Most UK startups underestimate how much they lose to transaction fees until they look closely. Whether it’s paying contractors abroad, collecting customer payments, or processing everyday expenses, fees creep in from all angles: FX markups, card network charges, bank processing costs, and hidden surcharges. It’s a quiet drain on your margins.

For fast-growing businesses dealing with cross-border payment charges or expanding into the EU and US, those seemingly small deductions can snowball into thousands lost every quarter. Add in business FX fees, and the impact on cash flow becomes impossible to ignore.

But there’s good news. But that’s changing. Open Banking payments now offer a faster, more affordable way for UK businesses to move money. By eliminating card networks and traditional banking rails, startups can use account-to-account payments to reduce fees, speed up settlement, and eliminate the friction of manual reconciliation.

In this guide, we’ll break down:

- Where UK startups typically lose money on transactions

- How Open Banking changes the cost structure

- A real-world comparison of low-cost payment solutions vs legacy methods

- What to prioritise if you want to reduce payment fees long term

Let’s unpack the true cost of moving money and how your business can keep more of it.

Where UK Startups Lose Money on Transactions

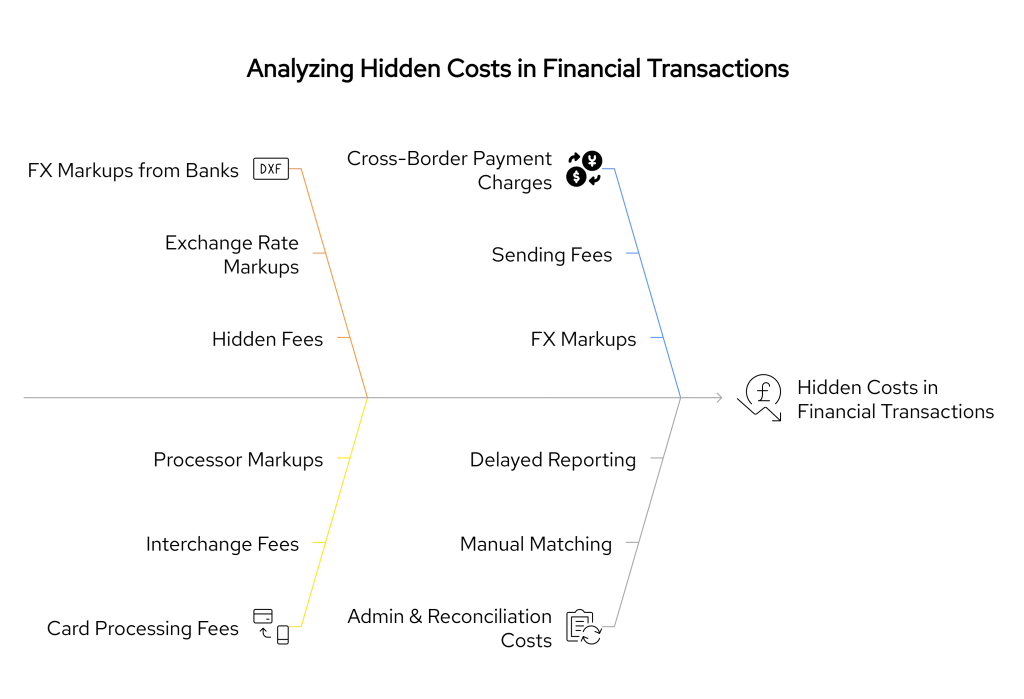

Hidden transaction fees quietly erode profitability, especially when payment volumes grow. Whether you’re sending invoices, paying freelancers, or collecting customer revenue, the UK’s traditional payment infrastructure often adds layers of cost without much visibility.

Here’s a breakdown of the most common fee drains:

1. FX Markups from Banks and Payment Providers

Even when advertised as “free international transfers,” UK banks typically bake hidden FX markups into the exchange rate.

- Typical FX spread: 2% to 4% above the mid-market rate

- Example: Paying a €10,000 invoice might cost you £200–£400 more than necessary

- Who charges this: High-street banks, traditional payment processors, and some digital wallets

These business FX fees add up quickly if you’re paying overseas contractors, suppliers, or software providers.

2. Interchange and Card Processing Fees

Accepting debit and credit card payments involves multiple fee layers:

- UK-issued consumer card: ~0.2% (interchange)

- Commercial cards / non-UK cards: up to 1.5%

- Processor/gateway markup: often 0.5% to 1.5%

- Blended card processing fee: between 1.5% to 3.4% per transaction

For startups with high transaction volumes or subscriptions, these payment processing costs can quickly become the largest line-item expense after payroll.

3. Cross-Border Payment Charges

When using legacy systems like SWIFT or IBAN transfers:

- Flat fees: £10–£30 per transfer

- Receiving bank charges: £10–£15 deducted from the amount

- Currency conversion markups: additional 1%–3% in hidden FX costs

Funds often take 1–5 days to arrive, with no guaranteed settlement time.

4. Domestic UK Payment Fees

Even within the UK, startups often incur fees on seemingly simple transfers:

- BACS payment: ~20p–50p per transaction

- Faster Payments: may cost £1–£3, depending on the bank

- CHAPS (used for large same-day transfers): up to £25 per transaction

- Monthly fees for business accounts: £5–£15 for standard access

These costs scale rapidly for companies running payroll or supplier payouts in bulk.

5. Admin & Reconciliation Costs

Many traditional providers still send partial remittance information or delay settlement. This creates:

- Reconciliation delays

- Higher staff time costs

- Errors in financial reporting

Manual work to match payments to invoices or clients can cost teams hours every month.

Why UK Founders Need to Care (Now, Not Later)

It’s easy to overlook transaction fees when your business is just getting off the ground. But as volume increases, more payments in, more payments out, those small percentage charges multiply fast. Left unchecked, they can quietly eat into your margins, distort cash flow forecasts, and complicate financial operations.

1. Small Margins Don’t Survive Hidden Fees

Most UK startups run on lean margins in their early years. A 2% FX markup or 3% card fee might not seem like much on a single transaction, but over 1,000 payments, that’s tens of thousands of pounds lost unnecessarily. With every round of investment or scaling milestone, these losses get amplified.

2. International Growth Means More Cost Exposure

Expanding to Europe or the US? Suddenly, you’re dealing with business FX fees, cross-border payment charges, and longer settlement times. Without a cost-efficient system, global expansion can turn into a payment headache and create forecasting issues for your finance team.

3. Investors Watch Your Cost Efficiency

Modern investors pay close attention to your burn rate, including how much you’re spending just to move money. High payment processing costs, poor visibility on outflows, and reliance on legacy providers all raise red flags when you’re fundraising or reporting financials.

4. Payment Delays Slow Down Operations

Late payments hurt your relationships with vendors, partners, and even employees. Card settlements can take 3–5 days, and international wires can be held up without warning. That uncertainty impacts your ability to operate smoothly.

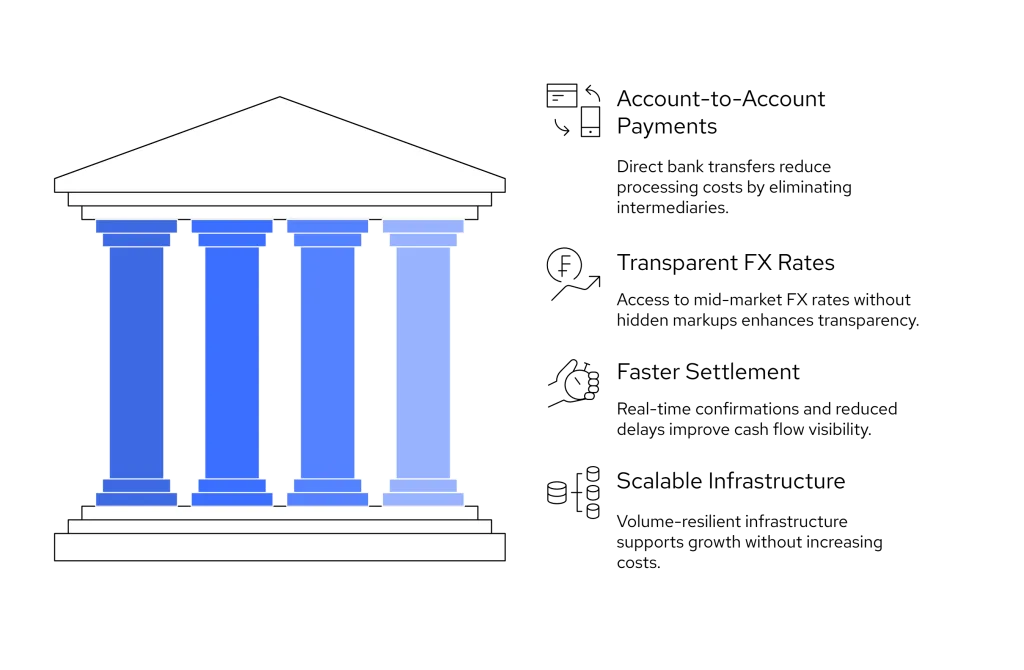

How Open Banking Cuts Transaction Fees

Open Banking was designed to give UK businesses direct, secure access to payment rails without the markups, intermediaries, or settlement delays that come with legacy systems. For startups focused on growth and cash preservation, it offers a way to reduce transaction fees without sacrificing speed or control.

Here’s how:

1. Account-to-Account Payments

Instead of routing payments through card networks or global processors, Open Banking enables direct account-to-account payments UK via secure APIs. Funds move instantly or same-day through domestic rails like Faster Payments, bypassing card schemes and reducing processing costs.

- Zero interchange fees

- No acquiring bank markups

- No card gateway charges

This drastically lowers payment processing costs, especially for high-volume or recurring payments.

2. No Hidden FX Markups

Some Open Banking platforms now integrate with FX providers offering mid-market exchange rates, the same benchmark used by banks before markups. That means UK startups can make cross-border payments with lower or no business FX fees.

- Transparent pricing

- Real-time conversion

- Reduced spread on currency exchange

3. Faster Settlement = Lower Operational Cost

With real-time payment initiation and immediate confirmation, you avoid settlement lags. That means:

- Fewer payment delays

- Instant cash flow visibility

- Less time spent reconciling mismatched data

It’s not just about avoiding fees, it’s also about saving money on admin and reducing manual intervention.

4. Scales Efficiently as You Grow

Open Banking infrastructure works natively across your banking partners and platforms. Whether you’re paying 10 or 10,000 suppliers, the cost per transaction doesn’t balloon as volume increases.

- No minimum volume surcharges

- Usage-based pricing models

- Fully digital initiation and tracking

For fast-scaling teams, Open Banking offers the kind of low-cost payment solution UK startups have needed for years.

How You Can Do It with Finexer

Finexer helps UK startups reduce transaction fees by replacing expensive card payments and legacy bank transfers with secure, real-time Open Banking APIs.

Key Features for Domestic UK Payments:

- Account-to-account transfers via Faster Payments: Settle transactions instantly between UK accounts without relying on card networks or slow BACS cycles.

- Save up to 90% on transactional costs with Finexer’s Paybybank API

- No interchange or processor fees: Eliminate hidden layers found in card-based payment flows.

- Usage-based pricing: Only pay for what you use, no monthly minimums, subscriptions, or per-payout markups.

- Automated reconciliation: Payments arrive with full metadata, reducing admin time and reporting errors.

Built for UK Finance Teams:

From paying suppliers to collecting from customers, Finexer makes it easy to move money efficiently across the UK at a fraction of the cost of traditional payment methods. Whether you’re running payroll, disbursing partner commissions, or accepting Pay by Bank at checkout, Finexer keeps your operations lean and compliant.

*Get Started

Connect today and see why businesses trust Finexer for secure, compliant, and tailored open banking solutions.

Try NowWhat types of transaction fees do UK startups usually pay?

UK startups typically face card processing fees (1.5%–3.4%), FX markups on currency conversion (2%–4%), cross-border payment charges (£10–£30), and domestic transfer fees ranging from 20p to £3 per transaction.

How does Open Banking reduce transaction fees?

Open Banking enables account-to-account payments that avoid card networks and processors.This removes interchange fees and lowers per-transaction costs, helping UK businesses save up to 90% on domestic payment fees.

Are there fees for domestic payments within the UK?

Yes. Many UK banks charge 20p–50p for BACS payments, £1–£3 for Faster Payments, and up to £25 for CHAPS transfers. These fees can add up quickly for startups managing payroll or vendor disbursements.

Paying too much in transaction fees? See how Open Banking helps UK startups cut costs by up to 90%