The compliance cost for lenders has escalated to a critical level in the UK. The sector is under tremendous financial strain, with anti-money laundering (AML) initiatives alone costing an estimated £34 billion a year. Every level is affected by this, as the price of a single corporate KYC review has increased by 19% annually. The rising cost of compliance that UK institutions must deal with is no longer a standard business expense; rather, it is a significant financial burden that necessitates a more intelligent solution. The challenge lies in finding a path forward that satisfies regulatory demands without sacrificing operational efficiency. This article breaks down these critical costs and introduces how open banking can transform the approach to compliance.

📚 Guide to Open Banking for Lenders

What Does Compliance Cost Mean and How Does It Affect Lenders?

The term ‘cost of compliance’ covers a wide range of essential business expenses, from technology to staffing. For modern lenders, managing this cost effectively is one of the most critical balancing acts in finance.

- A Whole Amount Spent: The total of all costs incurred by a lender in order to comply with regulations is known as the cost of compliance. This covers direct expenditures for software and technology, personnel and training, and required regulatory reporting.

- A Crucial Strategic Problem: Controlling this expense is a crucial strategic problem that has an immediate effect on the bottom line and overarching business plan for any organisation operating in the financial services industry, particularly lenders.

- An Act of High-Stakes Balancing: A careful balance is necessary for effective lender compliance. It involves making sufficient investments to ensure complete compliance and security without going over budget on ineffective procedures that impede expansion.

- The Risk of Underinvestment: If a company doesn’t make enough investments, it could suffer serious repercussions. Legal action, crippling regulatory fines, and long-term reputational harm that can undermine consumer trust are a few of these.

- Inefficiency’s Drag: Unwise investments in antiquated legacy systems, which are a frequent source of compliance issues for banks, have a direct negative impact on profitability, impede the development of new products, and frequently result in a sluggish and annoying customer experience.

A Breakdown of the Compliance Cost for Lenders in 2025

| Cost Area | Key Statistic / Data Point | Primary 2025 Driver in the UK |

|---|---|---|

| Overall AML Compliance | Costs UK financial institutions £34 billion annually. | Ongoing sophistication of financial crime. |

| Human Capital | 40–50% of the total compliance budget. | FCA Consumer Duty requiring labour-intensive monitoring. |

| Technology & Data | 30–40% of the total compliance budget. | Rise of Authorised Push Payment (APP) fraud. |

| Customer Due Diligence | 20–25% of the total compliance budget. | Increased regulatory focus on source of funds. |

| Specific KYC Cost | $2,613 (£2,050) average cost per corporate KYC review. | Tension between deeper checks and frictionless onboarding. |

This table breaks down the primary compliance cost for lenders, pinpointing where budgets are being spent. It highlights how the overall cost of compliance is overwhelmingly driven by major investments in human capital and technology.

What drives rising compliance costs for UK lenders?

Escalating regulatory scrutiny (Consumer Duty), sophisticated financial crime (APP fraud), and high demand for skilled compliance professionals & advanced RegTech are primary drivers.

How does open banking cut lender compliance costs?

Open Banking automates affordability/KYC checks, enhances AML with real-time data, and reduces fraud, significantly cutting manual review times and associated expenses.

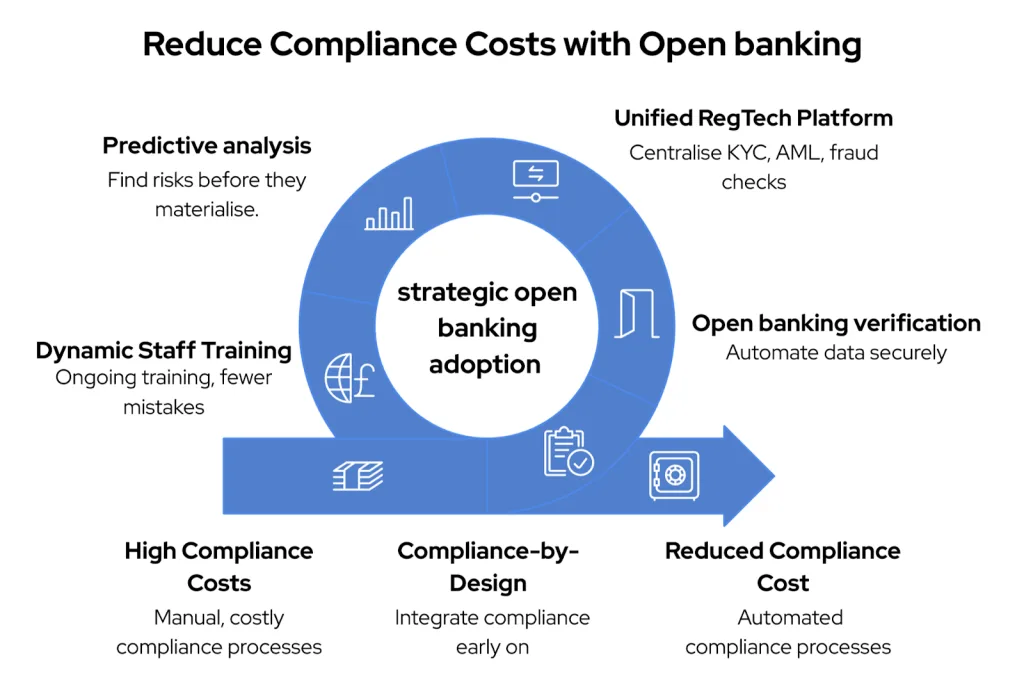

The Solution: Slashing the Cost of Compliance with Open Banking

Open Banking offers a secure, regulated way for lenders to access a customer’s financial data directly from their bank accounts with explicit consent. This technology is a game-changer for reducing the high cost of compliance.

How does it help?

- Automated Affordability Checks: Instead of manual reviews, Open Banking automates income and expenditure analysis. This drastically reduces the time and manpower needed for affordability checks, directly tackling a major component of the compliance cost for lenders.

- Enhanced KYC and AML: Accessing real-time bank data from a customer’s primary bank strengthens due diligence and streamlines identity verification, lowering the costs associated with traditional checks that inflate the compliance cost UK firms must bear.

- Reduced Fraud: A direct view of a customer’s finances makes it harder for applicants to use fraudulent documents, reducing fraud losses and the associated reporting costs that are a burden to compliance in financial services.

Actionable Recommendations: How to Rein In Your Compliance Costs

Understanding the problem is one thing; solving it is another. Here are five strategic recommendations powered by modern financial technology to get control of your compliance cost for lenders.

1. Adopt a “Compliance-by-Design” Approach

Instead of integrating compliance checks as a last gate, do so at the very start of the product development lifecycle. The need for costly, time-consuming post-launch fixes is significantly decreased and your go-to-market process is streamlined when regulatory requirements are incorporated into a product’s architecture from the beginning.

2. Harness Open Banking for Automated Verification

This is the most effective way to reduce expenses. Use Open Banking APIs to quickly and securely access customer-consented financial data rather than depending on manual document reviews. Automated affordability and income verification platforms are examples of specialised products that link straight to a customer’s bank account to:

- Verify your income in seconds rather than hours.

- Examine spending to ensure that the Consumer Duty-mandated affordability checks are accurate.

- Verify identity and account ownership while fortifying KYC procedures.

This eliminates the high costs of manual processing and significantly reduces the risk of fraud from forged documents.

3. Unify Due Diligence on a Single RegTech Platform

Establish a single, cohesive RegTech platform that serves as the basis for all KYC, AML, and fraud checks using data from Open Banking. You establish a single source of truth for every client by centralising this data. When AI-powered tools are added on top, they can reduce the number of false positives in transaction monitoring, freeing up your highly qualified analysts to work on cases that are truly high-risk.

4. Leverage Predictive Analytics with Real-Time Data

Give up battling fires. To find new compliance risks before they materialise, use predictive data models. The rich, real-time transactional data required to support these models is provided by Open Banking, greatly increasing their accuracy. This enables you to foresee possible consumer harm and proactively monitor for changes in a customer’s financial situation, which is crucial for managing modern regulations like the Consumer Duty.

5. Invest in Dynamic, User-Friendly Staff Training

Give up the yearly box-ticking exercise. Install ongoing, interesting training programmes that are incorporated into regular tasks. The risk of fines and the high expense of remediation are directly decreased by a knowledgeable, self-assured staff that knows how to use new technologies like Open Banking and makes fewer mistakes.

What is “Compliance-by-Design”, and how does it save money?

It embeds compliance from product conception. This saves money by preventing costly post-launch fixes, streamlining processes, and making compliance a foundational, efficient element.

Can technology replace human compliance teams?

No. Technology automates tasks, reduces false positives, and provides insights, empowering human teams to focus on complex cases, strategic oversight, and high-risk scenarios.

How Finexer Addresses Lender Concerns

| Lender Concern | How Finexer Helps | Key Outcome |

|---|---|---|

| High Manual Costs (staff, review time) | Automated verification with instant income, affordability, and identity checks. | Significant cost reduction and higher efficiency. |

| Complex Tech Landscape (multiple systems, vendors) | Unified regtech platform that centralises KYC, AML, and fraud checks. | Streamlined operations, lower tech spend, simpler integration. |

| Slow, Costly Due Diligence (onboarding friction) | Real-time, consent-driven access to secure financial data. | Faster onboarding, reduced cost per check, better customer experience. |

| Reactive Risk Management (missed threats) | Predictive analytics and dynamic monitoring to flag risks early. | Stronger compliance and fraud prevention with fewer penalties. |

Why Choose Finexer?

Harnessing open banking to its full potential requires a specialised platform. Finexer is an open banking API provider designed to help UK lenders master their lender compliance challenges.

We provide intelligent automation to directly address the high cost of compliance.

- Smart Affordability Engine: Our AI-powered tools deliver instant, FCA-compliant affordability assessments, cutting manual review time by over 90% and making compliance in a bank far more efficient.

- Unified Onboarding Platform: Finexer combines KYC, AML, and fraud checks into a single workflow. By using Open Banking, we reduce your reliance on multiple vendors, creating a faster, more cost-effective onboarding process.

- Dynamic Risk Monitoring: Our platform helps you meet ongoing consumer duty obligations, allowing you to proactively support customers showing signs of financial distress, a key part of modern lender compliance.

Get in touch with our team at Finexer to make the best use of open banking for your lending workflow!