Bringing new customers on board is more challenging than ever for businesses in 2025. With identity verification processes still rooted in outdated methods, many organisations face hurdles that slow down sign-ups and complicate compliance. Lengthy forms, repetitive data entry, and multiple verification steps not only frustrate potential customers but also open the door to errors, fraud, and regulatory pitfalls. The pressure to meet stringent standards—such as KYC and AML—only adds to these challenges, making it clear that a new approach is needed.

Client Drop-offs

A survey revealed that 67% of banks globally have lost a client during onboarding due to cumbersome procedures. This highlights the need for businesses to simplify their verification processes to enhance customer retention and reduce abandonment rates. Source

This blog explores how Customer onboarding using Open Banking offers a practical solution to these issues.

we will guide you through:

The Onboarding Challenge Businesses are Facing in 2025

Bringing new customers on board is often more complicated than it needs to be. Many businesses still rely on traditional identity verification methods that involve multiple steps and manual processes. These conventional approaches can create several problems:

Complex Verification Steps:

Traditional onboarding usually requires customers to fill out extensive forms and provide several types of identification. The process can be lengthy and confusing, which often leads to potential customers abandoning the sign-up process before it is completed.

Risk of Inaccurate Data:

Manual data entry increases the chances of errors. When customers are required to input their details repeatedly, mistakes can occur, causing delays and sometimes even resulting in incorrect records.

Fraud Concerns:

Relying on self-reported information or scanned documents makes it harder to detect fraudulent activities. Without a robust way to confirm the authenticity of the details provided, businesses face a higher risk of fraud, which can lead to financial and reputational damage.

Compliance Pressures:

Companies must adhere to strict rules and regulations, such as Know Your Customer (KYC) and anti-money laundering (AML) requirements. Traditional verification methods often complicate compliance because they rely on outdated or incomplete information, increasing the risk of regulatory issues.

These challenges highlight a clear need for a more reliable and user-friendly way to verify customer identities. Many businesses are now looking for alternatives that reduce manual errors, improve accuracy, and provide a smoother experience for both the customer and the company.

Benefits of Onboarding using Open Banking

1.Accurate Data Verification:

By pulling information directly from a customer’s bank, this approach reduces the need for manual data entry. The data used for verification is current and reliable, lowering the risk of errors.

2.Improved Fraud Detection:

When data is sourced directly from banks, it becomes easier to spot discrepancies. This makes it harder for fraudulent information to pass through unchecked, thereby protecting both the business and its customers.

3.Simpler Compliance:

Many businesses face strict regulatory requirements when verifying customer identities. With Onboarding using Open Banking, the process relies on verified bank data, which helps in meeting these compliance rules without adding extra steps.

4.Better Customer Experience:

Customers appreciate a process that is clear and requires fewer manual inputs. Instead of filling out lengthy forms, they can quickly verify their identity by logging into their bank account. This makes the sign-up process faster and more straightforward.

In summary, Onboarding using Open Banking not only cuts down on errors and fraud risks but also helps businesses meet regulatory requirements while making the process easier for customers. The natural flow of data from banks leads to a smoother, more dependable method of verifying identities.

Step-by-Step Guide to Onboarding using Open Banking

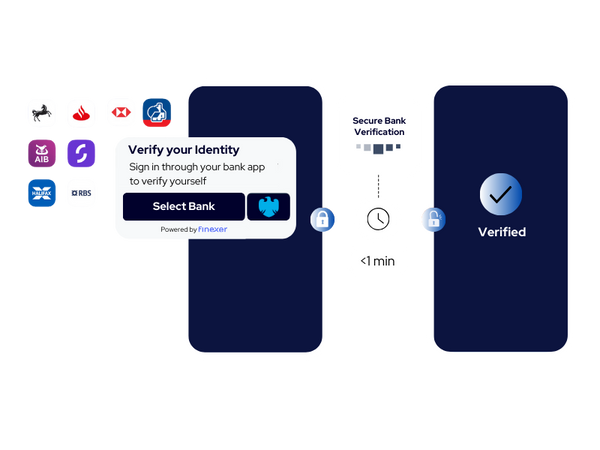

- Customer Selection:

The process begins when a customer visiting a website or app sees the option for Onboarding using Open Banking. By clicking this option, the customer indicates their preference to verify their identity using bank data. - Secure Bank Login:

After selection, the customer is redirected to their bank’s secure login page. The bank manages this step, ensuring that the login and data transmission are protected by the bank’s own security measures. - Consent and Data Sharing:

Once logged in, the customer is asked to give permission for their bank to share specific details—such as their name and address—with the business. This consent is a key part of Onboarding using Open Banking, ensuring that only the necessary information is transmitted. - Data Verification and Return:

After consent is given, the bank verifies the information and sends it back to the business. The verified data confirms the customer’s identity, allowing the business to quickly set up the new account.

This clear, step-by-step process helps reduce errors and simplifies the overall identity verification process. By relying on bank-held data, Onboarding using Open Banking minimises the need for manual data entry and offers a more reliable method for verifying customer identities.

A Real-World Example

When secure and efficient customer onboarding is essential for maintaining competitive advantage, organisations must seek solutions that truly deliver. VirtualSignature-ID (VSID), a UK Government-accredited provider of eSignature and digital identity services, found itself in need of a partner to support its growing requirement for compliant, bank-based verification technology.

The Situation

VSID specialises in certified document management and regulatory compliance services—including KYC, AML, and Source of Funds checks—for professional organisations in the legal and accountancy sectors. Faced with mounting challenges in integrating compliant open banking software into its operations, VSID needed a solution that could simplify complex processes without compromising on security or regulatory standards.

The Decision

When exploring options, VSID looked for a partner who offered flexibility, a cooperative approach, and tailored services. Finexer emerged as the clear choice. As David Kern, CEO of VSID, explained:

“Finexer is easy to work with and flexible in their approach, providing the bespoke services we required alongside a viable commercial package. Finexer has proven to be more than a provider—they’re a trusted partner who understands our vision and helps us achieve it.”

The Approach

By adopting Customer onboarding using Open Banking powered by Finexer, VSID was able to:

- Integrate Securely:

Finexer’s FCA-compliant technology allowed VSID to verify customer identities directly through bank-held data, ensuring that only accurate, up-to-date information was used. - Reduce Operational Complexity:

The pre-built, compliant software from Finexer streamlined internal processes, cutting down on manual entry and the potential for error. - Meet Regulatory Standards:

With robust, verified data at its disposal, VSID could confidently address stringent compliance requirements while enhancing overall service quality.

The Benefits

The partnership delivered significant advantages:

- Cost and Time Savings:

The ready-made solution reduced the need for extensive custom development, lowering both operational costs and implementation times. - Improved Workflows:

Automated data verification allowed for quicker customer account setup, reducing delays and administrative burdens. - Enhanced Customer Experience:

Clients experienced a straightforward verification process, which not only improved satisfaction but also bolstered trust in VSID’s services.

Looking Ahead

The collaboration between VSID and Finexer continues to evolve. With a shared commitment to quality and continuous improvement, both companies are focused on further refining their services. As Kern noted:

“We aim to continue our partnership with Finexer as we improve our services and expand the business further.”

In Summary

This case study demonstrates how Customer onboarding using Open Banking—when implemented with a reliable partner like Finexer—can transform the onboarding process. By leveraging verified bank data, VSID has achieved a more secure, efficient, and compliant method of onboarding customers. This partnership not only addresses current challenges but also sets a solid foundation for future growth and innovation.

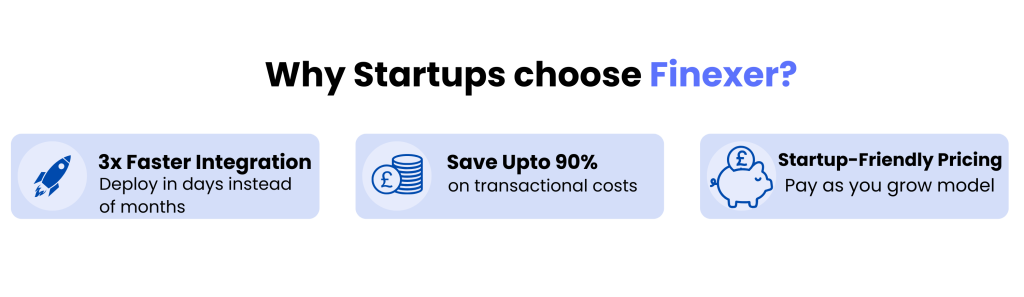

Why Choose Finexer for Onboarding

When it comes to Customer onboarding using Open Banking, selecting the right partner can make all the difference. Finexer has built a reputation for providing reliable, compliant solutions that are easy to implement and support business growth. Here’s why Finexer stands out:

1.Simple Integration:

Finexer’s technology is designed for straightforward integration. Their solution fits well with existing systems, reducing the need for extensive modifications or custom development.

2.User-Friendly Interface:

The platform is built with clarity in mind. Finexer offers an interface that is both visually appealing and simple to navigate, making it easier for customers to complete the onboarding process without confusion.

3.Robust Security and Compliance:

With strict adherence to regulatory standards, Finexer ensures that all data is handled securely. Their FCA-compliant technology provides reliable protection and meets the necessary requirements for identity verification.

4.Consistent Performance:

Finexer’s system is known for its reliability. It consistently delivers accurate, bank-verified data to support Customer onboarding using Open Banking, ensuring that customers can be verified quickly and with confidence.

5.Cost-Effective Solutions:

By offering pre-built, compliant software, Finexer helps businesses reduce both implementation time and operational costs. This focus on value means organisations can invest more in growth rather than in complex infrastructure.

6.Dedicated Support:

Beyond the technology itself, Finexer is committed to working closely with its partners. Their collaborative approach and responsive support ensure that businesses receive the guidance needed to achieve their onboarding goals.

In summary, Finexer provides a practical, secure, and efficient solution for Customer onboarding using Open Banking. Their commitment to simplicity, reliability, and compliance makes them a trusted partner for organisations looking to improve the customer verification process while maintaining high standards of security and performance.

How does Open Banking simplify the customer onboarding process?

Traditional onboarding often requires customers to manually enter data, upload documents, and go through multiple verification steps. Open Banking eliminates these inefficiencies by allowing businesses to retrieve verified customer data directly from banks. This reduces errors, speeds up identity verification, and enhances the overall user experience.

Is Open Banking onboarding secure, and how does it protect customer data?

Yes, Open Banking is built on strict security frameworks, including bank-level encryption, two-factor authentication (2FA), and secure API connections. Customers must explicitly consent to data sharing, and businesses only receive the necessary identity verification details—nothing more. Unlike traditional onboarding, no sensitive documents are stored or transferred manually, minimising fraud risks and ensuring compliance with GDPR and financial regulations.

How does Open Banking help businesses comply with KYC and AML regulations?

By accessing real-time, bank-verified customer data, Open Banking simplifies Know Your Customer (KYC) and Anti-Money Laundering (AML) compliance. Businesses can instantly verify a user’s identity, assess financial behavior, and detect fraudulent activities without relying on outdated document checks. This reduces compliance costs, speeds up regulatory approvals, and minimises the risk of financial crime.

Can Open Banking reduce customer drop-offs during sign-up?

Yes, Open Banking significantly reduces customer drop-offs by eliminating friction in the sign-up process. Instead of manually entering personal details and waiting for verification, users can authenticate their identity instantly via secure bank login. This reduces form abandonment rates, shortens onboarding time, and improves customer acquisition—leading to higher conversions and better retention.

Ease Onboarding process with Finexer in 2025 ! Schedule your free demo and get a 14 days Trial by Finexer 🙂