Your PropTech platform processes 200 tenancy applications monthly. Each one requires income verification. Right now, someone on your team is manually reviewing payslips, checking employment letters, calculating rent-to-income ratios, and hoping the documents are genuine. Three days later, you discover half the submitted payslips were edited PDFs.

A tenant affordability check API solves this by connecting directly to applicant bank accounts with their consent. Request verification, applicant authenticates through their banking app, your platform receives confirmed income data within minutes. No documents to review. No fraud risk from edited files. No three-day delays whilst your team manually processes applications.

For PropTech platforms and property management software, tenant affordability checks are not just compliance steps-they directly impact conversion rates, landlord trust, and operational scalability.

This matters because verification speed determines which PropTech platforms win landlord business and which lose tenants to faster competitors.

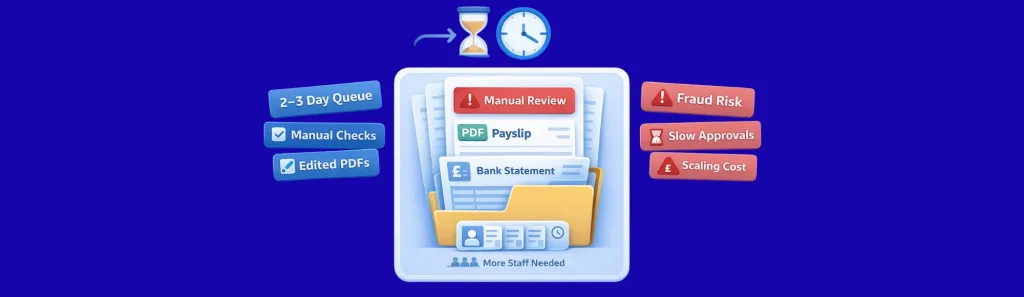

Why Manual Income Verification Creates Operational Bottlenecks

Most PropTech platforms still rely on document submission. Tenant uploads payslips and bank statements. Your team reviews them manually. Someone calculates whether income meets your 2.5x or 3x rent threshold. Another person checks if the documents look legitimate.

What this creates operationally:

- Applications queue for 2-3 days awaiting manual review

- Teams spend hours verifying document authenticity

- Fraudulent payslips pass through because edited PDFs look genuine

- Landlords lose confidence when verification takes longer than property viewings

- Your platform’s reputation suffers from slow processing times

- Scaling requires hiring more verification staff rather than improving systems

The actual issue isn’t document quality. It’s that document-based verification requires human review for every application. As your platform grows, verification costs scale linearly with application volume rather than staying fixed through automation.

What a Tenant Affordability Check API Actually Does

Traditional verification treats income proof as documents to review. A tenant affordability check API treats income as data to retrieve directly from source-the tenant’s actual bank account holding their salary deposits.

When tenants consent to verification through your platform, they authenticate using their banking app. The open banking API connects to their bank, retrieves recent transactions, identifies salary deposits, calculates average monthly income, and returns verified data to your platform. Your system then applies your own affordability rules and thresholds.

From Our Experience: What This Changes Operationally

We’ve observed PropTech platforms transition from document-based to API-based verification. The operational differences become apparent immediately:

Document review disappears entirely. Teams stop spending mornings checking payslip formatting and bank statement authenticity. The tenant affordability check API handles data retrieval automatically whilst your team focuses on exception handling-the genuine edge cases requiring human judgment.

Fraud detection becomes systematic rather than reactive. When verification connects to actual bank accounts, edited documents become irrelevant. You’re not trusting tenant-provided files-you’re retrieving data directly from banks. Fraudulent applications get rejected automatically rather than consuming verification team time.

Application processing speed changes landlord expectations. When your platform verifies income in minutes whilst competitors need days, landlords route more applications through your system. Processing speed becomes a competitive differentiator rather than just operational efficiency.

Platforms can use the same infrastructure to support rent affordability check flows and other affordability check rent use cases across different tenant types.

How Does API Verification Compare to Manual Document Checks?

Your current workflow probably involves document upload, manual review queue, authenticity assessment, income calculation, and threshold comparison. Each step adds time and requires human judgment.

Manual vs API-Based Verification: Operational Reality

| Process Stage | Manual Document Review | Tenant Affordability Check API |

|---|---|---|

| Tenant Action | Find payslips, screenshot statements, upload files | 2-minute banking app authentication |

| Data Received | PDFs/images requiring authenticity assessment | Direct bank transaction data |

| Verification Time | 2–3 days in review queue | Minutes from authentication |

| Fraud Risk | High (edited documents pass visual inspection) | Eliminated (data direct from bank) |

| Manual Processing | 15–30 minutes per application | Automated—human review only for exceptions |

| Scaling Cost | Linear (more applications = more staff) | Fixed (API handles volume increases) |

Explore how open banking verification works for PropTech platforms

The architectural difference matters for platform scalability. Document review requires human capacity that scales with application volume. API verification uses infrastructure that handles increased volume without proportional cost increases.

What to Look for in a Tenant Affordability Check API

Choosing the right infrastructure determines whether your platform builds a sustainable advantage or creates technical debt. When evaluating providers, focus on these capabilities:

Core Infrastructure Requirements

Open banking-based income data ensures you’re accessing real transaction records rather than relying on aggregated or estimated figures. This matters for accuracy in your own affordability logic.

Real-time account access (with consent) means your platform retrieves current data during the application flow rather than batch-processing overnight. Speed determines conversion rates.

UK-wide bank coverage eliminates the need to maintain manual fallback processes. Partial coverage means some applicants still require document submission, defeating automation benefits.

Technical Integration Essentials

Simple REST APIs that fit your existing application workflow without requiring architectural changes. Your dev team should be able to integrate in days, not months.

Webhooks for status updates enable asynchronous processing. Applications don’t block whilst waiting for bank authentication-your system gets notified when data becomes available.

Sandbox environment for testing before production deployment. This lets your engineering team validate integration thoroughly without affecting live applications.

Usage-based pricing that scales with actual verifications processed rather than requiring capacity forecasting. Tenant applications fluctuate seasonally-costs should match revenue cycles.

Fast onboarding with dedicated support ensures your team understands implementation patterns specific to tenant verification rather than generic API documentation.

See PropTech verification use cases

What Works in Practice: Implementation Considerations

From working with PropTech platforms integrating affordability verification, several implementation patterns consistently prove effective:

Parallel running reduces migration risk. Platforms typically run API verification alongside existing manual processes initially. This validates API accuracy against known outcomes before full cutover. After confidence builds through parallel operation, manual processes phase out gradually.

Exception handling determines user experience quality. No automated system handles every edge case perfectly. The critical design decision involves defining what triggers manual review. Too strict, and you’re manually reviewing unnecessary cases. Too loose, and verification quality suffers. Effective platforms tune thresholds based on actual fraud rates and verification team capacity.

Consent flow design impacts completion rates. When tenant authentication feels burdensome, completion rates drop. The API requires careful UX design around the consent journey. Platforms with high completion rates treat authentication as an integrated workflow rather than a separate process requiring tenant exit from your application.

How Finexer Enables Tenant Affordability Checks via Open Banking

Finexer provides open banking connectivity and data access that platforms use to build their own affordability logic using verified bank transaction data.

The platform connects to 99% of UK banks through regulated open banking infrastructure. This coverage means virtually all your applicants can verify income through their existing bank accounts without requiring specific banks or special account types.

What Finexer Provides:

- Direct access to real-time bank transaction data

- Access to bank transaction data, including income deposits

- Account authentication via secure banking apps

- REST APIs for seamless integration

- Webhooks for asynchronous status updates

What You Control:

- Affordability thresholds (2.5x rent, 3x rent, custom ratios)

- Risk assessment logic

- Exception handling rules

- User experience design

- Final approval decisions

We provide 3-5 weeks of dedicated onboarding support. This ensures tenant affordability check API integration aligns with your specific application workflow rather than forcing your platform to adapt to generic implementation patterns.

PropTech platforms using API-based verification report significant operational improvements. Manual review queues disappear. Fraud rejection becomes automatic. Application processing speed increases from days to minutes. Your verification team capacity redirects from routine checking to genuine exception cases requiring judgment.

Pricing works on actual API calls rather than fixed subscriptions. Quiet winter months cost less. Busy summer rental seasons scale naturally with verification volume. For platforms experiencing seasonal application patterns, costs match revenue cycles rather than requiring annual capacity planning.

Learn how letting agents use open banking verification

The platform integrates with existing PropTech infrastructure through standard REST APIs. You don’t rebuild your application-you add verification capability through documented endpoints. Sandbox environments let your engineering team test integration thoroughly before production deployment.

What is a tenant affordability check API?

A tenant affordability check API is infrastructure that connects PropTech platforms to tenant bank accounts through open banking, retrieving income data directly rather than requiring document submission and manual review. It provides verified bank transaction data that platforms use to apply their own affordability rules.

How does a tenant affordability check API work?

The API enables secure, consent-based connections to tenant bank accounts. Tenants authenticate through their banking app, the API retrieves transaction history and income deposits, then returns verified data to your platform. Your system applies your affordability thresholds-such as 2.5x or 3x monthly rent requirements-to make approval decisions.

Is this different from a rent affordability check?

No, the terms are interchangeable. Whether called tenant affordability check, rent affordability check, or affordability check rent, the process retrieves the same bank transaction data. The difference lies in how your platform defines affordability rules-some use rent-to-income ratios, others use net income thresholds or custom scoring models.

Does Finexer decide affordability outcomes?

No. Finexer provides open banking data access-we retrieve verified income information from tenant bank accounts. Your platform applies its own affordability rules, thresholds, and approval logic. This design ensures you control the entire verification workflow whilst we handle the regulated infrastructure for secure bank connections.

What compliance requirements apply?

All connections operate using FCA-authorised open banking infrastructure. This covers consent management, data access authorisation, and secure handling of financial information. As the platform operator, you remain responsible for how you use retrieved data and what affordability decisions you make-Finexer handles the regulated bank connectivity layer.

How quickly does API-based verification process applications?

Minutes from tenant authentication to verified income data return, compared to 2-3 day queues for manual document review. Actual processing time depends on how quickly tenants complete bank authentication, but data retrieval itself happens in real time once consent is granted.

Ready to Add Tenant Affordability Checks to Your Platform?

See how Finexer reduces manual processing by up to 90% with real-time reconciliation

Book Demo Now