Introduction

Imagine this: you’ve just returned an item you bought online. Typically, you’d expect your money back in a few days. Now, picture this instead—your refund arrives in your bank account within seconds, ready to use immediately. This is the kind of speed and convenience businesses can provide to their customers through instant payouts.

Instant refunds and withdrawals are becoming an essential part of today’s digital-first world. They don’t just save time; they transform the experience of how money moves, benefiting both businesses and their customers. Let’s explore what they are and how they work.

We will Guide you through:

Who Is This For?

You’re in the right place if you:

- Are part of a Fintech startup looking to understand how instant payouts can improve your services and give you a competitive edge.

- Run an e-commerce business or marketplace and want to make your refund process fast and friction-free for your customers.

- Manage a gig economy platform or freelancer network where fast payments to workers are key to retention and satisfaction.

- Lead a financial services company offering wallets or investment apps where instant withdrawals can be a major differentiator for user experience.

- Simply want to understand how Open Banking is reshaping payments in the UK and how you can use it to benefit your business.

This blog is tailored to help you learn the essentials of instant refunds and withdrawals and how they can directly impact your operations, customer experience, and bottom line. Whether you’re exploring solutions or planning implementation, you’ll find clear, actionable insights here.

What Are Instant Refunds & Withdrawals?

At their core, instant payouts refer to the process of transferring funds directly between bank accounts in real-time. This includes:

- Instant Refunds: When customers receive their money back immediately after returning a product or canceling a service.

- Instant Withdrawals: When users, such as freelancers or app users, withdraw their earnings or balance to their bank accounts without delays.

How is this possible? The magic lies in Open Banking, a system that allows secure, direct communication between financial institutions. Instead of relying on traditional payment methods, like card networks or lengthy bank processes, Open Banking enables businesses to process payments swiftly and reliably.

For example:

- A marketplace seller can get paid moments after a transaction.

- A customer returning a product online can see their refund reflected in their bank account immediately.

- A user withdrawing money from an app wallet can access their funds right away.

This approach eliminates waiting periods, offering a smooth experience for all parties involved.

Why Instant Refunds Matter More Than Ever

Consumer Demand for Instant Refunds

Imagine this: nearly 8 out of 10 customers are actively saying they would choose instant refunds if given the chance. That’s a staggering 79% of people who, when faced with a refund scenario, want their money back immediately, not in days or weeks. What’s more fascinating is that this number is not static—it’s growing rapidly. Between September 2023 and January 2024, this demand for instant refunds shot up by 17%.

This trend signals a clear shift in customer expectations. Refunds, once considered a routine and slow-moving process, have now become a key touchpoint in the customer experience journey. When refunds are delayed, customers are left feeling dissatisfied and disengaged. On the flip side, businesses offering instant refunds not only meet these growing expectations but also position themselves as responsive, customer-focused brands.

For businesses, this stats is a wake-up call. Failing to implement instant refund capabilities could mean falling behind in a competitive market where speed equals loyalty. This growing demand showcases that refunds are no longer a back-office process—they are a critical part of the customer experience that can win or lose repeat business.

Availability of Instant Payments

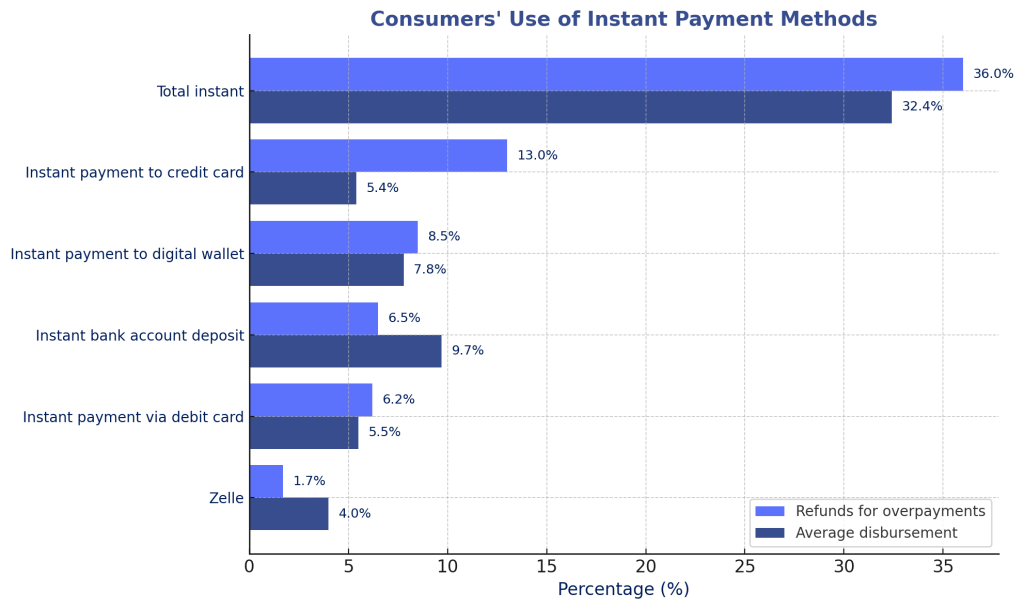

Source: Paymnts intelligence

This chart demonstrates how accessible instant payment options are for consumers:

- 40.7% of refund recipients were not offered instant payment options, compared to 33.4% for average disbursements. This highlights a gap in meeting consumer expectations for refunds.

- Only 41.5% of consumers receiving refunds could choose instant payment, compared to 51.8% for average disbursements. This indicates a need for businesses to increase availability.

Delayed Refunds: A Risk You Can’t Afford

Now, let’s talk about the flip side: what happens when businesses don’t offer instant refunds? The data tells us a troubling story—41% of customers receiving overpayment refunds reported they were not offered an instant payment option, even though they wanted one. That’s nearly half of all refund recipients feeling underserved.

This lack of instant refund options is more than just a missed opportunity—it directly impacts customer satisfaction. Waiting for refunds can be frustrating, especially for customers operating on tight budgets or needing funds urgently. In these cases, delays can erode trust in the brand. Customers might even associate the delay with the business’s inefficiency, even if the issue lies in outdated payment processes.

On the contrary, businesses that empower customers with instant refund options strengthen loyalty and improve retention. Providing instant refunds isn’t just about convenience—it’s about showing that the business values the customer’s time and trust. And with nearly half of refund recipients feeling let down by the lack of instant options, the opportunity for improvement is significant.

For businesses, this highlights the urgency of adopting real-time refund mechanisms. It’s a direct path to enhancing customer satisfaction, reducing churn, and creating a brand experience that keeps customers coming back.

Source: Paymnts intelligence

This chart reveals consumer preferences for instant payment methods:

- 36% of refund recipients used instant payment options compared to 32.4% for average disbursements, showing a higher demand for instant refunds.

- Among specific methods, instant payment to credit cards (13%) and digital wallets (8.5%) stand out as preferred options for refunds.

Why Instant Payouts Matter for Businesses

1. Reliable Cash Flow to Drive Growth

For businesses—whether you’re a Fintech startup, an accounting service, or an SMB—cash flow is the backbone of daily operations and long-term growth. Traditional payment methods often lead to frustrating delays: refunds taking days to process or payouts leaving sellers, freelancers, or employees waiting unnecessarily. Instant payouts resolve these pain points, empowering businesses to:

- Access funds quickly for reinvestment or operational needs.

- Avoid bottlenecks during peak seasons or high-demand periods.

- Maintain financial agility, ensuring operations stay smooth.

For example, a growing marketplace enabling instant payouts to sellers not only builds trust but also encourages more activity on the platform, leading to consistent revenue growth.

📚 Learn more about Open banking use cases for Accounting & ERP

2. Better Customer Satisfaction and Retention

Modern customers demand speed and convenience, and businesses that can meet these expectations stand out. When refunds take too long, customers grow frustrated, reducing loyalty and repeat engagement. Instant refunds offer:

- Quick access to funds after returns or cancellations.

- Enhanced trust, resulting in long-term customer loyalty.

A recent study shows that 90% of shoppers prefer businesses that provide instant refunds, as it simplifies their shopping experience. This is especially valuable for e-commerce platforms and subscription services, where keeping churn rates low and encouraging repeat purchases is critical.

3. Standing Out in the Competitive Landscape

In today’s digital economy, offering instant payouts isn’t just a feature—it’s a differentiator. Businesses that embrace instant refunds and withdrawals show they’re not just keeping up but leading the charge. This positions them as customer-focused and forward-thinking, which can:

- Attract more users, customers, or sellers.

- Stand out from competitors still relying on outdated payment methods.

- Generate positive reviews and word-of-mouth.

For Fintech startups, this can mean creating trust with their clients in industries like e-commerce, gig economy platforms, or financial services. Accounting firms and ERPs can integrate instant payouts to offer businesses seamless financial management solutions.

4. Cost-Effectiveness with Transparency

Unlike traditional systems that depend on costly intermediaries like card networks, instant payouts via Open Banking reduce overhead costs. By adopting instant payment technology, businesses can:

- Save on transaction fees.

- Minimise reconciliation errors through automated processes.

- Avoid chargebacks caused by refund delays.

Moreover, real-time payment tracking provides a clear view for both businesses and their customers, ensuring transparency and accountability.

Real-World Applications

1. E-Commerce Trades:

Refunds are a critical part of online shopping. Delayed refunds erode trust, but instant payouts restore confidence. By enabling quick refunds, businesses can:

- Build loyalty among customers.

- Reduce friction in the shopping process.

- Drive repeat business.

Example: A UK-based fashion retailer saw a 15% increase in repeat purchases after introducing instant refunds, demonstrating the direct impact on customer loyalty and revenue.

2. Gig Economy Platforms:

Freelancers and gig workers highly value fast payouts for their work. Platforms that integrate instant withdrawals can:

- Attract top talent by offering better financial convenience.

- Improve worker satisfaction, which leads to higher retention.

- Build a strong reputation as a worker-first platform.

Example: A ride-sharing app reported higher driver retention rates compared to competitors after implementing instant withdrawal options, moving away from the traditional weekly payout system.

3. Financial Services and Wallet Apps:

For apps offering financial services or investment tools, instant payouts play a vital role in user experience. They enable:

- Immediate access to funds after withdrawal requests.

- Increased deposits and activity as users gain confidence in fund accessibility.

Example: An investment platform noted that 37% of users deposited more money after enabling instant withdrawals, highlighting how trust in accessibility can directly boost engagement.

Don’t Let Slow Refunds Impact Your Customers!

Try Finexer’s Open Banking-powered instant payouts for free today!

How It Works

Finexer simplifies the process of instant payouts by offering a seamless, API-powered solution that handles everything from initiating to completing payouts securely and efficiently. Here’s how it works:

1.Initiate Payouts via Finexer’s API

Businesses can programmatically issue payouts (refunds, withdrawals, or account sweeps) to any user with pre-verified account data. Whether you’re a Fintech startup automating withdrawals for freelancers or an SMB processing customer refunds, Finexer’s API makes it effortless.

2.Secure Execution with Pre-Verified Data

Finexer ensures that all payouts are executed securely using pre-verified bank account details. This eliminates the risk of errors or fraud, giving you and your customers peace of mind.

3.Real-Time Notifications

You’ll be automatically notified of the payout status in real time. This transparency enables businesses to keep their customers informed, enhancing trust and satisfaction.

Workflow:

- A customer requests a refund or withdrawal.

- Your system sends the request to Finexer’s API.

- Finexer validates and processes the payout instantly using verified account data.

- You and your customer receive real-time updates on the transaction’s success.

This streamlined process ensures that payouts are not just fast but also secure and reliable, making it an ideal solution for Fintech platforms, accounting services, and SMBs alike.

How to Implement Instant Payouts

Implementing instant payouts doesn’t have to be a complex or overwhelming process. With the right tools and technology, businesses can seamlessly integrate this feature into their existing systems, delivering faster and more efficient financial services. Here’s how:

1. Leverage Open Banking Technology

Open Banking is the backbone of instant payouts. By enabling direct and secure connections to banks, it allows businesses to initiate real-time payments without relying on intermediaries. This is especially useful for:

- Fintech startups aiming to provide enhanced payment solutions.

- Accounting and ERP services looking to automate payments for their clients.

- SMBs wanting to simplify their financial processes.

Steps to Get Started:

- Partner with a trusted Open Banking service provider like Finexer.

- Use APIs to integrate account-to-account payments into your platform.

- Ensure your payment processes are PSD2-compliant for security and regulation adherence.

2. Choose the Right Open Banking Partner

The success of implementing instant payouts heavily relies on your service provider. Look for a partner that offers:

- Wide Bank Coverage: Access to all major banks in your region.

- Secure APIs: End-to-end encryption and PSD2 compliance.

- Ease of Integration: A single API for all payment and verification needs.

- Scalability: The ability to handle growing transaction volumes as your business expands.

Strategic Insight

Finexer delivers 3x faster deployment compared to competitors, connecting businesses to 99% of UK banks through a single integration.

3. Automate Payout and Refund Processes

Manual payment handling is prone to errors and inefficiencies. By automating payouts, you can:

- Save time and reduce administrative overhead.

- Minimise errors in financial reconciliation.

- Provide instant refunds and withdrawals with minimal human intervention.

Example: Fintech platforms can integrate automation tools to offer instant freelancer payments or e-commerce refunds.

4. Ensure Real-Time Payment Tracking

Transparency is a critical element of customer satisfaction. Real-time payment tracking allows both businesses and customers to:

- Monitor the status of their transactions in real-time.

- Build trust through consistent communication and updates.

- Resolve issues quickly if any arise during the payout process.

📚 Learn more about how Finexer supports Startups

Try Finexer for Instant Payouts

In a world where speed, transparency, and security are paramount, instant payouts have moved from being a luxury to an essential business feature. Whether you’re a Fintech startup looking to enhance your services, an accounting or ERP provider seeking to automate financial processes, or a small-to-medium business striving to deliver better customer experiences, instant payouts powered by Finexer offer the perfect solution.

With Finexer, you’re not just embracing faster payments—you’re adopting a system that prioritises:

- Reliability: Pre-verified transactions for secure and error-free payouts.

- Scalability: Ready to handle growing business needs with seamless API integration.

- Customer Satisfaction: Empower your customers with real-time access to their funds, building trust and loyalty.

Imagine being the business that doesn’t just meet expectations but exceeds them. With Finexer’s Open Banking solutions, you can transform how you handle payments, making your processes faster, more transparent, and highly secure.

Ready to Get Started?

The shift to instant payouts is not just a trend—it’s the new standard. Join the growing list of businesses already benefiting from Finexer’s technology. It’s time to redefine how your business handles refunds, withdrawals, and payouts.

Take the next step. Contact Finexer today and explore how our solutions can empower your business and delight your customers.

1. Create a dashboard account to manage payments.

2. Use Finexer’s APIs for seamless integration.

3. Launch and start processing real-time transactions.

Try Instant Payout today! Schedule your demo and get a 14 days free Trial by Finexer 🙂