Introduction

Every year, businesses across the UK lose a staggering £28 billion to payment delays, locking up cash that could fuel growth and innovation. Picture this: a small business owner hustling to keep the lights on, juggling supplier payments, payroll, and overdue invoices—all while waiting weeks for a critical payment to come through. Frustrating? Absolutely. Unavoidable? Not anymore.

Late payments don’t just disrupt cash flow; they cripple ambition and innovation. You’re not alone if you’ve ever faced the stress of chasing payments or struggling with outdated systems. But what if there was a way to take back control—one that’s simpler, faster, and more flexible? That’s where Request to Pay (RTP) steps in, revolutionising how businesses and customers manage payments.

In this guide, we’ll discuss:

- What Request to Pay is and why it matters.

- How the Request to Pay process works.

- Practical benefits and applications for businesses and consumers.

Whether you’re a business owner, a professional in financial services, or simply curious about modern payment methods, this guide will provide you with everything you need to understand Request to Pay.

What is Request to Pay?

Request to Pay is a structured way for businesses to ask another party for payment. Think of it as a digital invoice, but it gives the payer more control instead of being limited by rigid schedules or manual processes. The payer can decide when, how, and even if they want to fulfil the request while ensuring the process is clear and secure.

For example, let’s say a utility company sends you a bill through Request to Pay. Instead of the amount being directly debited from your account, you can choose to pay it immediately, decline it, or schedule it for a later date. This flexibility benefits both you and the company, as payments become more predictable and disputes are minimised.

Why Was Request to Pay Introduced?

Traditional payment methods, like direct debits or standing orders, come with fixed rules and limited flexibility. Many businesses face inefficiencies, including:

- Long settlement times that impact cash flow.

- Errors in payment reconciliation due to manual processes.

- High administrative costs for handling disputes and late payments.

Request to Pay was introduced to address these challenges by:

- Giving payers control over their payment schedules.

- Offering businesses real-time updates to reduce delays.

- Lowering costs by automating payment reconciliation and reducing errors.

A 2023 survey found that 23% of UK businesses struggle with payment reconciliation, leading to cash flow issues and delayed decision-making. Request to Pay helps streamline these processes, making life easier for both businesses and customers.

How Does Request to Pay Differ from Traditional Payments?

| Feature | Request to Pay | Direct Debit/Invoices |

|---|---|---|

| Control for Payer | High (payer decides) | Low (fixed schedule) |

| Real-Time Tracking | Available | Limited |

| Ease of Use | Flexible and adaptable | Manual intervention |

| Costs | Lower | Higher |

For businesses and customers, Request to Pay provides a tailored alternative that works for varying needs, while traditional systems remain a good option for predictable, recurring payments.

The Process

How Does Request to Pay Work?

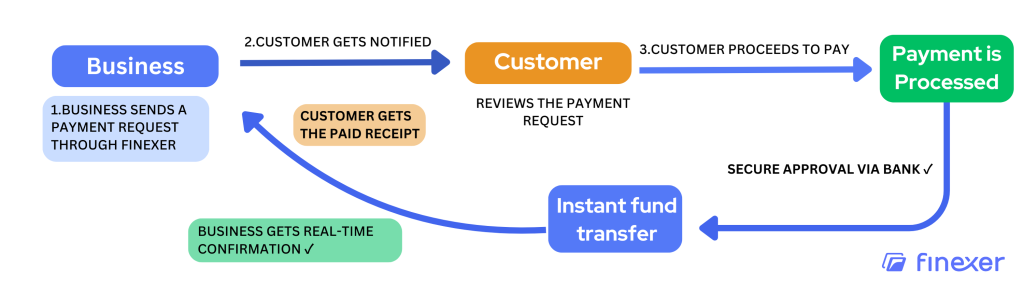

The Request to Pay process is designed to make transactions simple, secure, and efficient for both businesses and customers. Here’s a detailed breakdown:

1.Payment Request Initiation:

- The business initiates a payment request using either a dashboard interface or API integration.

- Essential details included in the request are:

- Payment amount.

- Due date.

- Customer identification or reference.

- Businesses can further tailor the request type to suit their needs:

- Single Payment: A fixed amount to be paid once.

- Multiple Payments: Recurring fixed amounts paid over a set period.

- Variable Payment: Flexible amounts where payers input the desired amount (e.g., for donations).

- This flexibility ensures businesses cater to different use cases and customer preferences.

2.Notification to the Payer:

- The notification medium depends on the payee’s configuration during the development phase. Options include:

- Email notifications.

- SMS messages.

- Phone-based notifications.

- QR codes embedded on invoices.

- Direct payment links shared via messaging apps or platforms.

- Embedded payment buttons on websites or apps.

- These notifications are implemented using webhook (API) integrations, enabling businesses to offer multiple options to customers, enhancing convenience.

3.Payment Accept or Decline:

- Upon receiving the payment request, the payer reviews the details such as amount, due date, and any attached notes.

- The payer is presented with options:

- Accept: Confirm and proceed with the payment.

- Decline: Reject the payment request if deemed invalid or unnecessary.

Note: The functionality of the payment link is controlled by the payee’s settings during setup. For example:

- Should the link be single-use or reusable?

- Can the payer re-click the link to initiate multiple payments?

- Is the amount fixed, or can it be modified?

- How long before the link expires?

These configurations give businesses granular control over payment terms.

4.Payment Execution:

- Once the payer accepts the request, they will authenticate and complete the transaction through their bank’s secure customer authentication.

- Payments are executed using Faster Payment rails, ensuring instant settlement of funds to the payee’s account.

- Open Banking standards ensure transactions are secure and adhere to compliance regulations.

5.Confirmation and Reconciliation:

- Both payer and payee receive real-time notifications confirming the payment’s status.

- For businesses, the dashboard automatically reconciles the payment, updating records without requiring manual intervention.

- This automation reduces administrative overhead and minimises errors commonly associated with manual reconciliation.

How It Works for Businesses

Imagine a small retail business, “Urban Wear Co.,” that needs to collect payment for a bulk order. Here’s how they utilise Request to Pay:

- The owner logs into the Request to Pay dashboard and creates a payment link for the customer.

- The payment link is customised to allow a single-use transaction with a fixed amount.

- The link is shared with the customer via email, ensuring convenience and clarity.

- The customer receives the email, reviews the payment details, and confirms the transaction.

- The funds are instantly transferred to Urban Wear Co.’s account, and both parties receive confirmation.

Ready to see how you can integrate request to Pay feature? → schedule a quick demonstration with our technical team

Ready to see how easily you can integrate request to Pay feature?

Schedule a quick demonstration and get 14 days free trial!

How It Works for Customers

Here’s how the process flows for customers or payers:

- Click or Scan: Customers access the payment link through an email, SMS, or by scanning a QR code.

- Review Details: The payment request is displayed, including amount, due date, and any notes.

- Select Bank: The customer chooses their bank from the options provided and proceeds to authenticate.

- Authenticate: The customer is redirected to their banking app to securely authorise the payment.

- Payment Confirmation: Once authorised, the transaction is completed, and the customer receives instant confirmation.

Why Is This Process Beneficial?

- Reduced Costs: Businesses avoid hefty card network fees, saving up to 90% on payment processing costs.

- Instant Funds Transfer: Payments settle in seconds, helping businesses manage cash flow effectively.

- Security: Open Banking authentication eliminates risks of fraud and chargebacks.

- Customisation: Payees can define parameters for payment links, tailoring them to specific business needs.

- Automation: The entire process, from request creation to reconciliation, is automated, saving businesses significant time and effort.

Benefits and Applications

1.Cost Savings

Traditional payment methods often come with substantial fees, especially when processing credit card transactions. By adopting Request to Pay (RTP) through Open Banking solutions, businesses can significantly reduce these expenses. For instance, Nordea Bank reported a remarkable 50% decrease in payment processing costs after implementing Open Banking APIs. Learn more

Strategic Insight

Higher-value transactions are now more secure than ever. Open Banking payments have fundamentally enhanced payment security by reducing chargebacks and fraud by an impressive

2.Improved Cash Flow:

Efficient cash flow management is crucial for the sustainability of any business. With RTP, payments are settled instantly into the payee’s account, eliminating the delays associated with traditional banking processes. The adoption of real-time payment systems, which often incorporate RTP functionalities, has been growing rapidly. In December 2022 alone, there were 7.7 million Open Banking payments in the UK, contributing to a total of 68 million payments for the year. This represents a growth of significantly more than 100% year-on-year, indicating a shift towards faster payment settlements. source

3.Enhanced Security:

Security concerns are paramount in financial transactions. Request to Pay leverages Open Banking authentication, providing a secure framework for customers to approve payments. This method reduces the risk of fraud, as transactions are authenticated through trusted banking channels, and eliminates chargebacks, which can be both costly and time-consuming for businesses to address.

4.Operational Efficiency:

Manual reconciliation of payments can be labor-intensive and prone to errors. RTP automates this process, ensuring that payments are accurately matched to invoices in real-time. This automation reduces administrative workload, minimises human errors, and allows staff to focus on strategic initiatives rather than routine tasks, thereby enhancing overall productivity. Research indicates that businesses incorporating Open Banking into their payment systems have reported substantial time savings, spending an average of 44.5 hours per month on finance tasks compared to over 57 hours for those not using Open Banking. This equates to a saving of more than 150 hours annually, enhancing operational efficiency. Source

5.Customisable Payment Options:

Every business has unique payment requirements. RTP offers the flexibility to define payment terms that align with specific operational needs. Whether it’s setting up single-use payment links, facilitating recurring payments, or allowing variable amounts, businesses can tailor the payment experience to suit their services and customer preferences, enhancing satisfaction and loyalty.

Applications Across Industries

For years, industries have relied on rigid and often outdated payment systems that slow down operations and inflate costs. Request to Pay (RTP) has emerged as a transformative solution, breaking away from traditional practices to offer businesses greater flexibility, transparency, and control. Whether you’re running a fintech startup, managing accounts in an ERP system, or navigating tight margins as an SMB, RTP has the potential to simplify and elevate your financial processes in profound ways.

📚 Learn more about how Finexer supports Startups

Tailored Advantages for Each Industry

For Fintech Startups:

Request to Pay empowers fintech companies to deliver seamless payment solutions through open banking channels. Companies can enhance their service offerings with:

- Multi-platform compatibility that ensures smooth payment processing across different banking systems

- Flexible payment scheduling that lets customers choose payment dates and methods that work best for their financial situation

- Real-time payment status updates that keep all parties informed throughout the transaction journey

- Detailed transaction reporting that provides clear visibility into payment flows and business patterns

📚 Top Open banking providers for Fintech

For Accounting and ERP Services:

Request to Pay transforms traditional accounting processes through standardised open banking protocols. Service providers can offer enhanced capabilities through:

- Streamlined exception management that quickly identifies and resolves payment issues

- Automated payment matching that connects incoming payments with outstanding invoices instantly

- Real-time cash flow monitoring that enables precise financial planning and forecasting

- Comprehensive transaction tracking that maintains clear records for audit and compliance

📚 Learn more about Open banking use cases for Accounting & ERP

For Small and Medium Businesses (SMBs):

Request to Pay brings enterprise-level banking capabilities to SMBs through simple, accessible interfaces. Businesses gain advantage through:

- Customisable payment options that accommodate various customer preferences and business needs

- Optimised cash flow management that aligns payment timing with business operations

- Automated payment collection that reduces payment delays while maintaining professional relationships

- Clear payment insights that reveal patterns in customer payment behavior

📚 Learn more about payment services for SMB’s

The Opportunity to Lead

The future of business payments belongs to those who recognise that Request to Pay is more than a technological upgrade – it’s a strategic advantage. As organisations move away from traditional payment methods, early adopters of Request to Pay will help define industry standards and shape customer expectations. This shift goes beyond simply modernising transactions; it represents a fundamental change in how businesses build financial relationships with their customers and partners.

By embracing Request to Pay today, businesses position themselves at the forefront of financial innovation, ready to deliver the speed, transparency, and flexibility that modern commerce demands. As the financial landscape continues to evolve, these pioneers will not just participate in the transformation – they will lead it, setting new benchmarks for efficiency and customer service in their respective industries. The question isn’t whether to adopt a Request to Pay but how quickly organisations can harness its potential to stay ahead in an increasingly dynamic business environment.

Try Request to pay today for free! Schedule your demo and get a free 14 days trial 🙂