Spreadsheets have long been part of day-to-day life in accounting firms. They’re familiar, flexible, and easy to set up for a variety of tasks from tracking deadlines to managing client records. But just because something is widely used doesn’t mean it’s the right tool for the job.

Many firms still rely heavily on manual accounting processes, using spreadsheets to manage workflows, track communications, and handle financial data. While this might seem practical on the surface, it often comes with hidden costs: wasted time, mistakes that slip through the cracks, and challenges with team collaboration. Over time, these issues add up, affecting client satisfaction, compliance, and ultimately, the firm’s bottom line.

In this blog, we’ll explore how spreadsheet-based workflows hold firms back, how much it’s really costing, and why it may be time to rethink the tools accountants depend on every day.

Keep Reading or Jump to the Section You’re looking for:

The Financial Impact of Manual Accounting Processes

Time is one of the most valuable resources in any accounting firm. But when firms rely on manual accounting processes to handle everyday tasks, that time quickly disappears into activities that could easily be automated or improved.

A recent report by Silverfin revealed that UK accounting firms lose approximately £5.3 billion each year due to outdated workflows and systems. This figure represents nearly 16 per cent of their potential revenue, driven largely by time-consuming processes and unnecessary admin. Much of this loss can be traced back to spreadsheet-based workflows that require constant manual updates, back-and-forth communication, and error-checking.

On average, accountants are losing over 1 hour every day on low-value work. That equates to thousands of pounds per year, per employee. Across an entire firm, this not only affects profitability but also limits the ability to grow or take on more clients without increasing staff costs.

Manual processes are also less scalable. As your client base expands, the risk of errors increases, and so does the burden on your team. Spreadsheets may feel comfortable, but they’re rarely sustainable when firms are juggling complex demands, tight deadlines, and regulatory compliance.

📚 Automate Bookkeeping with Open Banking API

Risks of Decentralised Data and Workflow Gaps

When accounting firms rely on spreadsheets to manage workflows, client communication, and financial records, they often create more complexity than they solve. Spreadsheets are rarely built for collaboration, and the data inside them is only as current as the last time someone remembered to update it.

One major concern is data security in accounting. Spreadsheets stored on personal desktops, shared via email, or synced through third-party cloud folders can expose sensitive financial information to unnecessary risk. There’s no audit trail, limited access control, and often no way to know who changed what or when.

This decentralised approach also causes workflow gaps. Tasks are duplicated, deadlines are missed, and small errors snowball into client dissatisfaction or compliance issues. According to Financial Cents, many firms using spreadsheets find it difficult to maintain a consistent, centralised view of client work, especially during busy periods.

Relying on manual accounting processes for document management and task tracking might seem manageable when the team is small or the client base is limited. But over time, this lack of structure makes it harder to scale services or adapt to new regulatory expectations.

A Smarter Way to Work: Moving Beyond Manual Tools

Spreadsheets may feel like a natural fit for accountants, but they aren’t built for the demands of modern firms. As client expectations grow and reporting standards tighten, more firms are realising that their existing setup is holding them back.

Modern tools built specifically for accounting workflows offer more reliable ways to handle client data, track progress, and stay compliant. Instead of relying on disconnected files and manual updates, firms can use integrated platforms that keep everything in one place and automatically pull data from trusted sources.

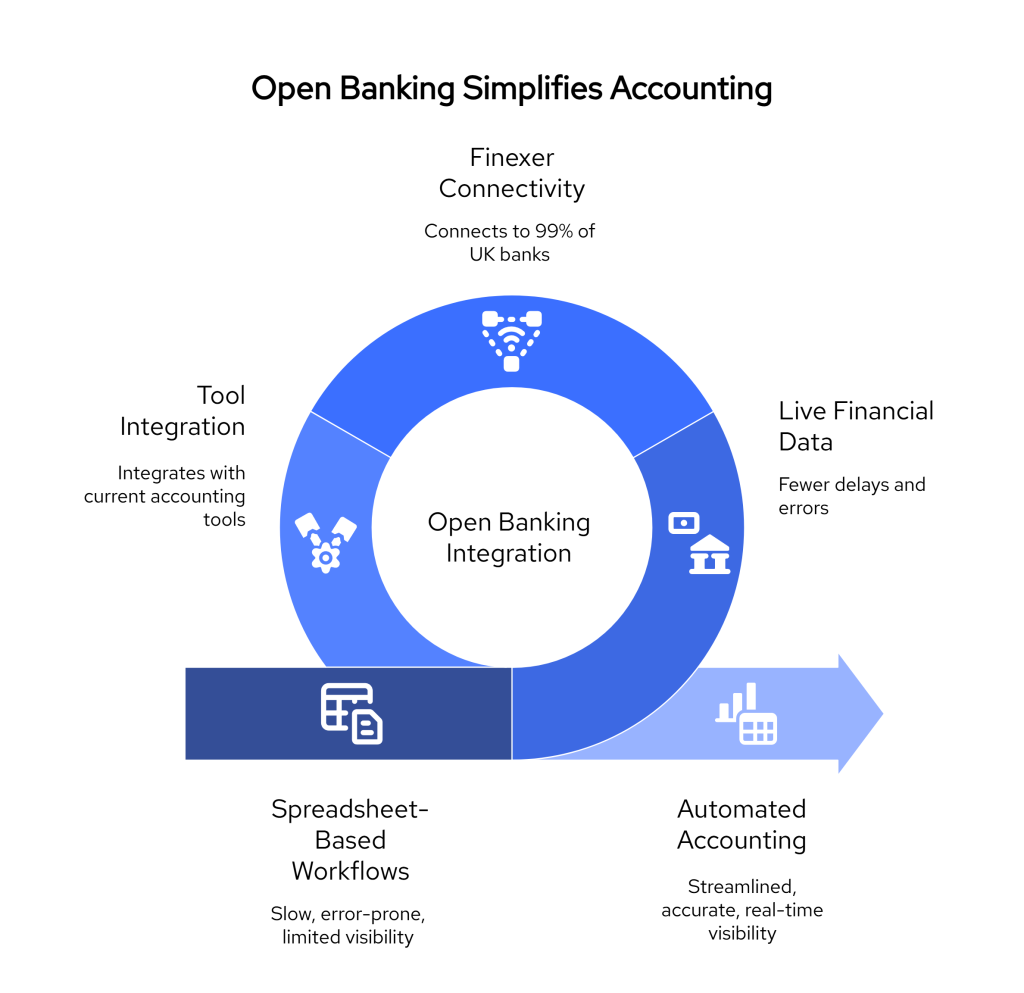

One of the most practical advances in recent years has been Open Banking integration. Rather than downloading statements, copying numbers into ledgers, or chasing clients for documents, Open Banking allows you to access real-time bank transactions directly from 99% of UK financial institutions — all with client permission.

This not only reduces the manual work involved in reconciliation and reporting, but also improves accuracy. Fewer gaps in data mean fewer surprises during tax season or audits. More importantly, it removes the guesswork that often comes with spreadsheets.

Manual accounting processes were never designed to handle live data. With Open Banking, firms finally have access to the financial information they need, when they need it, without relying on clients to provide it.

Why Accounting Firms Choose Finexer

Finexer is designed to help accounting firms move beyond the limits of spreadsheet-based workflows by giving them access to smarter, real-time financial tools. With Finexer’s Open Banking integration, you can securely connect to 99% of UK banks, allowing instant access to live transaction data, without chasing clients or manually importing files.

Whether you’re handling reconciliations, generating reports, or onboarding new clients, Finexer reduces the admin and eliminates data silos. Everything is centralised, secure, and fully traceable, giving your team more time to focus on billable work and delivering value to clients.

Key Benefits:

- Automate bank feeds and eliminate manual data entry

- Secure document sharing and permission-based access controls

- Real-time visibility into client transactions and account activity

- Scalable workflows designed for growing firms

With Finexer, your team can start working in a system built for the speed and scale of modern accounting.

Get Started

See why Accounting Firms trust Finexer for secure, compliant, and tailored Open Banking solutions

Wrapping Up

Spreadsheets have served accounting firms for decades, but today’s demands call for more reliable tools. The hidden costs of manual accounting processes, lost time, errors, and limited visibility continue to grow as firms handle more clients, data, and compliance tasks.

Moving away from spreadsheet-based workflows doesn’t mean disrupting everything. It’s about reducing the steps that drain resources and replacing them with smarter, secure alternatives. With Finexer Open Banking, firms can access live bank data, reduce dependency on clients for documents, and spend more time on the work that actually supports growth.

If you’re still relying on spreadsheets to manage your accounting workflows, it might be time to look at what that’s really costing you.

Why are spreadsheets still widely used by accounting firms?

Many firms use spreadsheets because they’re familiar and low-cost. However, as client demands and compliance requirements grow, these tools often create more problems than they solve.

What’s the biggest risk of spreadsheet-based workflows?

The lack of data security and version control. Spreadsheets shared over email or stored locally can expose client data and lead to compliance gaps.

How does Finexer improve manual accounting processes?

Finexer uses Open Banking integration to fetch live transaction data from banks. This removes the need for manual uploads, reducing delays and improving record accuracy.

Do I need to switch from my current software to use Finexer?

No. Finexer works alongside your existing workflow, including spreadsheets or bridging tools, making it easy to stay compliant without changing everything.

Is Finexer only for large accounting firms?

Not at all. Finexer uses flexible, usage-based pricing, making it suitable for firms of all sizes, including those serving seasonal or smaller clients.

Stop letting manual processes hold your firm back! Connect with Finexer to pull live bank data and keep your workflows on track 🙂