Overview

Finexer’s Variable Recurring Payments (VRPs) solution offers a cutting-edge approach to managing recurring payments, allowing businesses to automate and streamline transactions with greater flexibility and security. Currently in beta, Finexer’s VRPs leverage Open Banking technology to provide a smarter, more efficient way to handle recurring payments for a variety of use cases, from subscription services to loan repayments.

📚Guide Variable Recurring payments in 2025

Key Features

Cost Efficiency

Reduced Transaction Costs: By utilising direct bank transfers, VRPs reduce transaction costs compared to traditional methods involving intermediaries.

Transparent Pricing: Businesses benefit from predictable and transparent pricing, enabling better financial planning and budgeting.

Automation and Flexibility

Automated Payments: VRPs automate recurring payments, reducing the administrative burden on businesses and ensuring timely payments.

Variable Payment Amounts: Unlike traditional recurring payments that are fixed, VRPs allow for variable amounts, providing flexibility to accommodate changes in payment amounts.

Enhanced Security

Secure Transactions: Finexer employs robust security protocols, including AES-256 data encryption and TLS 1.2, to ensure the highest level of security for all transactions.

Fraud Prevention: Real-time fraud detection mechanisms monitor transactions, reducing the risk of fraudulent activities.

Seamless Integration

API Integration: Finexer’s APIs can be easily integrated into existing systems, allowing businesses to quickly implement the VRPs solution with minimal technical overhead.

White Label Solutions: Businesses can customise the payment interface to match their brand identity, providing a consistent and professional experience for end users.

Versatile Payment Options

Multiple Channels: VRPs support various payment channels, including direct bank transfers and recurring payments, catering to diverse business needs.

User-Friendly Interface: The intuitive design ensures a smooth user experience, making it easy for recipients to manage their payments.

Benefits

Operational Efficiency 🗹

Quick Setup: Quick Setup: Finexer’s streamlined API and comprehensive developer support enable businesses to integrate the VRPs solution quickly, minimising downtime and ensuring a smooth transition.

Reduced Manual Errors: Automated processes reduce the likelihood of human error, ensuring that payments are accurate and consistent, which enhances reliability and trust in financial operations.

Improved Cash Flow Management: By automating recurring payments, businesses can better predict cash flow and manage their finances more effectively, leading to improved operational efficiency.

Customer Satisfaction 🗹

Automated and Timely Payments: Customers benefit from the convenience of automated payments, ensuring their bills are paid on time without manual intervention, which enhances satisfaction and trust.

Flexible Payment Options: VRPs allow for variable payment amounts, providing customers with flexibility to manage their finances according to their specific needs and circumstances.

Enhanced User Experience: The intuitive and user-friendly interface of Finexer’s platform makes it easy for customers to set up and manage their payments, improving overall satisfaction and loyalty.

Regulatory Compliance 🗹

PSD2 Compliance: Finexer handles compliance with PSD2 regulations, ensuring that all transactions meet the necessary legal and regulatory standards, saving businesses time and resources on compliance management.

Data Security and Privacy: Finexer’s robust security protocols, including AES-256 data encryption and TLS 1.2, ensure that sensitive customer data is protected, helping businesses comply with data protection regulations.

Reduced Risk of Non-Compliance: By using Finexer’s compliant platform, businesses can reduce the risk of regulatory fines and penalties associated with non-compliance, ensuring peace of mind.

Fraud Detection 🗹

Real-Time Monitoring: Finexer’s advanced fraud detection mechanisms monitor transactions in real-time, identifying and preventing fraudulent activities before they can cause harm.

Secure Authentication: Customers authenticate directly with their banks through secure Open Banking APIs, reducing the risk of fraud associated with card payments and other traditional methods.

Comprehensive Fraud Protection: By utilising multiple layers of security, Finexer provides comprehensive protection against fraud, ensuring the safety of transactions for both businesses and customers.

Use Cases

Subscription Services

Automated Subscription Payments: Simplify the process of collecting subscription fees with automated, variable recurring payments. This is ideal for services that offer tiered pricing or usage-based billing.

Flexible Payment Amounts: Adjust payment amounts based on usage or subscription level changes, providing flexibility to both the business and the customer.

Loan Repayments

Automated Loan Payments: Enable borrowers to automate their loan repayments, ensuring timely payments and reducing the risk of default.

Variable Payment Amounts: Adjust repayment amounts based on interest rate changes or other variables, ensuring accurate and fair payments.

Utility Bills

Automated Bill Payments: Automate the collection of utility bills, such as electricity, water, and gas, ensuring timely payments and reducing administrative workload.

Usage-Based Billing: Adjust payment amounts based on actual usage, providing transparency and fairness to customers.

Seasonal Adjustments: Implement variable payments that adjust seasonally to reflect higher or lower usage, helping customers manage their budgets more effectively.

Insurance Premiums

Automated Premium Payments: Enable customers to automate their insurance premium payments, ensuring continuous coverage and timely payments.

Variable Payment Amounts: Adjust premium amounts based on policy changes or other factors, providing flexibility to both the insurer and the insured.

Policy Adjustments: Automatically update premium amounts based on changes in coverage, such as adding a new vehicle or adjusting home insurance coverage.

Membership Fees

Automated Membership Dues: Simplify the collection of membership fees for clubs, gyms, and organisations with automated recurring payments.

Tiered Membership Levels: Adjust payments based on membership levels, such as basic, premium, or VIP memberships, providing flexibility for members.

Renewal Management: Automatically handle membership renewals, ensuring continuous membership without manual intervention.

Charitable Donations

Automated Recurring Donations: Facilitate regular donations for non-profit organisations with automated variable payments, allowing donors to contribute consistently.

Flexible Donation Amounts: Enable donors to adjust their contribution amounts based on their financial situation or specific fundraising campaigns.

Campaign-Specific Adjustments: Automatically increase donation amounts during special campaigns or matching gift periods to maximise fundraising efforts.

Tuition and School Fees

Automated Tuition Payments: Simplify the collection of tuition and school fees for educational institutions with automated recurring payments.

Variable Payment Plans: Offer parents flexible payment plans that adjust based on the number of enrolled courses or additional school activities.

Seasonal Adjustments: Adjust payment amounts based on the school term or semester, providing an adaptable payment schedule for parents.

Property Management

Automated Rent Collection: Enable property managers to automate the collection of rent payments from tenants, ensuring timely and consistent payments.

Variable Rent Payments: Adjust rent payments based on lease agreements, such as including utilities or other variable costs.

Maintenance Fees: Automatically collect additional fees for maintenance or repairs, providing a seamless payment process for both tenants and property managers.

health and wellness services

Automated Service Payments: Automate payments for health and wellness services, such as therapy sessions, fitness classes, or wellness programs.

Variable Payment Amounts: Adjust payments based on the number of sessions or classes attended, providing flexibility for clients.

Package Adjustments: Offer clients the ability to adjust their payment amounts based on selected service packages or bundles.

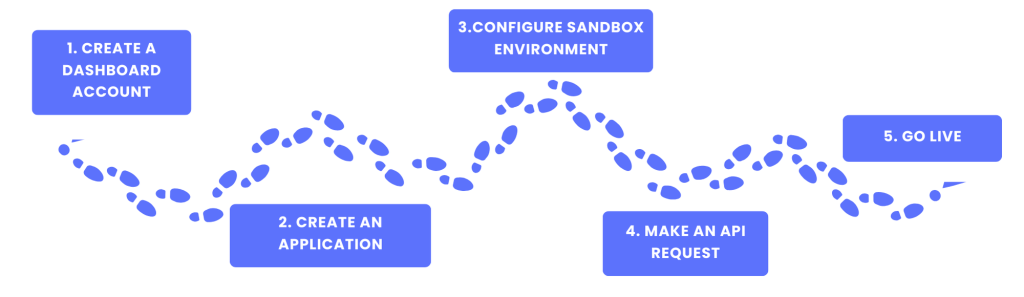

Getting Started

1.Create a Dashboard Account: Set up an account on the Finexer dashboard to manage and monitor payments.

2.Create an Application

3.Configure Sandbox Environment: Test integrations in a separate sandbox environment without affecting live data.

4.API Integration: Utilise Finexer’s APIs for seamless integration into existing systems.

5.Go Live: Launch the instant payment solution and start benefiting from real-time, secure transactions.

GET IN TOUCH

Experience the future of recurring payments with Finexer’s VRP solution – automate, secure, and simplify your transactions today!—read on to learn more!