Property management is under pressure. Rising operational costs, complex compliance rules, and tenant expectations are making rent collection and payment handling harder than ever. Traditional methods come with high fees and administrative drag, eating into margins and slowing down cash flow.

This is where digital property management payment software makes a difference. By shifting to open banking–powered solutions, property managers can cut transaction costs by up to 90% compared to card payments, speed up settlement, and strengthen tenant relationships. In fact, recent UK industry figures show that nearly 70% of property firms adopting digital payments report measurable cost savings within the first year.

In this blog, we’ll explore how proptech open banking tools are transforming property management payments—delivering faster, cheaper, and more secure transactions while helping firms reduce overhead and boost efficiency.

Present-day Cost Issues in UK Property Management

In the post-pandemic landscape, rising service charges, rent arrears, and cash flow issues further increase financial pressures. Inefficiencies in handling property management payments significantly impact profitability and staff productivity.

- Manual Payment Procedures: A large number of UK property managers continue to use manual payment procedures, which results in mistakes, delays, and more administrative work. The expenses related to property management payments are increased by this inefficiency.

- Fragmented Communication: The efficacy of digital property management is impacted by the confusion and delays that arise from the various channels of communication that exist between tenants, landlords, and management teams.

- Labour-intensive Reconciliation: Employees spend a lot of time manually balancing payments from various systems, which wastes time and raises the possibility of mistakes while also taxing the capabilities of property management payment software.

- Growing Service Fees: Cash flow and financial planning in property management are hampered by the rising service fees that property managers must deal with, which are frequently difficult to handle and communicate openly.

- Cash flow problems and rent arrears: Automated property management payment systems are necessary for prompt rent collection because late or missed payments impair cash flow, make managing rent arrears more difficult, and lower profitability.

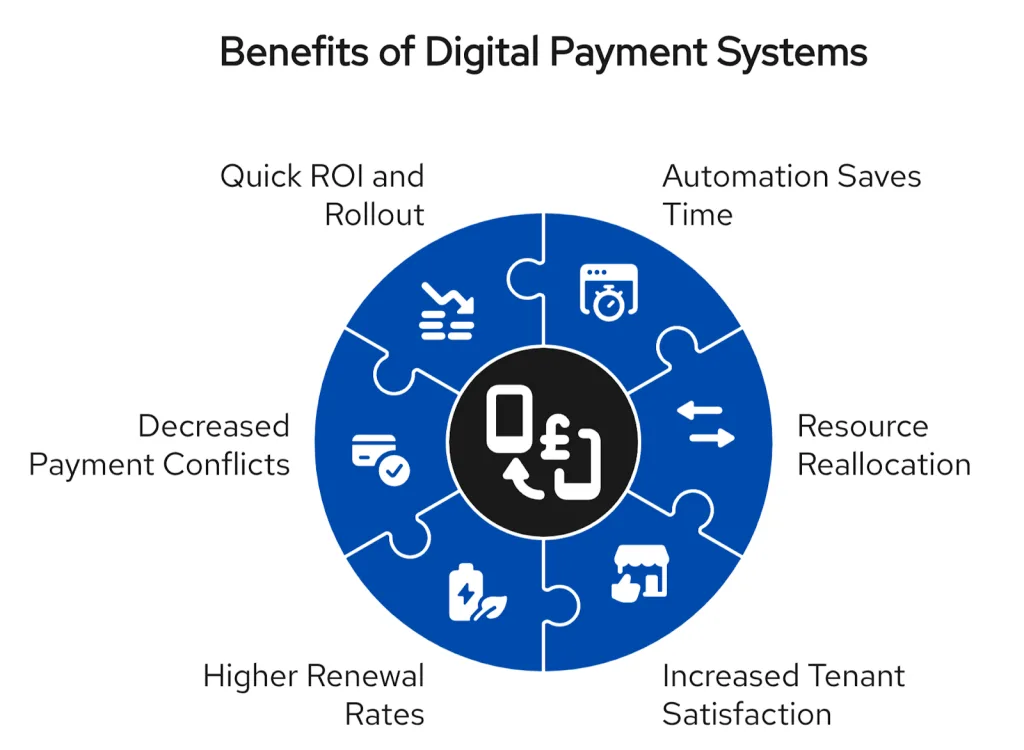

The Digital Payment Advantage: Measurable Benefits

1. Automation Saves Time

By eliminating the need for manual processing and reconciliation, property managers can save 10 to 15 hours every week by automating their property management payments. Teams are able to concentrate on higher-value tasks as a result, increasing overall operational effectiveness.

2. Possibilities for Resource Reallocation

Automation allows for the reallocation of valuable staff time and resources from administrative tasks to strategic projects. This change enhances workflow management for digital property management payments, resulting in increased productivity.

3. Increased Contentment of Tenants

Tenant satisfaction rates have increased by 15% to 20% as a result of their growing preference for digital payment methods. Offering safe, adaptable payment methods increases tenant loyalty and engagement, which is crucial for successful property management.

4. Higher Rates of Renewal

Improved tenant satisfaction lowers expenses associated with tenant turnover and new tenant acquisition by increasing lease renewals by 5–10%. This aids property managers in generating steady, predictable income streams.

5. Decreased Payment Conflicts and Collection Attempts

By minimising payment errors and disputes, digital payment platforms lower the costs associated with litigation or collections. All parties involved gain from quicker, more transparent transactions made possible by a streamlined property management payment software.

6 .Quick ROI and Rollout

Gained efficiencies and cost savings quickly offset the cost of implementing digital payment solutions. Adoption of digital payments is strategically necessary since the majority of UK real estate companies see a quick return on investment.

How does Open Banking reduce payment costs so significantly compared to cards?

It uses direct bank-to-bank transfers, bypassing expensive card networks. This cuts high percentage fees for huge potential savings.

Is open banking a secure way to handle tenant payments?

Yes. It’s highly secure and FCA regulated. Tenants authenticate directly with their own bank, so sensitive login details are never shared.

Open Banking and Proptech: The Revolution in Low-Cost Transactions

Open banking is one of the most impactful innovations for reducing transaction costs in property management. By enabling direct bank-to-bank transfers, property management solutions built on open banking can cut payment fees by as much as 90% compared to traditional card payments, which often carry high processing charges.

This benefit is demonstrated by Finexer’s model:

- Eliminating Fixed Costs: You only pay for what you use when you use a pay-per-successful-transaction model.

- Improving Security: Secure property payments are ensured by utilising PSD2 compliance and bank-level security protocols for all transactions, significantly lowering the risk of fraud.

- Enhancing Cash Flow: By removing the cash flow delays associated with conventional payment methods, real-time payment reconciliation ensures that funds settle instantly.

- Optimising Reach: You can provide a smooth digital experience for your whole portfolio since you are covered by almost all UK banks.

Checklist for Evaluating Property Management Payment Software

| Feature | Key Benefit |

|---|---|

| Real-Time Settlement | Instantly improves cash flow & financial accuracy. |

| Automated Reconciliation | Saves admin time & prevents costly data entry errors. |

| Versatile Payments | Boosts on-time payments by offering tenant convenience. |

| Mobile-First Interface | Maximises tenant usage with a simple phone experience. |

| Ironclad Security | Protects business & tenant data with FCA/PSD2 compliance. |

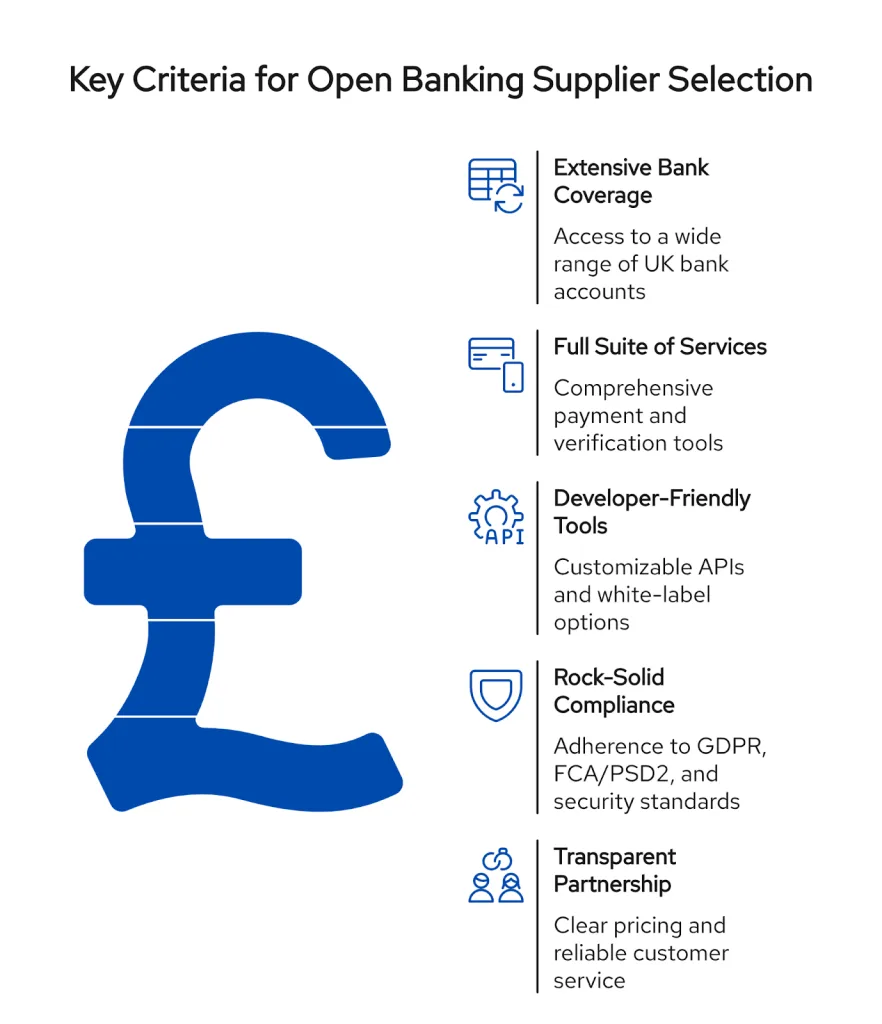

Selecting the Best Open Banking Supplier for Your Proptech

A successful transition to digital property management depends on choosing the right partner. Your selected supplier ought to provide:

- Extensive Bank Coverage: It is mandatory to have access to almost all personal and business bank accounts in the United Kingdom.

- Full Suite of Services: For a comprehensive payment toolkit, look for Payment Initiation Services (PIS) as well as Account Information Services (AIS) for verification.

- Developer-Friendly Tools: You can customise the property management payment software to fit your brand thanks to customisable APIs and white-label choices.

- Rock-Solid Compliance: Verify that the supplier complies with GDPR, is FCA/PSD2 authorised, and adheres to strict security guidelines.

- Transparent and Helpful Partnership: For a seamless experience, clear, usage-based pricing and dependable customer service are crucial.

These standards are met by Finexer, which provides a reliable and strong API solution made especially for the UK property management industry.

Your Digital Payment Roadmap: Getting Started Today

Are you prepared to switch? Take these actions:

- Evaluate: Examine your current procedures and determine the actual expenses associated with processing payments for property management.

- Select: For your property technology payments, pick a provider such as Finexer based on scalability, security features, and platform compatibility.

- Implement: To guarantee a seamless transition, roll out the new rent collection software in stages.

- Train & Communicate: Give your employees extensive training, and make sure your tenants understand the advantages of the new digital rent payment system.

- Monitor & Optimise: To gauge your success, keep an eye on important metrics like cost reductions, processing effectiveness, and tenant satisfaction.

Why Choose Finexer?

- Cut Costs: Save up to 90% on transaction fees compared to cards.

- Automate Workflow: Automate reconciliation and free up administrative time.

- Built for Property: Easily manage rent, service charges, and one-off payments.

- Secure & Trusted: Fully FCA/PSD2 authorised for bank-grade security.

Transform your property payments and cut costs—schedule your call with us today.

How difficult is it to integrate a solution like Finexer with my existing property management software?

Not at all. Modern APIs allow for seamless integration into your existing software, automating your workflow with minimal disruption.

What if my tenants are hesitant to use a new payment system?

Most tenants prefer the simplicity and enhanced security. Communicate that it’s faster than cards and uses the same trusted login as their bank app.

Your Next Step Towards a More Profitable Future

Adopting digital property management payment solutions powered by open banking is no longer just an option—it’s a competitive necessity for UK property managers.

Technology from providers like Finexer empowers you to significantly reduce administrative burdens, cut transaction costs, and build stronger tenant relationships through superior tenant payment solutions.

Begin your digital transformation today to unlock unparalleled efficiency and profitability in your property management business.

Ready to see how much you could save? Request your personalised plan with us today!