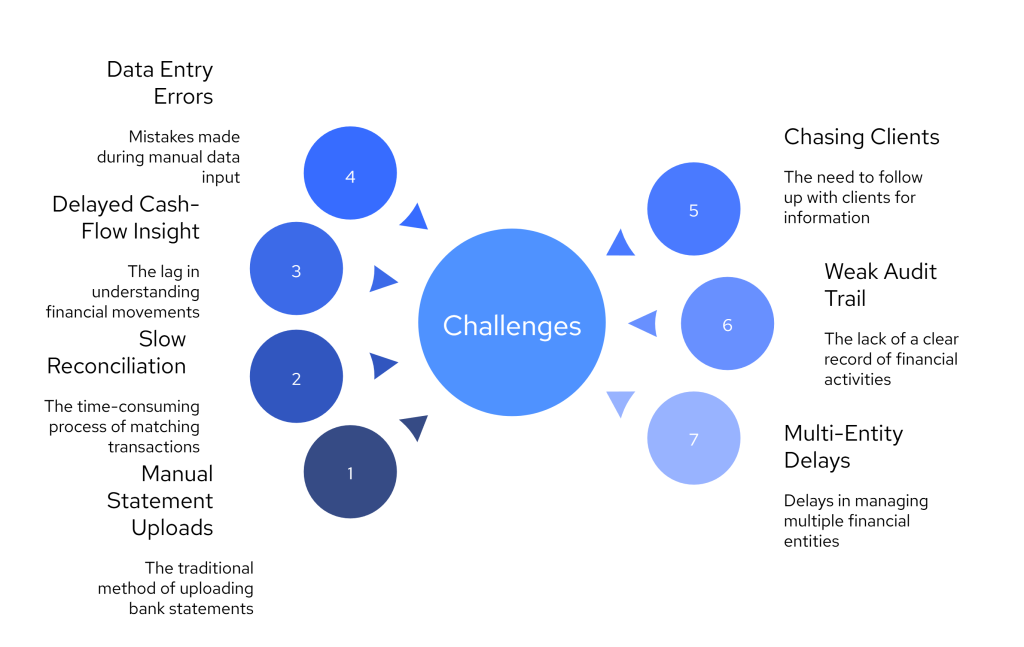

When accounting workflows stall, it’s often because of broken or outdated bank feeds, not the software.

Firms spend hours chasing client statements, correcting manual entries, or waiting for CSVs to arrive. Even the best platforms struggle when the data feeding them is delayed or incomplete. That’s why more UK firms are turning to real-time bank feeds to cut down errors, improve visibility, and speed up reconciliation.

Finexer gives you direct access to real-time bank feeds across 99% of UK banks — including both high street and digital-first providers. Built on FCA-regulated Open Banking APIs, Finexer helps you pull accurate, cleared transactions into your accounting software without relying on clients to send files manually.

In this blog, we’ll explore seven everyday accounting challenges and how real-time bank feeds through Finexer can help you solve them faster and more reliably.

1. Manual Bank Statement Uploads

The challenge

Chasing clients for bank statements eats up hours. Some send PDFs, others send the wrong files, and many don’t send anything at all until you nudge them multiple times.

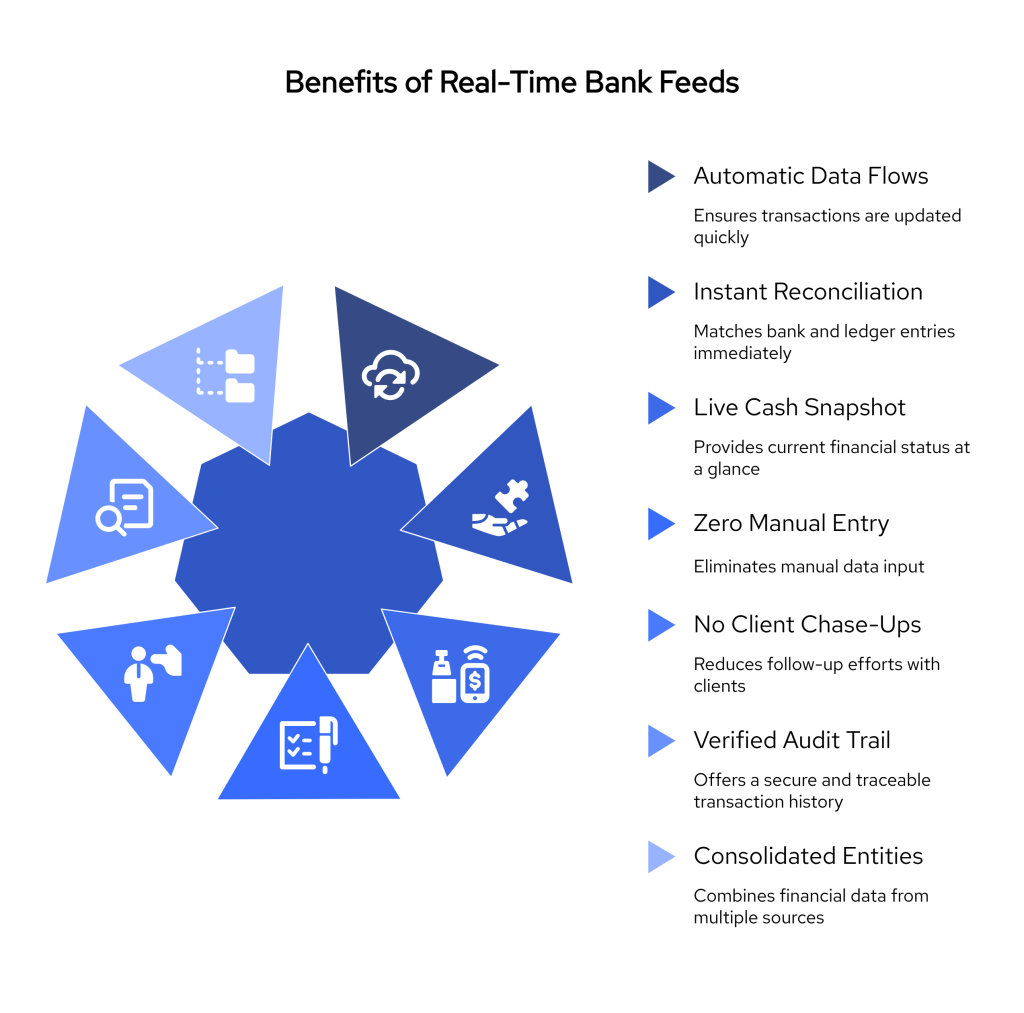

With Finexer

You can connect client accounts once and start receiving transaction data instantly — no need for CSVs or PDFs. Finexer’s real-time bank feeds pull in cleared transactions automatically, with no manual steps required.

Why it matters

This removes friction from client relationships and eliminates data delays from your month-end process.

2. Time-Consuming Reconciliation

The challenge

Reconciling client accounts becomes a slog when transactions don’t match up or you’re dealing with week-old data. Even automated software struggles if the bank feeds are broken or missing entries.

With Finexer

You get live transaction feeds that post daily, sometimes even multiple times a day, allowing you to reconcile accounts as you go. Finexer integrates easily with major accounting software, helping automate the matching process in real time.

Why it matters

You avoid last-minute scrambling and reduce the risk of errors during the month-end close.

3. Delayed Cash Flow Visibility

The challenge

Giving cash flow advice is risky when you’re basing it on outdated bank balances. Without live data, your insights may already be obsolete by the time the client acts on them.

With Finexer

You get up-to-date balances and cleared transactions across all linked accounts, including business and personal ones. This gives you a true view of the client’s financial health, not just an estimated guess.

Why it matters

It improves your ability to offer accurate, forward-looking advice and helps clients make informed decisions without delay.

4. Errors from Manual Entry

The challenge

Manual data entry is still common in firms that rely on client-uploaded statements or third-party bank portals. A single typo or misplaced decimal can throw off reconciliation, create reporting inaccuracies, or worse, misinform your client.

With Finexer

Finexer eliminates manual entry by fetching transaction data directly from the client’s bank account, using secure Open Banking APIs. Every transaction comes with metadata (like date, time, reference, and cleared status), reducing the risk of human error.

Why it matters

You can trust the accuracy of the numbers and reduce rework caused by incorrect entries.

5. Lack of Client Accountability

The challenge

When clients are responsible for sending statements or exporting CSV files, delays and inconsistencies are inevitable. This slows your workflow and adds avoidable communication loops.

With Finexer

Once the client authorises the connection (a quick SCA-verified step), Finexer handles the rest. The data comes in automatically, without needing constant follow-up. You get daily feeds across 99% of UK personal and business accounts, including challenger banks like Monzo, Starling, and Tide.

Why it matters

It simplifies your client engagement and ensures you’re always working with fresh data — even if the client forgets to check their inbox.

6. Limited Audit Trail for Compliance

The challenge

When transactions are entered manually or sourced from unreliable feeds, there’s often no clear audit trail. That can raise red flags during compliance checks or HMRC audits.

With Finexer

Each transaction pulled via Finexer includes a verified timestamp and bank-originated source, which creates a secure, traceable audit trail. This is particularly helpful for firms navigating MTD for VAT and other compliance requirements.

Why it matters

You get peace of mind knowing your records are accurate, complete, and audit-ready, with no manual patching needed.

7. Delays in Multi-Entity Accounting

The challenge

Managing multiple business entities or subsidiaries for a single client often means juggling several logins, bank portals, and formats. This slows down consolidation, reporting, and oversight.

With Finexer

You can connect multiple bank accounts across entities in one dashboard and pull all feeds into your accounting platform in real time. Whether your client runs three subsidiaries or ten, Finexer supports unified data visibility.

Why it matters

You reduce admin effort and can manage multi-entity clients more efficiently, without jumping between systems.

Wrapping Up

Whether you’re reconciling accounts, preparing reports, or offering client advice, having access to accurate and up-to-date bank data is no longer a luxury — it’s a necessity. Relying on manual uploads or delayed feeds only slows your team down and increases the risk of errors.

By switching to real-time bank feeds, your firm can move faster, work more accurately, and serve clients with greater confidence.

Finexer makes it easy to get started.

With secure, FCA-authorised access to 99% of UK banks and a simple, accountant-friendly setup, you can connect client accounts once and let the data come to you — automatically, securely, and in real time.

What are real-time bank feeds in accounting?

Real-time bank feeds are direct, secure connections between a client’s bank account and an accounting platform. They allow accountants to receive up-to-date transaction data automatically, without manual uploads or delays.

How do real-time bank feeds improve reconciliation?

Real-time bank feeds help automate reconciliation by importing cleared transactions as they happen. This reduces manual matching, lowers the risk of errors, and speeds up month-end closing for accounting teams.

Can real-time bank feeds reduce manual entry?

Yes, by automatically importing bank transaction data, real-time feeds eliminate the need to manually key in amounts, dates, or references. This improves data accuracy and reduces the risk of human error.

Is Finexer compliant with UK Open Banking regulations?

Yes. Finexer is FCA-authorised and fully compliant with UK Open Banking standards. It uses Strong Customer Authentication (SCA) and encrypted APIs to securely access client bank data with full consent.

No more chasing statements. No more manual uploads. Just faster, cleaner workflows — built for accountants Try Finexer Now!