The term no KYC casino is everywhere in 2025, often promising faster access, fewer drop-offs, and frictionless play. But for regulated operators, skipping KYC isn’t really an option. What platforms actually want is fast onboarding for casinos without increasing risk.

This is where Open Banking comes in.

Instead of asking players to upload documents or wait through manual reviews, Open Banking lets you verify player identity, income, and affordability directly through their bank, with consent.

The result? You offer a “no-KYC feel” experience without compromising on compliance.

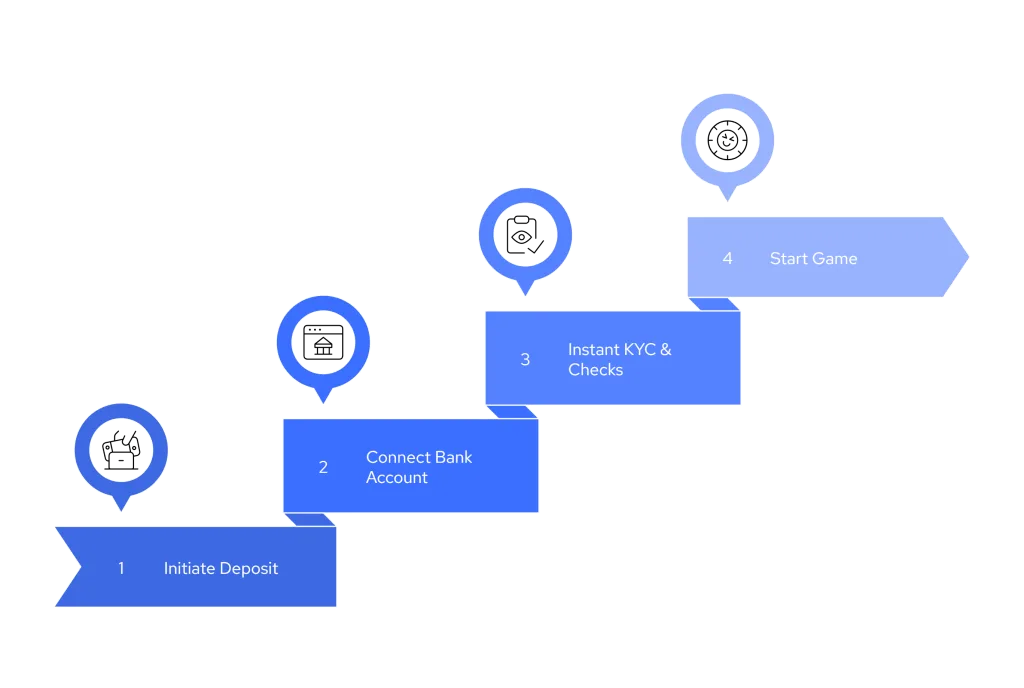

Here’s what this looks like in practice:

- Players connect their bank in under 60 seconds

- You receive verified data (name, address, income) instantly

- KYC, source of funds, and affordability checks run in real time

- Your team stays audit-ready, and the user sees no friction

Open Banking replaces outdated upload flows with real-time trust signals. The player gets a fast entry point, and your compliance team gets the data they need without delay.

📚 Guide to KYC Verification Process

How Open Banking Supports Source of Funds Check in Gambling

UKGC guidance now requires more than just identity checks. Platforms must prove players can afford to gamble and show regulators how that assessment was made.

This is where a source of funds for gambling becomes critical.

Instead of relying on self-declared income or static payslips, Open Banking APIs fetch real-time financial data straight from the player’s bank account. With consent, your platform can retrieve:

- Salary deposits and recurring income

- Recent transactions and gambling spend

- Account holder details to confirm identity

- Flagged risk indicators for affordability reviews

This data supports both your gambling KYC solution and your AML responsibilities, making your reviews faster and more defensible. No screenshots, no PDF uploads, just verified, timestamped bank data.

Platforms using Open Banking for affordability and source of funds checks reduce drop-offs by eliminating back-and-forth requests, especially during high-value reviews.

Player Verification API: The Fast Track to Casino Onboarding

Uploading documents. Waiting for reviews. Asking players to resubmit their ID because of glare or blur. Traditional KYC is a known conversion killer in casino onboarding.

A player verification API powered by Open Banking changes that.

Here’s what your platform can access in real time when a player consents to connect their bank account:

- Full legal name

- Address and date of birth

- Account status and ownership

- Proof of income and affordability

Since this data comes directly from the bank, it’s already verified; there’s no need for manual checks or third-party uploads. For no KYC casinos looking to retain high conversion while staying compliant, this is a real differentiator.

The result? Fast onboarding for casinos without the friction of legacy verification steps.

Players get a faster start, and your compliance team gets reliable, auditable data.

Why No KYC Casinos Still Need Strong Verification, Without the Paperwork

“No KYC” doesn’t mean skipping compliance. It means removing friction.

Most no KYC casinos still need to verify player identity, prove affordability, and check for risk, especially under UKGC or MGA frameworks. What’s changing is how that verification happens.

Instead of uploading PDFs, players can now connect their bank accounts and share verified data instantly.

This satisfies the requirements for:

- Source of funds check in gambling

- Age and identity verification

- Affordability risk flags

- Ongoing player monitoring

It also helps platforms meet growing regulatory expectations without hurting conversion or trust.

With Open Banking-powered gambling KYC solutions, you’re not trading off safety for speed. You’re achieving both in one consent-driven flow.

Get Fast, Document-Free Player Verification with Finexer

Finexer helps iGaming platforms reduce onboarding friction while staying fully compliant. Whether you’re running a no KYC casino, operating under UKGC rules, or serving high-risk jurisdictions, Finexer’s Open Banking API gets you verified bank data in seconds.

With Finexer, You Can:

- Let players verify their identity without uploading documents

- Perform source of funds checks for gambling with live transaction data

- Enable fast onboarding for casinos that care about conversion

- Fetch verified income and affordability insights automatically

- Stay compliant with GDPR, audit logs, and consent-based flows

Built for Gaming, Trusted Across the UK

- Covers 99% of UK banks

- Deploys 2–3x faster than most APIs

- Offers transparent, usage-based pricing

- Includes 3–5 weeks of hands-on integration support

- Delivers clean SDKs for fast dev team adoption

What is a no KYC casino?

A no KYC casino allows play without document uploads, often using Open Banking for real-time bank-based identity and affordability checks.

Are no KYC casinos legal in the UK?

They’re legal if they follow UKGC rules using tools like Open Banking to verify identity, source of funds, and affordability without paperwork.

How does Open Banking verify players?

It fetches real-time bank data to confirm identity, income, and spend history, making it faster and more accurate than document-based KYC.

What’s the best way to check the source of funds?

Use an Open Banking-powered player verification API to access verified transaction data instantly for faster compliance.

Skip the document uploads and start verifying players in seconds using Finexer’s Open Banking API.