Suspense account reduction is one of the most overlooked opportunities for improving financial accuracy and closing books faster. For many accounting teams, suspense entries grow month after month due to delays in data availability and incomplete transaction references.

What begins as a temporary holding account often turns into a recurring backlog filled with unallocated transactions that require manual investigation.

This is where bank reconciliation automation changes the game. By integrating live bank feeds accounting directly into your reconciliation workflow, finance teams can match transactions in near real time, reducing suspense entries before they pile up.

The key is real-time bank data. When your system has instant access to cleared transactions, it can apply intelligent matching rules and allocate entries accurately, often without human intervention.

Instead of chasing gaps between bank records and your general ledger, you can prevent them from forming in the first place.

How to Achieve Suspense Account Reduction Using Live Bank Data and Automation

Reducing suspense account entries doesn’t require a complete system overhaul. With the right setup, you can start resolving unallocated transactions in real time using live data and automation. Here’s how to do it:

Step 1: Connect Real-Time Bank Data with Open Banking

Start by replacing static bank statement imports with real-time bank data. This is made possible through Open Banking, which enables secure access to live bank transactions across most UK financial institutions.

Platforms like Finexer offer direct connectivity to over 99% of UK banks, allowing you to sync cleared transactions the moment they appear. With no file uploads or delays, your reconciliation system always stays current.

Step 2: Apply Matching Rules and Logic

Once data is flowing, your reconciliation software should use rule-based matching logic to automatically clear entries. Set up conditions based on:

- Amount thresholds

- Counterparty names

- Payment references

- Expected settlement dates

With automation in place, the system assigns the majority of incoming transactions to the correct GL accounts, dramatically reducing the suspense balance.

Step 3: Surface Exceptions Only

Even the best ruleset won’t catch everything, and that’s fine. The goal is to surface only the 10% to 20% of entries that truly require review. These are often:

- Unmatched client deposits

- Split payments

- Unknown charges

By limiting human review to edge cases, finance teams free up time and reduce the risk of errors in manual reconciliation.

Step 4: Track Suspense Account Reduction Over Time

It’s not just about setup. Measuring the impact is critical.

Start with your current baseline suspense balance, then monitor:

- Number of unallocated transactions per month

- Time taken to fully clear suspense accounts

- Total suspense value at period-end

A well-implemented system, supported by bank reconciliation automation, can cut suspense account volume by up to 80% within the first few months.

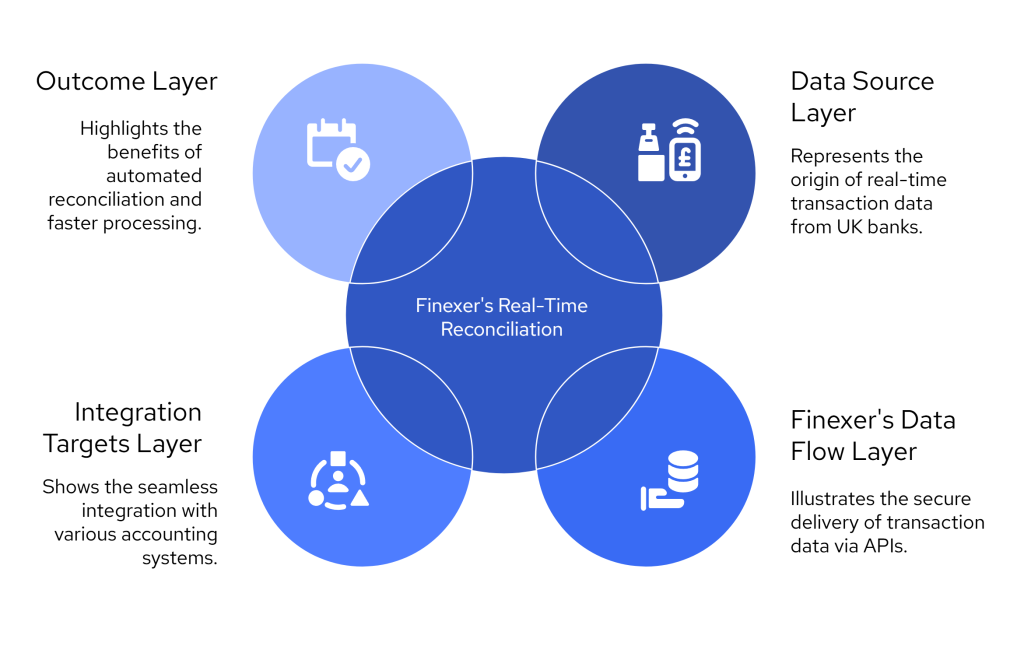

How Finexer Supports Real-Time Reconciliation with Open Banking APIs

For UK finance teams looking to eliminate unallocated transactions and reduce suspense balances, the right infrastructure is essential. That’s where Finexer comes in, providing the tools to automate reconciliation using secure, real-time data.

Built on Open Banking Infrastructure

Finexer connects directly to over 99% of UK banks through regulated Open Banking APIs. These connections deliver continuous real-time bank data, ensuring your system receives cleared transactions as soon as they’re available, not days later.

This enables live updates across all accounts, so finance teams can respond faster and reconcile more accurately.

Live Bank Feeds That Integrate with Your Accounting Platform

Finexer provides Open Banking-powered live bank feeds that integrate directly with the accounting and ERP platforms you already use. Whether your team works in Xero, QuickBooks, Sage, or a custom system, Finexer streams real-time transaction-level data into your reconciliation process.

This allows finance teams to reduce delays, improve data accuracy, and maintain continuous visibility over incoming and outgoing transactions, all without manual uploads or batch imports.

Automated Matching and Reconciliation

Using configurable rules and smart matching logic, Finexer enables:

- Auto-allocation of incoming payments

- Instant identification of unmatched or split transactions

- Daily reconciliation without manual imports

You can reduce your suspense account activity significantly by letting the system handle the bulk of transaction matching and only flagging entries that truly require attention.

No Developer Overhead

Finexer is built for finance teams, not developers. With a no-code setup and sandbox support, you can get started quickly without waiting on technical resources.

Whether you’re a reconciliation specialist or a management accountant, Finexer provides the speed and accuracy needed to reduce suspense items without extra workload.

Get Started

Connect today and see why businesses trust Finexer for secure, compliant, and tailored open banking solutions.

A Smarter Way to Reduce Suspense Accounts

Suspense account reduction doesn’t have to be a manual, month-end clean-up job. With the right systems in place, finance teams can proactively eliminate unallocated transactions before they disrupt reporting.

By using live bank feeds accounting powered by Open Banking, you gain access to real-time bank data that feeds directly into your reconciliation workflow. And when combined with bank reconciliation automation, most transactions are matched automatically, reducing risk, time, and effort.

If your suspense balances are growing and your close cycle is slowing down, it may be time to switch from reactive clearing to real-time control.

What is a suspense account in accounting?

A suspense account is a temporary holding account used when the purpose or classification of a transaction is unclear at the time of entry. It’s commonly used during bank reconciliation to store unallocated transactions until they can be reviewed and correctly assigned to the appropriate general ledger account.

What causes suspense account balances to increase in accounting?

Suspense account balances usually grow due to delays in transaction identification, missing payment references, or bank data not syncing in real time. Without timely reconciliation, these entries remain unallocated and build up over time.

How can I reduce unallocated transactions in my reconciliation process?

You can reduce unallocated transactions by integrating live bank feeds into your accounting system and using automated matching logic. Real-time visibility helps match payments as they clear, reducing suspense items significantly.

What is bank reconciliation automation and how does it work?

Bank reconciliation automation uses software to match transactions from your bank feed with accounting records automatically. It applies pre-defined rules to allocate entries, flags unmatched items, and reduces manual effort in clearing suspense accounts.

Can Open Banking help reduce suspense accounts in the UK?

Yes, Open Banking allows secure access to real-time bank transactions across UK banks. Platforms like Finexer use Open Banking APIs to deliver live data and automate reconciliation, helping teams reduce suspense accounts.

Ready to reduce suspense accounts with real-time reconciliation? Connect Finexer to your accounting system!