking transforms payroll into a more agile and reliable process.

1. Final-Hour Payroll Approvals Are Now Possible

Open Banking allows you to finalise payroll later in the day without worrying about traditional cut-off times. With instant payment initiation, your team can approve a payroll run at 4:45 PM and still have salaries land in employee accounts before 5 PM.

2. Last-Minute Changes Don’t Delay Payday

Need to add a performance bonus or fix a salary figure right before disbursing payroll? With real-time payment capabilities, those updates can be made confidently and processed immediately. There’s no need to delay the entire run for a small change.

3. Recovery from Failed BACS Is Immediate

If your payroll file didn’t make it through BACS or CHAPS in time, Open Banking offers a way out. You can rerun payroll instantly using Finexer’s API and ensure employees still receive their wages on the scheduled day.

4. Weekly Payroll Without the Stress

Short payroll cycles leave very little margin for error. Open Banking gives you breathing room, allowing you to approve and process payroll with less lead time. You no longer have to adjust your schedule just to avoid missing cut-offs.

5. Pay Employees on Holidays or Weekends

BACS doesn’t process on weekends or bank holidays — Open Banking does. Even if payday lands on a Friday night or a public holiday, your payroll can still be processed and settled in real time, keeping your commitments to your team.

6. Works for Hybrid, Remote, and On-Demand Workforces

Whether your team is in one office or scattered across locations, Open Banking supports flexible scheduling. You can initiate multiple batches at different times, all within the same day, and still ensure that payments arrive on time.

📚 Guide to Open Banking Payroll

A Better Way to Handle Payroll Submission Delays

Payroll delays are rarely intentional. But when systems rely on outdated processes and rigid submission windows, even minor setbacks can cause missed salaries, increased workload, and strained trust with your team.

Open Banking changes that.

Instead of being locked into fixed payment cycles and early cut-offs, finance teams now have access to tools that enable real-time payroll processing, even on tight timelines. Whether you’re finalising at the last minute, making end-of-day approvals, or recovering from a missed BACS file, you can still disburse salaries on time and with complete confidence.

Platforms like Finexer are purpose-built for this kind of flexibility. By combining batch payouts, instant settlement, live payment tracking, and built-in account verification, Finexer helps payroll teams deliver faster, more reliable outcomes without working around the clock.

It’s not about rushing to meet the deadline. It’s about removing the deadline as a risk entirely.

What is a payroll processing timeline?

It’s the time from collecting payroll data to when employee salaries are paid, including approvals and payment processing.

What happens if payroll is submitted after the cut-off time?

Late submissions can delay salaries by 1–2 days unless real-time payment options like Open Banking are used.

How can I avoid missing payroll deadlines?

Use automated approvals, plan for reviews, and enable real-time payments to process payroll on time, even if finalised late.

Can payroll be processed on weekends or holidays?

Not with BACS or CHAPS, but Open Banking Platforms like Finexer allow payroll to be settled even on weekends or holidays.

What is the benefit of using batch payments for payroll?

Batch payments let you pay all employees at once, saving time, reducing errors, and avoiding delays during tight schedules.

How does Open Banking improve the payroll process?

It allows instant salary payments from your payroll system to employee accounts, with no cut-offs and full payment visibility.

Payroll Deadlines Are Tight. Your Payments Don’t Have to Be! Use Finexer to disburse salaries in minutes 🙂

![Payroll Processing Timeline: How to Handle Late Submissions Without Missing Payday 1 Payroll Processing Time & Late Submission Fix [2025]](/wp-content/uploads/2025/05/Payroll-Processing-Timeline.jpg)