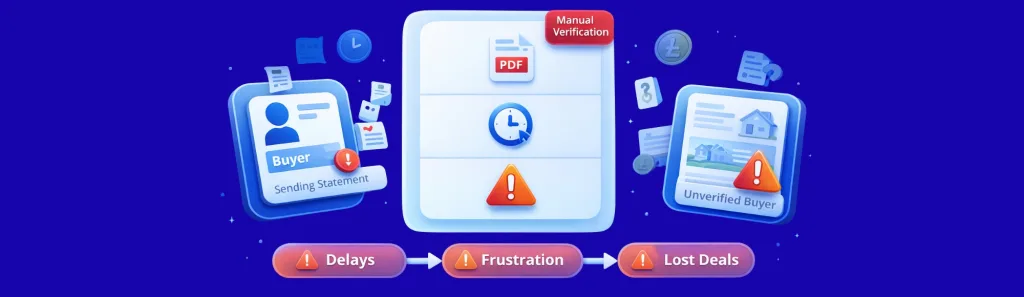

Your buyer says they have the deposit. You’ve requested bank statements. Now you’re waiting three days for PDFs that arrive redacted, date-stamped last month, and require manual verification. Meanwhile, another agent with instant proof of funds verification for estate agents has already moved their buyer to offer stage.

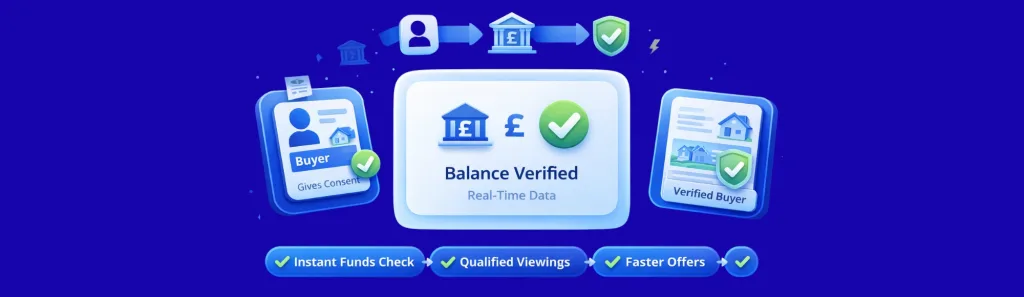

Real estate bank verification through open banking solves this by connecting directly to buyer bank accounts with their consent. Request verification, buyer authenticates through their banking app, you receive confirmed balance within minutes. No PDFs. No waiting. No wondering if the funds are actually there.

This matters because transaction speed determines which agents close deals and which lose buyers to faster competitors.

Why Manual Bank Statement Verification Costs You Deals

Picture your current process. Buyer registers interest. You request proof of funds. They promise to send statements. Days pass. The PDF arrives but shows balances from three weeks ago. You can’t verify if funds are still available. So you request updated statements. Another delay.

What this creates in practice:

- Buyers grow frustrated with repetitive documentation requests

- Sellers question whether your viewings involve qualified buyers

- Competing agents with faster verification capture your prospects

- Your pipeline fills with unverified interest rather than qualified buyers

- Deal progression stalls whilst waiting for basic financial verification

The actual problem isn’t that buyers lack funds. It’s that manual verification takes so long that qualified buyers move to agents offering instant processes. Your operational speed directly impacts your close rate.

What Changes With Real Time Bank Account Verification for Real Estate?

Traditional verification relies on documents buyers provide and you manually check. Real time bank account verification for real estate connects directly to source data-the actual bank account holding the deposit.

When buyers consent to verification, they authenticate through their banking app. The bank verification API for property platforms retrieves current balance information and confirms funds availability. You see verified balances within minutes rather than waiting days for statements that may already be outdated.

Operational benefits:

- Verify deposit funds during initial buyer consultation

- Qualify viewing requests before confirming appointments

- Provide sellers with confidence about viewer financial capability

- Reduce pipeline clutter from unqualified interest

- Accelerate offer-to-exchange timelines through pre-verified funds

Explore how bank verification works for estate agents

Open banking verification for property transactions accesses real-time data rather than static documents. Bank balances change constantly. Statements capture a moment in time. Direct account verification confirms current availability, eliminating the risk of outdated information derailing transactions.

How Does This Compare to Traditional Statement Checks?

Your current method involves requesting PDFs, manually reviewing them, noting balances, and hoping the information remains accurate. Each step requires human time and introduces delay.

Manual vs Instant Verification:

| Verification Step | Traditional Method | Real Estate Bank Verification |

|---|---|---|

| Request to Receipt | 2–5 days waiting for statements | Immediate verification request |

| Buyer Action Required | Download, redact, email PDFs | 2-minute banking app authentication |

| Data Accuracy | Historical (days/weeks old) | Current balance confirmed |

| Agent Processing Time | 15–30 mins reviewing documents | Instant automated confirmation |

| Reverification | Request new statements each time | Real-time balance check anytime |

See real estate bank verification in action

The difference matters most for competitive situations. Two buyers viewing the same property-one pre-verified with instant proof of funds verification for estate agents, one still gathering statements. Which buyer’s offer do you present first?

What Should Estate Agents Look for in Verification Systems?

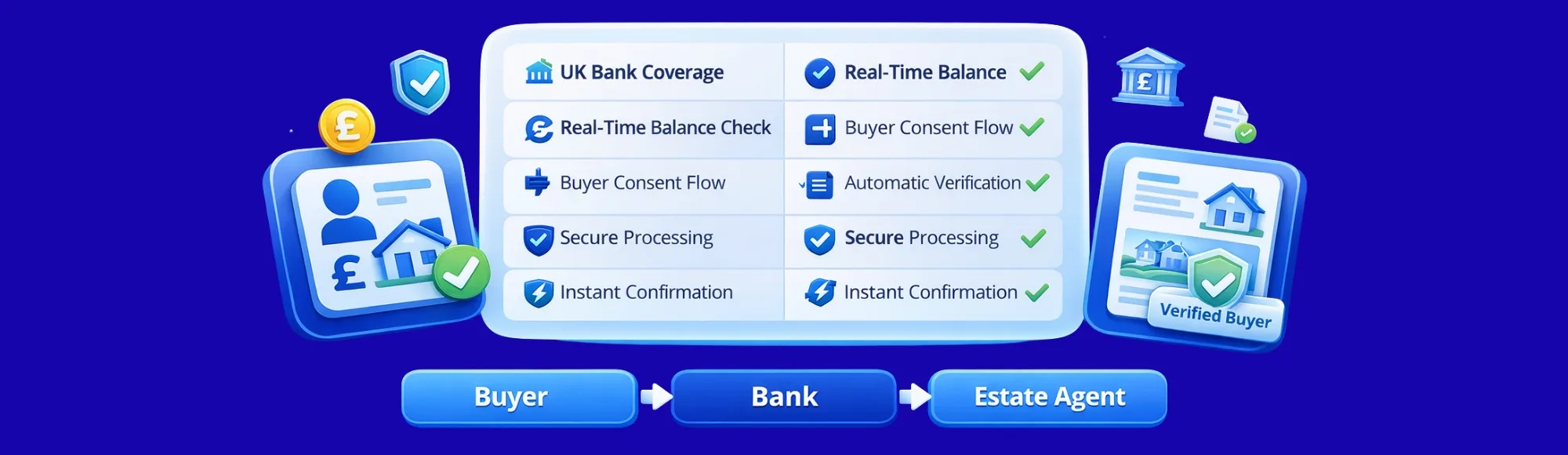

UK bank coverage determines whether your entire buyer base can verify instantly. Partial coverage means maintaining manual processes for some buyers-which defeats the purpose. Bank verification API for property platforms needs access to banks your buyers actually use.

Integration with your property management system matters significantly. If verified buyer data requires manual transfer into your CRM, you’ve simply moved the admin work. Real time bank account verification for real estate should update buyer records automatically.

Compliance with UK financial regulations isn’t optional. Open banking verification for property transactions must follow FCA guidelines for data access and buyer consent. Systems designed for UK estate agents understand these requirements inherently.

How Finexer Enables Instant Real Estate Bank Verification

Finexer connects to 99% of UK banks through regulated open banking infrastructure. This coverage means virtually all your buyers can verify funds through their existing bank accounts without special arrangements.

The platform provides 3-5 weeks of dedicated onboarding support. This ensures real estate bank verification integrates with your existing property management systems rather than requiring workflow rebuilds.

Estate agents using instant verification report significantly faster qualification cycles. Time from initial enquiry to qualified viewing drops from days to minutes. Your pipeline contains verified buyers rather than hopeful interest.

Pricing works on actual verifications performed rather than fixed monthly fees. Quiet periods cost less. Busy months with high viewing volumes scale naturally with your activity.

What is real estate bank verification?

Direct connection to buyer bank accounts through open banking to confirm deposit funds availability instantly rather than waiting for manual statement reviews.

How does real time bank account verification protect buyer privacy?

Buyers control access through their banking app, consenting to specific verification requests rather than providing downloadable statements with full account history.

Can open banking verification for property transactions work with all UK banks?

Yes-with 99% UK bank coverage through regulated open banking connections, virtually all buyers can verify through their existing accounts.

How quickly does instant proof of funds verification actually work?

Minutes from buyer authentication to confirmed balance display, compared to days waiting for manual statement provision and review.

Does bank verification API integration require replacing existing property software?

No-verification capability integrates with current systems through API connections, adding instant verification without replacing existing workflows.

Ready to Implement Instant Bank Verification?

See how Finexer enables real-time buyer verification whilst reducing transaction costs by up to 90%

Book Demo Now