The financial scene in the United Kingdom has recently reached a significant milestone. According to the most recent data from Open Banking Limited (OBL), Open Banking, the technology that powers the easy “Pay by Bank” options at checkout and the intelligent apps that control your spending, has officially surpassed 15 million active users. This significant achievement solidifies its evolution from a specialised regulatory idea to a powerful force reshaping UK finance.

This quick adoption highlights a fundamental change in how businesses and consumers behave. “To see this exponential growth, with 15 million active users and adoption now becoming embedded, is a huge testament to the benefits Open Banking is delivering,” said Marion King, Chair and Trustee of Open Banking Limited, in a recent statement.

What is this innovative technology, then? Fundamentally, Open Banking is a straightforward but groundbreaking idea that the Competition and Markets Authority (CMA) of the United Kingdom has mandated. The fundamental idea is that you ought to be in total control of your own financial information. In order to access a multitude of advantages, including expedited mortgage applications, immediate business loans, and more sophisticated accounting software, you can now safely share your information with regulated third parties.

From a regulatory idea to a widespread success, this guide charts the entire development of open banking in the UK. We’ll examine its practical effects on customers and Open Banking for businesses, as well as anticipate Open Finance, the next development in the financial industry.

So what exactly is Open Banking? And why is it so important?

Consider Open Banking as providing a service with a temporary, secure key for a particular task instead of your real password. Using the secure app or website of your own bank, you directly approve each request. This implies that you have the ability to withdraw access at any moment and that your login information is never shared.

The purpose of its creation was to promote innovation in UK finance.

The UK’s transition to open banking wasn’t a coincidence. The Competition and Markets Authority (CMA) ordered the purposeful action to boost competition in the UK financial industry. Better services and more options for businesses and consumers were the objectives.

The outcome is a huge surge in innovation, which is one of the primary advantages of Open Banking. The Financial Conduct Authority (FCA) claims that hundreds of regulated providers are currently developing tools for everything from simpler mortgage applications to more intelligent Open Banking for business solutions.

Is Open Banking safe?

Open Banking is highly secure, built on three layers: strict FCA regulation, bank-grade technology, and full user control. You always decide what data is shared and can revoke permission anytime.

Can anyone use Open banking?

Yes, almost anyone with a UK online bank account can use Open Banking, including individuals and businesses. To use it, you simply need to give your consent through a regulated app or service to securely connect to your bank account.

The UK’s Path to 15 Million Users: A Growth Timeline

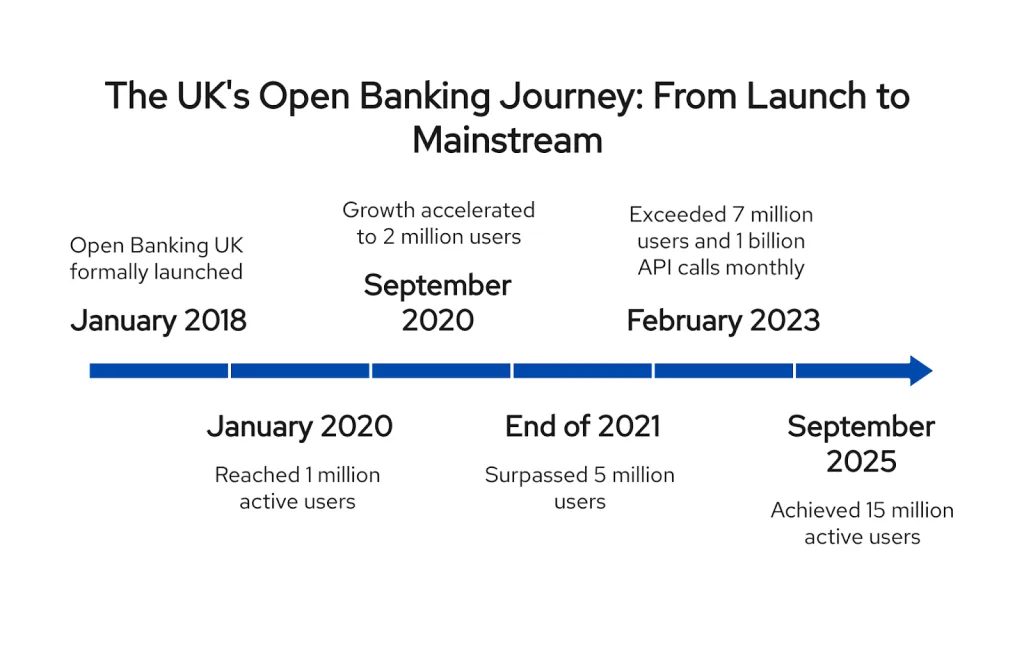

The development of Open Banking did not happen overnight. Establishing trust and demonstrating its worth took time. This timeline demonstrates its evolution from a novel concept to a widely used financial instrument.

In January 2018, Open Banking UK formally launched in response to a directive from the Competition and Markets Authority (CMA). Building the secure infrastructure was the main goal of the first phase, not the number of users. The nine biggest banks in the UK had to develop the technology that would enable clients to safely exchange their financial information.

Key Stat: Because the emphasis was solely on technical implementation, user adoption began at zero in early 2018.

Getting Started (2019–2020): The Initial Million

At this point, the first wave of fintech apps started to highlight the practical advantages of Open Banking. People could now view all of their bank accounts in one location and gain a better understanding of their personal finances for the first time thanks to regulated apps.

Key Stat: One million active users was the first significant milestone in the Open Banking journey by January 2020.

Key Stat: Growth picked up speed, reaching 2 million users in September 2020, just eight months later.

The Tipping Point: Rapid Development (2021–2023)

- Open Banking was prepared for the massive shift to digital finance brought on by the pandemic. Its applications went far beyond just viewing accounts. As “Pay by Bank” services proliferated, companies started implementing them for more efficient bookkeeping.

- Key Stat: By the end of 2021, there were over 5 million users.

- Key Stat: By February 2023, there were over 7 million users, and the monthly number of API calls had surpassed one billion.

Today’s Mainstream Moment: A Common Feature

Open Banking UK is now a dependable and commonplace aspect of contemporary finance. It is integrated into major e-commerce checkouts, business software, and government services like HMRC. It has effectively transitioned from a specialised idea to vital infrastructure.

Key Stat: The ecosystem now has more than 15 million active users, according to a September 2025 report from Open Banking Limited.

Key Stat: Over 11 million transactions are made through Open Banking payments each month, demonstrating its importance in commerce.

Impact in the Real World: A Success Story of Finexer and Sysynkt

The way that Open Banking addresses actual business problems demonstrates its full potential. The issue was obvious to Sysynkt, a top B2B automation provider: the majority of Open Banking partners prioritised customers over the intricate requirements of businesses.

Sysynkt needed a partner that could provide its international clientele with top-notch, business-focused services. Finexer was selected due to its customised B2B solutions and collaborative approach.

“Our business isn’t about the volume of consents—it’s about delivering high-quality services to some of the biggest names in the industry. We needed a partner who understood the importance of providing business-focused solutions, and Finexer joined us on that journey.”

— Penny Phillips, Chief Commercial Officer at Sysynkt

The result is a strong, long-term partnership that enables Sysynkt to enhance its automation services through secure, reliable, and business-focused Open Banking technology.

Open Banking in Your Daily Life: More Than Just an App

The Open Banking evolution has moved beyond abstract numbers and into the practical tools millions use daily. The real Open Banking benefits are often invisible, working seamlessly to make managing your finances simpler, faster, and smarter. Here’s how it impacts daily life across the UK.

How UK Open Banking Strengthens Your Personal Finances

For individuals, Open Banking UK has revolutionised how we deal with our finances, enabling everyone to have access to excellent financial management.

- Smarter Budgeting: Open Banking is used by well-known UK apps to safely link to your bank accounts. They save you hours of manual work with spreadsheets by automatically classifying your spending, keeping track of your bills, and giving you a single, clear view of your personal finances.

- Easier Saving: These services can analyse your spending patterns to find extra money that can be “swept” into a savings account automatically or use virtual round-ups to help you save money without realising it.

- Faster Credit & Mortgages: By granting UK lenders temporary, secure access to your income and expenditure financial data, Open Banking eliminates the need to print months’ worth of paper bank statements, greatly speeding up the mortgage process.

Using Open Banking to Transform Business Operations in the UK

Open Banking has quietly changed the business landscape, particularly for small and medium-sized businesses (SMEs) in the UK.

- Real-Time Cash Flow: Open Banking feeds are now used by business tools like Finexer’s accounting software. This eliminates the need for manual uploads and gives a precise, real-time picture of a company’s cash flow by updating transaction data in real-time.

- Faster, Cheaper Payments: One obvious advantage is the growth of the “Pay by Bank” option. With reduced transaction costs and immediate settlement, open banking payment solutions are a strong substitute for credit cards for businesses.

- Simplified Lending: Similar to personal mortgages, Open Banking enables UK business lenders to make credit decisions more quickly and accurately by using secure real-time financial data with the customer’s consent.

What data can be shared through Open Banking?

With your consent, you can share financial data from current, savings, and credit card accounts. This includes your account details, balances, transaction history, and information about regular payments like direct debits, all through secure, regulated apps.

What is the difference between Open Banking and Normal banking?

Your financial information is kept separate within your bank during regular banking. You can safely share this information with other regulated apps using Open Banking, but only if you give your express permission.

The Ripple Effect: How Open Banking Changed UK Finance Forever

The introduction of Open Banking did more than just create new apps; it sent a ripple effect across the entire UK finance industry, fundamentally changing how banks, businesses, and consumers interact with money.

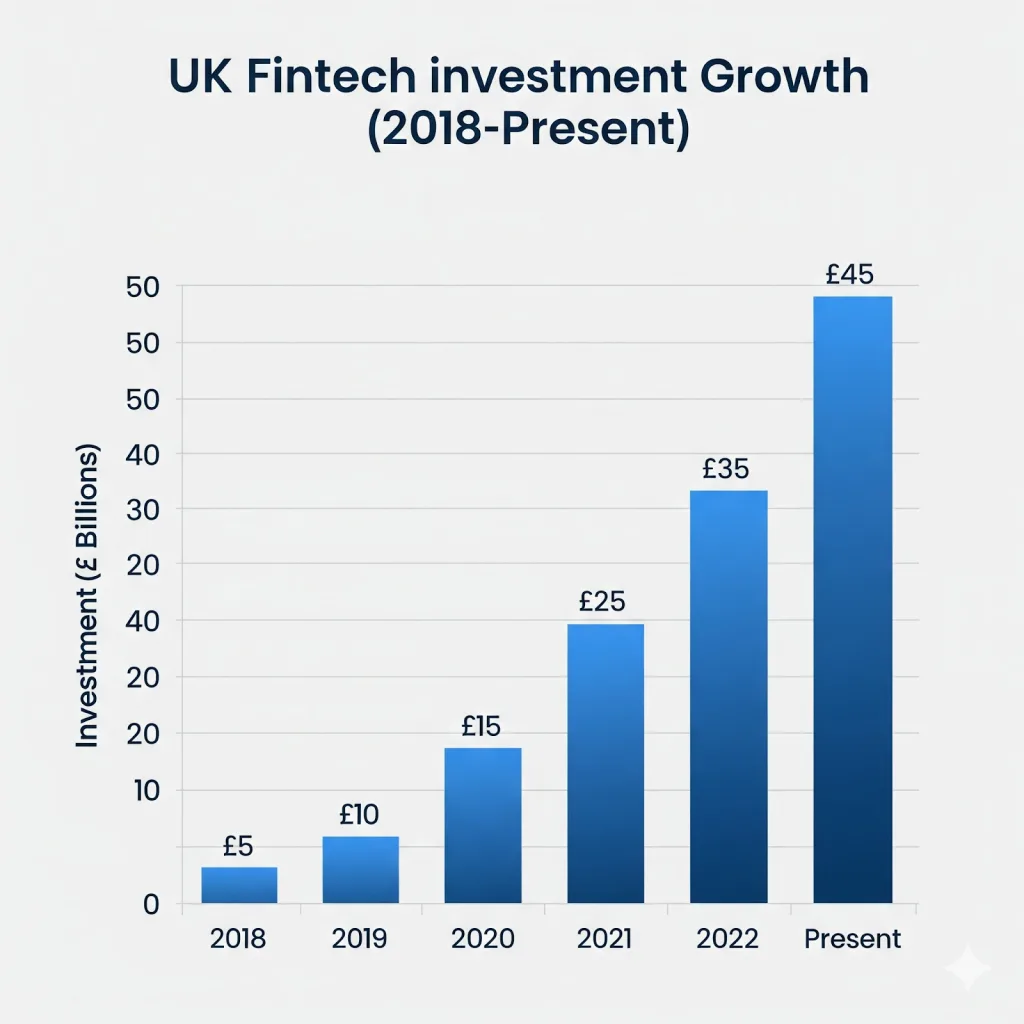

A New Competitive Wave

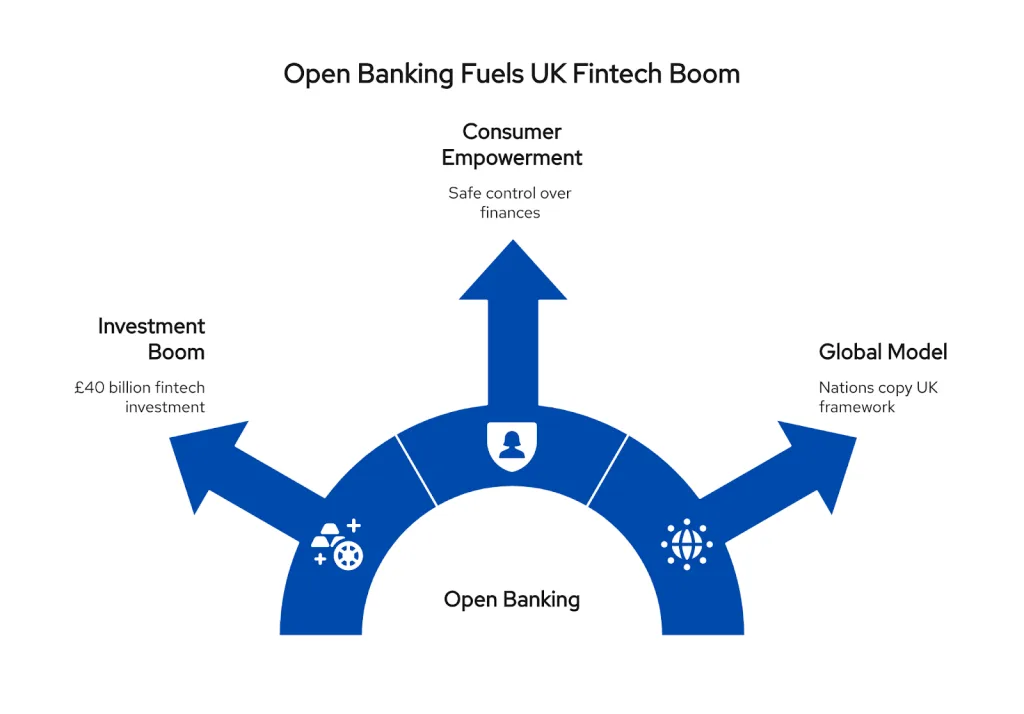

The introduction of intense competition into a market that had previously been controlled by a small number of powerful companies was arguably the biggest influence. A new generation of creative fintech companies in the UK were able to create better products and services because the CMA mandate forced traditional banks to open their doors. Since 2018, the UK fintech industry has drawn over £40 billion (according to KPMG’s “Pulse of Fintech” report) in investment, resulting in an amazing boom. With more than 3,000 fintech companies vying for customers’ attention like the UK Government’s Department for Business and Trade reports suggest, which periodically releases data on the strength of the sector, the UK is currently a major global centre for financial innovation.

Empowered Consumer Power

In the end, consumer empowerment has been one of the main advantages of Open Banking. It changed the balance of power by granting individuals safe control over their own financial information. Millions of people in the UK can now share their information safely and easily to access personalised products, get better deals, and better manage their personal finances. More than 70% of UK adults who are digitally active currently use at least one fintech service, and as of September 2025, Open Banking Limited reports that over 15 million individuals and businesses actively use these services.

The United Kingdom as a Global Model

The success of the UK has not gone unnoticed. Its Open Banking model, which is governed by regulations, has emerged as the industry standard and a model for fintech innovation worldwide. Using the UK’s successful Open Banking journey as a model, nations all over the world are now copying this framework to strengthen their own financial ecosystems. Since more than 80 nation, including Australia, Brazil, and Canada,have put similar frameworks into place or are thinking about doing so, the UK has solidified its position as a leader in Open Banking implementation, routinely ranking in the top three worldwide.

The Next Chapter: Open Finance

Open Banking is followed by Open Finance. It safely links all of your financial affairs, including banking, investments, insurance, and pensions. Using the same security guidelines and your permission, this enables you to view everything in one location.

The Final Objective

Giving you a comprehensive, up-to-date view of your overall financial health is the aim. You can stop speculating and begin making better decisions based on your entire financial situation by safely combining all of your disparate financial data.

Future Forecasts

AI-powered hyper-personalised services will be available in the future. Imagine smarter insurance that adjusts to your needs, automated financial advice that is customised to your life, and pension planning that takes into account your whole financial situation to assist you in getting ready for retirement.

In summary, the revolution is here to stay.

In the UK, Open Banking’s journey has been nothing short of revolutionary. What started out as a specialised regulatory tool from the CMA to force open a closed market has developed into a vital component of the financial system in the United Kingdom. Reaching more than 15 million users is evidence of a fundamental change in the way we engage with our finances, not just a statistic.

To conclude, let’s quickly look at why open banking is always a better choice:

| Feature | Normal Banking (Traditional) | Open Banking |

|---|---|---|

| Data Access | Your financial data is kept in a silo, accessible only by you and your bank. | You can grant secure access to your financial data to regulated third-party apps and services. |

| Core Principle | Closed system. The bank controls the customer relationship and data within its walls. | Open system (with consent). The customer owns their data and has the right to share it securely. |

| Services | Limited to the products offered directly by your bank (e.g., current accounts, loans). | Enables a wide range of innovative services like all-in-one budgeting apps, automated savings, and faster credit checks. |

| Technology | Relies on the bank’s own internal, proprietary systems. | Uses secure, standardised APIs (Application Programming Interfaces) that act as a protected bridge between banks and third parties. |

| User Control | You manage your account through the bank’s channels but cannot easily share your data. | You have explicit control. You must give consent for any data sharing and can revoke access at any time. |

Are You Prepared to Take Advantage of Open Banking?

Open banking is now the present rather than the future. The time to act is now, regardless of whether you’re a fintech company trying to develop next-generation financial products or a business trying to streamline payments, lower transaction fees, or increase cash flow visibility.

Open Banking is more than just a fad; it’s the UK’s new financial infrastructure, with over 15 million active users and billions of API calls each month.

Maintain your competitiveness, give customers more control, and innovate more quickly with regulated, safe technology.

Choose the Correct Open Banking Provider to Collaborate with:

You need a partner who is FCA-authorised, quick to deploy, and designed for UK businesses if you’re prepared to incorporate Open Banking into your systems.

Finexer works with 99% of UK banks, the open banking infrastructure that enables secure bank connections, real-time financial data, and instant payments.

- White-label APIs that go live 2-3 times quicker than industry norms

- You don’t have to worry about regulations because compliance is taken care of.

- Pricing based on usage—affordably scale as you expand, with a 90% lower transaction fee.

See how Finexer can improve your data and payment processes by requesting a demo right now.