Managing risk during customer onboarding is no easy task. Just when you think you’ve built a reliable process, new threats emerge—identity fraud gets more sophisticated, compliance requirements become stricter, and manual checks slow everything down.

If you’re in risk management, you’ve likely faced these problems firsthand, balancing security, regulations, and customer experience in an increasingly complex environment.

But what if you could tackle these challenges differently? Imagine having instant access to verified financial data, automating identity checks, and reducing fraud—all in real time. This is exactly what an Open Banking API can offer. In this blog, we’ll break down the most common onboarding challenges, show how an Open Banking API helps solve them, and give you practical examples to apply in your own processes.

Let us guide you through:

Risk Management during Onboarding

Customer onboarding may seem like a simple process at first glance, but for risk management professionals, it’s where serious risks can begin. The process is more than just collecting basic customer information—each step presents an opportunity for potential fraud, regulatory issues, or data mishandling. Below are the key challenges that make onboarding one of the riskiest phases.

1. Identity Verification Complexities

Confirming a customer’s identity is the foundation of risk management. Yet, traditional methods—such as document uploads or manual reviews—are prone to errors and delays. Worse, fake documents and synthetic identities are getting harder to detect, leaving organisations exposed to fraud risks.

Common Problems:

- Inconsistent document quality and authenticity issues

- Customers submitting incomplete or incorrect information

- Rising use of sophisticated synthetic identities

2. Compliance Burdens

KYC (Know Your Customer) and AML (Anti-Money Laundering) regulations are constantly evolving, making it harder for institutions to keep up. Even a minor compliance failure can lead to hefty fines and reputational damage. Risk management teams are under pressure to ensure every onboarding step adheres to regulatory standards without creating unnecessary friction for customers.

Common Problems:

- Complex and varying regulatory requirements across regions

- Manual compliance checks that are time-consuming and error-prone

- Increased risk of data breaches when handling sensitive customer information

3. Fraud Detection Challenges

Fraudsters continue to find new ways to bypass traditional security measures. Identity theft, transaction laundering, and first-party fraud are just a few examples of the risks that financial institutions face during onboarding. Without real-time data validation and advanced fraud detection systems, spotting these risks becomes increasingly difficult.

Common Problems:

- Delayed fraud detection due to lack of real-time data

- Limited visibility into a customer’s complete financial behavior

- High false-positive rates that frustrate genuine customers

4. Operational Inefficiencies

Manual checks and outdated processes not only slow down onboarding but also increase operational costs. These inefficiencies create a poor customer experience and divert resources away from higher-value tasks like proactive risk management and customer engagement.

Common Problems:

- Fragmented systems that require switching between multiple tools

- Lengthy onboarding processes that cause customer drop-offs

- High cost of maintaining manual verification teams

How a single Open Banking API can solve these challenges

The challenges we just discussed can feel overwhelming—but they don’t have to be. Open Banking APIs offer a smarter, faster, and more secure way to manage risk during customer onboarding. By allowing real-time access to verified financial data, these APIs transform how institutions verify identities, assess risks, and comply with regulations. Here’s how Open Banking tackles each major challenge head-on.

1. Real-Time Identity Verification

With Open Banking APIs, verifying customer identities becomes a matter of seconds. Rather than relying on manual document checks or outdated databases, you can securely access live bank account information to confirm a customer’s identity and transaction history in real time. This significantly reduces the risk of fraud.

How it Helps:

- Eliminates the need for manual document reviews

- Detects synthetic identities by cross-checking data with trusted financial sources

- Provides an up-to-date financial picture for better risk assessment

2. Automated Compliance and KYC Checks

Open Banking APIs simplify KYC and AML compliance by integrating automated checks into the onboarding process. Instead of handling compliance manually—an approach prone to errors—you can rely on real-time verification and automated risk scoring, ensuring that every step adheres to the latest regulations.

How it Helps:

- Reduces compliance costs and minimises human error

- Ensures continuous updates to regulatory requirements through automated systems

- Tracks customer risk profiles dynamically as new data becomes available

3. Advanced Fraud Detection and Risk Assessment

Fraud detection becomes much more effective with Open Banking. By analysing real-time financial data across multiple accounts, APIs can detect unusual activity and flag potential risks early. This makes it easier to spot fraudulent behavior without overwhelming your team with false positives.

How it Helps:

- Real-time data enables early detection of fraud patterns

- Dynamic risk scoring provides a more accurate assessment of customer risk

- Minimises false positives, improving both security and customer experience

4. Operational Efficiency and Cost Reduction

Gone are the days of juggling multiple tools and manually verifying customer information. Open Banking APIs streamline the onboarding process into a single, automated flow. This improves efficiency, cuts costs, and allows risk management teams to focus on strategic tasks rather than repetitive checks.

How it Helps:

- Reduces onboarding time from days to minutes

- Lowers operational costs by minimising manual processes

- Improves overall customer satisfaction with faster approvals

Benefits of Using Open Banking API for Onboarding Risk Management

Integrating an Open Banking API into your onboarding process brings significant advantages for risk management. Beyond solving the common challenges, it helps financial institutions improve compliance, reduce fraud risks, and offer a more seamless experience to both their teams and customers. Let’s dive into the key benefits.

1. Speed and Efficiency

Traditional onboarding processes often take days or even weeks due to manual verifications and multiple layers of checks. Open Banking APIs reduce this timeline dramatically by automating most of the process, giving risk management teams access to verified customer data in real time.

What This Means:

- Faster onboarding decisions

- Reduced paperwork and fewer manual reviews

- Higher customer satisfaction due to quicker approvals

2. Increased Accuracy and Security

Relying on outdated data or incomplete information introduces significant risk. Open Banking APIs provide direct access to live financial data, which helps verify customer details accurately and reduces the risk of human error. This real-time data access also strengthens your security framework.

What This Means:

- Fewer false positives and more accurate risk assessments

- Stronger identity verification processes

- Reduced exposure to fraudulent activities

3. Enhanced Compliance Management

Regulatory compliance can be a major burden without the right tools. Open Banking APIs simplify this by automating KYC and AML checks. Institutions can quickly ensure that customers meet compliance standards, with no need for manual monitoring.

What This Means:

- Automatic updates to regulatory requirements

- Lower risk of non-compliance penalties

- Improved audit trails and reporting

4. Cost Savings and Scalability

Manual processes are expensive and difficult to scale as your customer base grows. With Open Banking APIs, institutions can significantly cut operational costs by reducing manual verification efforts and optimising resource allocation. The scalable nature of APIs also ensures that the system can grow with your business.

What This Means:

- Reduced operational expenses

- Easier scaling for growing customer bases

- More focus on higher-value tasks for risk management teams

5. Improved Customer Experience

A long and cumbersome onboarding process frustrates customers and increases the chances of drop-offs. By simplifying verification and approval steps through Open Banking, you provide a smoother and faster experience that builds trust from day one.

What This Means:

- Higher onboarding success rates

- Stronger customer trust and retention

- Competitive advantage in a crowded financial services market

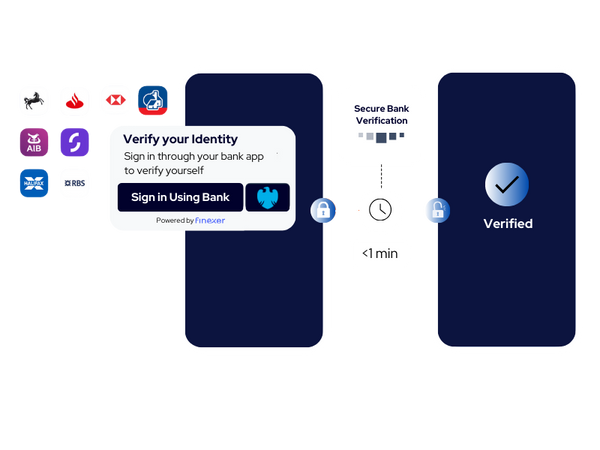

User Journey for Onboarding

The Open Banking KYC API transforms what used to be a lengthy and complex verification process into a seamless journey for both businesses and customers. Here’s how it works:

Step 1: User Selects “Sign in Using Bank”

When a new user visits the company’s website or app, they are presented with an option to Sign in Using Bank. This option initiates the secure verification process, offering a fast and reliable alternative to uploading documents manually.

Step 2: Secure Redirect

Upon selecting their bank, the platform securely redirects the user to their chosen bank’s login interface. This connection is established through open banking APIs, ensuring that the verification process benefits from the bank’s trusted security protocols and encrypted environment.

Step 3: Authentication and Consent

At the bank’s interface, the user logs in using their normal credentials (e.g., username and password). Once authenticated, the bank requests the user’s consent to share specific data—such as their name, address, or account details—with the company.

This step is fully transparent, allowing the user to control what data is shared.

Step 4: Return to the Platform

After granting permission, the user is redirected back to the company’s platform. The bank shares verified data with the platform in real time, confirming the user’s identity and other essential details.

This data allows the company to quickly verify the user, approve the account, and complete the onboarding process within minutes.

Why This Process Works

- No Complex Verification Systems Needed: Businesses can rely on the security and accuracy of banking data without building their own identity verification systems.

- Real-Time Verification: Reduces delays caused by manual reviews or incomplete information, ensuring faster customer onboarding.

- Enhanced Fraud Prevention: The process leverages the bank’s existing security measures, minimising the risk of identity fraud.

- Improved Compliance: Open Banking APIs help businesses meet KYC and AML requirements effortlessly, ensuring a compliant and secure onboarding process.

Get Started

Start your 14-day free trial today and see why businesses trust Finexer for secure, compliant, and tailored open banking solutions.

Why Choose Finexer for Faster and Smarter Onboarding?

Finexer’s Open Banking API offers more than just a fast onboarding experience—it provides a scalable, compliant, and tailored solution designed to meet the unique needs of businesses of all sizes. Here’s what makes Finexer the ideal partner:

- Instant Access to 99% of UK Banks: Connect with almost every UK bank through a single integration, enabling real-time data verification for seamless onboarding.

- Compliance Made Simple: Finexer’s FCA-authorised infrastructure automates regulatory compliance (KYC, AML), so you stay secure and compliant without added complexity.

- Built for Growing Businesses: Whether you’re a startup or an established SMB, Finexer’s platform grows with you—no additional tech investment needed, even as your transaction volume scales.

- Faster Deployment: Get up and running 2–3x faster compared to other providers, thanks to our easy integration process and rigorous pre-deployment testing.

- Customisable, White-Label Solutions: Launch under your brand identity with full control, ensuring a consistent experience for your customers.

- Transparent Pricing: Startup-friendly, consumption-based pricing lets you pay as you grow, without enterprise-level commitments.

With Finexer, onboarding isn’t just faster—it’s smarter, secure, and built to help your business thrive in a highly competitive market. Schedule a free demo today and experience the difference.

1. What is the primary purpose of this KYC API?

This KYC API is built to streamline the customer verification process during onboarding. It leverages real-time financial data to quickly and accurately confirm customer identities, thereby reducing the risks associated with identity fraud, regulatory non-compliance, and operational delays.

2. How does the KYC API tackle identity verification challenges during onboarding?

Traditional identity checks—such as manual document reviews—can be slow and prone to errors. In contrast, the KYC API uses real-time access to bank data to verify customer details instantly. This method helps detect synthetic or fraudulent identities by cross-referencing trusted financial information, ensuring a higher level of accuracy and security.

3. In what ways does the KYC API improve compliance during customer onboarding?

Compliance with KYC (Know Your Customer) and AML (Anti-Money Laundering) regulations is critical. The KYC API automates these checks, ensuring that customer data is verified against current regulatory standards. This automation minimises human error, reduces compliance costs, and maintains an up-to-date record of verification processes for audit purposes.

4. What are the operational benefits of using this KYC API in the onboarding process?

By automating the verification process, the KYC API significantly reduces manual tasks. This leads to:

Faster Onboarding: Verification is completed in minutes rather than days.

Lower Operational Costs: Reduced need for manual reviews and paperwork.

Enhanced Customer Experience: A smooth, quick verification process lowers the risk of customer drop-offs.

7. How does this KYC API contribute to effective onboarding risk management?

By verifying customer identities instantly and accurately, the KYC API minimises the chance of fraud and regulatory breaches during onboarding. This proactive approach to risk management helps financial institutions maintain a secure onboarding process while also delivering a seamless customer experience.

Try Onboarding using Open banking with Finexer in 2025 ! Schedule your free demo and get a 14 days Trial by Finexer 🙂