SPAA stands for “SEPA Payment Account Access.” It is a framework designed to enhance the way payment account data is accessed and used within the Single Euro Payments Area (SEPA). SEPA is a region in which individuals and businesses can make and receive payments in euros under the same basic conditions, rights, and obligations, regardless of their location within Europe.

What You’ll Discover in This Blog:

Introduction

In an era where digital transformation dictates the pace of advancements in the financial sector, the Standardized Payments API Access (SPAA) initiative stands out as a pivotal enabler of open banking and open finance. By facilitating secure and standardized API access for Third Party Providers (TPPs), SPAA not only aligns with the Payment Services Directive 2 (PSD2) regulatory requirements but also propels the broader adoption of account-to-account (a2a) payments. This advancement underscores a significant shift towards more accessible, transparent, and efficient financial services, highlighting why SPAA is essential for the evolution of open banking.

Our exploration into SPAA will uncover its transformative role in open banking by detailing how it serves as a cornerstone for innovation and collaboration between financial institutions, TPPs, and consumers. We will delve into the benefits it brings to the table, including enhanced operational efficiencies, improved customer experiences, and the opening up of new opportunities for financial products and services. Through a clear, concise, and informative lens, we aim to provide a comprehensive understanding of SPAA’s impact on the financial sector, underscoring its importance in the dynamic landscape of financial technology.

What is SPAA?

SPAA, which stands for SEPA Payment Account Access, is a groundbreaking initiative that aims to revolutionize the open banking landscape. Published by the European Payments Council (EPC), it is designed to create a standardized and secure framework for accessing payment account data within the Single Euro Payments Area (SEPA).

How Does It Work?

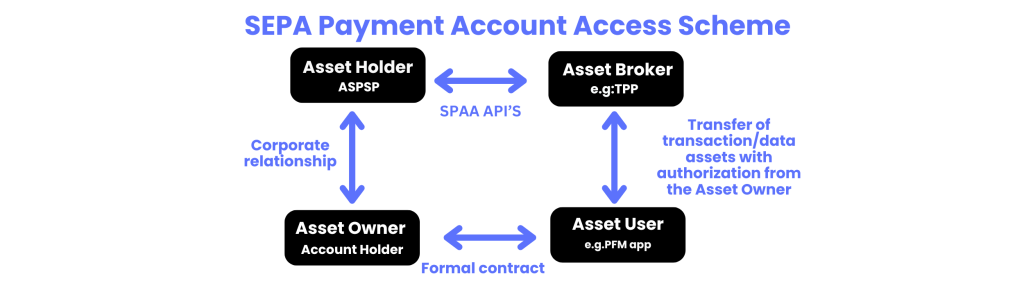

Consent: You provide consent to a TPP (Asset Broker) to access your payment account information. This is usually done through a simple authorization process on your banking app or the TPP’s app.

Data Access: The TPP (Asset Broker) accesses your payment account data via secure APIs (SPAA APIs) provided by your bank (Asset Holder, ASPSP). These APIs ensure the safe transfer of your data.

Service Provision: The TPP uses your payment account data to offer you the desired service, such as providing spending insights or financial advice. The data is then used by a service (Asset User) like a PFM (Personal Finance Management) app.

Example:

Imagine you use a budgeting app that helps you track your expenses. With SPAA, this app can securely access your transaction history from multiple bank accounts (with your permission) and provide you with a comprehensive overview of your spending habits, helping you manage your finances better.

How SPAA Transforms Open Banking

SPAA (SEPA Payment Account Access) is set to revolutionize the open banking landscape by going beyond the basic services mandated by PSD2 (Payment Services Directive 2). The SPAA rulebook, published by the European Payments Council (EPC), aims to standardize the approach and implementation of data exchange between banks and third-party providers, paving the way for innovative “premium” services powered by open banking.

For Data Assets, SPAA details new “premium” data accessible to Asset Brokers from Asset Holders, which includes:

| Category | Data Details |

|---|---|

| List of Payment Accounts | Name, Address, Age, DOB, Phone Number, VAT Number, Country, Account Details, Balances, Currency, Product Name, Account Type, Account Name, Status, Usage |

| List of Current Accounts | Name, Address, Age, DOB, Phone Number, VAT Number, Country, Account Details, Balances, Currency, Product Name, Account Type, Account Name, Status, Usage |

| List of Current Accounts with Credit Line | Credit Conditions, Linked Account Information |

| List of Savings Accounts | Interest Conditions |

| List of Payment Account Transactions | Date, Amount, Currency, Balances, Status, ID, Charges, MCC, Card Number, Card Brand |

| List of Cards | Card Holder Name, Card Number, Balance, Currency, Card Type, Linked Account Information, Product Name, Account Name, VAT, Address, DOB, Age, Phone Number, Card Status, Card Brand, Credit Conditions |

| List of Card Transactions | Date, Amount, Currency, Balances, Status, ID, Charges, MCC, Card Number, Card Brand |

Notes–

Useful Details for Personal Finance Management (PFM):Product Name, Usage, Credit Conditions, Interest Conditions: Help recommend higher yielding or lower cost products.

Personal Information for Enhanced Security:Date of Birth (DOB), Age, Phone Number: Used for enhanced authentication and verification to combat fraud.

Going Beyond PSD2

PSD2’s Role:

PSD2 (Payment Services Directive 2) started the open banking revolution by making banks open their payment systems to third-party providers (TPPs).

SPAA’s Advancement:

SPAA (SEPA Payment Account Access) builds on this by supporting more types of payments. These include:

🗸 Simple one-time payments.

🗸 Payments scheduled for future dates.

🗸 Complex recurring payments, similar to the UK’s Variable Recurring Payments (VRP).

In The UK & SEPA Region

In the UK:

- The Competition and Markets Authority (CMA) has mandated Variable Recurring Payments (VRP) for sweeping use cases, meaning automatic transfers between a customer’s own accounts.

- This mandate ensures that certain financial services are provided to customers as a requirement.

In the SEPA Region :

- The services outlined in the first version of the SPAA rulebook are currently optional.

- This means that banks and financial institutions in the SEPA region can choose whether or not to implement these services.

In summary, while the UK has mandatory regulations for certain open banking services, the SPAA framework in the SEPA region currently provides optional guidelines, giving banks and financial institutions the flexibility to adopt these services at their own pace.

Future Developments:

- The SPAA multi-stakeholder group is working on:

- Delivering a “minimum viable product” that participants in the scheme will need to support.

- Establishing default fees for the use of the SPAA API.

- Exposing additional “assets” by banks to third-party providers.

By going beyond PSD2, SPAA aims to enhance the open banking ecosystem, making it more dynamic and versatile.

API’s Role in SPAA

- Data Exchange and Standardisation

- APIs (Application Programming Interfaces) are vital for enabling data exchange necessary for SPAA’s premium services.

- The rulebook establishes the data framework required to support various payment flows, ensuring a standardized approach across banks and third-party providers.

- Supporting Diverse Use Cases

- By leveraging APIs, SPAA supports a wide range of use cases, surpassing current open banking services.

- Facilitates multi-counterparty payments, enhancing marketplace effectiveness and operational efficiencies for merchants.

- Positioning the EU as a Leader

- Adoption of SPAA, supported by payment schemes and European Commission’s proposed legislation for Instant Payments, could position the EU as a market leader in open banking payments.

- Advances in enabling frictionless Pay by Bank experiences across various use cases can benefit merchants significantly, including reduced costs, increased efficiency, and secure payments through Strong Customer Authentication (SCA).

Impact of SPAA

For Banks

- Monetising Open Banking Investments

- SPAA provides an opportunity for banks to monetise their open banking investments by offering chargeable premium API services beyond basic PSD2 functionalities.

- This new revenue stream can incentivise banks to invest further in maintaining and enhancing their API infrastructure.

- Tailored Payment Solutions

- SPAA’s modular approach allows banks to customise payment solutions to meet specific customer needs, potentially improving customer satisfaction and loyalty.

- Rich functionality, such as Dynamic Recurring Payments (DRP), enables banks to offer innovative payment services that rival traditional card-based methods.

For Fintechs and Consumers

- Lowering Barriers for Fintechs

- SPAA reduces entry barriers for fintechs by providing a standardised and efficient way to access customer account data and initiate payments.

- Fosters innovation and competition in the open banking ecosystem, leading to new financial products and services benefiting consumers.

- Enhanced Services for Consumers

- Enables fintechs to offer enhanced services such as personal finance management tools, budgeting apps, and automated payment solutions by combining various transaction and data assets.

- Leads to more convenient and tailored experiences for consumers, including features like one-click checkouts and seamless subscription management.

- Improved Payment Options

- SPAA’s support for instant payments and reduced reliance on card-based transactions can result in faster, more secure, and cost-effective payment options for both merchants and consumers.

Benefits for Financial Institutions and Consumers

Enhanced Services

- Access to Customer Account Data

- SPAA enables Third Party Providers (TPPs) to access a wide range of customer account data, including account balances, transaction history, and payee information, with explicit customer consent.

- Empowers TPPs to develop innovative financial services, such as personal finance management tools, budgeting apps, and automated payment solutions catering to specific customer needs.

- Initiating Payments

- SPAA allows TPPs to initiate payments from customer accounts to other accounts, facilitating faster, more convenient, and potentially automated payment processes.

- Features like Dynamic Recurring Payments (DRP) support one-click checkouts and subscription services, enhancing user convenience.

SPAA’s implementation promises to bring significant advancements in the financial sector, fostering innovation and providing improved services for both financial institutions and consumers.

Monetisation Opportunities

- Revenue Generation for Financial Institutions

- SPAA presents opportunities for financial institutions to monetise their data assets through fees for API access and data sharing.

- Banks can potentially create new revenue streams by partnering with Third Party Providers (TPPs) to offer innovative service offerings.

- Fair Distribution of Value and Risk

- The scheme ensures a fair distribution of value and risk among all stakeholders.

- Customers retain control over their data and can choose which TPPs to share it with, while banks maintain security and compliance.

- Promoting a Competitive and Innovative Market

- SPAA’s collaborative framework, developed by the European Payments Council (EPC), European Retail Payments Board (ERPB), and various EU institutions, promotes a more competitive and innovative market.

- By extending beyond the scope of PSD2, SPAA aims to increase open banking adoption across Europe, creating a more robust financial ecosystem that benefits both financial institutions and consumers.

Conclusion

The Standardized Payments API Access (SPAA) initiative revolutionizes open banking within the Single Euro Payments Area (SEPA) by providing a secure, standardized framework for accessing payment account data. Going beyond the Payment Services Directive 2 (PSD2), SPAA supports various payment types and premium services, enabling financial institutions to monetize their data and offer tailored solutions. This initiative fosters innovation, lowers entry barriers for fintechs, and enhances consumer experiences with improved financial tools and payment options. SPAA’s collaborative framework promotes a competitive market, driving the adoption of open banking across Europe and creating a more robust financial ecosystem.

FAQs

1. Which countries are leaders in open banking initiatives?

Currently, the United Kingdom and Australia are at the forefront of establishing open banking systems. These countries have the most advanced and actively pursued open banking initiatives.

2. What makes open banking significant?

Open banking is significant because it allows customers access to a broader array of financial products and services. Through open banking, customers benefit from collaborations between financial institutions and fintech providers, offering tailored solutions for budget management, investments, loans, and insurance that better meet their needs.

3. What essential function does the commercial banking system serve in market responses?

The commercial banking system plays a crucial role in the economy by generating capital, credit, and liquidity. These functions are vital for the overall market’s operation and stability.

4. Why do policymakers and regulators support open banking?

Policymakers and regulators advocate for open banking because it promotes competition and innovation within the financial sector. Originating from the EU’s second Payment Services Directive (PSD2) and backed by the Competition Markets Authority, open banking allows customers to permit third-party providers to access their payment account information or make payments on their behalf, facilitating a more competitive market environment.

Are you a company seeking easier bank cash management or payment automation? We’d love to chat.