Note: All pricing information comes from publicly available sources as of Jan 2026.

What You Will Discover:

Introduction

In today’s financial technology sector, connecting banking data with applications forms the backbone of many modern financial services. Plaid, a prominent name in this space, primarily serves large enterprises and established fintech companies. Let’s examine their services, pricing, and market position in detail.

Understanding Plaid’s Core Services

Plaid’s service catalogue extends across several key areas of financial connectivity. Their account-linking service enables applications to connect with users’ bank accounts, forming the foundation of their offering. They also provide payment processing capabilities, allowing businesses to initiate and manage financial transactions. Their identity verification services help companies verify user identities through banking data, while their transaction data services offer insights into banking activities.

📚Guide to payment service providers

Plaid’s Pricing Framework

Plaid structures their pricing across four distinct tiers, each designed for different stages of business development:

1.The Free Development Tier allows businesses to build and test their applications. This tier provides access to Plaid’s core products in a sandbox environment, letting developers experiment with the API and understand its capabilities without cost.

2.The Pay as You Go Tier removes minimum commitments, offering flexibility for businesses just starting their production journey. However, this tier comes with standard per-use rates that can add up quickly as volume increases.

3.The Growth Tier introduces volume discounts, starting at $100 monthly. This tier suits businesses with predictable usage patterns and requires no annual commitment, though costs can still mount significantly with increased usage.

Starting at $500 monthly, the Scale Tier provides access to custom solutions and volume pricing. This tier typically involves custom contracts and includes dedicated support, though it requires substantial minimum commitments. (source)

UK Market Considerations

In the UK market, Plaid’s operations become more complex. Operating under FCA regulations, they provide connections to major UK banks, but their service structure differs notably from that of their US operations. UK businesses must navigate custom contracts, even at lower tiers, which often extends implementation timelines and increases initial commitments.

Their pricing for UK operations often requires custom negotiations, reflecting the more regulated nature of the UK banking environment. This can mean longer setup periods and higher minimum commitments than their standard US pricing might suggest.

Technical Implementation Requirements

Implementing Plaid’s services demands significant technical resources. Their API integration requires experienced developers who are familiar with handling financial data. The technical requirements include the following:

Setting up secure server environments for handling sensitive financial data & payment initiation involves implementing proper encryption and security protocols and maintaining PCI compliance where necessary.

Establishing robust error handling systems. Financial data connections can face various interruptions and edge cases, requiring comprehensive error management.

Creating user authentication flows that meet both technical and regulatory requirements is particularly complex in the UK market, where Strong Customer Authentication (SCA) rules apply.

Support and Maintenance Structure

Plaid provides different levels of support based on pricing tier. Development tier users access basic documentation and community support. Pay-as-you-go and Growth-tier customers receive standard support through their ticketing system. Scale-tier clients get dedicated support channels, though response times and support depth vary by contract terms.

Regulatory Compliance

For UK businesses, compliance considerations become paramount. Plaid’s services must adhere to:

- FCA regulations governing payment services

- UK Open Banking standards

- GDPR and data protection requirements

- Strong Customer Authentication rules

- Anti-money laundering regulations

Meeting these requirements through Plaid’s platform requires careful attention to implementation details and ongoing monitoring.

📚 Learn more about PSD2 & Security

Initial and Ongoing Costs

Beyond the base pricing tiers, businesses must consider several cost factors:

Initial implementation costs include developer time, security setup, and integration testing. These costs often exceed the direct service fees during the setup phase.

Ongoing maintenance requires dedicated technical resources to monitor connections, handle updates, and manage any issues that arise.

Transaction costs can vary significantly based on volume and type. Some transactions, particularly those involving identity verification or detailed financial data retrieval, incur higher per-use fees.

Support costs may include internal resources needed to manage the integration and any premium support packages required for adequate service levels.

This comprehensive view of Plaid’s services and pricing structure provides context for understanding how it fits different business needs, particularly in the UK market. As we’ll explore in our next section, this enterprise-focused approach has created space for alternative solutions that might better serve the needs of growing businesses and startups.

Understanding Alternative for UK Startups

As we’ve explored Plaid’s pricing structure and its implications for different business sizes, a clear pattern emerges in the UK market. While Plaid offers robust services that serve many businesses well, their pricing model and implementation requirements often align more naturally with established companies and larger enterprises. This raises an important question: what options exist for UK startups and growing businesses with similar capabilities but different operational needs?

Plaid’s Pricing Structure

Plaid offers four main pricing tiers:

Free Tier: For building and testing Pay as You Go: No minimum commitments Growth: Starting at £100/month Scale: Starting at £500/month with custom solutions

For UK businesses, Plaid requires custom contracts, which often means longer setup times and higher minimum commitments. This structure works for large companies but creates challenges for smaller ones.

What UK Startups Really Need

UK startups tell us they need:

- Simple Pricing: Know exactly what you’ll pay

- Low Starting Costs: Begin without large commitments

- Pay for Usage: Only pay for what you actually use

- Quick Setup: Start working with banks right away

- UK-Focused Support: Help that understands UK banking

Download Our USP Guide only for Startups in the UK

A Closer Look at Startup-Friendly Pricing

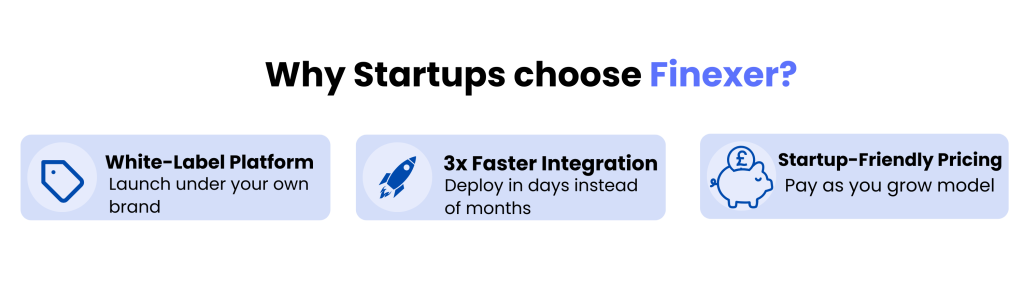

This is where newer services like Finexer stand out. Their pricing starts at rates that work for startups, with no enterprise-level commitments. You pay based on what you use as your business grows.

The difference shows in real numbers:

- No large upfront costs

- Usage-based fees that match your growth

- Clear pricing without hidden charges

- Direct access to 99% of UK banks

Breaking Free from Traditional Implementation Barriers

Finexer’s consumption-based pricing starts at levels that work for early-stage companies, allowing businesses to begin with manageable costs that align with their actual usage. This shift in approach extends beyond just pricing. When examining implementation requirements, we see similar adaptations for different business needs.

Navigating UK-Specific Requirements

The UK market presents unique considerations. With its specific regulatory requirements and banking landscape, businesses need solutions that understand and address these local factors. This becomes particularly relevant when considering the speed at which new financial products can enter the market. While enterprise solutions excel at serving established operations, growing businesses often need faster deployment options that don’t compromise on regulatory compliance or security.

Real-World Implementation Challenges

Consider how this plays out in practice. A UK startup looking to launch a new financial product faces several critical decisions. They must balance immediate costs against future scalability, technical requirements against available resources, and implementation speed against market opportunities. Traditional enterprise pricing tiers might suggest starting with basic services and upgrading over time, but this approach can lead to difficult transitions as businesses grow.

3x Faster deployment at Affordable Rates Only for Startups → Book Your Demo

Modern Solutions for Growing Businesses

In contrast, newer market solutions have developed models that better align with growing businesses’ trajectories. These solutions typically offer more flexible starting points while maintaining paths for growth. For example, Finexer’s approach allows businesses to begin with straightforward implementations that can scale without requiring fundamental changes to their infrastructure. The difference becomes clear when examining specific aspects like bank connectivity.

Support and Compliance: A New Approach

Technical support represents another area where market approaches have evolved. While enterprise providers typically offer standardised support tiers, newer solutions often provide more focused assistance that understands growing businesses’ specific challenges. The market has also seen innovation in handling compliance requirements, with solutions designed for growing businesses typically including more comprehensive compliance automation.

Making Informed Choices for Long-Term Success

As UK businesses evaluate their options for financial data or payments services, understanding these market developments helps inform better decisions. The choice extends beyond comparing feature lists or pricing tiers – it involves finding solutions that align with business goals, resources, and growth plans. The evolution of financial data & payments services in the UK continues to create new possibilities for businesses at all stages, providing growing businesses with options that might better suit their current needs and future aspirations.

What factors influence open banking pricing for startups?

Open banking providers typically structure pricing based on:

->Transaction volume – The number of successful payments or data requests.

->Service tier – Free/testing tiers vs. paid plans with advanced features.

->Technical integration needs – Costs related to API setup and maintenance.

->Compliance & security requirements – Meeting financial regulations can add costs.

How can startups minimize costs when choosing an open banking provider?

Startups should look for:

->Pay-as-you-go models instead of high monthly minimums.

->Free trials or test environments to explore features before committing.

->Scalable pricing that grows with business needs.

Transparent pricing structures to avoid hidden fees.

What are the hidden costs startups should be aware of?

->Technical support fees – Faster response times may come at an extra cost.

->Compliance expenses – Regulatory audits and security certifications.

->Scaling costs – Some plans become expensive as transaction volumes grow.

Skip Enterprise Prices: Launch Open Banking in Days, Not Months – Save Up to 90% on transactional costs → Book a demo