For most retailers, getting paid is the priority. But what happens when the money has to go the other way?

Refunds and withdrawals aren’t just a backend task—they directly impact customer satisfaction, operational efficiency, and how trustworthy your business appears at checkout. In a world where instant delivery and smooth returns are now expected, the refund process can’t afford to be an afterthought.

Yet, it often is. Many retailers focus on how easily they can take payments, without considering how easy it is to return them. And when refund requests start piling up or withdrawals take days to process, the cracks begin to show.

In this guide, we break down the real cost of refunds and withdrawals for retailers.

We’ll cover the difference between refunds and chargebacks, how long different methods take, and why the right refund system can be the difference between a repeat customer and a lost sale.

Keep Reading or jump to the section you want:

Refunds vs Chargebacks: What’s the Difference?

Let’s clear up a common point of confusion.

A refund is a payment the retailer willingly returns to a customer, often after a product is returned or a service is cancelled. It’s part of a retailer’s direct relationship with the buyer.

A chargeback, on the other hand, is a forced refund initiated by the customer’s bank or card provider when there’s a dispute. This typically happens when:

- The customer claims they didn’t receive the product

- The transaction was fraudulent

- The goods didn’t match the description

- The retailer refuses a refund

Chargebacks are a major pain point in retail payment systems. Not only do they result in lost revenue, but they often include admin fees and can impact your standing with payment providers. If your retail chargeback ratio climbs too high, you could face higher processing fees or even get banned from certain platforms.

That’s why it’s critical to process valid refunds quickly. The faster you act, the less likely a customer is to escalate the issue with their bank.

What Affects Refund Processing Times?

The speed and cost of processing refunds depends on a few key factors:

- The original payment method (card, wallet, bank transfer, etc.)

- The retailer’s own refund policy

- The speed of the return confirmation

- The payment processor or gateway involved

For example, a debit card refund might take up to 10 business days, while an Open Banking refund can settle in seconds, directly back to the customer’s bank account.

In most cases, customers expect refunds to be fast and frictionless. Delays create frustration and increase the chances of complaints or chargebacks.

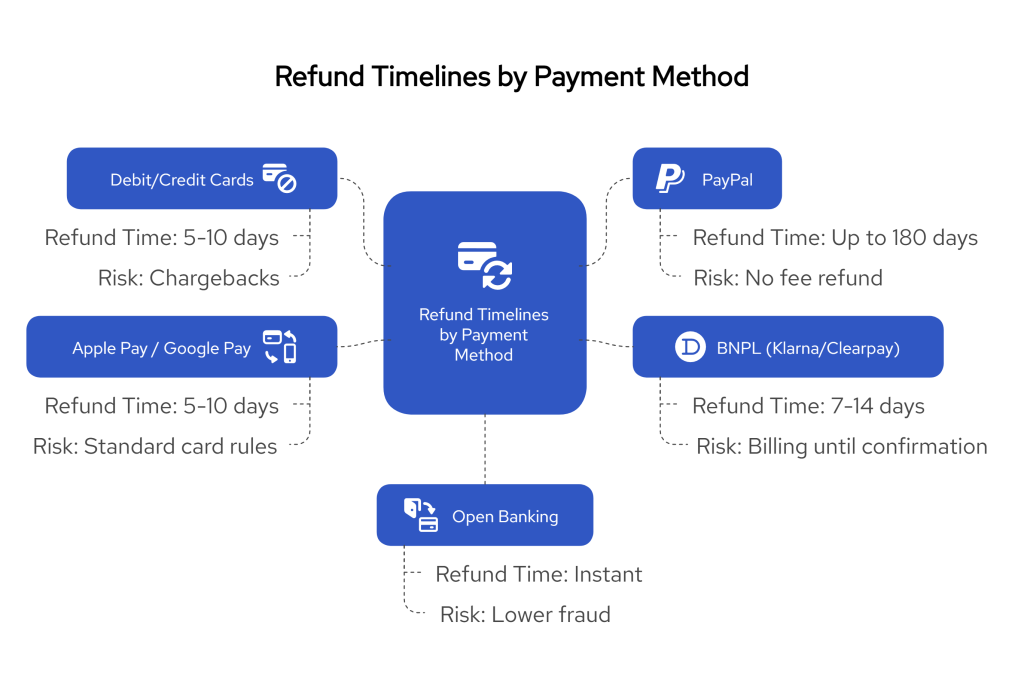

Refund Timelines by Payment Method

Here’s how long refunds typically take with various payment methods used in UK retail:

Debit and Credit Cards

- Refunds may take 5–10 working days

- Involves both the retailer’s acquiring bank and the customer’s issuing bank

- Chargeback risk is higher with card payments

- Admin costs and non-refundable fees are common

PayPal

- Customers can request a refund up to 180 days after purchase

- Funds are returned to the original PayPal balance or linked card

- Transaction fees are not refunded to the retailer

BNPL Providers (Klarna, Clearpay)

- Refunds are tied to the customer’s repayment plan

- Retailer must approve the refund first

- Completion time: 7–14 days, plus banking delays

- Customer may still be billed until refund is confirmed

Apple Pay / Google Pay

- Follows the same refund logic as the underlying card (debit or credit)

- No separate dispute resolution — goes through issuer

Open Banking Refunds

- Funds are sent directly to the customer’s bank account

- Settlement time: instant or near-instant

- Lower risk of disputes or fraud

- Ideal for retailers handling high volumes or time-sensitive refunds

Withdrawals for Retailers: How Are They Different from Refunds?

While refunds return money to customers, withdrawals involve retailers accessing their own funds, for example:

- Marketplace sellers withdrawing balances

- Retailers moving payouts from PSPs to bank accounts

- Multi-store businesses consolidating funds

Withdrawal delays often happen when:

- Payment providers batch settlements (e.g., once per day)

- Extra AML/KYC checks are triggered

- Payment gateways use multiple intermediaries

Retailers looking for faster cash flow often turn to providers with real-time bank transfers, which enable funds to land in their business account the same day, without manual steps.

Common Pain Points in Refunds and Withdrawals

Even the best-run retailers face challenges, including:

- Delayed refunds that frustrate customers and support teams

- Manual withdrawal processes that take hours to reconcile

- Inconsistent refund policies across different payment methods

- Chargeback abuse, especially with card payments

- Limited payout visibility, leading to accounting confusion

Addressing these requires both policy clarity and better tools — especially for businesses managing high transaction volumes or seasonal spikes.

How Open Banking Simplifies Refunds and Withdrawals

If you’re still relying on traditional card networks or waiting days for bank transfers to go through, it might be time to reconsider how your business handles refunds and withdrawals.

Modern retailers are increasingly turning to Open Banking because it helps them manage both incoming and outgoing payments faster — and more securely.

But what exactly does that mean for your day-to-day operations?

✅ Faster Refunds, Happier Customers

With Open Banking, refunds are processed through account-to-account (A2A) transfers — this means money goes directly from your business account back to the customer’s verified bank account.

Unlike card refunds, which can take 5 to 10 working days to settle, Open Banking refunds typically land within seconds or minutes. That means fewer support tickets, less customer frustration, and more trust in your brand after a return.

✅ No More Delays on Withdrawals

Retailers often experience delays when moving funds from their payment processor to their business bank account. Open Banking-enabled platforms can cut that waiting time down significantly by offering real-time or same-day withdrawals.

Whether you’re a marketplace seller withdrawing sales revenue or a store reconciling end-of-day payments, Open Banking ensures your money isn’t stuck in a holding account for days.

✅ Lower Costs Compared to Cards

Every card transaction, including refunds, usually involves multiple fees. From interchange fees to processing charges, these costs eat into your margins.

Open Banking reduces these costs by cutting out the card networks entirely. With A2A payments, your transactions route directly between bank accounts, often at a fraction of the cost.

✅ Better Protection Against Fraud and Refund Abuse

Refund fraud is a growing issue — especially when funds are requested to be sent to a different account than the one originally used.

Open Banking addresses this risk with bank account verification. You always know who you’re paying and where the money’s going. This helps protect against impersonation, stolen card use, and refund scams.

✅ Easier Reconciliation and Record-Keeping

With A2A payments, each transaction comes with a clear reference, matched to the original order. That means no more chasing missing data or reconciling vague payment entries.

Retailers gain better visibility over both inbound and outbound payment flows, making accounting and cash flow tracking far easier, especially during busy periods.

Why Finexer Might Be the Right Fit for Your Refunds and Withdrawals

If your current setup makes refunds feel like a chore, or you’re tired of waiting days to withdraw your own funds, it might be time to explore a better way.

Finexer is built specifically for UK-based businesses that need speed, reliability, and control when it comes to both incoming and outgoing payments.

Here’s what makes Finexer a strong choice for retailers handling refunds and withdrawals:

✅ Instant Refunds via Open Banking

With Finexer, you can issue account-to-account refunds in real time. The money lands directly in your customer’s verified UK bank account — no card networks, no delays.

✅ Same-Day Withdrawals Without Extra Layers

Finexer helps you move your own funds fast. Whether you’re paying suppliers, settling payouts, or moving money into your main account, you don’t have to wait 2–3 business days for access.

✅ Usage-Based Pricing with No Monthly Minimums

Unlike providers that bundle in hidden fees or require fixed commitments, Finexer uses a transparent, usage-based model, so you only pay for what you use. There are no monthly minimums, setup fees, or surprise deductions.

✅ Account Verification to Prevent Refund Abuse

Every refund request is routed back to the original verified account. This helps prevent fraud, chargebacks, and misrouted funds, especially useful when dealing with higher-value orders or regulated sectors.

✅ Built for UK Businesses from Day One

Finexer connects to 99% of UK banks and is authorised by the FCA. You don’t need to deal with cross-border features or pay for services you won’t use.

✅ Unified Dashboard for Full Payment Visibility

Refunds, withdrawals, payouts — all in one place. The Finexer dashboard gives you real-time insight into your transaction flow, helping you reconcile quickly and act faster when something needs attention.

Whether you’re an online retailer, marketplace operator, or a subscription-based business, Finexer is designed to make refunds and withdrawals as seamless as taking a payment.

Can Open Banking really speed up refunds?

Yes. With Open Banking refunds, money is sent directly from your business account to the customer’s verified bank account. These account-to-account (A2A) transfers often settle in seconds, making them much faster than card-based refunds.

Is it safe to use Open Banking for withdrawals and refunds?

Absolutely. Open Banking in the UK is regulated by the FCA and uses strong customer authentication (SCA). With features like account verification, it also helps reduce refund fraud and ensure funds are sent to the right place.

How does Finexer help with refunds and withdrawals?

Finexer offers instant refunds using Open Banking, along with same-day withdrawals to UK bank accounts. It also includes a unified dashboard, verified account payouts, and usage-based pricing — ideal for UK retailers looking to simplify payment operations.

Can I partially refund a transaction?

Yes, most providers allow partial refunds — but this depends on the payment method and the provider’s system. With account-to-account payments, partial refunds can be issued directly back to the verified payer in real time.

How can I reconcile refunds and withdrawals more easily?

Choose a platform that gives you access to real-time dashboards and detailed transaction metadata. With Finexer, for instance, every refund and withdrawal is logged with clear references, making it easier to match payments with orders during accounting.

Looking for a Refund Processor? Try Finexer! Schedule your free demo and get a 14-day Trial by Finexer 🙂