Tag: Open Banking

Best Data Enrichment Tools for UK Fintech & Accounting Scaleups (2026 Guide)

Compare the best data enrichment tools for UK fintech and accounting scaleups. Evaluate transaction enrichment, merchant identification, and Open Banking integration capabilities from top providers.

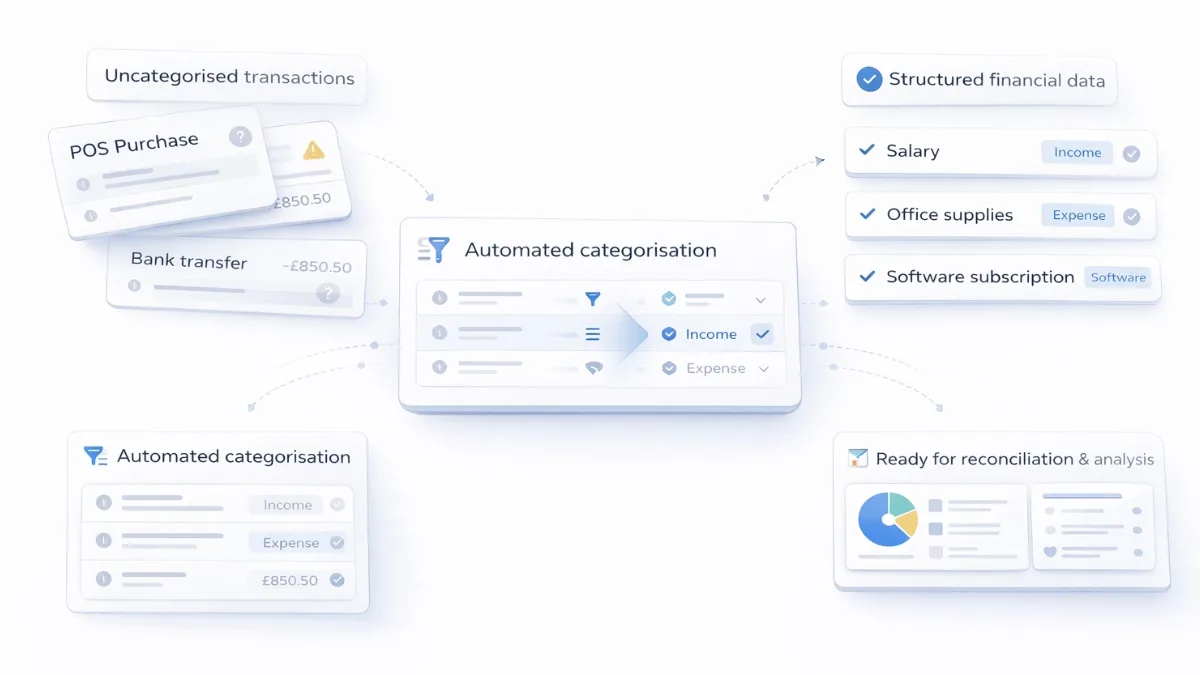

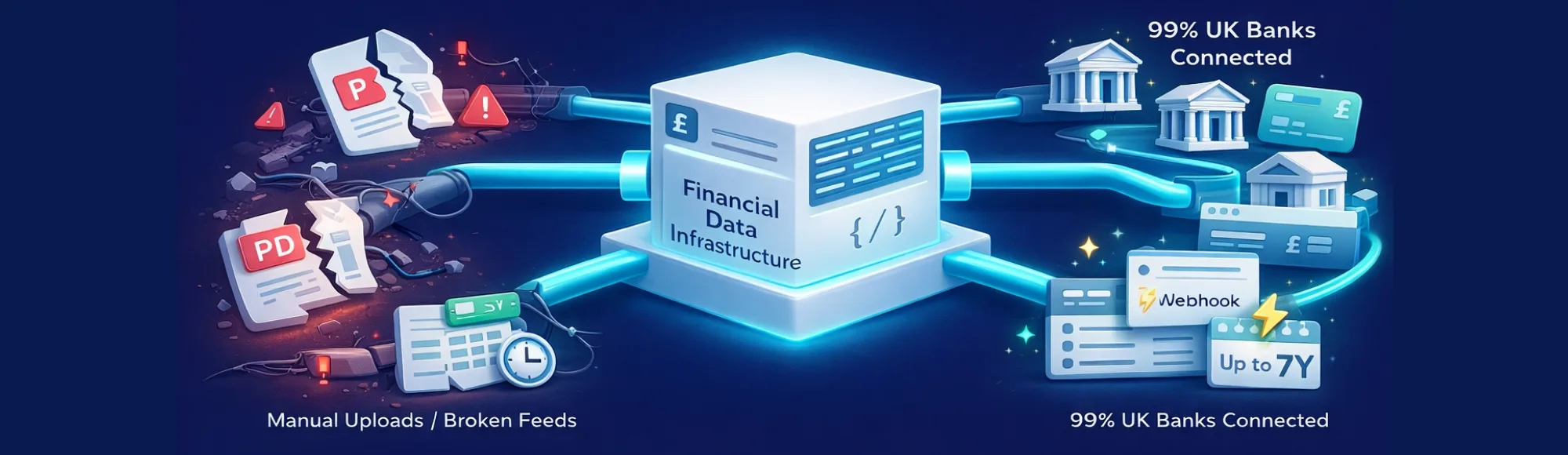

Automated Financial Data Categorisation for UK Platforms

Automated financial data categorisation enables UK platforms to access structured bank transaction data automatically. Platforms integrate open banking APIs for categorised merchant details and spending classifications supporting automated reconciliation and financial analysis without manual processing.

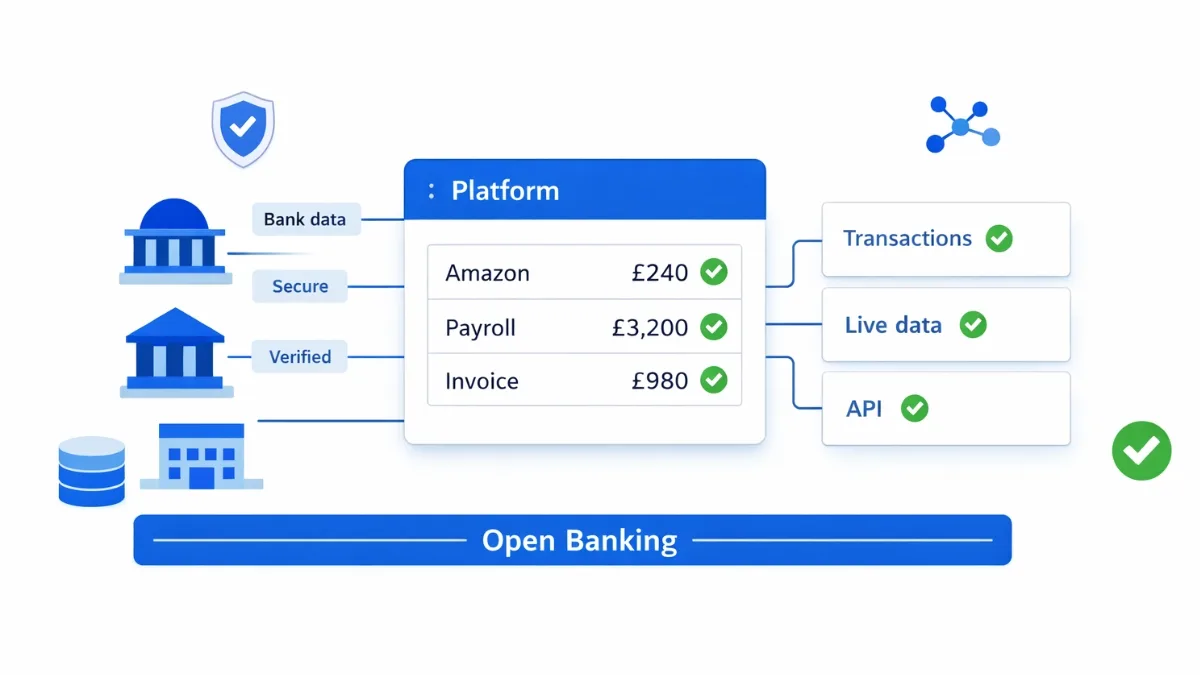

Open Banking Financial Data: UK Platform Integration Checklist

Open banking financial data integration requires reliable infrastructure. UK platforms evaluate bank coverage, feed reliability, and consent management when choosing providers. Finexer provides FCA-authorised connectivity with structured transaction feeds.

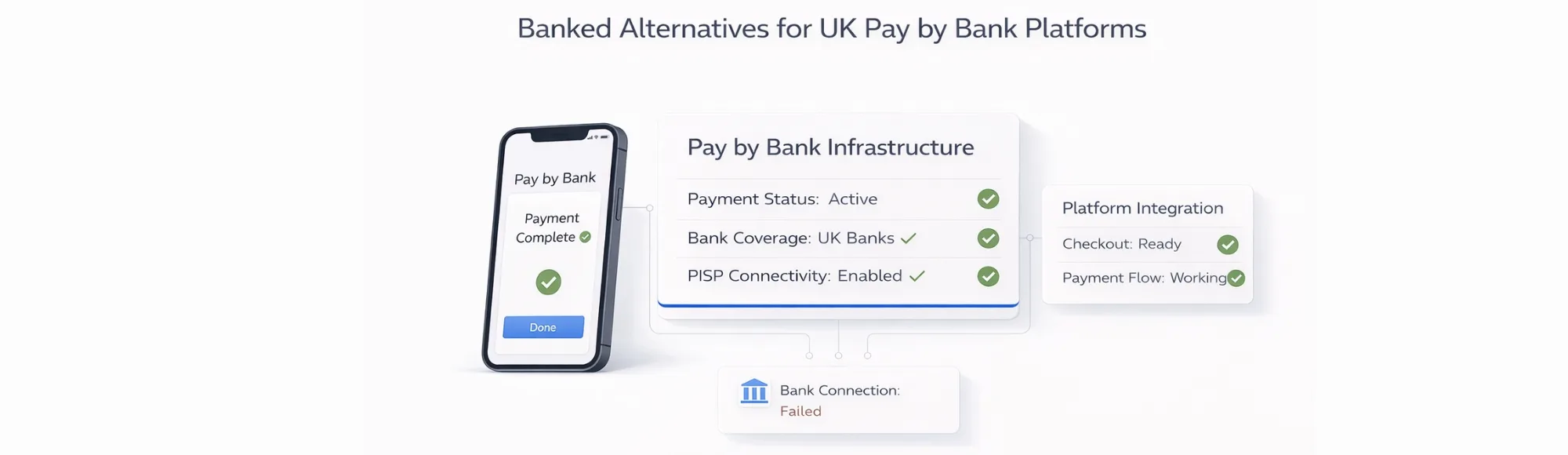

Top 6 Banked Alternatives for UK Pay by Bank Platforms

Compare 6 Banked alternatives for UK Pay by Bank platforms. Evaluate FCA-authorised PISP infrastructure options with stable connectivity and transparent pricing.

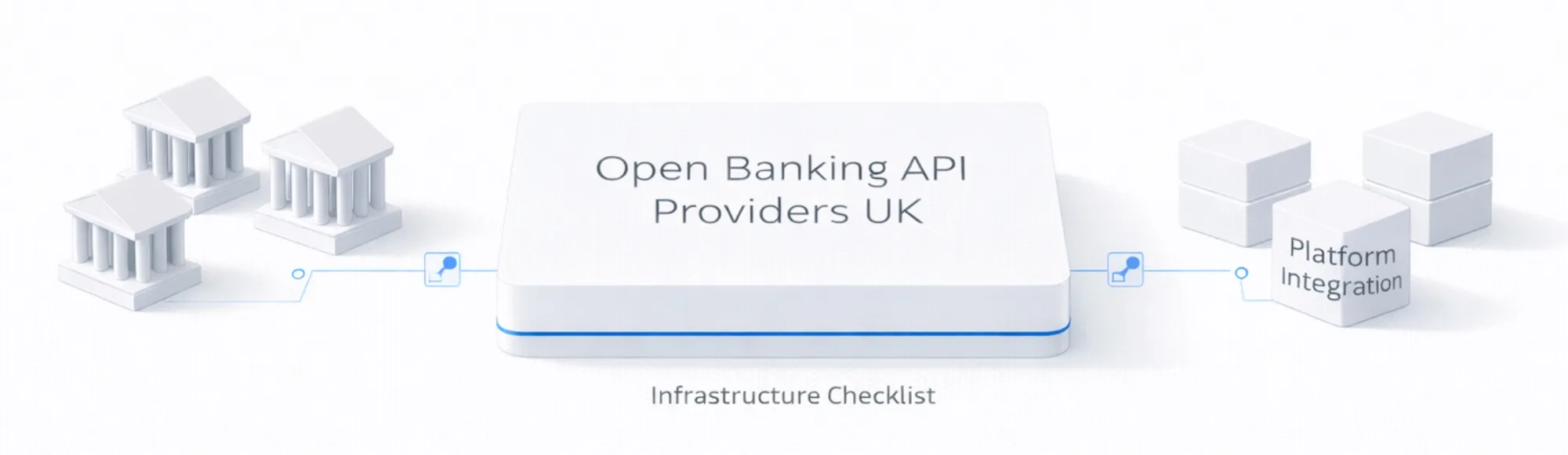

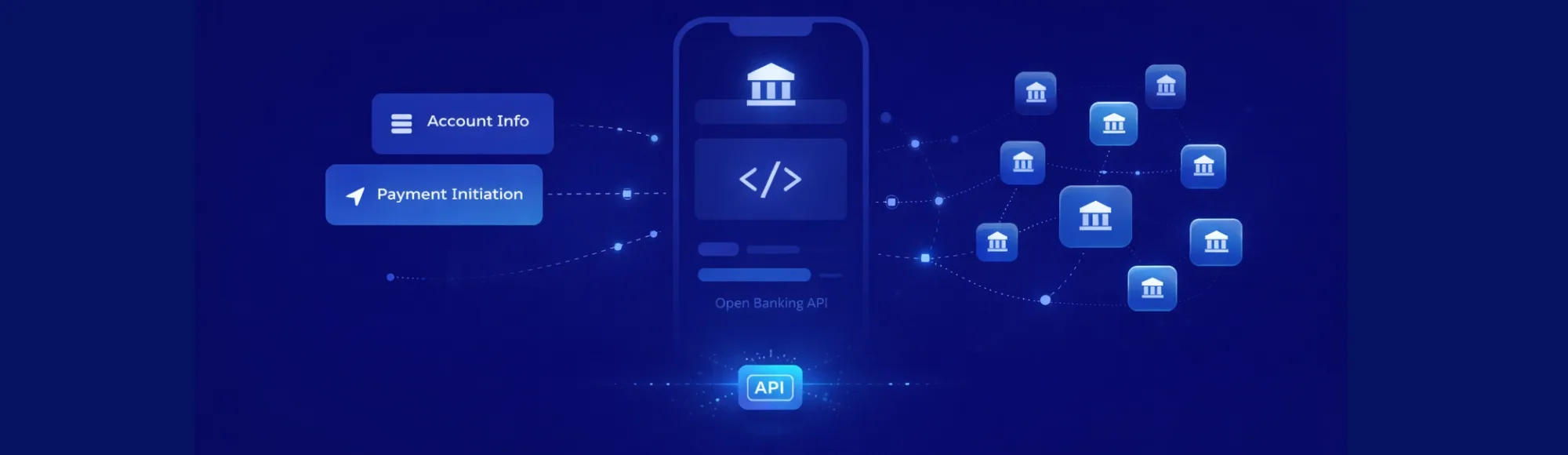

Best Open Banking API Providers UK (2026 Buyer Checklist)

Compare open banking API providers UK with infrastructure-focused checklist. Evaluate coverage, pricing, deployment beyond feature lists. FCA-authorised connectivity for platforms.

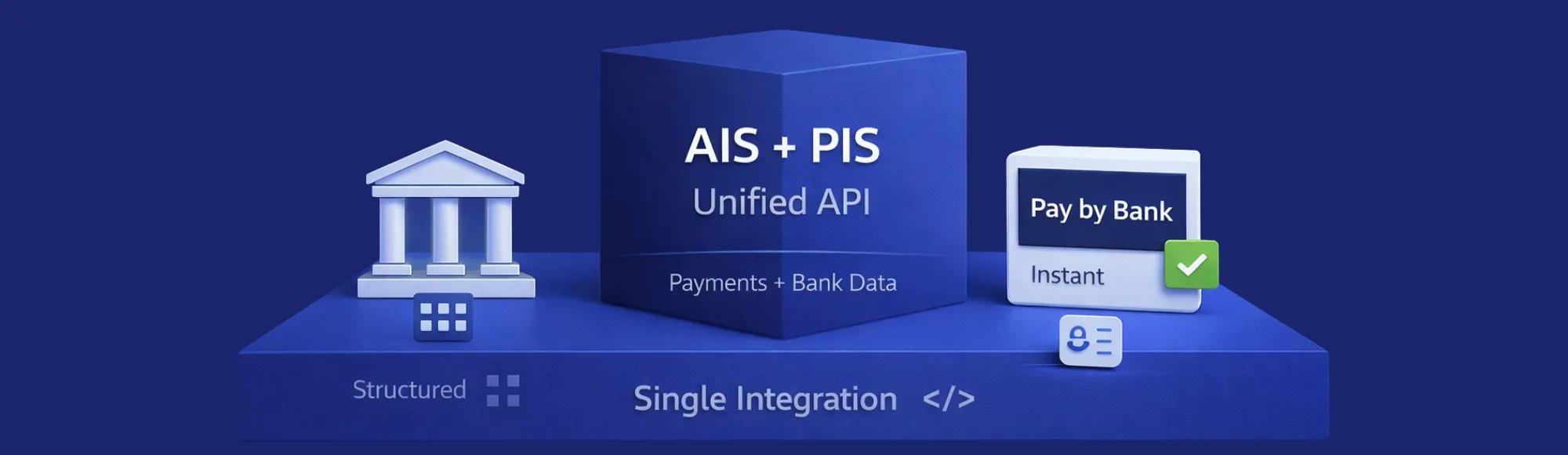

API Financial Services for Platforms Building Payments & Open Banking

API financial services with AIS+PIS in one integration. Compare Open Banking providers for UK platforms. Evaluate payments and bank data infrastructure now.

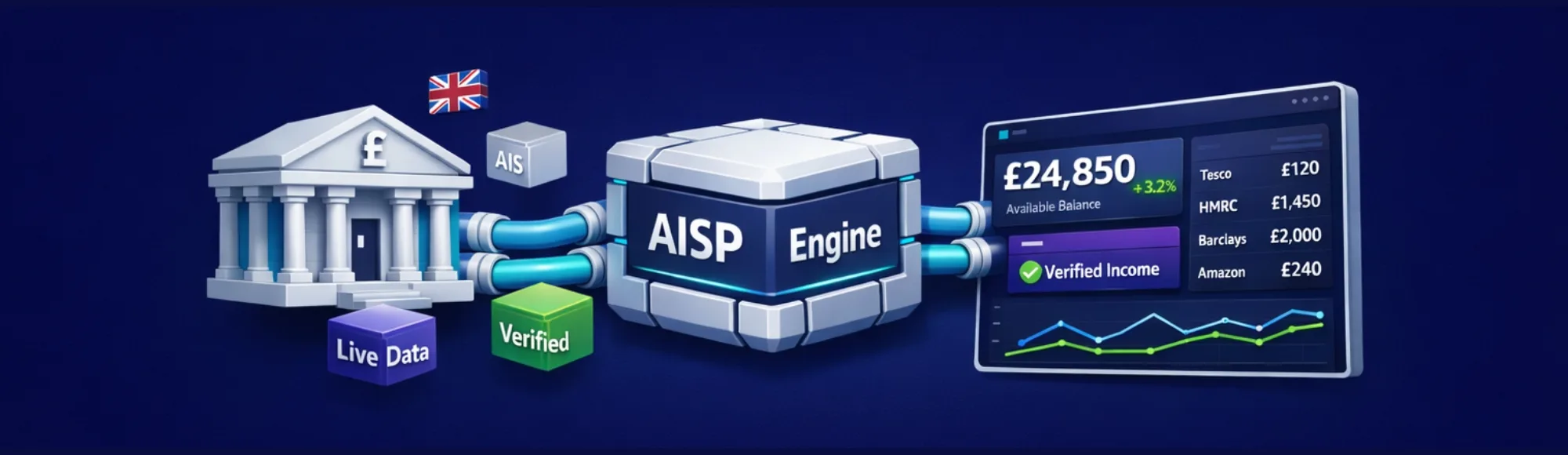

AISP Open Banking: Build Faster AIS Banking Access for Your Platform

aunch faster with AISP Open Banking in the UK. Access verified AIS banking data from 99% of banks. Build verification & aggregation. Book a demo.

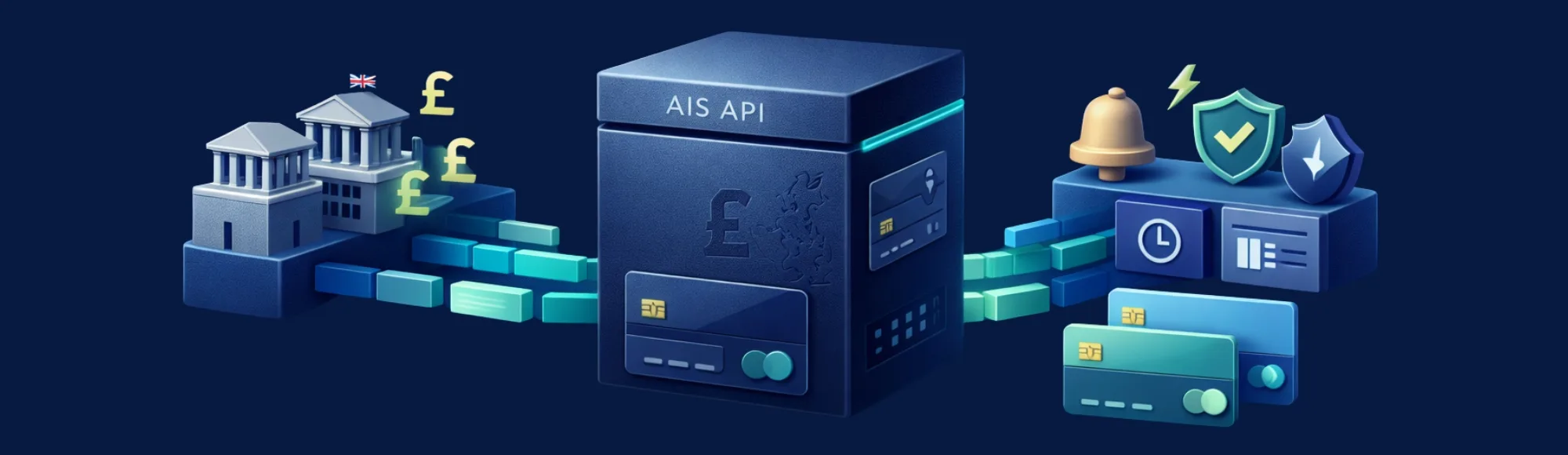

AIS API for SaaS & Fintech Platforms in the UK

Access verified UK bank data with a reliable AIS API. Build income checks, reconciliation & aggregation fast. Book a demo with Finexer today.

Financial Data Aggregation for Platforms: What Actually Matters

Broken feeds and manual uploads hold your product back. Finexer’s financial data aggregation delivers structured UK bank data via Open Banking APIs. Book a demo.

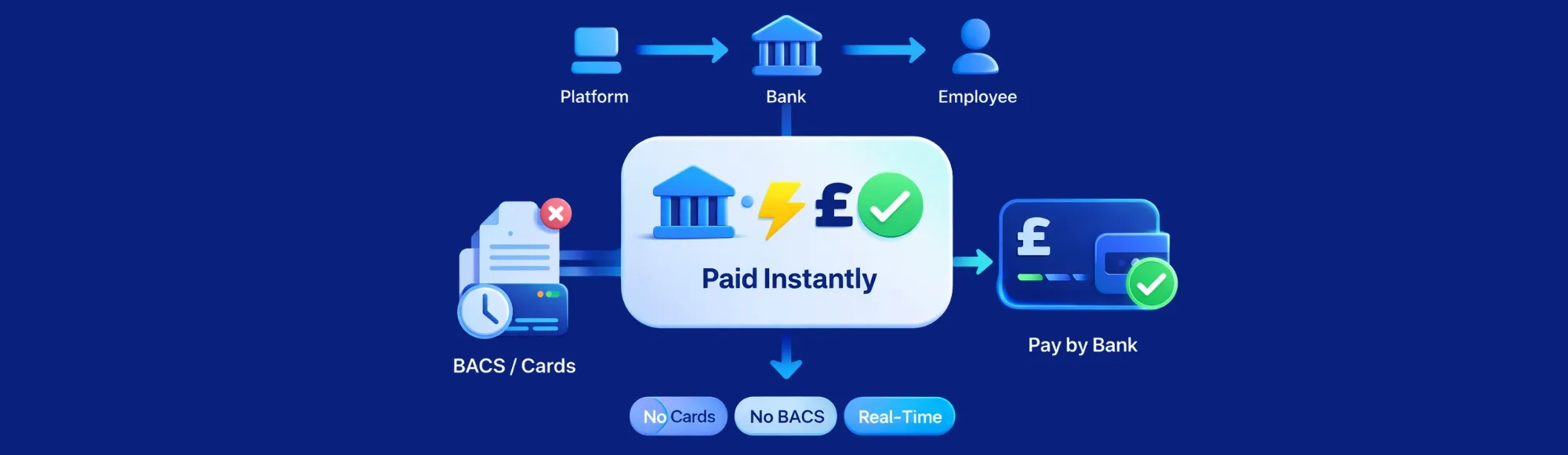

Open Banking Payroll Disbursement APIs: How Fintechs & Payroll Platforms Enable Real-Time Salary Payouts Without Cards or BACS

Open banking payroll disbursement API for fintechs & payroll platforms. Enable real-time salary payouts without cards or BACS-99% UK coverage, instant settlement.

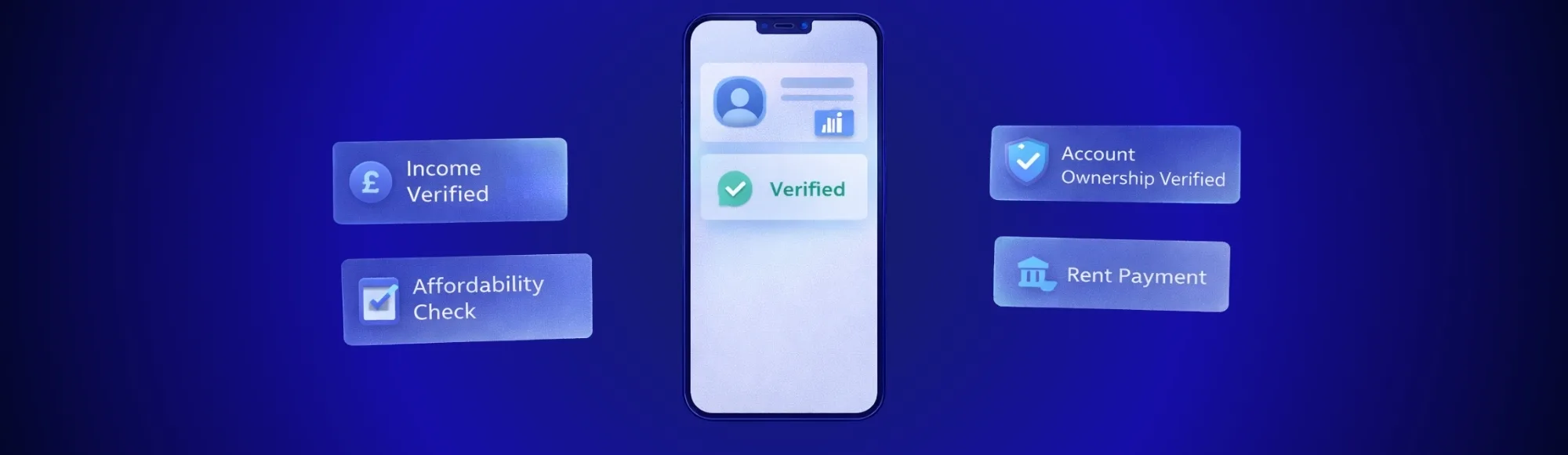

AML Checks for Estate Agents Using Open Banking Data

AML checks for estate agents using open banking data. Verify bank accounts, funds & financial history in minutes. Reduce manual onboarding and fraud.

Instant Payroll Payment Software: How Businesses Can Pay Employees in Real Time Without Bank Delay

Instant payroll payment software for UK businesses. Pay employees in real time, eliminate 3-day bank delays & improve retention with 99% UK bank coverage.

Law Firm Payment Automation for UK Firms: Automating Client Payments End-to-End

Law firm payment automation for UK firms. Automate client payments end-to-end, reduce admin by 90% & eliminate delays with 99% UK bank coverage from Finexer.

Onfido: Detailed Pricing Guide for Businesses in 2026

Get Verified with Finexer Connect with 99% of UK Banks and Scale Your Business without Limits Try Now The information about Onfido Pricing in this blog was sourced from publicly available materials on Jan 2026. Please note that details may be subject to change. We will guide you through: What is Onfido? Onfido is…

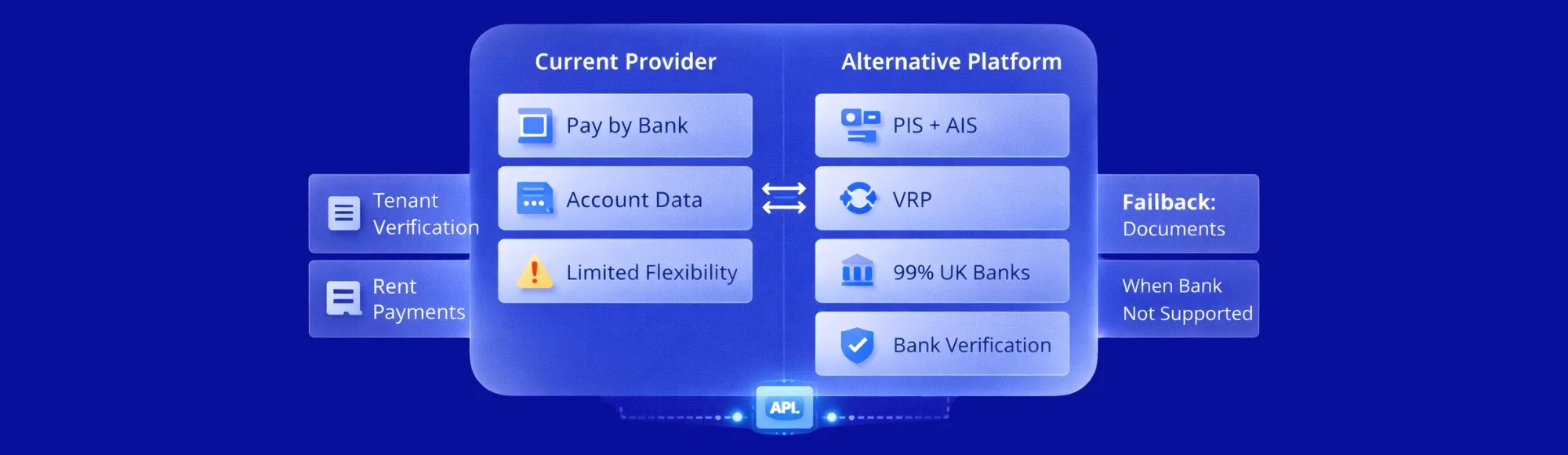

Switching from GoCardless Open Banking: UK Alternatives for Payments & Data APIs

Looking for GoCardless alternatives? Switch to Finexer for 99% UK bank coverage, VRP support, and complete migration assistance in 3-5 weeks

Open Banking for Renting: How Letting Agents Automate Tenant Affordability & Rent Payments

How letting agents use open banking for renting to automate tenant checks. Verify affordability faster with Finexer’s real-time bank data access.

Top 10 Open Banking API Examples That Power Real AIS Products in the UK

Discover 10 open banking API examples powering real UK businesses. Compare providers, bank coverage & integration times. Reduce costs by 90% with Finexer.

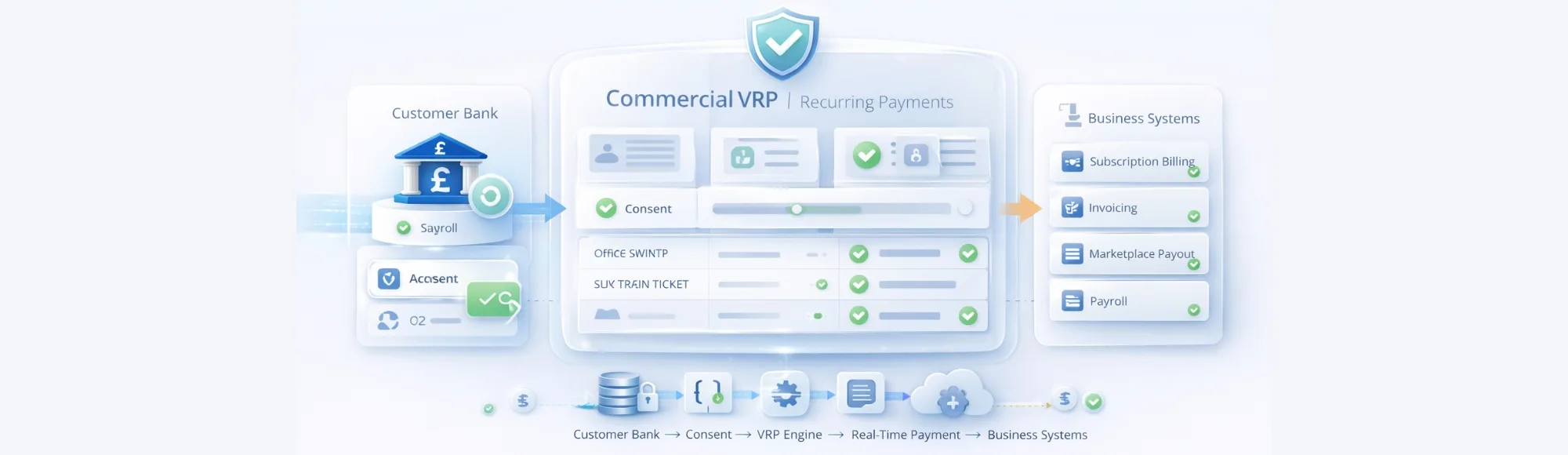

FCA Confirms Commercial VRP: What UK Businesses Must Prepare For

FCA confirms commercial variable recurring payments in the UK. Learn how to prepare your payment infrastructure and reduce costs with Finexer’s VRP platform.

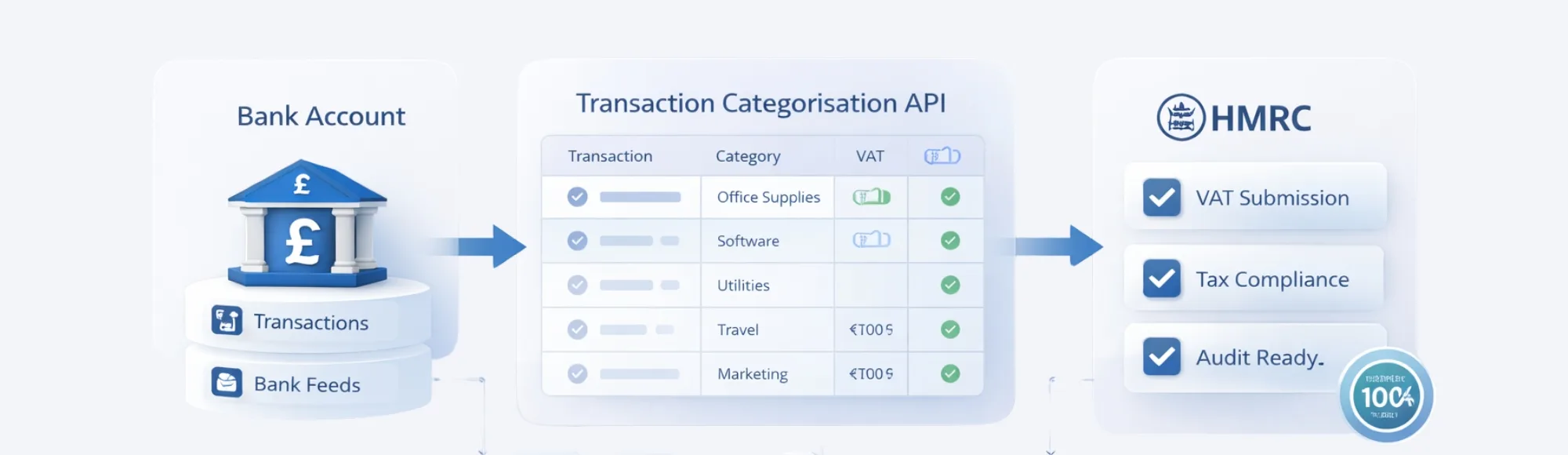

Transaction Categorisation API for Audit-Ready Bookkeeping: How UK Firms Reduce VAT Errors

See why transaction categorisation APIs outperform manual processing with faster setup, lower VAT errors, and automated audit trails.

A2A Payments in the UK: Buyer Checklist for Choosing an Open Banking Provider

Learn how to choose the right A2A payments provider in the UK with this open banking buyer checklist covering bank coverage, pricing, success rates, and speed.

How Far Back Do Source of Funds Checks Go in the UK? Complete Guide

UK source of funds checks usually cover 3–6 months of history. Learn what affects lookback periods and how Finexer automates faster, compliant verification.

Bank Account Verification in the UK: How to Confirm Customer Details Instantly (Without Manual Checks)

Confirm customer bank details in seconds, cut failed payments, and speed up onboarding with Finexer’s instant bank account verification.

Top 5 Refund Management Platforms Built for High-Volume Retailers

Get Paid with Finexer Connect with 99% of UK Banks and Scale Your Business without Limits Try Now Handling refunds at scale isn’t just a back-office task — for high-volume retailers, it can make or break the customer experience. In a world where return rates can reach up to 30% in ecommerce, having a clear,…

Free MTD Software for Landlords: What’s Actually Free and What Can Cost You Penalties

Free MTD software for landlords often misses key features. Discover what’s truly free, what triggers penalties, and how to stay compliant.

MTD Bridging Software: What UK Businesses Must Check Before Choosing One

Struggling with HMRC VAT submissions? Learn how to choose the right MTD bridging software to avoid errors, ensure compliance, and submit VAT smoothly.

Bank Feed API for UK Accounting SaaS: What to Build First for Faster Growth

Build bank feed APIs for UK accounting SaaS that actually work. Get 99% UK bank coverage and deploy faster with Finexer’s regulated platform.

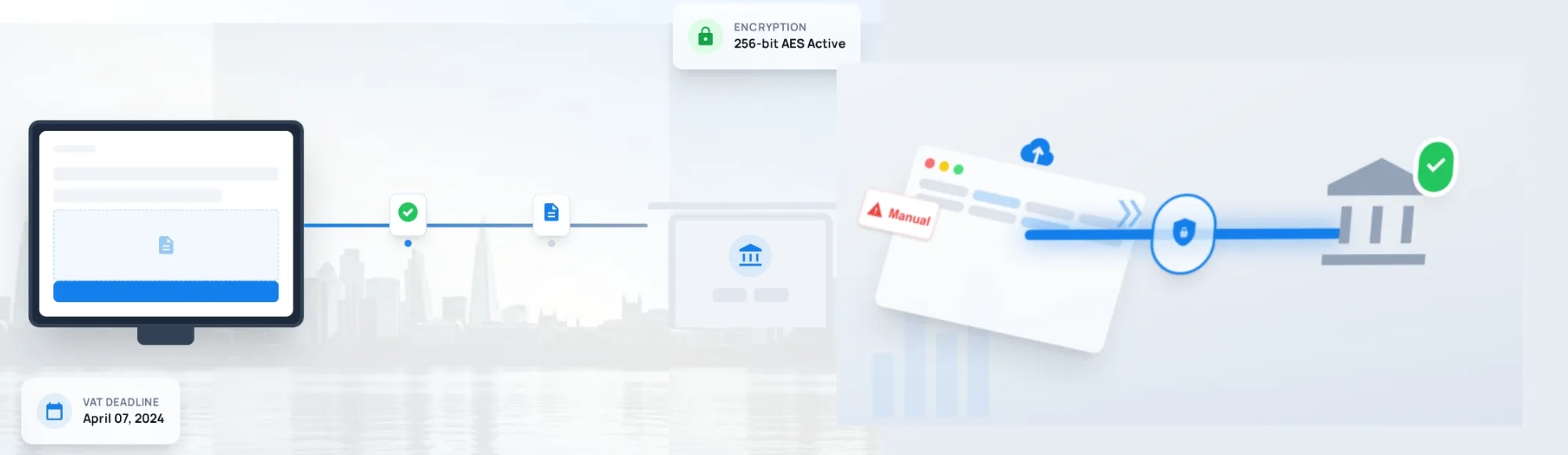

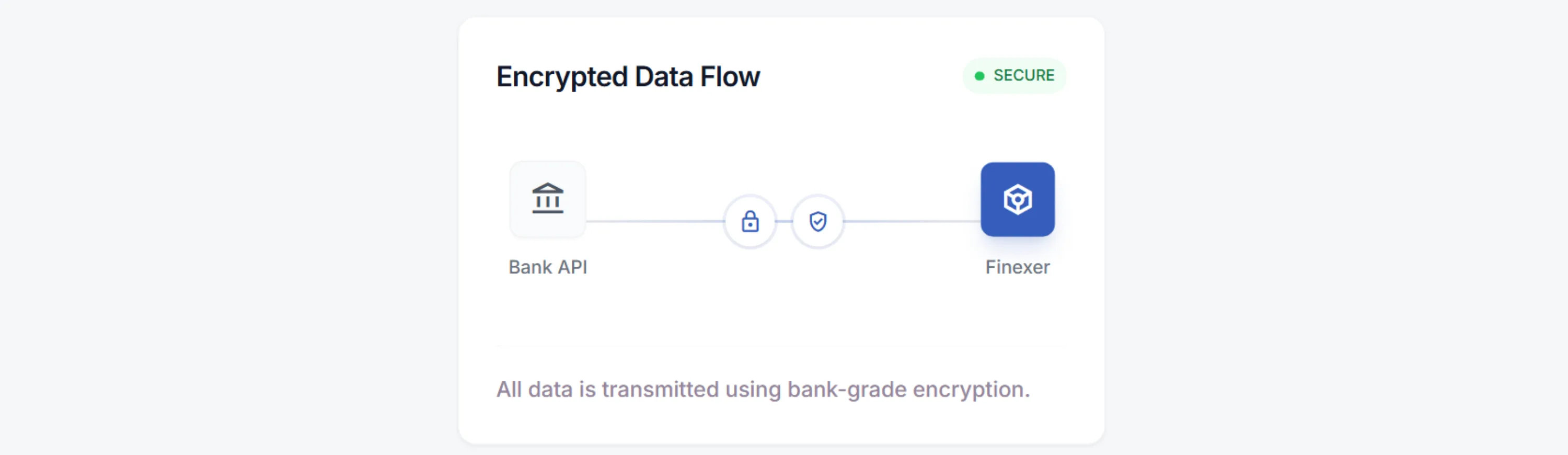

Why Open Banking API Security Is Under Regulatory Pressure in 2026

Get Secure Open banking API with Finexer Connect with 99% of the UK Banks and Scale Your Business without Limits Try Now Open Banking API Security in the UK has reached a scale where security failures now pose systemic risk, not isolated product issues. Active users grew from 12.1 million (Dec 2024) to 13.3 million…

Why 2026 Is the Right Time to Invest in Open Banking

Explore Finexer for Open banking services Connect with 99% of the UK Banks and Scale Your Business without Limits Try Now The UK Is Reaching a Rare Alignment Moment For investors deciding whether to invest in open banking, timing matters more than enthusiasm. In the UK, three forces are lining up at the same time:…

How to Choose an AIS Provider for Income Verification: A Step-by-Step Guide for 2026

Learn how to select the right AIS Provider for accurate income verification in 2026. Compare key features, compliance factors, and leading platforms.

How Enterprises Should Evaluate Bank Data Quality: A 12-Point Checklist

A practical, enterprise-friendly framework for evaluating Bank Data Quality, accuracy, enrichment, and compliance for real-time financial operations.