Introduction

What if you could tap into a resource that reveals your business’s financial health in real time, helping you make faster, smarter decisions? Whether you’re a fintech startup designing financial tools, a small business trying to stay on top of cash flow, or a lender deciding who to approve, the way you handle financial data can make all the difference. Bank transaction data isn’t just numbers—it’s a blueprint for better decision-making.

Imagine this: the global value of open banking transactions is expected to grow from $57 billion in 2023 to $330 billion by 2027. Businesses around the world are realising the potential of transactional data to drive smarter and more precise financial decisions. Why not be part of that movement?

This guide is designed for business professionals, decision-makers, and innovators who want to understand how bank transaction data can help their organisations thrive. If you’re here to learn what transactional data is, how it works, and how it can benefit your business, you’re in the right place. We’ll cover the fundamentals, real-world applications, challenges to consider, and how to get started effectively. Let’s explore how this data can support smarter financial decisions for your business.

What is Bank Transaction Data?

Bank transaction data refers to detailed information about the movement of money in and out of a bank account. It includes information such as account balances, transaction amounts, dates, payees, and merchants. Through open banking frameworks like PSD2 in the UK, businesses can access this data securely with the customer’s explicit consent. The key aspect of open banking is that it places customers in control of their financial data, allowing them to share it with trusted third-party providers.

Unlike traditional banking systems where accessing this information was often slow and restricted, open banking makes real-time bank transaction data readily available through secure APIs. This data is not only accessible quickly but also provides a more comprehensive and up-to-date picture of financial activities.

How Does Open Banking Enable Access to Transaction Data?

Open banking uses APIs (Application Programming Interfaces) to create a bridge between banks and third-party providers. Once a customer gives their consent, the third-party provider can access and use their transaction data to provide personalised services. These APIs are regulated under frameworks like PSD2, ensuring data is shared securely and only with authorised parties.

For example:

- A customer may consent to share their bank transaction data with a personal finance app to track spending and create budgets.

- A business could use the data to automate payment reconciliation or analyse trends in cash flow.

Why Is Real-Time Access Important?

Real-time bank transaction data offers businesses the ability to see up-to-date financial information without delays. Here’s why this matters:

- Timely Decision-Making: Businesses can react quickly to financial changes, such as identifying discrepancies or preparing for unexpected expenses.

- Accurate Insights: Instead of relying on outdated statements, businesses can analyse the latest financial activity for precise reporting and forecasting.

- Better Customer Experiences: Companies can deliver services, such as instant loan approvals or spending insights, that rely on live data.

How It Works

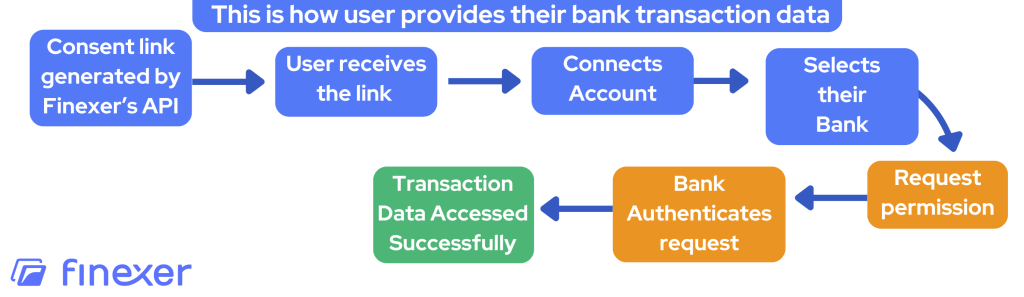

To effectively utilise bank transaction data, it’s essential to understand how the process works. Open banking frameworks enable businesses to access this data securely and with the customer’s explicit consent. Here’s a step-by-step breakdown:

Step 1: Account Connection

The process begins when the user is prompted to connect their bank account. This is often done through a consent link shared by the business, either via a dashboard or an integrated API.

Step 2: Bank Selection

The user selects the bank they wish to connect. Open banking platforms provide a list of supported banks, making it easy for the user to choose their financial institution.

Step 3: Permission Request

Once the user selects their bank, they are asked to give consent for sharing their financial data. This includes details on the type of data being accessed (e.g., transaction history, account balances), the frequency, and the validity period for which data will be shared.

Step 4: Bank Authentication

The user authenticates the connection directly with their bank using secure methods, such as entering their credentials or using two-factor authentication. This ensures that the connection is safe and fully authorised.

Step 5: Real-Time Data Access

After authentication, the connection is established, and real-time transaction data becomes accessible to the business through the open banking API. Businesses can now retrieve up-to-date account details, transaction history, and balance information as per the agreed permissions.

Note: Businesses have control over the parameters of the data request, such as setting the duration (e.g., how many days of history to fetch), frequency, and expiration of the access, based on their operational needs.

This seamless process ensures that data is shared securely, transparently, and efficiently, creating trust between businesses and their customers.

Get Access to Real-Time Bank Transaction Data

Get a 14-day free trial to see how bank transaction data can work for your business. Contact us now!

Practical Applications of Bank Transaction Data

How Can Businesses Use Bank Transaction Data?

The ability to access real-time bank transaction data opens doors to numerous applications across industries. Here are some practical ways businesses can leverage transactional data to their advantage:

Fintech Startups:

Building Financial Apps: Startups can develop personal finance management apps that help users track spending, set budgets, and monitor savings goals.

Credit Scoring Solutions: By analysing a user’s cash flow, fintechs can create credit scoring systems that go beyond traditional metrics, offering fairer and faster assessments.

Fraud Detection: Startups can use real-time transaction monitoring to detect anomalies and flag suspicious activities, enhancing financial security.

Lending and Credit Providers:

Faster Loan Decisions: By analysing bank transaction data, lenders can quickly assess a borrower’s financial health, income stability, and spending patterns, speeding up the loan approval process.

Risk Management: Transactional data helps identify potential risks by providing a detailed look at an applicant’s financial habits.

Accounting and ERP Services:

Automated Reconciliation: Bank transaction data can match payments with invoices in real-time, reducing manual errors and saving time for accountants.

Streamlined Bookkeeping: With up-to-date data, accounting software can provide businesses with instant reports on cash flow, expenses, and financial health.

📚 Guide to Open banking for Accountants

Small and Medium-Sized Businesses (SMBs):

Cash Flow Management: SMBs can monitor real-time bank balances and transaction data to ensure they stay on top of their finances.

Tax Preparation: Categorised transaction data simplifies tax filings by providing accurate and detailed records of expenses and revenues.

Payment Processors:

Real-Time Payment Verification: Payment platforms can use transactional data to instantly confirm completed payments, reducing delays and errors.

Customer Insights: By analysing payment patterns, businesses can tailor their services to meet customer needs more effectively.

Key Drivers

A report by Curity reveals that the top three drivers for adopting open banking are increasing competitiveness (58%), delivering new products and services (55%), and meeting customer demand (48%). Source

Real-World Example

Imagine a fintech startup developing a budgeting app for small businesses. By integrating an open banking API, the app can pull real-time transaction data to provide users with instant cash flow updates, categorise expenses automatically, and even alert them when payments are due. The result? A tool that not only saves time but also helps small business owners make better financial decisions.

Challenges to Consider

While the potential of bank transaction data is significant, businesses need to address some challenges to fully leverage it. Here are the key considerations:

- Data Security and Privacy:

- Customers must trust that their data will be handled securely and responsibly.

- Compliance with regulations like GDPR and PSD2 is essential to avoid breaches and maintain user confidence.

- Customer Consent:

- Gaining explicit consent from customers requires transparency about what data is being accessed and how it will be used.

- Providing clear and user-friendly consent mechanisms is crucial.

- Integration Complexity:

- Incorporating open banking APIs into existing systems can require technical expertise.

- Ensuring compatibility with different banks and platforms adds an additional layer of complexity.

Insights

Despite the advantages, 61% of financial institutions cite compliance and security risks as primary concerns in adopting open banking. Source

Get Started with Bank Transaction Data

Getting started with real-time bank transaction data doesn’t need to be complicated. Finexer offers a reliable and accessible platform designed specifically for small and medium-sized businesses (SMBs) and fintech startups. Here’s how you can begin:

1. Partner with Finexer for Easy Integration

Finexer simplifies access to bank transaction data by providing a single API that connects to 99% of UK banks. Key features include:

- Scalable Solutions: Start with a small setup and grow as your business needs evolve. Finexer’s infrastructure handles up to 100,000 transactions without requiring additional resources or technical upgrades.

- Custom Branding Options: Use Finexer’s white-label platform to align the interface with your business identity, ensuring a consistent and professional look for your customers.

- Faster Setup: Finexer’s streamlined process ensures quick onboarding with user-friendly tools, enabling your business to get started in significantly less time.

2. Ensure Compliance

With Finexer, regulatory requirements are fully handled by an FCA-authorised infrastructure. This eliminates the need for businesses to navigate complex compliance challenges on their own, ensuring adherence to frameworks like PSD2 and GDPR.

3. Define Your Objectives

Clarify how your business plans to use bank transaction data. Some common applications include:

- Building apps for financial planning or budgeting.

- Simplifying accounting processes like reconciliation and expense categorisation.

- Improving credit decision-making through detailed transaction analysis.

- Monitoring cash flow in real-time to support operational planning.

Finexer’s platform is designed with these specific use cases in mind, giving businesses tools they need to deliver meaningful results.

4. Begin the Integration Process

Finexer’s platform makes integration straightforward and accessible:

- Use a centralised dashboard to manage all financial operations.

- During onboarding, rigorous testing ensures a secure and reliable connection to banking systems.

- Access Finexer’s expert support team to address any setup-related questions or challenges.

5. Educate and Engage Your Customers

Customer trust is crucial when accessing sensitive financial data. Finexer supports businesses with:

- Clear and transparent consent workflows to explain how data will be used.

- Secure authentication processes that prioritise customer privacy.

- Tools to demonstrate the value of sharing bank transaction data, such as quicker loan approvals or smarter financial tools.

6. Use Data to Drive Results

Once integrated, transactional data can be used to:

- Identify spending trends that inform better decision-making.

- Automate repetitive tasks like payment reconciliation and financial reporting.

- Deliver personalised services based on customer behavior and financial activity.

📚 Download Finexer’s USP for Startups in the UK

Why Choose Finexer?

Finexer is more than just a data provider—it’s a partner for growth. Here’s why it’s ideal for SMBs and startups:

- Flexible Pricing: Only pay for what you use, with no high upfront costs or long-term commitments.

- Expert Guidance: Get support from fintech specialists who understand your business goals.

- Reliable Access: With nearly 100% uptime and a robust connection to UK banks, Finexer ensures your business has uninterrupted access to bank transaction data.

Getting started with Finexer means gaining the tools and support needed to use bank transaction data effectively, helping your business grow and succeed. Schedule a demo today to see how Finexer can work for you.

Try Accessing Bank Transaction data today! Schedule your demo and get a 14 days free Trial by Finexer 🙂