Getting new customers on board in 2025 should be simple, but many businesses struggle with identity verification challenges that slow down the process. Long and complex verification steps frustrate users, leading to high drop-off rates. At the same time, AI-powered fraud like deepfakes and fake identities is making it harder than ever to confirm if a person is who they claim to be. On top of that, businesses must follow strict compliance rules (KYC, AML) to avoid legal risks.

In this blog, we’ll break down the biggest challenges in customer onboarding and identity verification. We’ll also explore how “Sign in Using Bank” offers a secure, fast, and hassle-free way to verify users using real-time bank data.

Let’s get into it

Challenges in Customer Onboarding and Identity Verification

1. Complex Verification Processes Lead to High Drop-Off Rates

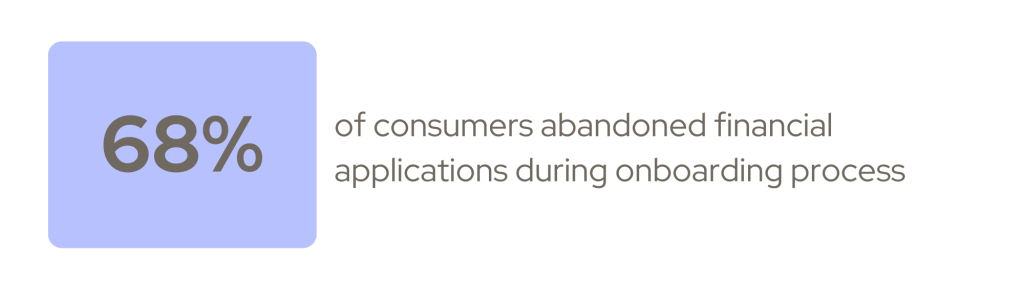

For businesses, a lengthy or complicated verification process can be a major roadblock in onboarding new customers. Many users abandon sign-ups when asked to provide multiple forms of identification, manually enter personal details, or wait for approval. This not only results in lost revenue opportunities but also impacts user trust and engagement.(source)

2. AI-Powered Fraud Is Making Verification More Difficult

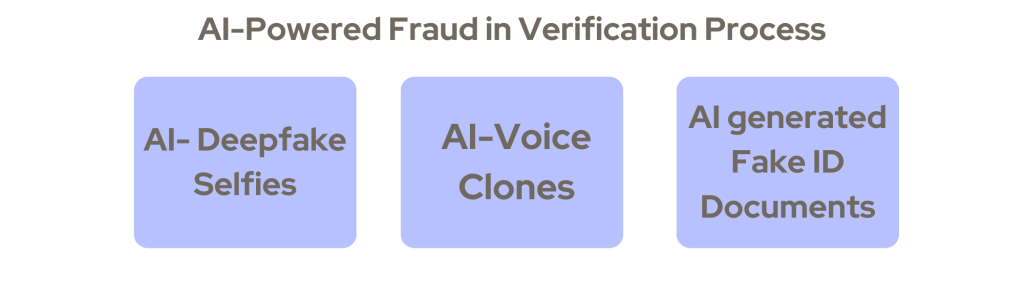

With advancements in artificial intelligence, fraudsters are using deepfake technology, voice cloning, and synthetic identities to bypass traditional identity verification systems. This makes it harder for businesses to distinguish between real users and fraud attempts. Fake digital identities can be used to create unauthorised accounts, commit financial fraud, and exploit online services.(source)

3.Stricter Compliance Rules Require Reliable Identity Checks

As digital fraud grows, businesses must comply with strict Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations to ensure that users are who they claim to be. Failing to implement strong identity verification measures can result in legal penalties, reputational damage, and even bans from financial networks.(source)

One Simple Solution to All These Problems

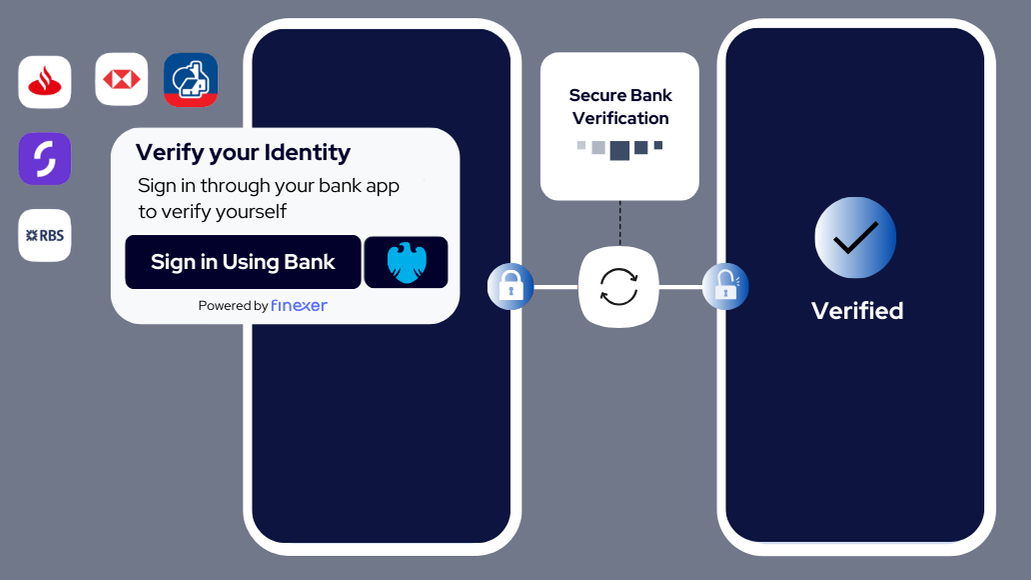

Implementing Sign in Using Bank, powered by open banking, offers businesses a secure and efficient method to verify and onboard customers. This innovative approach lets users authenticate their identities through their trusted financial institutions, ensuring that the information received is both accurate and up-to-date.

Key Benefits:

- Enhanced Security: By leveraging bank-level security protocols, businesses can significantly reduce the risk of fraud and unauthorised access.

- Regulatory Compliance: Open banking frameworks are designed to meet stringent regulatory standards, helping businesses adhere to compliance requirements effortlessly.

- Improved Customer Experience: Streamlining the onboarding process through familiar banking interfaces leads to faster sign-ups, higher customer satisfaction, and increased retention.

Instead of relying on manual checks, weak passwords, or outdated security methods, this solution allows users to verify their identity instantly using their bank account. With the strict security measures in place at banks, the risk of fraud is minimised, user data remains accurate, and compliance standards are met without adding extra friction to the sign-up process. This results in a faster, safer, and more confident customer onboarding experience.

What Is Sign in Using Bank ?

Sign in Using Bank is a streamlined way for users to verify their identity by linking directly to their bank account through open banking. Rather than filling out lengthy forms, users simply allow access to select details—such as their name and address—from their bank. This process not only speeds up onboarding but also enhances security and accuracy, because:

- Convenience: The familiar banking interface makes it easy and fast for users to sign in or register.

- Trusted Data: Information comes directly from the bank, ensuring it’s accurate and up-to-date.

- Robust Security: Banks have stringent security measures in place, which protect user data during the verification process.

How It Works Behind the Scenes

When a user opts for Sign in Using Bank, several secure processes work together to verify their identity:

Verification Process:

Identity Check: The system cross-references the customer’s details from their bank account with information provided during sign-up.

- Facial Recognition: Tools compare a user’s selfie with their identity document (like a passport or driver’s license) to confirm authenticity.

- Similarity Score: A score is generated based on how well the provided data matches the bank records, giving businesses confidence in the verification.

- Name Confirmation: The name provided is matched with the bank’s records to ensure consistency and accuracy.

Data Extraction:

- Document Data: Essential information is automatically extracted from identity documents, reducing manual errors.

- Real-Time Comparison: A selfie is instantly compared to the photo on the identity document, streamlining the process.

Unified Workflow:

- Multiple Checks: The system performs several layers of verification—from identity documents and selfies to bank data—ensuring a comprehensive check without extra hassle.

- Seamless Integration: All these checks are integrated into a single, user-friendly process that’s both efficient and secure.

📚 Learn more about PSD2 and Open banking

Why It Matters for Businesses

Sign in Using Bank is an innovative solution that addresses these challenges head-on. Here’s a detailed look at why this method is critical for businesses:

1. Enhanced Security and Fraud Prevention

- Bank-Level Security:

By integrating directly with banks, businesses benefit from the robust security protocols already in place. This minimises the risk of fraud, unauthorised access, and data falsification. - Multi-Layer Verification:

Combining real-time bank data with additional checks—such as facial recognition and identity document verification—creates multiple layers of defense against identity theft and fraud. - Reduced Manual Errors:

Automated data extraction and verification reduce human error, ensuring that customer information is accurately captured and validated.

2. Streamlined Onboarding Process

- Faster Sign-Up:

Traditional onboarding often involves cumbersome forms and manual data entry. With Sign in Using Bank, users can quickly verify their identity as their information is automatically populated from their bank. - Improved User Experience:

A simpler, more intuitive sign-in process reduces friction and drop-off rates during onboarding, leading to higher conversion rates and better customer retention. - Consistent, Familiar Interface:

Using a familiar banking interface helps customers feel more secure and confident during the sign-up process, enhancing overall satisfaction.

3. Regulatory Compliance and Data Accuracy

- Adherence to Strict Standards:

Open banking frameworks are built to meet rigorous regulatory requirements. This ensures that businesses remain compliant with data protection laws and financial regulations without additional complexity. - Real-Time, Reliable Data:

Access to current bank data means that customer information is always up-to-date, significantly reducing the risks associated with outdated or inaccurate records. - Automated Audit Trails:

Every verification process generates detailed reports and logs, which can be essential for audits and regulatory reviews, streamlining compliance efforts.

4. Cost Savings and Operational Efficiency

- Lower Operational Costs:

Automation of the verification process decreases the need for manual checks and paperwork, reducing administrative overhead. - Prevention of Fraud Losses:

Enhanced security measures help prevent costly fraudulent activities, saving businesses from potential financial losses. - Efficient Resource Allocation:

With a streamlined onboarding process, staff can focus on strategic initiatives rather than being bogged down by time-consuming manual verifications.

5. Improved Customer Trust and Engagement

- Increased Transparency:

Customers appreciate a secure, transparent process that leverages trusted financial institutions, leading to greater trust in the business. - Reduced Onboarding Friction:

A simplified verification process means customers spend less time on registration, which can enhance satisfaction and encourage ongoing engagement. - Enhanced Data Privacy:

By relying on direct, secure data exchanges from banks, customers can be confident that their sensitive information is handled responsibly and with the utmost care.

📚 Open banking verification explained

User Journey: From Sign-Up to Verification

1.User Selects -Sign in Using Bank

Upon reaching the company’s website or app, the user notices an option labeled “Sign in Using Bank.” Clicking on it initiates the secure verification process.

2.Secure Redirect

The platform then redirects the user to their chosen bank’s login interface through a secure channel. This connection is powered by open banking, ensuring that the bank’s existing security protocols are used.

3.Authentication and Consent

At the bank’s interface, the user logs in with their regular bank credentials (e.g., username and password). The bank confirms these details and requests permission to share specific information—like the user’s name or address—with the company’s platform.

4.Return to the Platform

After granting permission, the user is brought back to the website or app. The shared bank data confirms the user’s identity, enabling the business to quickly approve or set up the user’s account.

By following these steps, Sign in Using Bank leverages the bank’s trusted security measures and real-time data to reduce fraud risks and speed up the onboarding process. This means businesses don’t have to build complex verification systems from scratch, and users benefit from a faster, safer experience.

Success Story: Transforming Virtual ID’s KYC with Finexer’s Verification API

VirtualSignature-ID, a UK Government-accredited eSignature and digital identity service provider, was facing challenges integrating compliant open banking software to enhance its certified document management, KYC, AML, and Source of Funds solutions. Their goal was clear: to support their operations in the legal and accountancy sectors with technology that delivered efficiency and uncompromised compliance.

Searching for a partner who offered flexibility, a collaborative approach, and tailored services, VirtualSignature-ID turned to Finexer. Finexer’s FCA-compliant open banking technology provided the immediate solution they needed. As David Kern, CEO of VirtualSignature-ID, explained:

“Finexer is easy to work with and flexible in their approach, providing the bespoke services we required alongside a viable commercial package.”

By leveraging Finexer’s platform, VirtualSignature-ID seamlessly integrated compliance-ready software into its operations—enhancing service delivery, reducing integration time, and supporting future growth. This real-world example clearly demonstrates how Finexer not only meets current onboarding and verification challenges but also paves the way for scalable, secure, and efficient future growth…learn more

Get Started

Start your 14-day free trial today and see why businesses trust Finexer for secure, compliant, and tailored open banking solutions.

Why Choose Finexer for Onboarding and Verification?

Finexer simplifies onboarding and identity verification for SMBs and fintech startups by leveraging real-time bank data, facial recognition, and document verification in a single, secure platform. Here’s why Finexer is the ideal choice:

1. Single-Platform Identity Verification

- Finexer combines document scanning, facial recognition, and bank data authentication into one seamless process.

- Users can verify their identity without manual form-filling, reducing errors and fraud risks.

2. Instant Access to 99% of UK Banks

- Direct integration with UK banks allows real-time identity verification, ensuring accuracy and compliance.

- Unlike traditional methods, bank data verification eliminates the risk of falsified details.

3. 3X Faster User Onboarding

- Finexer enables businesses to onboard users up to 3X faster than manual verification processes.

- No-code integration allows easy deployment without requiring extensive technical resources.

4. Regulatory Compliance Made Easy

- FCA-authorised infrastructure ensures adherence to GDPR, AML, and KYC regulations.

- Automated verification reduces compliance risks without adding extra operational burden.

5. Multi-Layer Fraud Prevention

- Facial recognition and bank-level authentication prevent identity fraud and unauthorised access.

- Similarity score matching ensures that the identity document and user selfie belong to the same person.

6. Startups-First Pricing & White-Label Customisation

- Transparent pay-as-you-grow pricing, with no enterprise lock-ins.

- Businesses can custom-brand the verification process for a seamless onboarding experience.

The Finexer Advantage

With real-time data verification, regulatory compliance, and automated fraud prevention, Finexer provides businesses with a secure, scalable, and frictionless onboarding solution—allowing them to focus on growth while ensuring user trust and security.

- Fintech & Payment Platforms – To meet compliance requirements while reducing fraud.

- E-commerce & Subscription Services – For frictionless sign-ups and secure transactions.

- Lending & Financial Services – To verify applicants quickly without manual document checks.

- Gaming & Online Marketplaces – To prevent fake accounts and unauthorised access.

Try Sign in using bank with Finexer in 2025 ! Schedule your free demo and get a 14 days Trial by Finexer 🙂