The information about 12 Open providers in this blog was sourced from publicly available materials on Jan 2026. Please note that details may be subject to change.

Open Banking in the UK has seen remarkable growth, with over 11 million active users now leveraging its benefits. This adoption is reshaping how businesses approach payments and financial data services, offering practical solutions for improving transaction management and customer experiences. Whether it’s small businesses looking for cost-effective tools or enterprises integrating advanced financial APIs, Open Banking is becoming a fundamental part of business operations.

Choosing the right Open Banking provider, however, is essential to ensure businesses get the most suitable features, coverage, and support for their needs. In this guide, we’ll explore the top 12 Open Banking providers in the UK for 2026, focusing on key metrics—Coverage, Core Products & Solutions, Integration & Developer Experience, Pricing, and Industry Focus—to help you identify the ideal partner for your goals.

1. Finexer

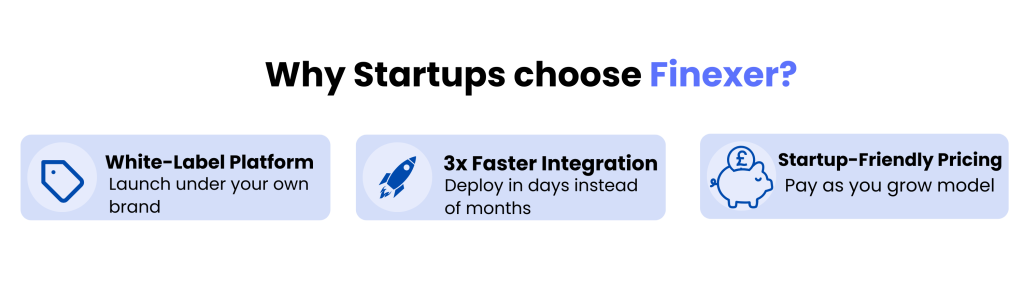

When it comes to catering to small to medium businesses (SMBs) and fintech startups, Finexer stands out for its affordability and tailored approach. With a focus on making Open Banking accessible, Finexer provides reliable APIs and developer-friendly solutions, making it an ideal choice for growing businesses looking to efficiently integrate Open Banking services.

1. Coverage

Finexer connects to 99% of UK banks, including major high-street banks (Barclays, HSBC, NatWest) and challenger banks. This extensive coverage ensures businesses can serve a wide range of customers without compatibility concerns.

2. Core Products & Solutions

- Financial Operations in One Place: Finexer’s platform provides a single interface to manage payments, financial data, and compliance needs.

- White-Label Solutions: Businesses can fully customise the platform under their own branding for a consistent customer experience.

- Compliance Management: Finexer handles regulatory requirements with its FCA-authorised infrastructure, allowing businesses to operate with peace of mind.

- Faster Deployment: Finexer enables deployment of its APIs 2-3x faster than many competitors, ensuring businesses can integrate and go live quickly.

3. Integration & Developer Experience

- Scalability: Handles anywhere from 100 to 100,000 transactions with 98% uptime, providing dependable performance as businesses grow.

- Developer Tools: Offers an intuitive dashboard and thorough documentation, making integration smooth, even for teams with limited technical resources.

- Customised Onboarding: Personalised testing during onboarding ensures a seamless fit with each business’s unique needs.

📚 Finexer USP For UK Startups and SMB’s in 2026

4. Pricing

- Affordable for Startups: Finexer offers transparent, consumption-based pricing, which allows businesses to pay only for what they use.

- Free Trial: A 14-day free trial enables businesses to test the platform before committing.

- Flexible Growth Options: Pricing scales with the business, ensuring no unnecessary costs for startups or SMBs.

5. Industry Focus

- Fintech Startups: Ideal for startups with limited budgets, offering cost-effective solutions and rapid deployment.

- Accounting & ERP: Tailored features designed to streamline financial workflows for ERP and accounting systems.

- SMBs: Provides enterprise-level features customised for smaller businesses, helping them access tools traditionally reserved for larger players.

Why Finexer?

Finexer’s affordability, scalability, and tailored solutions make it a standout choice for SMBs and fintech startups. Its developer-friendly tools, comprehensive bank coverage, and commitment to compliance ensure businesses can grow without unnecessary complexity. For businesses seeking reliable Open Banking services that grow with them, Finexer delivers unmatched value.

2. Salt Edge

For businesses that prioritise compliance, security, and global bank connectivity, Salt Edge stands out as a leader in Open Banking. With extensive bank coverage and a comprehensive suite of tools, Salt Edge empowers businesses to streamline data aggregation, payment initiation, and regulatory compliance.

Let’s take a closer look at why Salt Edge is one of the top Open Banking providers in the UK for 2026.

1. Coverage

Salt Edge provides access to 5,000+ banks and financial institutions across 50+ countries, including full coverage of major UK banks and challenger banks. This global reach makes it an ideal solution for businesses operating in both domestic and international markets.

Whether you’re connecting to high-street banks like Barclays, Lloyds, and HSBC or newer players like Monzo and Starling, Salt Edge ensures robust compatibility for seamless operations.

2. Core Products & Solutions

Salt Edge offers a wide range of services designed to meet the diverse needs of businesses:

- Payment Initiation: Enable direct payments from customers’ bank accounts, reducing transaction costs and improving payment efficiency.

- Account Information API: Access real-time financial data, including account balances, transaction history, and spending insights, through a single API.

- PSD2 Compliance: Salt Edge provides a ready-made solution for businesses to meet PSD2 and GDPR requirements, ensuring regulatory compliance with minimal effort.

- Partner Program: Even businesses without a PSD2 license can access Salt Edge’s bank data services through this program.

- Security Enhancements: Features like transaction monitoring help businesses detect potential fraud and mitigate risks.

3. Integration & Developer Experience

Salt Edge is designed with developers in mind, offering tools that simplify the integration process:

- Developer-Friendly APIs: Comprehensive documentation, a sandbox environment, and sample code make it easy for businesses to test and deploy Salt Edge’s APIs.

- Compliance Support: By automating complex regulatory requirements, Salt Edge reduces the technical burden on your development team.

- Reliable Support: Businesses can rely on Salt Edge’s dedicated support team to troubleshoot issues and ensure a smooth onboarding experience.

4. Pricing

Salt Edge adopts a customised pricing model based on the services and features you need:

- Flexible Plans: Tailored solutions for Fintechs, SMBs, and enterprises to meet their specific needs.

- Transparent Costs: While detailed pricing requires consultation, Salt Edge is known for its clarity in outlining fees without hidden charges.

Businesses interested in exploring their services can contact Salt Edge directly for a personalised quote.

📚 Saltedge pricing Analysis in 2026

5. Industry Focus

Salt Edge’s solutions are versatile, catering to a variety of industries:

- Fintechs: Offers tools for building payment and data aggregation features with minimal resources.

- SMBs & E-Commerce: Helps businesses enhance their payment processes and leverage financial data for customer insights.

- Lending & Financial Services: Features like compliance automation and fraud detection make Salt Edge a preferred partner for financial institutions.

3. Ozone API

Ozone API is a UK-based Open Banking provider that focuses on helping banks and financial institutions deliver open APIs that meet regulatory requirements and support innovation. Unlike providers focused on aggregation or payments, Ozone API provides bank-grade open banking infrastructure, enabling institutions to expose and manage compliant APIs effectively.

1. Coverage

Ozone API powers Open Banking APIs for multiple regulated banks and financial institutions in the UK, EU, and beyond. They are used by banks to publish APIs, not as aggregators or PISPs, making them a foundational player in the Open Banking ecosystem.

2. Core Products & Solutions

- Open Banking API Platform: A full-stack platform for publishing compliant PSD2 and Open Banking APIs.

- Consent & Access Management: Built-in tools for secure user consent flows and fine-grained data access control.

- Developer Portal: For banks to onboard and manage third-party providers (TPPs) easily.

- API Monitoring & Analytics: Dashboards and insights to track usage, performance, and compliance.

3. Integration & Developer Experience

- Pre-built Compliance Templates: Meets UK Open Banking and PSD2 specifications.

- High Configurability: Designed to be embedded into the bank’s core systems with custom branding.

- Sandbox & Support: Offers a TPP sandbox, full documentation, and live support for smooth implementation.

4. Pricing

Ozone API uses a licensing model that depends on the size and scope of the bank’s operations. Pricing is customised based on the number of users, hosted vs. self-managed options, and support levels.

5. Industry Focus

- Banks & Building Societies: Ideal for institutions looking to meet PSD2 compliance or expand their digital banking capabilities.

- Challenger Banks & EMIs: A Fast and cost-effective way to launch compliant APIs.

- Regulated Firms: Firms that want to embed Open Banking into their architecture with full control.

4. Yapily

Yapily is an Open Banking infrastructure provider that enables businesses to access financial data and initiate payments through a secure API. With extensive coverage across the UK and Europe, Yapily offers solutions tailored for various industries, including payments, lending, and digital banking.

1. Coverage

Yapily connects to over 2,000 banks and financial institutions across 19 countries, with comprehensive coverage in the UK and Germany. This extensive reach allows businesses to access both consumer and business accounts, facilitating a wide range of financial services.

2. Core Products & Solutions

Yapily offers a suite of products designed to enhance financial services:

- Payments: Facilitates instant money transfers directly from customer bank accounts, providing a faster and more cost-effective alternative to traditional payment methods.

- Variable Recurring Payments (VRP): Enables secure and efficient recurring payments, ideal for subscription-based businesses.

- Data Access: Provides real-time insights into customer financial data, allowing businesses to analyse behavior, build comprehensive financial profiles, and manage risk effectively.

- Yapily Connect: Offers businesses without a PSD2 license the ability to connect securely to thousands of institutions with 100% compliant connectivity, simplifying the complexities of Open Banking integration.

3. Integration & Developer Experience

Yapily is designed with developers in mind, offering:

- Comprehensive API Documentation: Detailed guides and resources to facilitate seamless integration with existing systems.

- Customer Console: A single interface to manage integrations, monitor performance, and access support resources.

- Sandbox Environment: Allows businesses to test and simulate transactions in a controlled setting before going live.

📚 Yapily pricing Analysis in 2026

4. Pricing

Yapily offers customised pricing plans tailored to the specific needs of businesses. For detailed pricing information, businesses are encouraged to contact Yapily directly to discuss their requirements and obtain a personalised quote.

5. Industry Focus

Yapily’s solutions cater to a diverse range of industries:

- Payment Services: Enhances payment processing capabilities for businesses, providing efficient and secure transaction methods.

- Lending & Credit: Offers access to real-time financial data, enabling more accurate credit assessments and streamlined lending processes.

- Digital Banking: Empowers digital banks to offer personalised financial experiences by leveraging comprehensive data insights.

- Accounting: Automates data entry and provides real-time visibility of cash flow, streamlining reconciliation processes for accounting firms.

5. Plaid

Plaid is a financial technology company that provides a data transfer network, enabling applications to connect with users’ bank accounts. Operating in the UK and across Europe, Plaid offers solutions that facilitate seamless access to financial data and payment initiation services.

1. Coverage

Plaid connects to over 2,000 European financial institutions, covering more than 95% of banks across 20 countries, including the UK. This extensive reach allows businesses to access a broad customer base, facilitating a wide range of financial services.

2. Core Products & Solutions

Plaid offers a suite of products designed to enhance financial services:

- Transactions: Provides detailed transaction data, enabling businesses to offer insights into spending patterns and financial behavior.

- Auth: Allows businesses to verify account ownership and retrieve account and routing numbers for payments.

- Balance: Enables real-time access to account balances, helping businesses prevent overdrafts and failed transactions.

- Identity: Facilitates the verification of end-user identities by accessing bank account holder information.

- Payment Initiation: Allows businesses to initiate payments directly from users’ bank accounts, providing a streamlined payment experience.

3. Integration & Developer Experience

Plaid is designed with developers in mind, offering:

- Comprehensive API Documentation: Detailed guides and resources to facilitate seamless integration with existing systems.

- Sandbox Environment: Allows businesses to test and simulate transactions in a controlled setting before going live.

- Plaid Link: A front-end module that provides a quick and secure way for users to connect their bank accounts to applications.

📚 Plaid pricing Analysis for Startups

4. Pricing

Plaid employs a flexible pricing model that varies based on the products and services utilised:

- One-Time Fees: Applied to products like Auth and Identity, where a fee is incurred for each connected account.

- Subscription Fees: For products like Transactions, a monthly fee is charged for each connected account.

- Per-Request Fees: Certain services incur a fee per API call.

For detailed pricing information, businesses are encouraged to contact Plaid directly to discuss their requirements and obtain a personalised quote.

5. Industry Focus

Plaid’s solutions cater to a diverse range of industries:

- Fintech Applications: Empowers apps that provide budgeting, saving, and investment services by accessing users’ financial data.

- Lending: Assists lenders in verifying borrower information and assessing creditworthiness through access to financial data.

- Personal Finance Management: Enables applications to offer users insights into their spending habits and financial health.

- Payments: Facilitates businesses in initiating payments directly from users’ bank accounts, reducing reliance on card networks.

6. Tink

Tink is a leading European open banking platform that enables banks, fintechs, and merchants to develop data-driven financial services and create better user experiences. Through a single API, Tink provides access to a broad range of financial data and payment initiation services across Europe.

1. Coverage

Tink connects to over 6,000 banks and financial institutions across Europe, offering extensive coverage that includes both PSD2 and non-PSD2 data. This broad connectivity allows businesses to access high-quality financial data from a wide array of sources.

2. Core Products & Solutions

Tink offers a comprehensive suite of products designed to enhance financial services:

- Account Aggregation: Provides access to aggregated financial data, enabling businesses to deliver personalised offerings and empower end-customers with a clearer understanding of their finances.

- Payment Initiation: Allows businesses to initiate payments directly from users’ bank accounts, providing a streamlined and efficient payment experience.

- Data Enrichment: Offers enriched and categorised financial data, helping businesses gain deeper insights into customer behavior and improve decision-making processes.

- Personal Finance Management: Enables the development of tools that help end-users manage their finances more effectively, fostering better financial health.

3. Integration & Developer Experience

Tink is designed with developers in mind, offering:

- Comprehensive API Documentation: Provides detailed guides and resources to facilitate seamless integration with existing systems.

- SDKs: Offers software development kits that make it fast and easy to build products using Tink’s connectivity and data services.

- Security: As an ISO 27001-certified company, Tink ensures that all customer data is encrypted in transit and at rest, providing a secure environment for financial data handling.

4. Pricing

Tink employs a flexible pricing model tailored to the specific needs of businesses:

- Customised Plans: Offers tailored solutions for businesses of various sizes and requirements.

- Transparent Costs: Provides clear pricing structures without hidden fees.

For detailed pricing information, businesses are encouraged to contact Tink directly to discuss their requirements and obtain a personalised quote.

5. Industry Focus

Tink’s solutions cater to a diverse range of industries:

- Banking: Empowers banks to offer personalised financial experiences by leveraging comprehensive data insights.

- Lending: Provides access to real-time financial data, enabling more accurate credit assessments and streamlined lending processes.

- Payments: Facilitates businesses in initiating payments directly from users’ bank accounts, reducing reliance on traditional payment networks.

- Personal Finance Management: Enables applications to offer users insights into their spending habits and financial health.

7. Token.io

Token.io is a leading account-to-account (A2A) payment infrastructure provider, leveraging open banking to facilitate faster, more cost-effective payments across Europe. By connecting businesses to over 567 million bank accounts, Token.io enables seamless payment initiation and data access through a single API.

1. Coverage

Token.io offers best-in-class connectivity to over 80% of bank accounts in 21 European markets, including the UK. This extensive reach allows businesses to initiate payments and access financial data across a broad customer base.

2. Core Products & Solutions

Token.io provides a comprehensive suite of products designed to enhance payment services:

- Single Immediate Payments: Enables instant bank payments with easy, secure authorisation, providing a faster alternative to traditional payment methods.

- Variable Recurring Payments (VRP): Facilitates secure and efficient recurring payments, ideal for subscription-based businesses.

- Settlement Accounts: Offers real-time status updates, API-driven refunds, and flexible settlement options to streamline payment processes.

- Data Access: Provides access to bank account and transaction data, enabling businesses to create smarter payment experiences.

3. Integration & Developer Experience

Token.io is designed with developers in mind, offering:

- Comprehensive API Documentation: Provides detailed guides and resources to facilitate seamless integration with existing systems.

- SDKs: Offers software development kits that make it fast and easy to build products using Token.io’s connectivity and data services.

- Security: Token.io is ISO 27001:2013-certified, ensuring that all customer data is encrypted in transit and at rest, providing a secure environment for financial data handling.

📚 Token pricing Explained in 2026

4. Pricing

Token.io employs a flexible pricing model tailored to the specific needs of businesses:

- Customised Plans: Offers tailored solutions for businesses of various sizes and requirements.

- Transparent Costs: Provides clear pricing structures without hidden fees.

For detailed pricing information, businesses are encouraged to contact Token.io directly to discuss their requirements and obtain a personalised quote.

5. Industry Focus

Token.io’s solutions cater to a diverse range of industries:

- Payment Service Providers (PSPs): Enables PSPs to launch A2A payments as a core payment method with complete infrastructure support.

- Banks: Empowers banks to offer new A2A payment propositions using Token.io’s white-label-ready infrastructure.

- Merchants: Works with partners to help merchants accept lower-cost, frictionless A2A payments, enhancing the customer payment experience.

8. Volt

Volt is building the world’s first global real-time payment network, enabling businesses to receive and send real-time account-to-account payments. By uniting domestic real-time payment systems into a single, harmonised solution, Volt offers a faster, more secure way to handle customer funds.

1. Coverage

Volt processes payments in 33 countries and connects to 1,900 banks, providing extensive coverage across multiple territories. This broad connectivity allows businesses to access a wide range of financial institutions through a single integration.

2. Core Products & Solutions

Volt offers a comprehensive suite of products designed to enhance payment services:

- Instant Payments: Enables businesses to switch on a globally optimised Pay by Bank solution via one simple integration, facilitating instant bank payments with secure authorisation.

- Refunds: Allows businesses to issue real-time refunds directly to customers’ bank accounts, improving customer satisfaction.

- Payouts: Enables on-demand, real-time payouts to millions of consumer bank accounts, streamlining disbursement processes.

- Volt Accounts: Combines full visibility of customer funds with business-critical functionality, enhancing cash management capabilities.

- Virtual IBANs: Provides instant reconciliation of deposits and top-ups at scale, simplifying payment management.

- Power Tools: Includes features like Circuit Breaker for fraud prevention, Transformer for easing the switch from cards to Pay by Bank, and Verify for automating bank account ownership authentication.

3. Integration & Developer Experience

Volt is designed with developers in mind, offering:

- Comprehensive API Documentation: Provides detailed guides and resources to facilitate seamless integration with existing systems.

- Developer Resources: Offers a developer center with documentation, resources, and quick start guides to support efficient integration.

- Security: Ensures that all customer data is encrypted in transit and at rest, providing a secure environment for financial data handling.

📚 Volt Open banking pricing explained

4. Pricing

Volt employs a flexible pricing model tailored to the specific needs of businesses:

- Customised Plans: Offers tailored solutions for businesses of various sizes and requirements.

- Transparent Costs: Provides clear pricing structures without hidden fees.

For detailed pricing information, businesses are encouraged to contact Volt directly to discuss their requirements and obtain a personalised quote.

5. Industry Focus

Volt’s solutions cater to a diverse range of industries:

- Retail: Lowers the cost of payment acceptance and significantly speeds up settlement times globally.

- Travel: Facilitates real-time payments for bookings and refunds, enhancing the customer experience.

- Wealthtech: Facilitates investments and money movement directly from users’ bank accounts, streamlining financial operations.

- Gaming: Drives revenue and boosts player loyalty by enabling instant access to winnings.

- Crypto: Optimises on-ramps and off-ramps with real-time wallet deposits and withdrawals, enhancing the efficiency of cryptocurrency transactions.

9. Moneyhub

Moneyhub is an Open Finance platform that provides comprehensive data aggregation, insights, and payment solutions. By leveraging Open Banking and Open Finance APIs, Moneyhub enables businesses to create personalised customer experiences and streamline financial operations.

1. Coverage

Moneyhub offers connections to thousands of financial institutions across 37 countries. This extensive reach includes major banks, pensions, investments, loans, property values, savings, and mortgages, providing a holistic view of customers’ financial landscapes.

2. Core Products & Solutions

Moneyhub provides a suite of APIs designed to enhance financial services:

- Data & Intelligence API: Offers a single connection to a wide range of financial institutions, enabling access to aggregated financial data for personalised customer insights.

- Payments API: Facilitates account-to-account Open Banking payments, providing a faster and more cost-effective alternative to traditional card-based methods.

- API Bundle: Combines various APIs to maximise the possibilities of Open Banking and Open Finance, helping businesses create transformative customer experiences.

3. Integration & Developer Experience

Moneyhub is designed with developers in mind, offering:

- Comprehensive API Documentation: Provides detailed guides and resources to facilitate seamless integration with existing systems.

- Sandbox Environment: Allows businesses to test and simulate transactions in a controlled setting before going live.

- Security: As an ISO 27001-certified company, Moneyhub ensures that all customer data is encrypted in transit and at rest, providing a secure environment for financial data handling.

📚 Moneyhub costs, features & Pricing explained

4. Pricing

Moneyhub offers flexible pricing models tailored to the specific needs of businesses:

- Customised Plans: Provides tailored solutions for businesses of various sizes and requirements.

- Transparent Costs: Offers clear pricing structures without hidden fees.

For detailed pricing information, businesses are encouraged to contact Moneyhub directly to discuss their requirements and obtain a personalised quote.

5. Industry Focus

Moneyhub’s solutions cater to a diverse range of industries:

- Financial Services: Empowers financial institutions to offer personalised financial experiences by leveraging comprehensive data insights.

- Retail: Enables retailers to provide tailored financial solutions and payment options to customers.

- Telecommunications: Assists telecom companies in integrating financial services into their offerings, enhancing customer engagement.

- Healthcare: Supports healthcare providers in managing financial transactions and offering personalised financial advice to patients.

10.TrueLayer

TrueLayer is a global open banking platform that enables businesses to securely access financial data and facilitate instant payments. By leveraging open banking APIs, TrueLayer allows companies to build innovative financial services and enhance customer experiences.

1. Coverage

TrueLayer provides extensive coverage across major European markets, connecting to over 95% of bank accounts. For instance, it covers 98% of bank accounts in the UK, 99% in Spain, and 95% in Ireland. This broad connectivity ensures businesses can reach a wide customer base across Europe.

2. Core Products & Solutions

TrueLayer offers a comprehensive suite of products designed to enhance financial services:

- Payments: Facilitates instant bank payments, providing a faster and more secure alternative to traditional payment methods.

- Payouts: Enables fast, verified payouts to customers’ bank accounts, streamlining disbursement processes.

- Signup+: Streamlines customer onboarding by verifying bank account information in real-time, reducing friction during the signup process.

- Data: Provides access to enriched financial data, allowing businesses to offer personalised services and gain deeper insights into customer behavior.

- Verification: Automates the verification of customer bank account ownership, enhancing security and compliance.

3. Integration & Developer Experience

TrueLayer is designed with developers in mind, offering:

- Comprehensive API Documentation: Provides detailed guides and resources to facilitate seamless integration with existing systems.

- SDKs and Client Libraries: Offers software development kits and client libraries for various programming languages, simplifying the development process.

- Sandbox Environment: Allows businesses to test and simulate transactions in a controlled setting before going live.

- Security: TrueLayer is authorised and regulated by the UK Financial Conduct Authority (FCA), ensuring compliance with industry standards and providing a secure environment for financial data handling.

4. Pricing

TrueLayer employs a flexible pricing model tailored to the specific needs of businesses:

- Customised Plans: Offers tailored solutions for businesses of various sizes and requirements.

- Transparent Costs: Provides clear pricing structures without hidden fees.

For detailed pricing information, businesses are encouraged to contact TrueLayer directly to discuss their requirements and obtain a personalised quote.

5. Industry Focus

TrueLayer’s solutions cater to a diverse range of industries:

- Financial Services: Empowers financial institutions to offer personalised financial experiences by leveraging comprehensive data insights.

- E-commerce: Enables retailers to provide seamless payment solutions and personalised financial services to customers.

- iGaming: Facilitates instant deposits and withdrawals, enhancing the gaming experience for users.

- Travel: Streamlines payment processes for bookings and refunds, improving the customer experience.

- Cryptocurrency: Provides secure and instant payment solutions for crypto exchanges and platforms.

11.Bud

Bud is a data intelligence platform that helps financial companies access, interpret, and enrich complex financial data, transforming it into actionable insights. By leveraging advanced AI and machine learning, Bud enables businesses to offer personalised financial experiences and make informed decisions.

1. Coverage

Bud processes over 50 billion transactions and connects with numerous financial institutions across multiple countries. This extensive reach allows businesses to gain a comprehensive understanding of their customers’ financial behaviors and preferences.

2. Core Products & Solutions

Bud offers a suite of products designed to enhance financial services:

- Enrich: Provides market-leading transaction enrichment with over 97% accuracy, enabling businesses to gain deeper insights into customer spending habits.

- Drive: Delivers analytics and segmentation tools to understand customer behaviors, facilitating personalised marketing and product offerings.

- Engage: Offers personalised financial management features to improve customer engagement and financial well-being.

- Assess: Provides accurate lending suitability and lifecycle management solutions, aiding in effective credit risk assessment.

3. Integration & Developer Experience

Bud is designed with developers in mind, offering:

- Comprehensive API Documentation: Provides detailed guides and resources to facilitate seamless integration with existing systems.

- Sandbox Environment: Allows businesses to test and simulate data interactions in a controlled setting before going live.

- Security: Bud is SOC2 and ISO27001 certified, ensuring that all customer data is encrypted in transit and at rest, providing a secure environment for financial data handling.

4. Pricing

Bud offers flexible pricing models tailored to the specific needs of businesses:

- Customised Plans: Provides tailored solutions for businesses of various sizes and requirements.

- Transparent Costs: Offers clear pricing structures without hidden fees.

For detailed pricing information, businesses are encouraged to contact Bud directly to discuss their requirements and obtain a personalised quote.

5. Industry Focus

Bud’s solutions cater to a diverse range of industries:

- Retail Banks: Empowers banks to offer personalised financial experiences by leveraging comprehensive data insights.

- Fintechs: Enables fintech companies to enhance their offerings with enriched financial data and analytics.

- Lenders: Assists lenders in making informed credit decisions through accurate lending suitability assessments.

- Credit Unions and Community Banks: Supports these institutions in understanding member behaviors and delivering personalised services.

12.Yodlee

Yodlee, a subsidiary of Envestnet, is a leading data aggregation and analytics platform that provides consumer-permissioned access to financial data. By leveraging open banking APIs, Yodlee enables businesses to deliver innovative financial services and personalised customer experiences.

1. Coverage

Yodlee connects to over 19,000 data sources globally, including major banks, credit card providers, investment accounts, and other financial institutions. This extensive reach allows businesses to access a comprehensive range of financial data to better understand and serve their customers.

2. Core Products & Solutions

Yodlee offers a suite of products designed to enhance financial services:

- Data Aggregation: Provides access to a vast array of financial data sources, enabling businesses to offer comprehensive financial insights to their customers.

- Account Verification: Facilitates the quick and secure verification of customer accounts, streamlining onboarding processes and reducing fraud.

- Transaction Data Enrichment: Enhances raw transaction data by categorising and labeling it, providing clearer insights into customer spending behaviors.

- Financial Wellness Solutions: Offers tools and insights to help consumers manage their finances more effectively, promoting better financial health.

3. Integration & Developer Experience

Yodlee is designed with developers in mind, offering:

- Comprehensive API Documentation: Provides detailed guides and resources to facilitate seamless integration with existing systems.

- Sandbox Environment: Allows businesses to test and simulate data interactions in a controlled setting before going live.

- Security: Yodlee adheres to strict security standards, ensuring that all customer data is encrypted in transit and at rest, providing a secure environment for financial data handling.

4. Pricing

Yodlee offers flexible pricing models tailored to the specific needs of businesses:

- Customised Plans: Provides tailored solutions for businesses of various sizes and requirements.

- Transparent Costs: Offers clear pricing structures without hidden fees.

For detailed pricing information, businesses are encouraged to contact Yodlee directly to discuss their requirements and obtain a personalised quote.

5. Industry Focus

Yodlee’s solutions cater to a diverse range of industries:

- Financial Institutions: Empowers banks and credit unions to offer personalised financial experiences by leveraging comprehensive data insights.

- Fintech Companies: Enables fintech innovators to enhance their offerings with enriched financial data and analytics.

- Wealth Management: Assists wealth managers in gaining a holistic view of clients’ financial situations, facilitating informed investment decisions.

- Retail Banking: Supports retail banks in understanding customer behaviors and delivering personalised services.

Get Started

Start your 14-day free trial today and see why businesses trust Finexer for secure, compliant, and tailored open banking solutions.

Choosing the Right Open Banking Provider

Finding the right Open Banking provider can significantly influence the success of your financial services or payment initiatives. With so many options on the market, it’s essential to evaluate providers based on the core areas that matter most to your business:

1.Coverage & Connectivity

Check the range of banks and markets each provider supports. If you operate or plan to expand internationally, ensure your chosen provider has robust global connections as well as local coverage.

2.Core Features & Solutions

Map out the specific features you need—whether it’s payment initiation, account data aggregation, or compliance solutions—and verify each provider meets those requirements. Look for any unique or value-added solutions (e.g., fraud prevention, white-label offerings) that align with your roadmap.

3.Integration & Developer Experience

Consider the complexity of integrating new APIs with your existing systems. A well-documented API and sandbox testing environment can streamline onboarding, reduce developer friction, and accelerate your time-to-market.

4.Pricing & Flexibility

Examine the provider’s pricing model—fixed plans, consumption-based, or custom quotes—to ensure it complements your budget and growth strategy. Some providers cater more to startups with affordable tiers, while others may have enterprise-focused models.

5.Security & Compliance

Given the regulatory landscape of Open Banking, compliance and data protection are paramount. Ensure that your provider holds relevant certifications and adheres to the standards mandated by regulatory bodies like the FCA and PSD2.

6.Industry Focus

If you’re in a niche sector—like lending, e-commerce, or fintech—look for providers with tailored features or dedicated support for that industry. Their familiarity with sector-specific requirements can give you a head start.

By assessing your goals, technical needs, and compliance requirements against each provider’s strengths, you can identify the solution that best aligns with your operational model and long-term vision.

Try Open Banking with Finexer in 2026 ! Schedule your free demo and get a started with Finexer 🙂