For accountants, having clean and complete bank data is essential. Whether you’re preparing financial reports, doing monthly reconciliations, or managing VAT returns, everything starts with having the right transaction history.

Yet, many firms still rely on manual bank data import to get that information into their systems. Instead of using live bank feeds or Open Banking tools, they continue to import bank transactions manually using downloaded CSV or PDF statements.

Why? In many cases, clients aren’t set up for automatic feeds, or the firm is used to the routine of uploading files by hand. Some accountants also prefer to review each file before it’s entered into the system.

If this sounds familiar, the next section walks you through how to import bank data into Excel or accounting software using the manual process most UK firms still follow.

How to Import Bank Data Manually

Even today, manual bank data import remains a common practice for many accounting professionals in the UK. Whether it’s because of client preferences, legacy systems, or lack of automation, the manual method is still widely used.

Here is how most accountants handle this process in real-world situations.

1.Access the Client’s Online Banking

The first step is gaining access to the client’s online banking account. Some firms have direct login details for the business accounts they manage. Others ask clients to download and send the bank statements themselves.

The goal is to get access to the transaction history for a specific period, usually monthly or quarterly.

2.Download the Bank Statement

Once logged in, the accountant downloads the statement in a preferred format. The most common formats include:

- CSV which is widely used for importing bank transactions manually into Excel or accounting platforms

- Excel (.xlsx) if available directly from the bank

- PDF which is frequently used but often requires additional effort to clean

- OFX or QFX formats supported by some accounting software tools

CSV is typically the best choice for firms that use spreadsheets or software with CSV bank statement import features.

3.Clean the File in Excel

After downloading, the file needs to be prepared. This is where manual bank data import becomes time-consuming.

Tasks usually include:

- Removing extra rows or headers added by the bank

- Renaming columns to standard fields like Date, Description, and Amount

- Making sure dates are in UK format (DD/MM/YYYY)

- Separating a single “Amount” column into two columns if necessary, one for money in and one for money out

- Fixing any line breaks, special characters, or empty cells

If the statement was downloaded as a PDF, the data may need to be manually copied into Excel or converted using a third-party tool, which often leads to formatting problems that must be corrected before import.

4.Prepare for Import into the Accounting Software

Once the data is clean, it must match the required format of the accounting platform being used. Most software has a specific layout for CSV import of bank statements, including:

- Correct column headings and order

- Consistent formatting for dates and amounts

- No additional characters or formulas

Even a small mistake here can lead to an upload failure or incorrect data mapping.

5.Upload the File into the System

With the file ready, the accountant logs into the software and begins the import process.

This usually involves:

- Selecting the relevant bank account

- Uploading the CSV file

- Mapping each column correctly to fields like Date, Payee, and Amount

Some platforms offer a preview to check that the data looks correct before confirming the import.

6.Review and Reconcile Transactions

Once the data has been imported, the accountant reviews each transaction. This includes:

- Assigning each line to the correct expense or income category

- Checking for duplicate entries or missing transactions

- Matching the closing balance with the bank statement

This step is crucial to ensure that the books match the bank and are ready for reporting.

Common Problems with Manual Bank Data Import

While the manual process works, it’s far from ideal. For many accountants, this task ends up taking more time than it should. And when done across multiple clients or accounts, it can quickly become a regular source of stress.

Here are the common issues that come with manual bank data imports.

1. It’s Time-Consuming

Cleaning CSV files, fixing formatting issues, and uploading transactions might not sound like a lot, but the time adds up. Especially when files aren’t downloaded correctly, columns are in the wrong order, or dates need reformatting.

For a single account, it might take 30 to 45 minutes. Multiply that by a dozen clients or more, and it easily turns into hours of repetitive work every month.

2. Formatting Mistakes Are Easy to Miss

When working manually, small formatting problems can cause big issues. A misplaced decimal, incorrect date, or an extra space in a column header can prevent the file from uploading or create wrong entries in the books.

These errors are not always obvious right away, which means they can sit unnoticed until something doesn’t reconcile later on.

3.PDF Statements Are a Headache

Some clients still send PDF statements, which aren’t built for data entry. These files have to be copied or converted, and the results are often messy. Columns might shift, descriptions might get split, and rows might break apart during the process.

Even after using converters, the file often needs to be cleaned again before it can be used.

4.No Real-Time Visibility

With manual imports, the data is only as recent as the last file uploaded. If a statement was downloaded last week, anything that happened after that won’t be visible in the system. This makes it harder to work with up-to-date figures, especially during month-end or tax prep.

5.It Doesn’t Scale Well

For small firms or low-volume clients, the manual method might be manageable. But as the client base grows or more frequent reporting is required, the time spent importing and cleaning data can start to hold things back. It also increases the chance of human error when working under pressure.

📚 Top 10 Accounting Software for UK

A Simpler Way to Import Bank Data Automatically

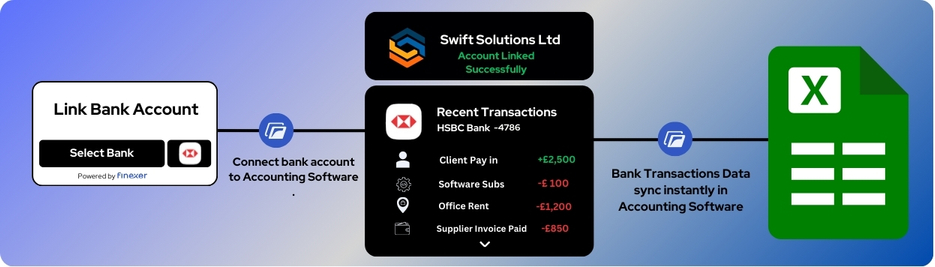

If you’re still relying on manual bank data import every week or month, there’s a better way to handle your clients’ bank transactions. Instead of downloading and cleaning CSV files, Finexer allows you to pull bank data directly from almost every UK bank, automatically and securely.

This removes the need for repetitive downloads and fixes the common problems that come with manually handling files.

What Finexer does differently

Finexer replaces the manual bank data import process with automatic bank feeds through Open Banking. Once your client gives permission, their transaction data flows directly into your system, no need to log in to their online banking or clean up files.

The connection stays live, so you’re not working with outdated figures or waiting for monthly statements.

How Finexer supports accounting teams

Replacing manual bank data import with automatic syncing can:

- Cut out hours of monthly admin work

- Avoid common file errors like mismatched dates or broken columns

- Provide up-to-date visibility into your client’s financial activity

- Simplify monthly reconciliation by keeping everything current

- Free up time for more valuable review work

If your firm handles ongoing bookkeeping, payroll, or monthly reports, this shift can save time and reduce friction across the board.

Why this matters for UK-based firms

Finexer is designed to remove the hassle of manual bank data import for UK accounting firms. It connects with 99% of UK banks, supports multiple accounts per client, and helps firms working with small to medium-sized businesses stay on top of their work without drowning in spreadsheets.

There’s no complex setup, no technical configuration, and no need to rely on clients to send over their latest statements.

Should You Move On from Manual Bank Data Import?

For many accountants, manual bank data import has been the standard way of working for years. It’s reliable, familiar, and in some cases, necessary when automation is not an option.

But as client expectations grow, reporting becomes more frequent, and time becomes harder to manage, relying on manual processes begins to create more problems than it solves.

Every spreadsheet download, every formatting adjustment, and every import adds up. And when you are doing this across multiple accounts, the hours spent each month on these small tasks can quietly chip away at your team’s time.

If you regularly import bank transactions manually, it is worth asking how much of that work could be avoided. Finexer gives you the tools to stay updated without relying on spreadsheets or PDFs. By using secure Open Banking connections, you can move away from repetitive admin and focus on the parts of accounting that require your attention.

Manual methods still have a place, especially for one-off cases or very small accounts. But for firms looking to work faster, stay accurate, and reduce risk, automatic bank data sync is a simple change that brings long-term value.

Finexer helps make that transition easier, especially for accounting teams working with small to medium-sized UK businesses. It is a practical step away from manual bank data import, and one that pays off quickly once it is in place.

What is manual bank data import?

Manual bank data import is the process of downloading bank statements and uploading them into accounting software manually, often using CSV files and spreadsheets.

How do I manually import bank transactions?

Download the statement in CSV format, clean and format it in Excel, then upload it into your accounting software using the import feature.

What are the problems with manual bank data import?

Manual imports can lead to formatting errors, outdated data, duplicate entries, and take up a lot of time, especially across multiple accounts.

Can I convert a PDF bank statement to Excel?

Yes, but it often needs extra cleanup. PDF data may shift or break during conversion, requiring manual adjustments in Excel before importing.

How can I avoid manual bank data import?

Use Open Banking tools like Finexer, which connect to UK banks and sync transactions automatically without needing manual uploads.

Get Instant Bank Data with Finexer in 2025 ! Schedule your free demo and get a 14 days Trial by Finexer 🙂