Table of Contents

Implementing PISP Payment Infrastructure Is Not Simple

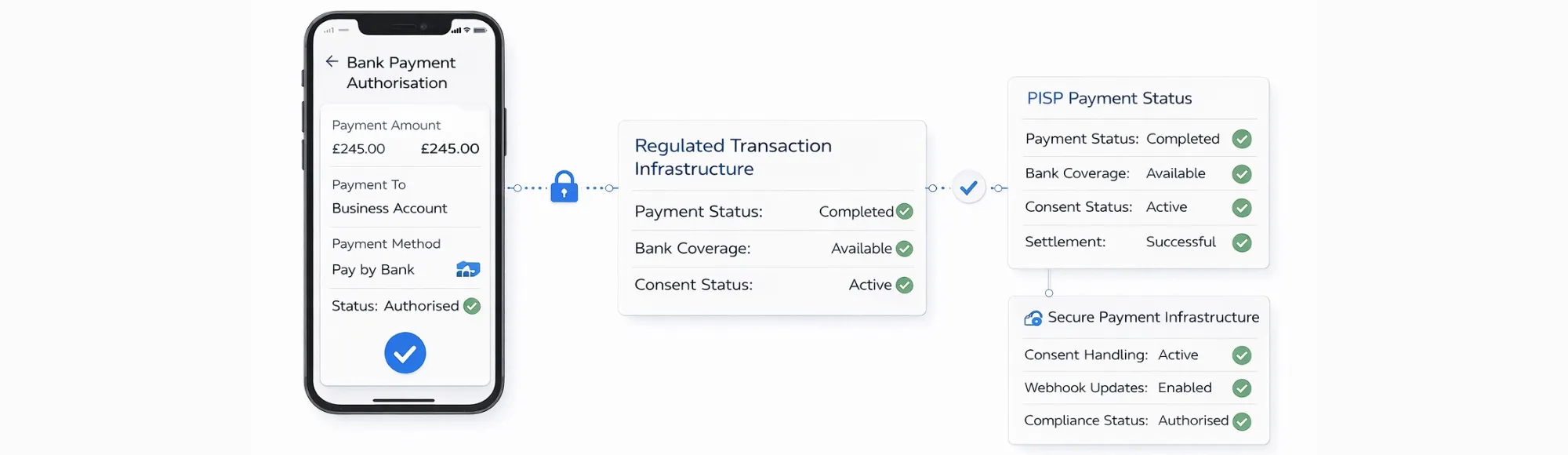

Platforms implementing pisp payment infrastructure often assume payment initiation is straightforward. It is not.

When consent handling fails, payments fail. When bank coverage is incomplete, revenue is lost. When reconciliation breaks, finance teams absorb the cost.

If you are evaluating payment initiation service provider payments for your UK platform, this checklist will help you avoid costly infrastructure mistakes.

Key Takeaways

What happens when PISP payment infrastructure is weak?

Limited bank support loses conversions. Poor consent lifecycle management disrupts access. Inconsistent status updates create reconciliation errors.

Why does “pisp on bank statement” matter to users?

Unclear payment references cause customer confusion, increase refund disputes, and generate support tickets requiring manual investigation.

What should a Payment Initiation Service Provider actually offer?

FCA-authorised infrastructure, 99% UK bank coverage, consent lifecycle handling, webhook-based updates, structured status responses.

What mistakes do platforms make when choosing providers?

Choosing cheapest option first, treating consent expiry as edge case, ignoring payment reference clarity, relying on demo environment performance.

Where does Finexer fit operationally?

FCA-authorised Open Banking connectivity providing payment initiation service provider payment infrastructure across 99% of UK banks with webhook delivery and white-label flows.

Is This Relevant to Your Platform?

This article is for you if:

- You are replacing card rails with Pay by Bank

- You need lower transaction costs

- You require account-to-account settlement

- You are embedding payments into SaaS

- You operate only in the UK

If your platform depends on predictable settlement and regulatory clarity, pisp payment infrastructure must be evaluated properly.

What Happens When PISP Payment Infrastructure Is Weak?

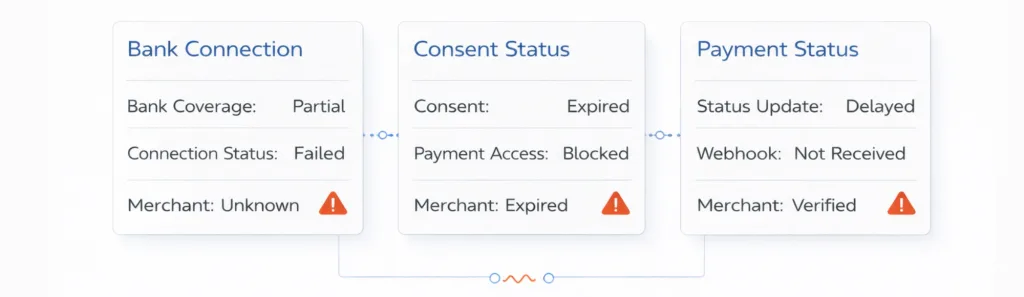

When the wrong provider is selected, the impact is operational:

| Infrastructure Gap | Business Impact |

|---|---|

| Limited UK bank support | Lost payment conversions |

| Poor consent lifecycle management | Access disruption after expiry |

| Inconsistent status updates | Reconciliation errors |

| Weak audit trails | Compliance exposure |

| No webhook support | Manual status tracking |

If pisp payments fail at scale, support tickets increase. If settlement clarity is weak, finance teams intervene manually. If customers see unclear references such as “pisp on bank statement“, confusion follows.

These are not technical issues. They are operational risks.

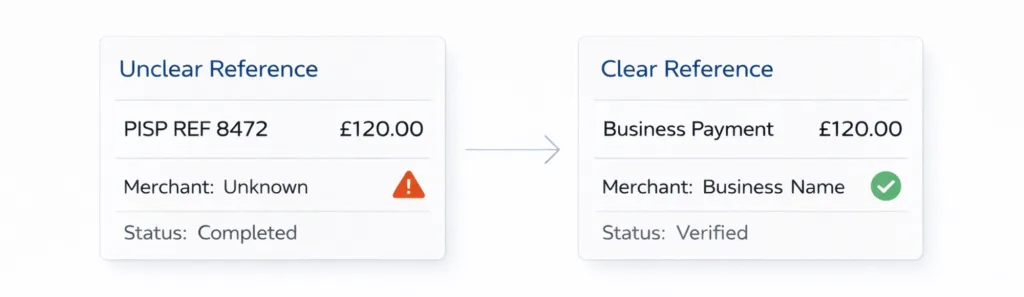

Why Does “PISP on Bank Statement” Matter?

Many platforms ignore how pisp on bank statement appears to users.

If payment references are unclear:

- Customers question legitimacy

- Refund disputes increase

- Support teams investigate manually

- Trust erodes over time

A well-configured pisp payment flow ensures clear payment descriptions, traceable references, and consistent merchant identifiers.

Small details affect trust. Understanding what payment initiation services provide helps platforms configure user-facing elements correctly.

What Should a Payment Initiation Service Provider Offer?

When evaluating pisp payments, infrastructure matters more than features.

Look for:

- FCA-authorised Open Banking infrastructure – Regulatory compliance through proper authorisation

- 99% UK bank coverage – Including challengers and building societies

- Consent lifecycle handling – Automated expiry tracking and renewal

- Webhook-based payment updates – Real-time status without polling

- Structured status responses – Clear payment states for reconciliation

- Usage-based pricing – Scales with volume without fixed commitments

- White-label ready flows – Maintains brand throughout payment journey

- AIS and PIS connectivity combined – Account data and payment initiation in single integration

A production-grade payment initiation service provider payment setup should not depend on polling or manual reconciliation.

The difference between AISP and PISP capabilities affects what infrastructure you need for complete payment workflows.

What We See in Practice

After working with UK SaaS and fintech platforms, clear patterns appear:

The cheapest provider is chosen first. Coverage gaps are discovered later when users cannot connect their banks.

Consent expiry is treated as edge case. It becomes a support issue at scale when payment access stops working.

Payment references are ignored. Users contact support asking about “pisp on bank statement” appearing on their transactions.

Infrastructure works in demo environments. Production reveals the weaknesses – incomplete bank support, slow webhooks, unclear status responses.

Platforms comparing payment initiation platforms often optimise for integration speed without evaluating operational reliability.

Common Provider Selection Mistakes

| Mistake | Why It Matters | What to Look For |

|---|---|---|

| Choosing cheapest option | Hidden costs in manual reconciliation | Total cost of ownership evaluation |

| Limited bank coverage | User drop-off at payment stage | 99% UK bank support minimum |

| No consent lifecycle management | Support tickets after expiry | Automated renewal handling |

| Batch status updates only | Delayed reconciliation | Real-time webhook delivery |

| Unclear payment references | Customer confusion and disputes | Configurable statement descriptors |

| Card-style pricing models | High transaction fees | Usage-based Open Banking pricing |

Understanding Open Banking pricing models helps platforms evaluate total cost beyond initial integration fees.

Where Finexer Fits

Finexer provides Open Banking connectivity using FCA-authorised infrastructure for UK platforms.

The focus is infrastructure, not consumer-facing software.

Finexer supports:

- PISP payments across 99% of UK banks including high-street and challenger institutions

- Usage-based pricing without fixed commitments or minimum volumes

- White-label payment flows maintaining brand continuity throughout journey

- Webhook delivery for real-time payment status updates

- Historical data access through AIS for account verification and analysis

- 3 – 5 weeks onboarding assistance ensuring integration aligns with platform architecture

Transaction costs can be reduced compared to card rails, depending on volume and use case.

Forpayroll and invoicing workflows,payment initiation service provider payment infrastructure enables direct bank transfers without card network fees.

Finexer does not perform business logic or replace your product layer. The platform enables reliable pisp payment infrastructure beneath it.

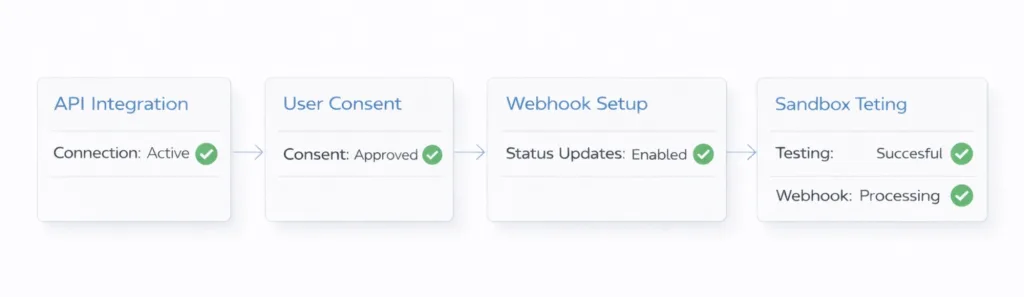

How Should payment initiation service provider Payment Be Implemented?

A stable rollout usually follows this sequence:

- Define the payment use case – Determine transaction types and settlement requirements

- Integrate PIS API – Connect payment initiation endpoints

- Implement consent flow – Configure user authentication journey

- Configure webhooks – Set up real-time status notifications

- Validate sandbox testing – Test edge cases and error handling

- Deploy with monitoring – Track payment success rates and failures

This approach reduces disruption in live environments.

Evaluating the best UK payment initiation platforms helps establish implementation benchmarks and realistic timelines.

Key Questions Before Choosing a PISP Provider

When evaluating payment initiation service provider payments infrastructure, platforms should ask:

- Does the provider support 99% of UK banks including challengers?

- Is consent lifecycle managed automatically with renewal handling?

- Are payment updates delivered via webhooks in real-time?

- How will pisp on bank statement appear to users?

- Is pricing usage-based without fixed commitments or minimums?

- What webhook events are available for payment status tracking?

- Does infrastructure support both AIS and PIS in single integration?

These questions determine whether payment initiation service provider payments scale smoothly without operational overhead.

What I Feel About PISP Payment Infrastructure

After observing platforms implement pisp payment infrastructure, the difference between successful and struggling implementations is clear.

Successful platforms treat payment initiation as infrastructure they consume. They focus engineering effort on product features, user experience, and business logic. Not on building consent lifecycle management or maintaining bank connectivity.

Struggling platforms underestimate operational complexity. They assume payment initiation is simple API integration. Then discover consent expiry issues, incomplete bank coverage, and reconciliation gaps.

The “pisp on bank statement” detail seems minor during evaluation. It becomes major when support teams handle customer confusion tickets at scale. Clear payment references affect trust.

Infrastructure reliability matters more than initial pricing. A provider charging slightly higher per-transaction fees but delivering reliable webhooks and complete bank coverage provides better economics than cheaper providers requiring manual reconciliation.

What is a pisp payment?

A pisp payment allows a Payment Initiation Service Provider to initiate bank-to-bank payments using Open Banking infrastructure and customer consent without card networks.

Are pisp payments regulated in the UK?

Yes, payment initiation service provider payments must operate through FCA-authorised infrastructure ensuring regulatory compliance for Payment Initiation Service Providers.

Why does pisp on bank statement appear?

Pisp on bank statements appear when a Payment Initiation Service Provider processes the bank transfer, indicating the payment was initiated through Open Banking infrastructure.

Can payment initiation service provider payments reduce card processing costs?

Pisp payments can reduce card-related fees depending on transaction volume and setup, eliminating card network processing costs for account-to-account transfers.

Do pisp payments work with all UK banks?

Coverage depends on the provider. Leading payment initiation service provider payment infrastructure supports around 99% of UK banks including high-street institutions and challengers.

Build reliable UK PISP payments with compliant Open Banking connectivity and complete bank coverage.