Choosing an open banking API in 2025 isn’t just about brand recognition. While TrueLayer has been a familiar name in the UK fintech scene, it doesn’t always offer the flexibility, pricing, or integration style that every business needs.

From real-time bank payments to enriched financial data, the right provider can help you improve user experience, reduce payment friction, and even automate parts of your customer onboarding.

In this guide, we compare three well-positioned alternatives to TrueLayer: Volt, Finexer, and Token.io. Whether you’re a startup, a platform, or a regulated payments business, this guide will help you choose a partner that aligns with your goals.

What Does TrueLayer Offer?

TrueLayer is one of the most recognised open banking providers in the UK and Europe. Its platform offers both payment and data APIs, widely used by fintechs, investment platforms, and digital wallets.

Here’s what TrueLayer delivers in terms of open banking functionality:

- Account-to-Account Payments: One-off and variable recurring payments (VRPs) using open banking rails.

- Instant Refunds & Payouts: Enables businesses to process near-instant withdrawals and refunds.

- Bank Data Access: Real-time account balances, transaction history, and account verification.

- Developer Tools: Offers a well-documented API, SDKs, and hosted payment flows for faster integrations.

Where It Might Not Fit Every Business

While TrueLayer is strong for payment initiation and data aggregation, it doesn’t always tick every box:

- No-code payment tools: TrueLayer is built with developers in mind. There are no native options like payment links or QR-based flows for teams that want fast, no-code access.

- Limited customisation: Hosted flows are pre-built, so full white-label or embedded control may require workarounds.

- VRP availability: Commercial VRP is still in early stages, often invite-only or limited to sweeping use cases.

Alternatives to Consider

Volt

Built for conversion-focused platforms that need real-time A2A payments at scale.

Volt is a high-performance open banking payments platform designed for speed, reliability, and orchestration. It connects to major banks across the UK and EU, enabling real-time account-to-account payments with built-in smart routing and fraud controls.

Volt is ideal for platforms processing large payment volumes—think ecommerce marketplaces, lenders, or pay-out heavy use cases—where payment success rate matters just as much as speed.

What Volt Offers

- Real-time bank payments: Instant A2A transfers with 24/7 settlement capabilities across supported UK and EU banks.

- Smart routing engine: Volt automatically retries failed transactions and selects the best-performing payment paths, increasing success rates—especially during high-traffic periods.

- Bulk pay-outs & refunds: Offers merchant tools to issue instant refunds and supplier payments.

- Virtual IBANs: Businesses can assign unique accounts for reconciliation, improving visibility and cash flow control.

- Developer tooling: REST APIs, documentation, and test environments available for both low-code and fully custom integrations.

What Sets Volt Apart

Volt focuses heavily on orchestration. Its payment routing engine is designed to maximise conversion and reduce failure rates, something traditional open banking APIs don’t always address. With built-in fraud detection, risk monitoring, and payout scheduling, Volt delivers infrastructure-level performance without the merchant having to piece it all together.

What to Consider

- Data access limited: Volt is a PIS-first provider. It does not offer account information (AIS) endpoints such as transaction history or balance checks, so it may need to be paired with a second provider if data enrichment is important.

- Enterprise-focused setup: Volt is optimised for mid-size and enterprise firms. Smaller businesses may find the onboarding process or feature set broader than needed.

- Custom pricing: There is no standard pricing page. Quotes are tailored per business, depending on volume, flow, and settlement terms.

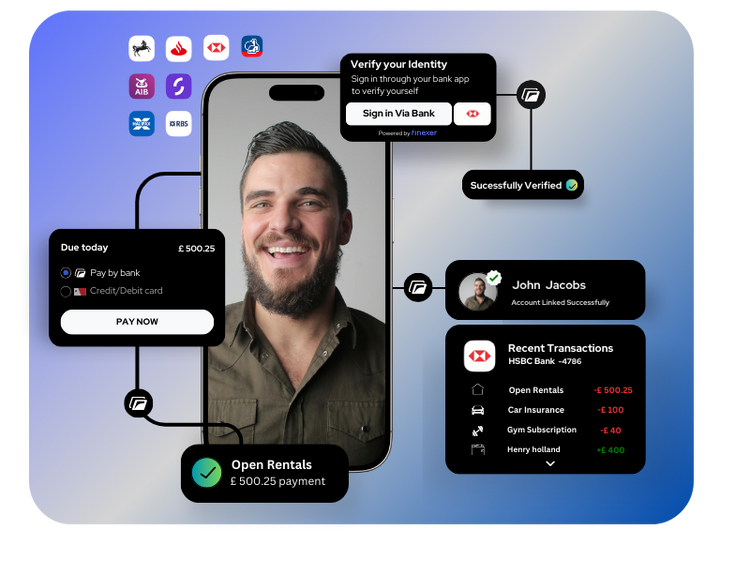

Finexer

An open banking platform designed for UK startups, SaaS firms, and accounting platforms.

Finexer is a UK-first open banking provider that offers full-stack account-to-account payments, real-time data access, and instant onboarding features. Built specifically for local businesses, Finexer connects to 99% of UK banks and focuses on affordability, speed, and developer-friendly integration.

It’s a great fit for teams that want to launch quickly without the overhead of enterprise contracts or complex setups.

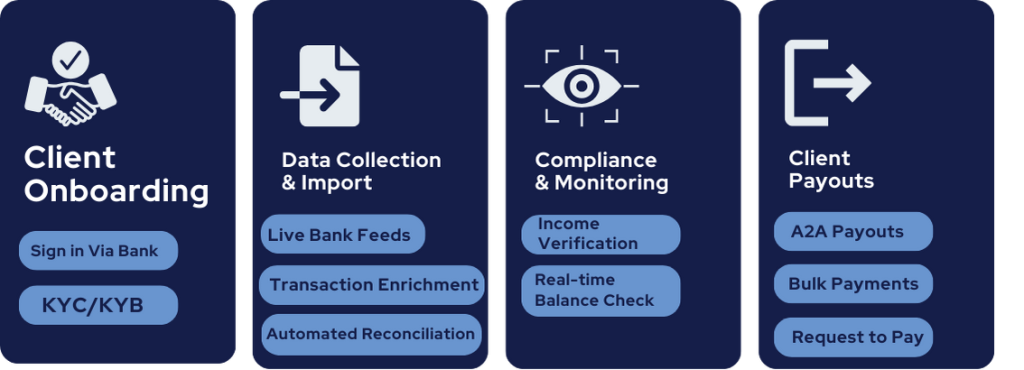

What Finexer Offers

- Instant Pay-by-Bank payments: One-off payments and batch transfers using real-time bank rails.

- Bulk payouts: Send funds to multiple recipients instantly—ideal for payroll runs, client disbursements, and supplier payments.

- 99% UK bank coverage: Full integration with both major and challenger banks across the UK.

- Data endpoints: Access real-time balances, enriched transactions, and account ownership verification.

- White-label options: Full control over branding, custom domains, and embedded flows for client-facing apps.

What Sets Finexer Apart

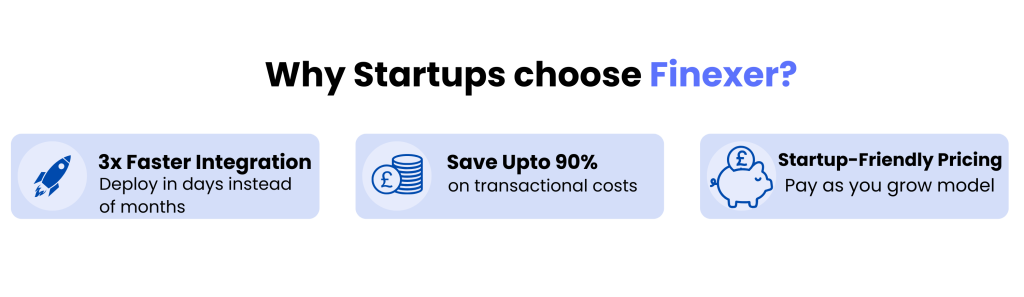

Finexer is tailored for UK-based businesses that need to move fast. There are no setup fees, no minimum commitments, and you get instant access to a live sandbox with unlimited test calls. That makes it especially attractive for startups and growing platforms that want to test, iterate, and scale without the friction of long enterprise sales cycles.

Pricing is simple and startup-friendly, with usage-based billing across both data and payments. You only pay when you go live.

What to Consider

- UK-first focus: Finexer is purpose-built for UK businesses. If your operations extend beyond the UK, you may consider pairing it with a secondary provider.

Get Started

Start your 14-day free trial today and see why businesses trust Finexer for secure, compliant, and tailored open banking solutions.

Token.io

Open banking payments at scale for PSPs, platforms, and regulated financial institutions.

Token.io is a leading open banking provider focused exclusively on account-to-account payments across the UK and Europe. Built for scale and speed, Token offers high-performing payment APIs that power pay-ins, refunds, and merchant payouts—with instant settlement.

Token is ideal for platforms that need to move large volumes of money quickly and want a single provider for multi-country operations.

What Token.io Offers

- A2A Payments: Single and recurring payments with instant settlement directly into the merchant’s account.

- High coverage: Access to 567 million bank accounts across the UK and 20+ European countries.

- Payout tools: Offers merchant-to-customer refunds, supplier pay-outs, and direct merchant settlements via open banking.

- Developer-first experience: REST APIs, hosted flows, and full documentation support both direct and indirect integration models.

- Compliance-ready infrastructure: Built with PSD2, SCA, and ISO 20022 standards in mind.

What Sets Token.io Apart

Token.io is engineered to process open banking payments at high success rates—nearly 1 in every 5 A2A payments in the UK currently flows through their platform. Unlike many competitors, it offers instant settlement as a core part of the product, giving platforms better cash flow control without the delays typical in card-based systems.

It’s also one of the few providers built with a pure focus on payments—without bundling in data endpoints—making it extremely specialised and scalable for regulated platforms and PSPs.

What to Consider

- No AIS/data access: Token.io does not offer access to transaction data, balance checks, or account information. If you need financial insights, you’ll need a second AIS provider.

- Commercial VRP still early: Support for VRP is growing, but commercial use cases may still require direct bank relationships or phased access.

Comparing Truelayer Alternatives

| Feature | Volt | Finexer | Token.io |

|---|---|---|---|

| UK Bank Coverage | ~80%+ | ✅ 99% | ~95%+ |

| A2A Payments | ✅ Real-time | ✅ Instant | ✅ Instant |

| Bulk Payouts | ✅ Yes | ✅ Yes | ✅ Yes |

| Commercial VRP | Pilot phase | In beta | Limited rollout |

| AIS / Data Access | ❌ | ✅ Real-time + enriched | ❌ |

| No-Code Tools | Limited | ✅ Payment links, QR | ❌ |

| White-Label Options | ✅ Available | ✅ Full control | Partial |

| Ideal For | High-volume platforms | UK startups & SaaS | PSPs & platforms |

| Pricing Transparency | Custom quote | ✅ Usage-based | Custom quote |

What are the best alternatives to TrueLayer in 2025?

Volt, Finexer, and Token.io are top open banking API options for UK payments, VRP support, and platform integrations.

Does Volt support commercial VRP?

Volt supports commercial VRP in a pilot phase with selected UK banks and is ideal for platforms needing smart payment orchestration.

Is Finexer suitable for UK startups?

Yes. Finexer is built for UK startups and SMEs, offering instant payments, 99% bank coverage, and usage-based pricing with no setup fees.

Does Token.io offer account data access?

No. Token.io focuses on A2A payments and does not offer account information services like balances or transaction history.

Need an Affordable Provider? Switch to Finexer! Schedule your free demo and get a 14-day Trial by Finexer 🙂

![TrueLayer Alternatives for UK Open Banking in 2025 1 Truelayer Alternatives for UK Open Banking [2025 Guide]](/wp-content/uploads/2025/04/Truelayer-Alternatives.png)